No edit summary |

|||

| Line 54: | Line 54: | ||

* [[Print Asset Analysis]] | * [[Print Asset Analysis]] | ||

* [[Print Asset Disposal Listing]] | * [[Print Asset Disposal Listing]] | ||

* [[How to tally | * [[How to process Asset Opening and tally with the GL Maintain Opening Balance]] | ||

* [[Import-Asset Master List]] | * [[Import-Asset Master List]] | ||

Latest revision as of 08:50, 14 December 2022

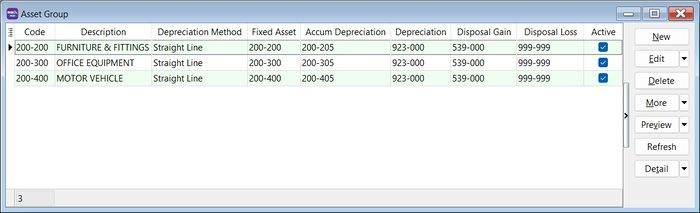

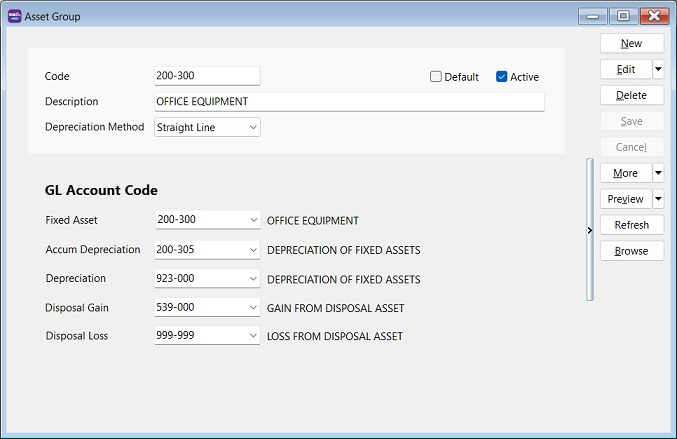

Menu: Asset | Asset Group...

Introduction

- Group the asset items based on the following considerations.

Maintain Asset Group

Field Name Explanation & Properties Code - Input the new Asset Group Code

- Field type : Alphanumerical

- Length : 20

Description - Input the Asset Group description, eg. Furniture, Motor Vehicle

- Field type : Alphanumerical

- Length : 200

Depreciation Method - Select an appropriate Depreciation Method to generate depreciation value

Fixed Asset - Select Balance Sheet GL Account code for Fixed Asset.

Accum Depreciation - Select Balance Sheet GL Account code for Accumulated Depreciation.

Depreciation - Select P&L GL Account for Depreciation of Asset.

Disposal Gain - Select P&L GL Account for Gain from Disposal Asset.

Disposal Loss - Select P&L GL Account for Loss from Disposal Asset.