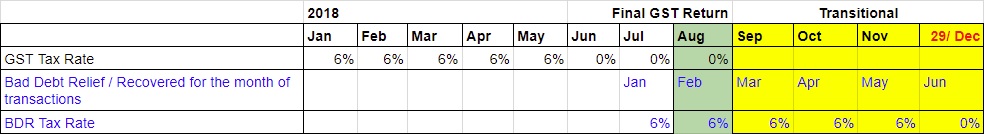

Bad Debt Relief/Recovered

- GST registered person is eligble to claim the bad debt relief even if it spans on or after 1 September 2018.

- Bad Debt Relief is allowed to be claimed within 120 days from the SST effective date (eg. 1 September 2018).

- Bad Debt Recovery made on or after 1 September 2018 must to be paid as output tax to RMCD within 120 days from the SST effective date by amending the Final GST Return.

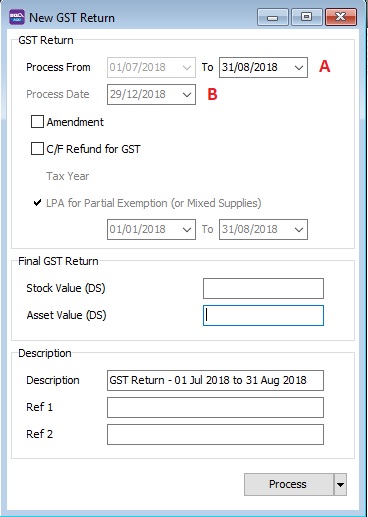

Final GST Return Processor

Menu: SST/GST | New GST Return...

- 1. System will AUTO define the last taxable period (A), eg...

Process From Process To 01/07/2018 31/08/2018

- 2. Set the Process Date to the date that you have submit the Final GST return before 29 December 2018 (within 120 days from the SST effective date).

- For example, company A submit the Final GST Return on 30/11/2018.

Process Date Bad Debt Relief / Recovery 30/11/2018 Mar, Apr, May 2018

- 2. Set Posting Date... to post this transaction into GL reporting as at 13 SEP 2018.

Note: To enable to set Posting Date, the Double Document Module is required.

- 3. Set Tax Date...to declare this GST input tax into Final GST Returns (31 AUG 2018).

