No edit summary |

|||

| Line 17: | Line 17: | ||

<br /> | <br /> | ||

Available in: | |||

''Menu : [Purchase | Purchase Invoice...]'' or [Supplier | Supplier Invoice...] | |||

''[Supplier | Supplier | ''Menu : [Purchase | Cash Purchase...]'' or [Supplier | Supplier Invoice...] | ||

''Menu : [Purchase | Purchase Debit Note...]'' or [Supplier | Supplier Debit Note...] | |||

''Menu : [Purchase | Purchase Returned ...]'' or [Supplier | Supplier Credit Note...] | |||

<br /> | <br /> | ||

:1. | ==Withholding Tax Entry== | ||

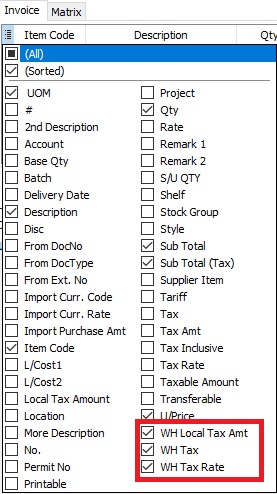

:2. Select the ''' | :1. In'''Purchase Invoice''', insert the following columns: | ||

: | * WH Local Tax Amt | ||

: | * WH Tax | ||

* WH Tax Rate | |||

:[[File: WTH- | <br /> | ||

:[[File: WTH-Tax_10a.jpg| 300PX]] | |||

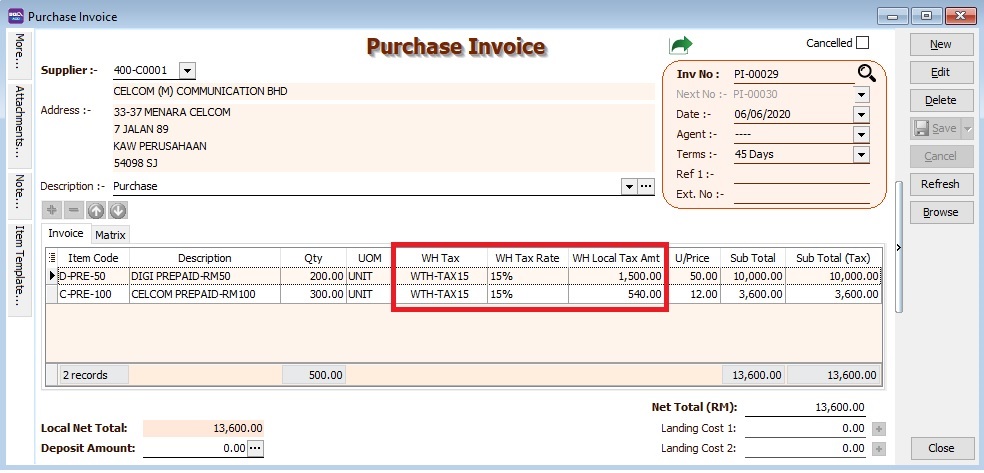

:2. Select the Withholding Tax Code in '''WH Tax''' column. | |||

:[[File: WTH-Tax_10b.jpg| 500PX]] | |||

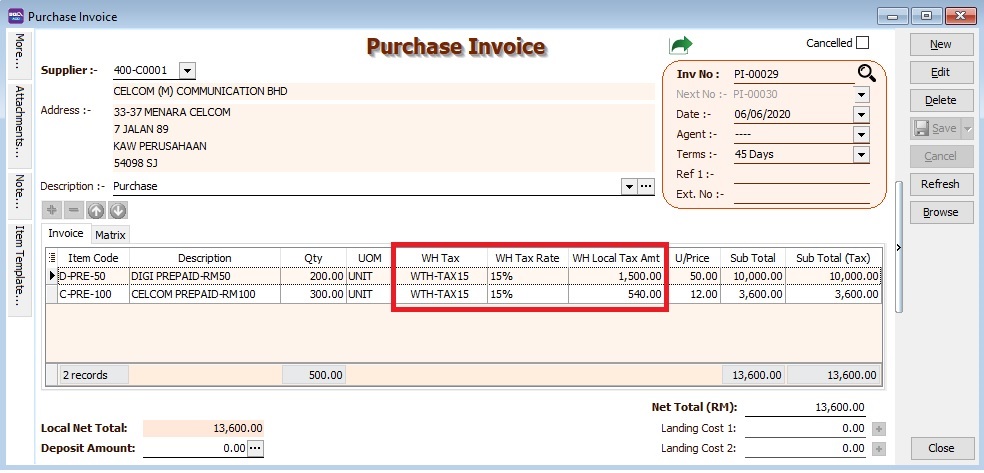

:3. System will auto post the withholding tax double entry. Press '''CTRL + O''' to check the double entry. | |||

