No edit summary |

|||

| Line 1: | Line 1: | ||

==Initial Setup== | ==Initial Setup== | ||

=== | ===Withholding Tax Account=== | ||

'' | ''Menu : GL | Maintain Account...'' | ||

<br /> | <br /> | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! GL Account !! Description !! | ! GL Account !! Description !! Remark | ||

|- | |- | ||

| | | 460-XXX || WITHHOLDING TAX PAYABLE || Under Current Liabilities | ||

|- | |||

| 990-XXX || WITHHOLDING TAX EXPENSE || Under Expenses | |||

|} | |} | ||

'''NOTE:''' | |||

' | GL Account not compulsory to follow. | ||

: | |||

<br /> | <br /> | ||

Revision as of 03:14, 6 June 2020

Initial Setup

Withholding Tax Account

Menu : GL | Maintain Account...

GL Account Description Remark 460-XXX WITHHOLDING TAX PAYABLE Under Current Liabilities 990-XXX WITHHOLDING TAX EXPENSE Under Expenses

NOTE: GL Account not compulsory to follow.

Withholding Tax Entries

Withholding Tax Payable (AP)

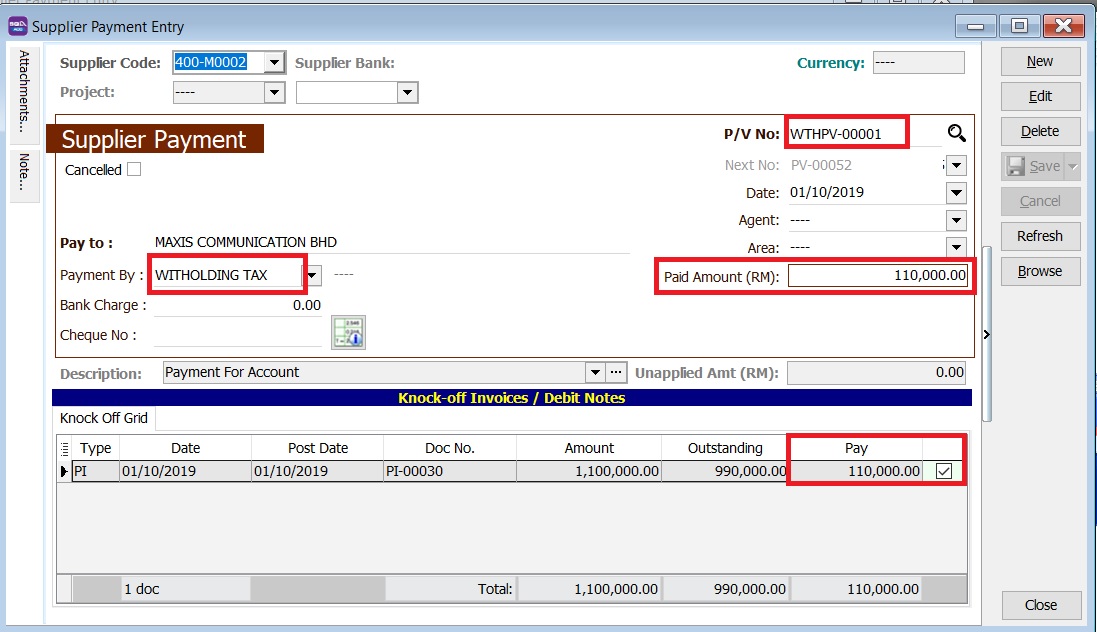

[Supplier | Supplier Payment...]

- 1. Create new Supplier Payment.

- 2. Select the Supplier Code.

- 3. Select the Payment by: WITHHOLDING TAX.

- 4. Enter the Paid Amount: 110,000.00 (eg. the withholding tax amount 10% of supplier invoice value).

- 5. Knock-off the supplier invoice.

Payment of Withholding Tax

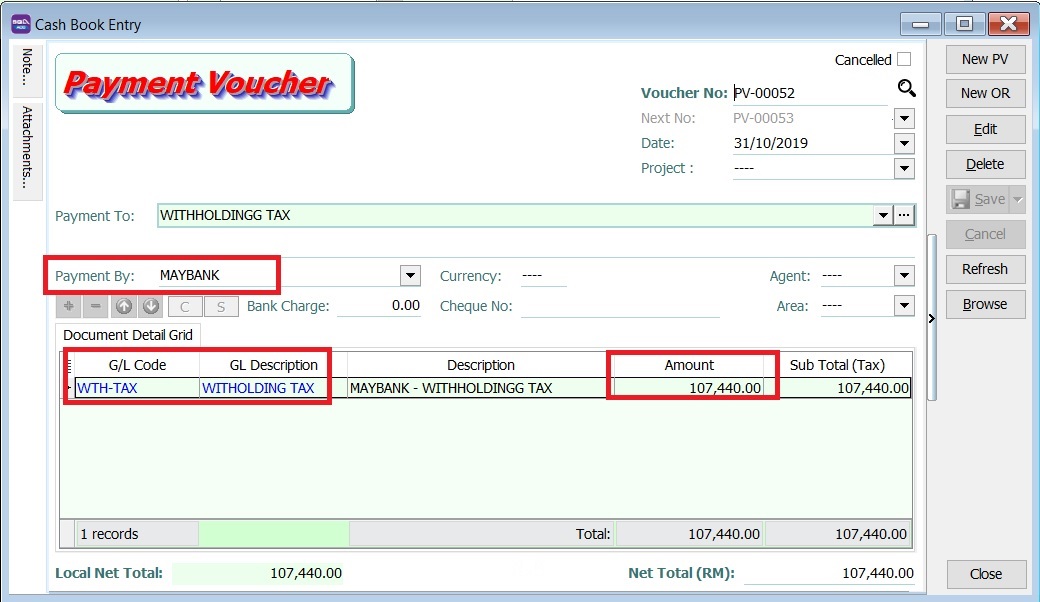

[ GL | Cash Book Entry..]

- 1. Create new PV.

- 2. Enter Payee name.

- 3. Select Payment By: Bank Account

- 4. At detail grid, select GL Code: WTH-TAX

- 5. Enter the withholding tax amount to paid.

- 6. You can check the ledger report for Withholding Tax balance.