| Line 28: | Line 28: | ||

:2. Next, Go to ''Tools | Maintain Payment Method...'' | :2. Next, Go to ''Tools | Maintain Payment Method...'' | ||

:3. Edit the '''WITHHOLDING TAX'''. | :3. Edit the '''WITHHOLDING TAX'''. | ||

:4. Set | :4. Set the PV number Set to '''WITHHOLDING TAX'''. Click Save. | ||

<br /> | <br /> | ||

Revision as of 07:12, 25 March 2020

Initial Setup

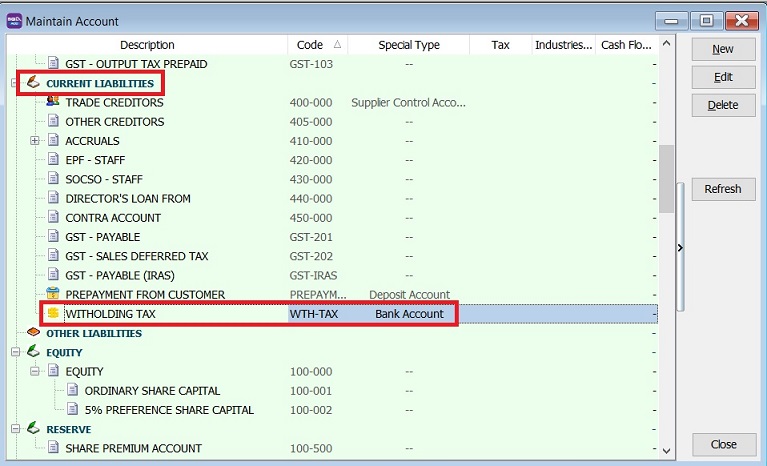

Create Withholding Tax Account

[GL | Maintain Account...]

- Create the following GL Account under Current Liability.

GL Account Description Special Type WTH-Tax Withholding Tax Bank Account

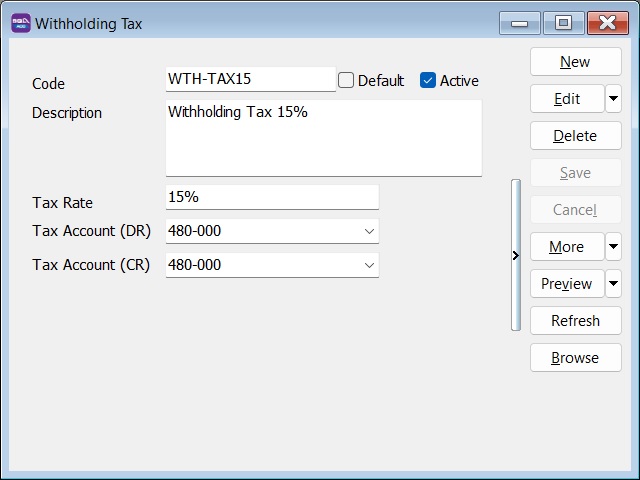

Withholding Document Number Set

[Tools | Maintain Document Number...]

Descripion Document Type Format WITHHOLDING TAX Payment Voucher WTHPV-%.5d

- 2. Next, Go to Tools | Maintain Payment Method...

- 3. Edit the WITHHOLDING TAX.

- 4. Set the PV number Set to WITHHOLDING TAX. Click Save.

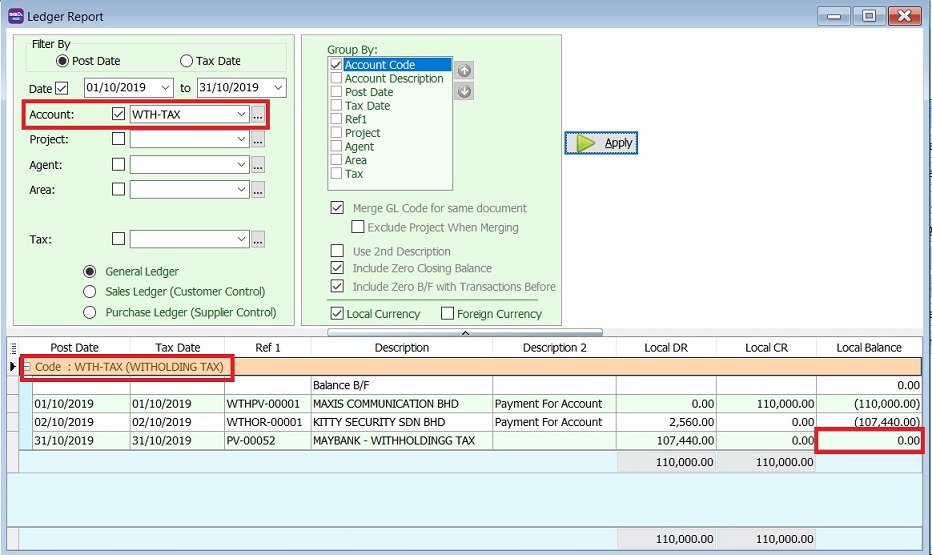

Withholding Tax Entries

Withholding Tax Payable (AP)

