| (9 intermediate revisions by the same user not shown) | |||

| Line 20: | Line 20: | ||

==Customer Payment== | ==Customer Payment== | ||

''Menu: Customer | Customer Payment...'' | ''Menu: Customer | Customer Payment...'' | ||

=== | ===Non-Refundable (SR)=== | ||

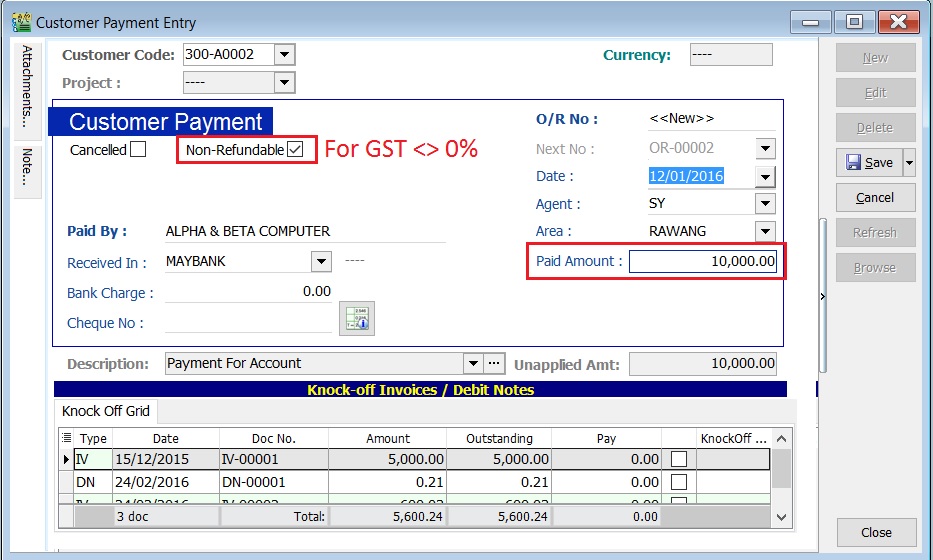

:1. Create '''New Customer Payment'''. | :1. Create '''New Customer Payment'''. | ||

:2. Enter the '''Paid Amount''', eg. Rm10,000.00 | :2. Enter the '''Paid Amount''', eg. Rm10,000.00 | ||

:3. | :3. '''Tick Non-Refundable''' for '''GST not equal to 0%'''. | ||

:4. See the screenshot below. | :4. See the screenshot below. | ||

::[[File: GST-Non-RefundableDep-01.jpg]] | ::[[File: GST-Non-RefundableDep-01.jpg]] | ||

