| Line 56: | Line 56: | ||

:2. Enter Payee name. | :2. Enter Payee name. | ||

:3. Select bank account to pay. | :3. Select bank account to pay. | ||

:4. | :4. In detail grid, select the GL Account '''(Withholding Tax Payable)'''. | ||

:5. Enter the withholding tax amount to be paid. | :5. Enter the withholding tax amount to be paid. | ||

:[[File: WTH-Tax 10d.jpg| 500PX]] | :[[File: WTH-Tax 10d.jpg| 500PX]] | ||

Revision as of 03:51, 6 June 2020

Initial Setup

Withholding Tax Account

Menu : GL | Maintain Account...

GL Account Description Remark 460-XXX WITHHOLDING TAX PAYABLE Under Current Liabilities 990-XXX WITHHOLDING TAX EXPENSE Under Expenses

NOTE: GL Account not compulsory to follow.

Available in:

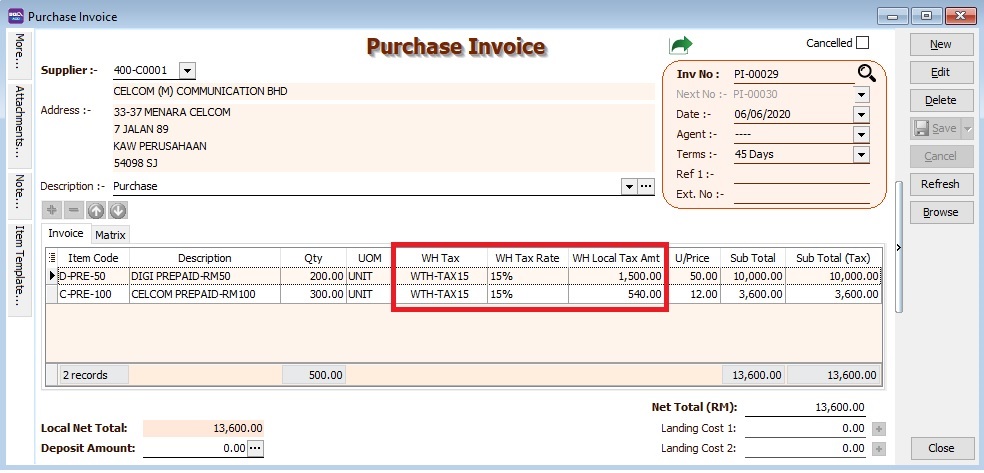

Menu : [Purchase | Purchase Invoice...] or [Supplier | Supplier Invoice...]

Menu : [Purchase | Cash Purchase...] or [Supplier | Supplier Invoice...]

Menu : [Purchase | Purchase Debit Note...] or [Supplier | Supplier Debit Note...]

Menu : [Purchase | Purchase Returned ...] or [Supplier | Supplier Credit Note...]

Withholding Tax Purchase Entry

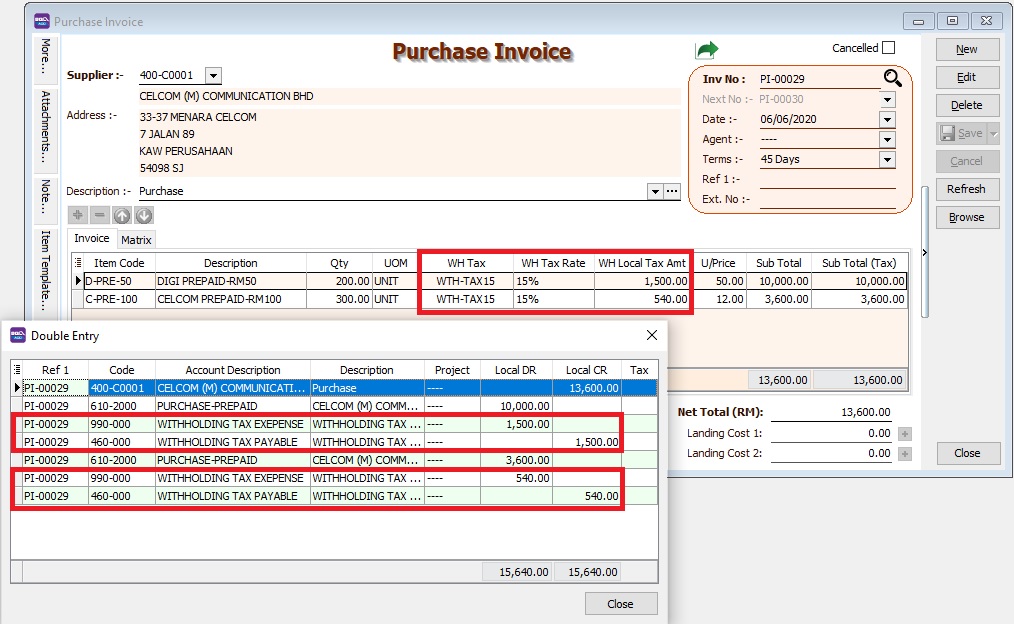

- 3. System will auto post the withholding tax double entry. Press CTRL + O to check the double entry.

GL Description Local DR Local CR Withholding Tax Expense XXX Withholding Tax Payable XXX

NOTE: Withholding tax amount will not add into the purchase invoice amount.

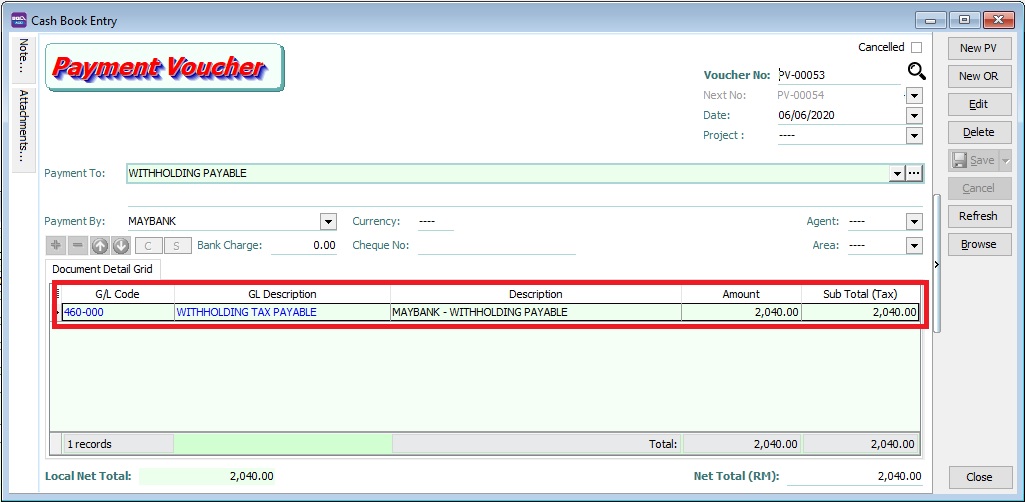

Payment of Withholding Tax

[ GL | Cash Book Entry..]

- 1. Create new PV.

- 2. Enter Payee name.

- 3. Select bank account to pay.

- 4. In detail grid, select the GL Account (Withholding Tax Payable).

- 5. Enter the withholding tax amount to be paid.

- 6. You can check the ledger report for Withholding Tax Payable balance.