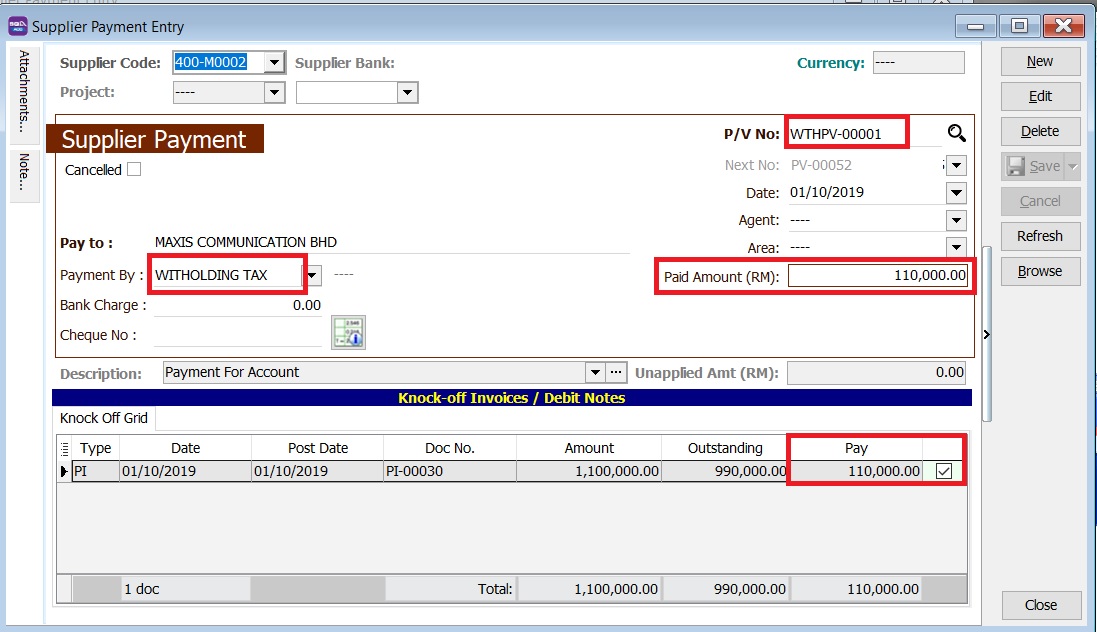

[Supplier | Supplier Payment...]

- 1. Create new Supplier Payment.

- 2. Select the Supplier Code.

- 3. Select the Payment by: WITHHOLDING TAX.

- 4. Enter the Paid Amount: 110,000.00 (eg. the withholding tax amount 10% of supplier invoice value).

- 5. Knock-off the supplier invoice.

Payment of Withholding Tax

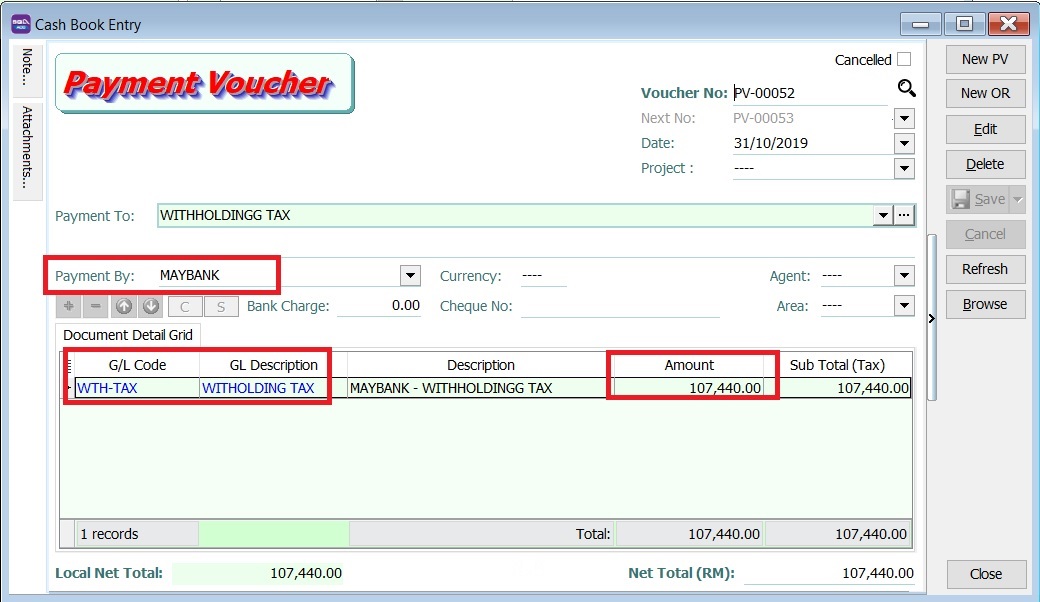

[ GL | Cash Book Entry..]

- 1. Create new PV.

- 2. Enter Payee name.

- 3. Select Payment By: Bank Account

- 4. At detail grid, select GL Code: WTH-TAX

- 5. Enter the withholding tax amount to paid.