| Line 32: | Line 32: | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

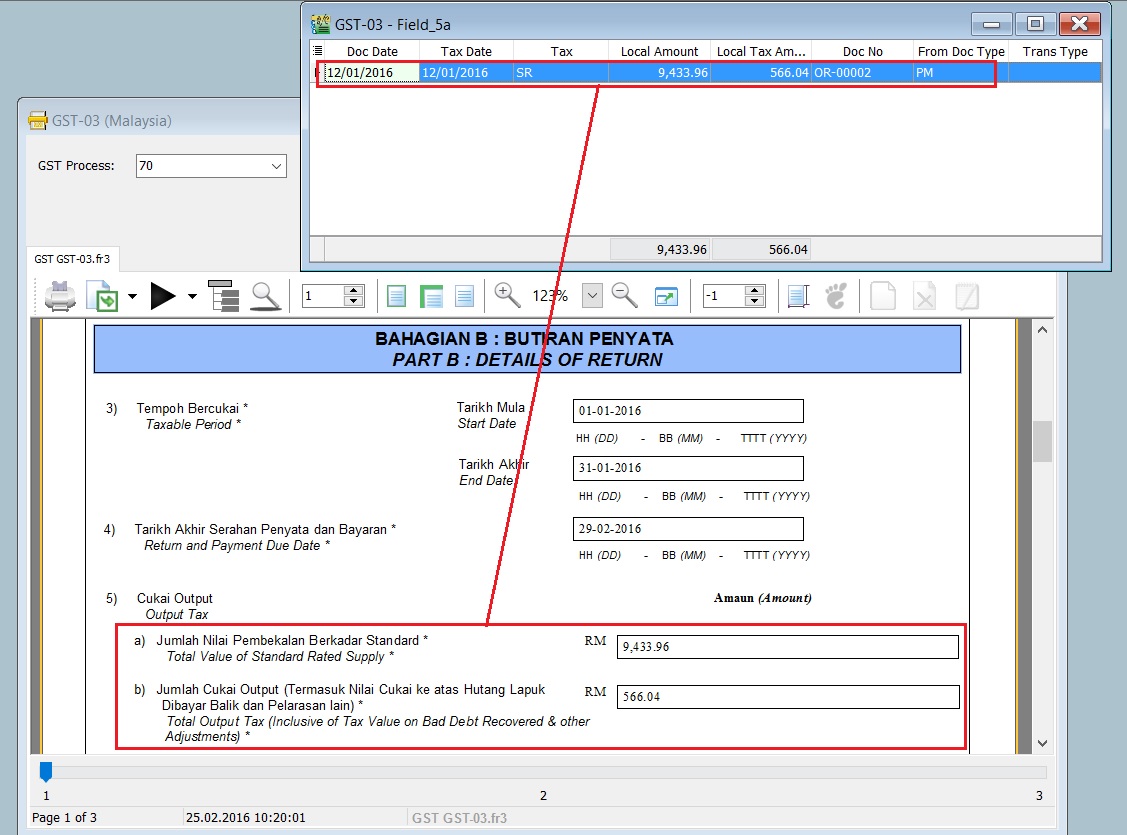

! Item | ! GST-03 Item !! Description !! Local Amount | ||

|- | |- | ||

| 5a || Total Value of Standard Rated Supply || | | 5a || Total Value of Standard Rated Supply || style="text-align:right;"| '''9,433.96''' | ||

|- | |- | ||

| 5b || Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments) || | | 5b || Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments) || style="text-align:right;"| '''566.04''' | ||

|} | |} | ||

<br /> | <br /> | ||

| Line 44: | Line 44: | ||

<br /> | <br /> | ||

===Non-Refundable (ZR)=== | |||

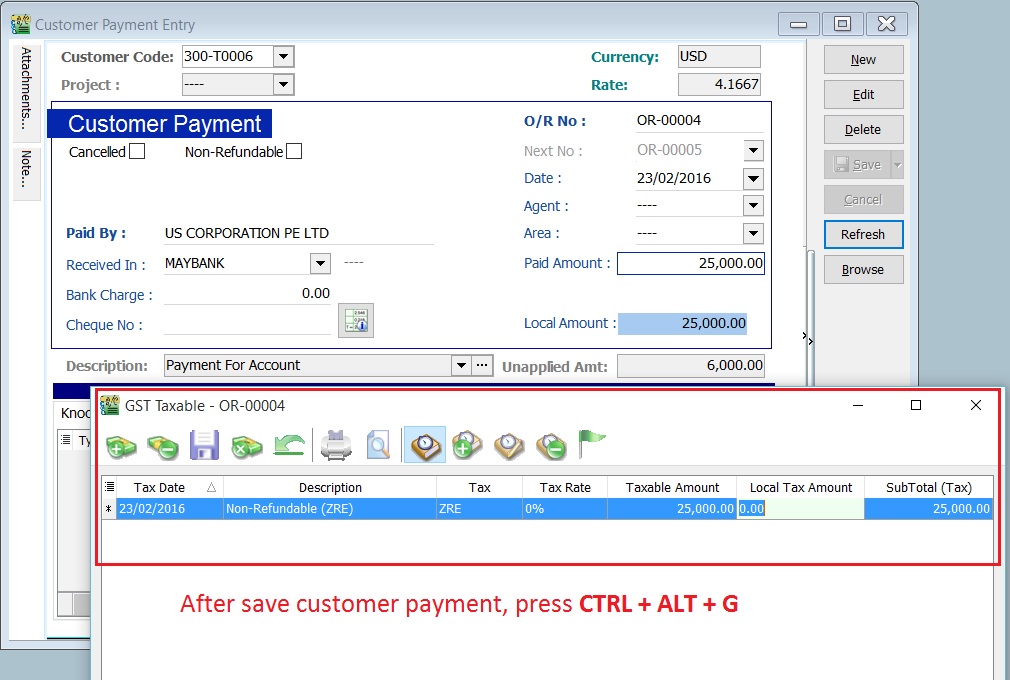

=== | :1. Create '''New Customer Payment'''. | ||

:2. Enter the '''Paid Amount''', eg. Rm25,000.00 (USD6,000.00) | |||

'' | :3. Ensure the '''Non-Refundable checkbox''' is '''Untick''' for '''GST equal to 0%''', eg. ZRL and ZRE. | ||

:4. Press '''CTRL + ALT + G'''. | |||

: | :5. Enter the tax transactions. See the '''GST Taxable''' detail in the screenshot below. | ||

