Introduction

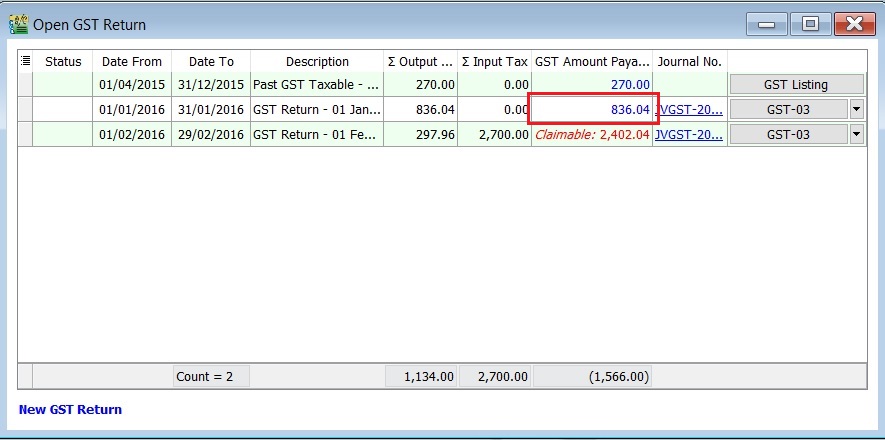

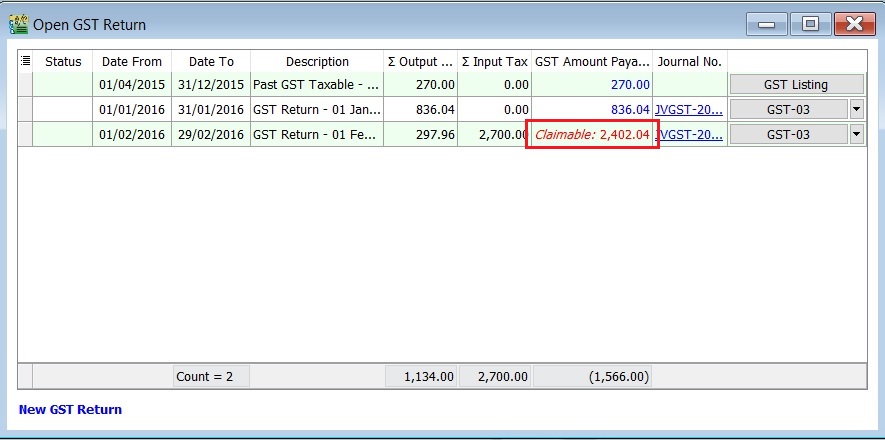

- 1. Net GST Payable is the total GST amount to be paid to RMCD.

- 2. Net GST Claimable is the total GST amount to be claimed or refund from RMCD.

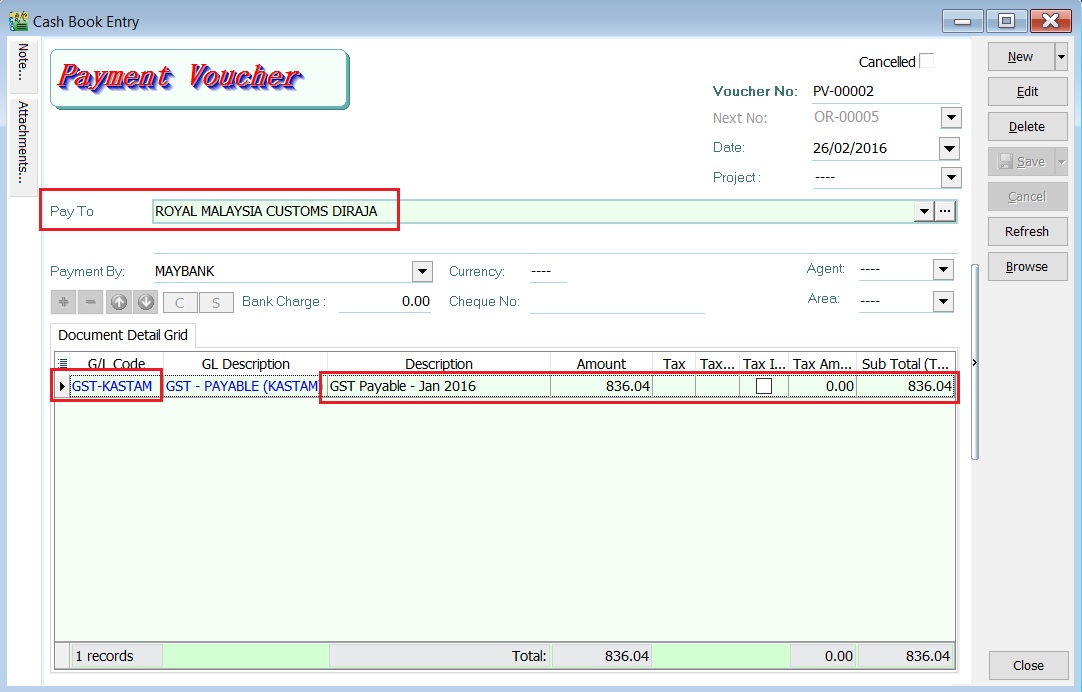

Payment to RMCD

Menu: GL | Cash Book Entry (PV)...

- 1. Click on the New follow by select select Payment Voucher.

- 2. Enter the ROYAL MALAYSIA CUSTOMS DIRAJA' into Pay To field.

- 3. At the detail, select GL Code: GST-KASTAM.