:[[File: WTH-Tax_10b.jpg| 500PX]] | |||

<br /> | <br /> | ||

Revision as of 03:36, 6 June 2020

Initial Setup

Withholding Tax Account

Menu : GL | Maintain Account...

GL Account Description Remark 460-XXX WITHHOLDING TAX PAYABLE Under Current Liabilities 990-XXX WITHHOLDING TAX EXPENSE Under Expenses

NOTE: GL Account not compulsory to follow.

Available in:

Menu : [Purchase | Purchase Invoice...] or [Supplier | Supplier Invoice...]

Menu : [Purchase | Cash Purchase...] or [Supplier | Supplier Invoice...]

Menu : [Purchase | Purchase Debit Note...] or [Supplier | Supplier Debit Note...]

Menu : [Purchase | Purchase Returned ...] or [Supplier | Supplier Credit Note...]

Withholding Tax Entry

- 1. InPurchase Invoice, insert the following columns:

- WH Local Tax Amt

- WH Tax

- WH Tax Rate

- 2. Select the Withholding Tax Code in WH Tax column.

- 3. System will auto post the withholding tax double entry. Press CTRL + O to check the double entry.

:

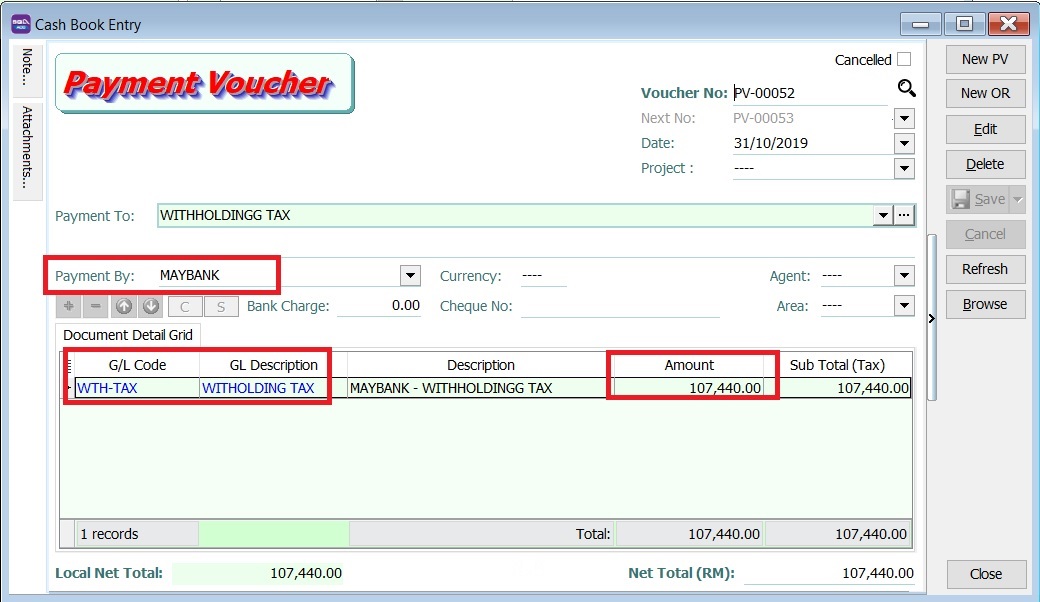

Payment of Withholding Tax

[ GL | Cash Book Entry..]

- 1. Create new PV.

- 2. Enter Payee name.

- 3. Select Payment By: Bank Account

- 4. At detail grid, select GL Code: WTH-TAX

- 5. Enter the withholding tax amount to paid.

- 6. You can check the ledger report for Withholding Tax balance.