::[[File: GST | ::[[File: GST-Non-RefundableDep-03.jpg]] | ||

<br /> | <br /> | ||

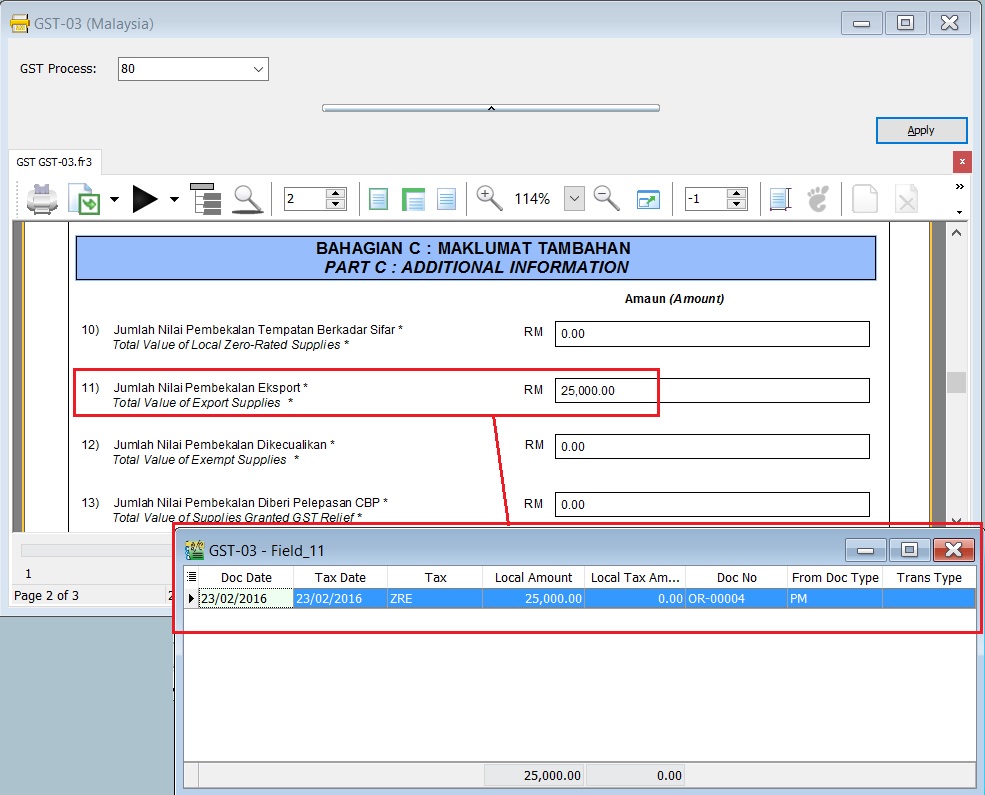

: | :5. Process GST Returns (GST | New GST Returns...). | ||

: | :6. Print the GST-03. | ||

::'''GST-03 results:- ''' | |||

::{| class="wikitable" | |||

|- | |||

! GST-03 Item !! Description !! Local Amount | |||

|- | |||

| 11 || Total Value of Export Supplies '''(ZRE)''' || style="text-align:right;"| '''25,000.00''' | |||

|} | |||

<br /> | <br /> | ||

: | :7. See the GST-03 screenshot below. | ||

::[[File: GST-Non-RefundableDep-04.jpg]] | |||

::[[File: GST | |||

<br /> | <br /> | ||

==See also== | ==See also== | ||

* [[Customer Payment]] | * [[Customer Payment]] | ||

* [[Print GST-03]] | * [[Print GST-03]] | ||

Latest revision as of 01:29, 26 February 2016

GST Treatment-Non-Refundable Deposit

Introduction

- How to enter the non-refundable deposit accounted to Standard Rated (SR) and Zero Rated(ZRL & ZRE) to reflect in GST-03 submission?

- This guide will help you out. All non-refundable deposit amount are inclusive tax.

Type of supplies Tax Rate GST-03 Standard Rated (SR) 6% 1. Total Value of Standard Rated Supply (5a)

2. Total Output Tax (5b)

Zero Rated (ZRL & ZRE) 0% 1. Total Value of Local Zero Rated Supplies

2. Total Value of Export Supplies

Customer Payment

Menu: Customer | Customer Payment...

Non-Refundable (SR)

- 1. Create New Customer Payment.

- 2. Enter the Paid Amount, eg. Rm10,000.00

- 3. Tick Non-Refundable for GST not equal to 0%.

- 4. See the screenshot below.

- 5. Process GST Returns (GST | New GST Returns...).

- 6. Print the GST-03.

- GST-03 results:-

GST-03 Item Description Local Amount 5a Total Value of Standard Rated Supply 9,433.96 5b Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments) 566.04

Non-Refundable (ZR)

- 1. Create New Customer Payment.

- 2. Enter the Paid Amount, eg. Rm25,000.00 (USD6,000.00)

- 3. Ensure the Non-Refundable checkbox is Untick for GST equal to 0%, eg. ZRL and ZRE.

- 4. Press CTRL + ALT + G.

- 5. Enter the tax transactions. See the GST Taxable detail in the screenshot below.

- 5. Process GST Returns (GST | New GST Returns...).

- 6. Print the GST-03.

- GST-03 results:-

GST-03 Item Description Local Amount 11 Total Value of Export Supplies (ZRE) 25,000.00