- 4. Enter the description to describe the GST Payable for the period, eg. GST Payable - Jan 2016.

- 5. Based on the GST Returns, enter the GST amount payable (Rm836.04) into the Amount column.

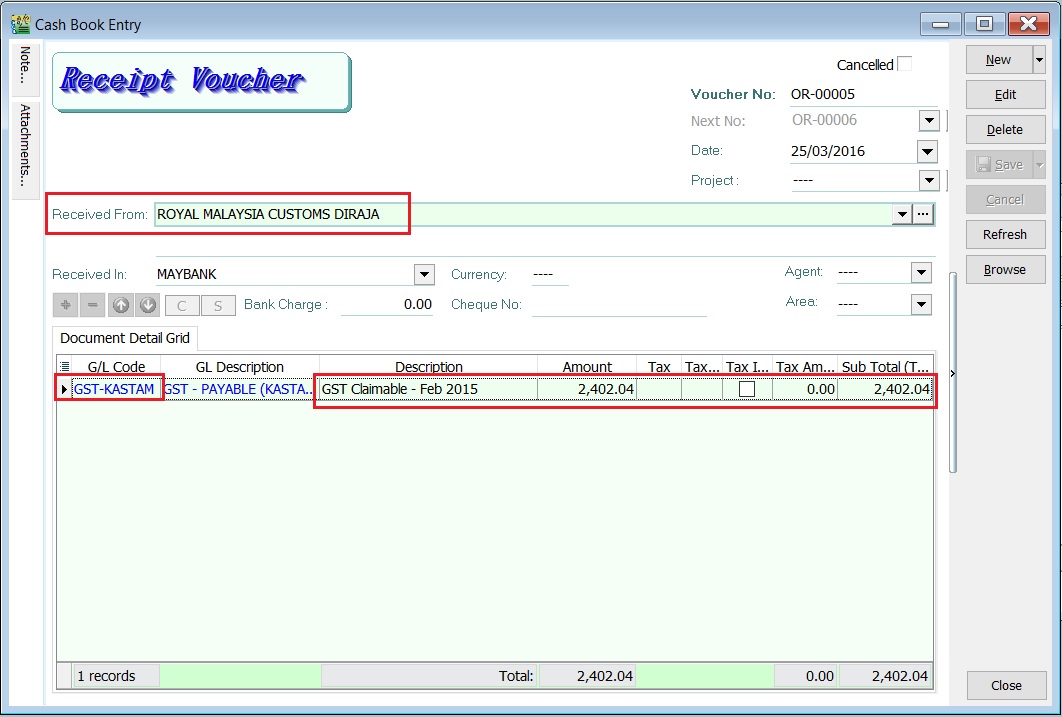

Refund from RMCD

Menu: GL | Cash Book Entry (OR)...

- 1. Click on the New follow by select Official Receipt.

- 2. Enter the ROYAL MALAYSIA CUSTOMS DIRAJA' into Received From field.

- 3. At the detail, select GL Code: GST-KASTAM.

- 4. Enter the description to describe the GST Claimable for the period, eg. GST Claimable - Feb 2016.

- 5. Based on the GST Returns, enter the GST amount claimable (Rm2,402.04) into the Amount column.

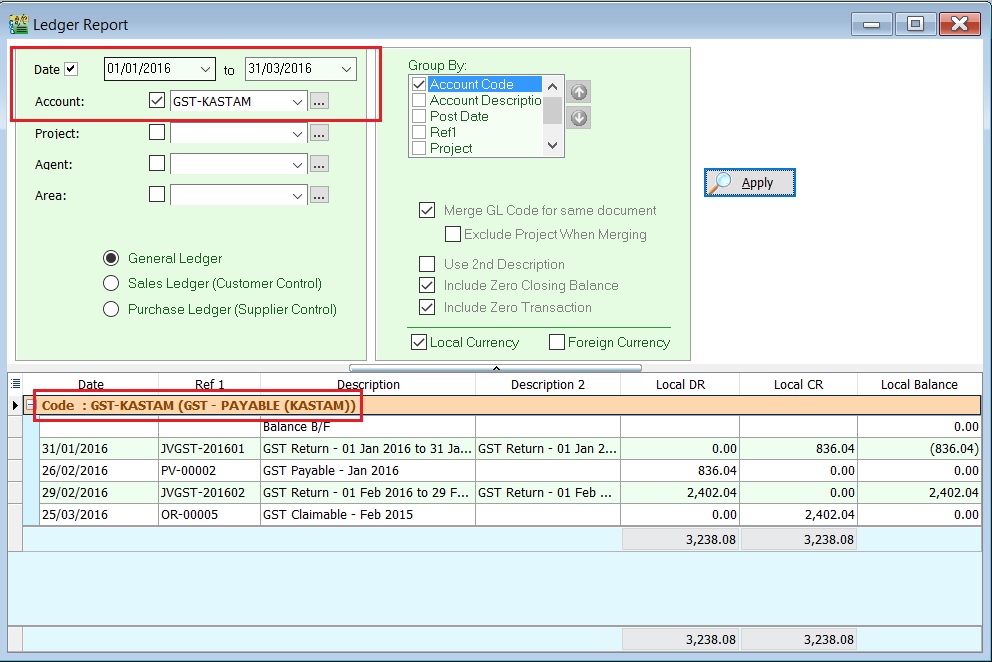

GST-Kastam Account Inquiry

Menu: GL | Print Ledger Report...

- 1. Select the date range.

- 2. Select the GL Account code : GST-KASTAM.

- 3. Click Apply.

- 4. RMCD outstanding transactions will be display as below.