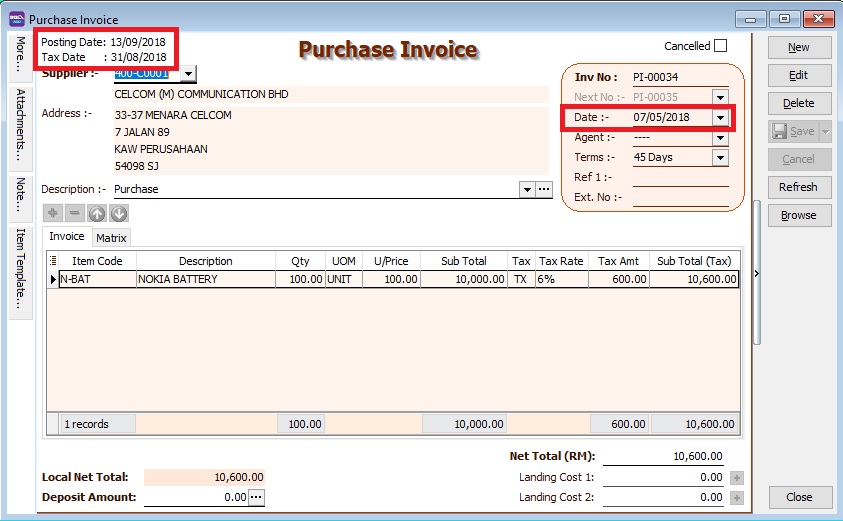

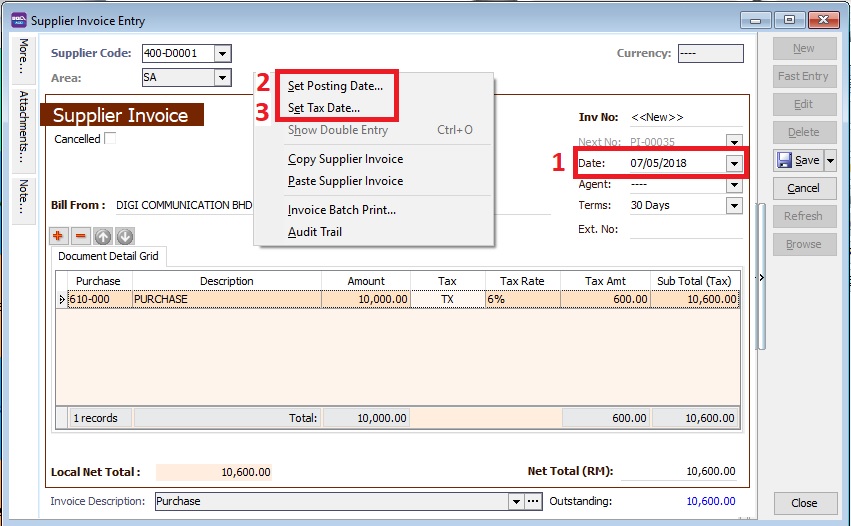

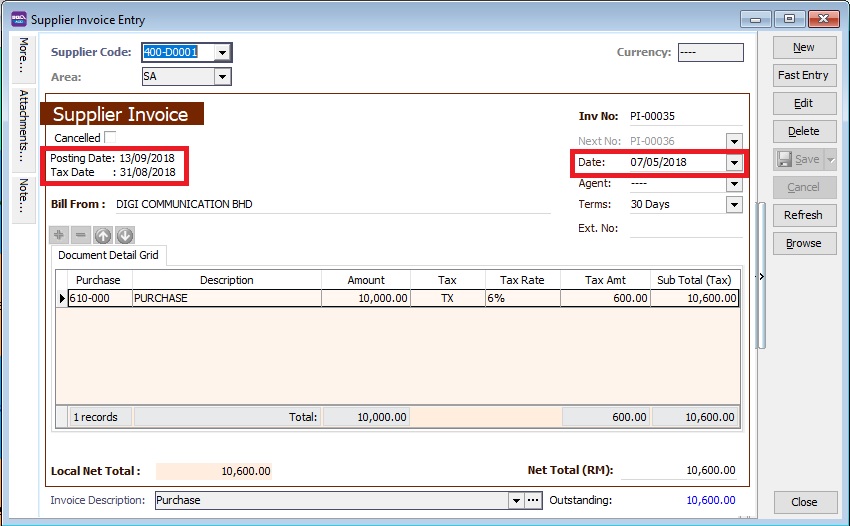

Enter at Supplier Invoice

Menu: Supplier | Supplier Invoice

- 1. Set Date.... to record the original invoice date (eg. 07 MAY 2018).

- 2. Set Posting Date... to post this transaction into GL reporting as 13 SEP 2018.

Note: To enable to set Posting Date, the Double Document Module is required.

- 3. Set Tax Date...to declare this GST input tax into Final GST Returns (31 AUG 2018).

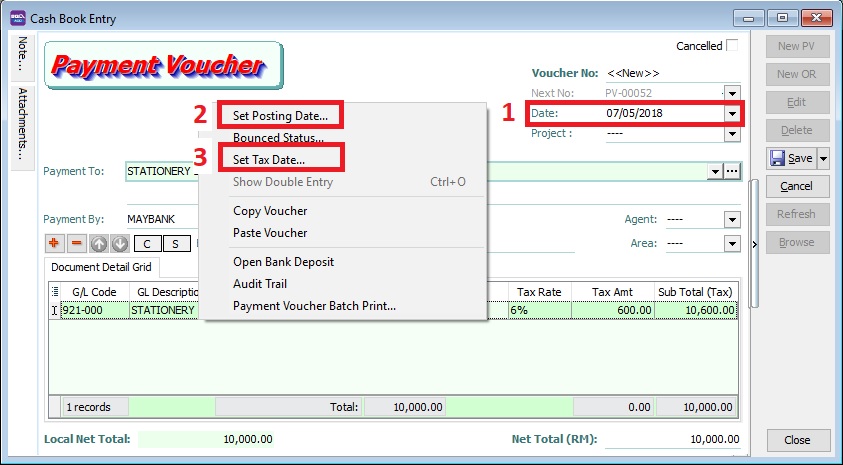

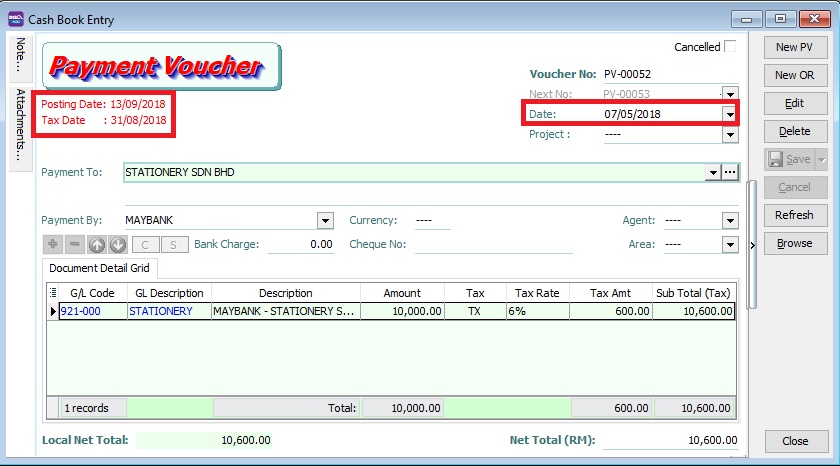

Enter at Cash Book (PV)

Menu: GL | Cash Book Entry...

- 1. Set Date.... to record the original invoice date (eg. 07 MAY 2018).

- 2. Set Posting Date... to post this transaction into GL reporting as at 13 SEP 2018.

- 3. Set Tax Date...to declare this GST input tax into Final GST Returns (31 AUG 2018).

Final GST Returns

Menu: GST | New GST Return

- Process GST Returns up to 31 AUG 2018.

Items Value 6a 10,000 6b 600

NOTE: * Final GST Returns until 31 AUG 2018. * Last date of submission for the Final GST Returns is 29 DEC 2018.