| Line 34: | Line 34: | ||

! Item no !! Description !! Amount | ! Item no !! Description !! Amount | ||

|- | |- | ||

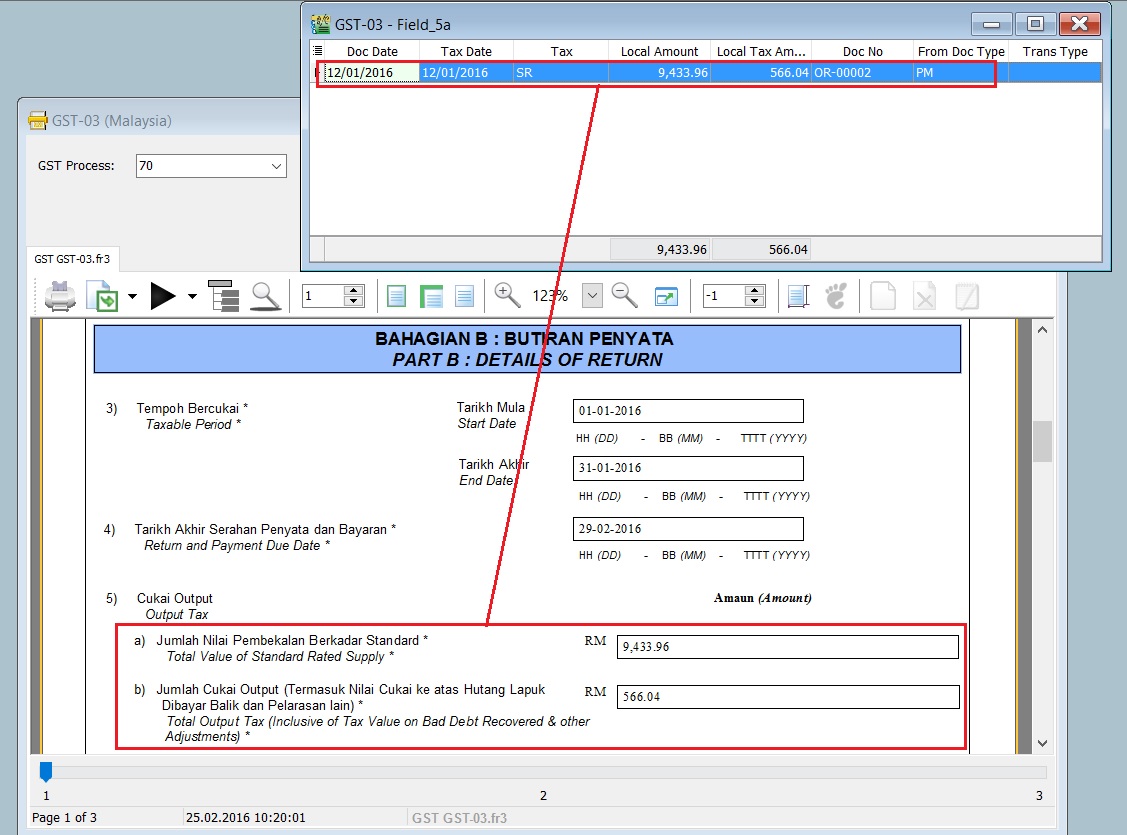

| 5a || Total Value of Standard Rated Supply || | | 5a || Total Value of Standard Rated Supply || style="text-align:right;"| '''9,433.96''' | ||

|- | |- | ||

| 5b || Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments) || | | 5b || Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments) || style="text-align:right;"| '''566.04''' | ||

|} | |} | ||

<br /> | <br /> | ||

Revision as of 04:20, 25 February 2016

GST Treatment-Non-Refundable Deposit

Introduction

- How to enter the non-refundable deposit accounted to Standard Rated (SR) and Zero Rated(ZRL & ZRE) to reflect in GST-03 submission?

- This guide will help you out. All non-refundable deposit amount are inclusive tax.

Type of supplies Tax Rate GST-03 Standard Rated (SR) 6% 1. Total Value of Standard Rated Supply (5a)

2. Total Output Tax (5b)

Zero Rated (ZRL & ZRE) 0% 1. Total Value of Local Zero Rated Supplies

2. Total Value of Export Supplies

Customer Payment

Menu: Customer | Customer Payment...

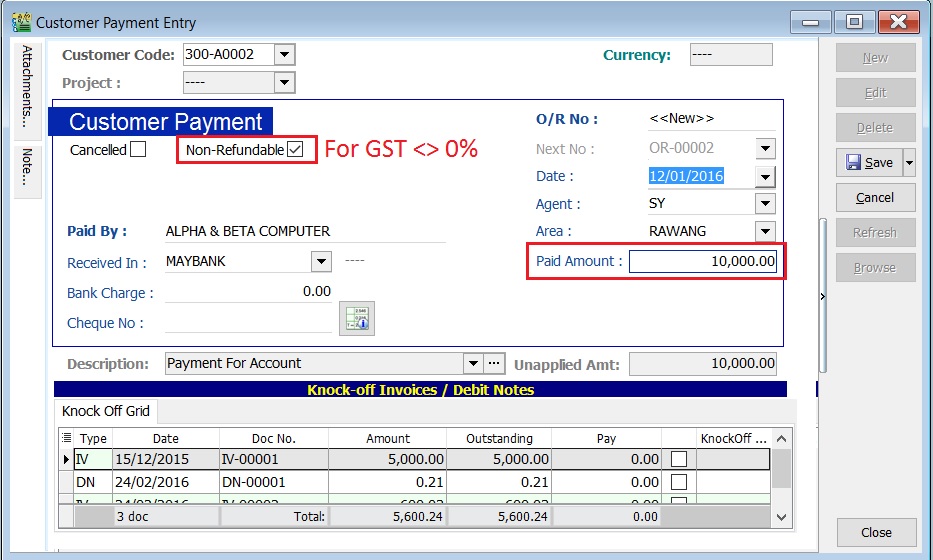

A. Non-Refundable (SR)

- 1. Create New Customer Payment.

- 2. Enter the Paid Amount, eg. Rm10,000.00

- 3. Tick Non-Refundable for GST not equal to 0%.

- 4. See the screenshot below.

- 5. Process GST Returns (GST | New GST Returns...).

- 6. Print the GST-03.

- GST-03 results:-

Item no Description Amount 5a Total Value of Standard Rated Supply 9,433.96 5b Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments) 566.04

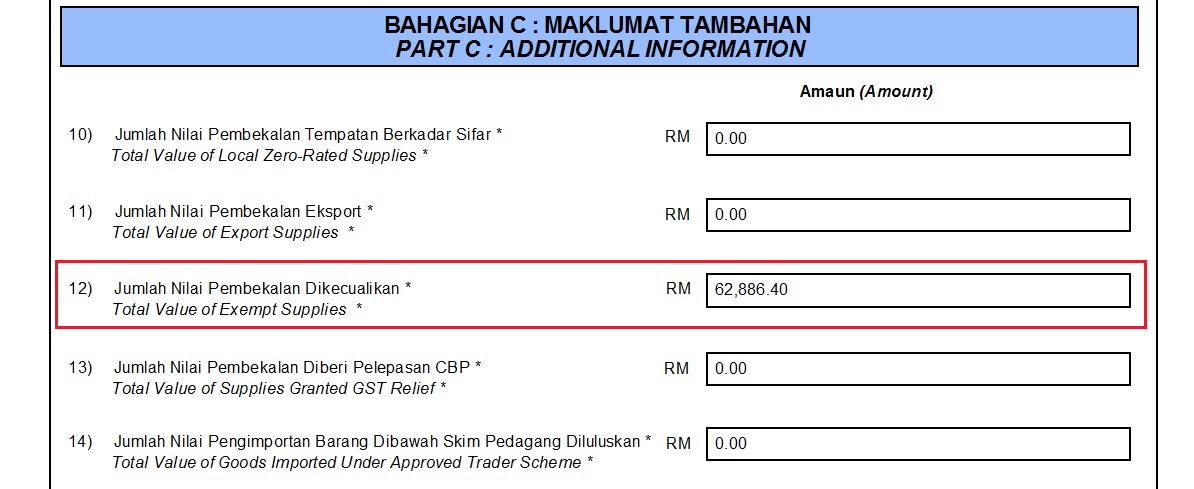

B. Non-Refundable (ZR)

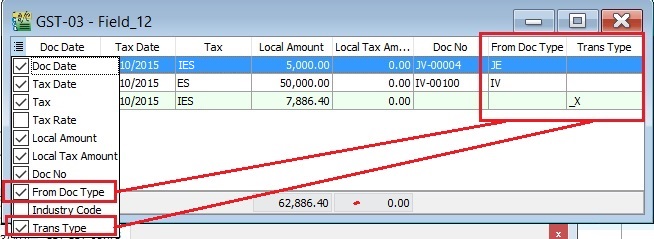

[GST | Print GST-03...]

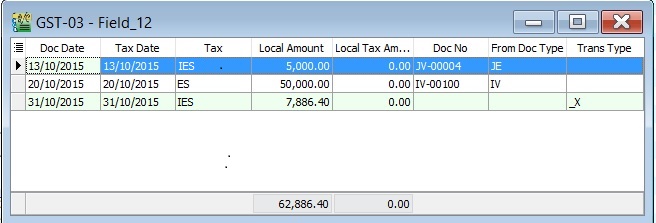

- 2. You can check the details by double click on the amount in Item 12.

- 3. Pop-up the item 12 detail.

- 4. You can insert additional column, ie. From Doc Type and Trans Type.

NOTE: Trans Type = _X, it means the posting entry related to Realized Gain or Loss in Foreign Exchange.