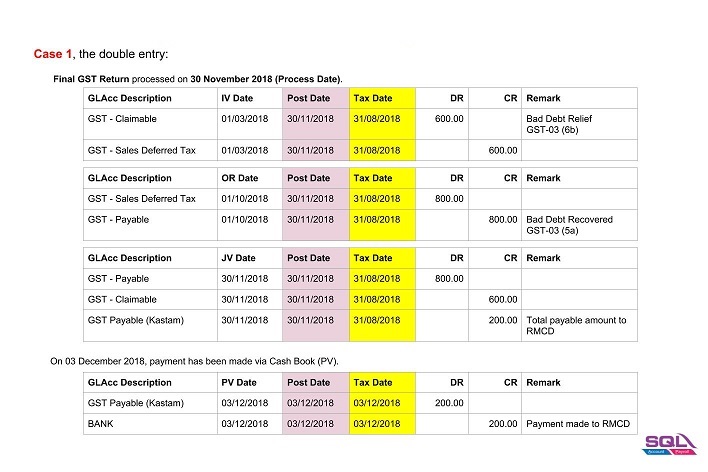

| Line 24: | Line 24: | ||

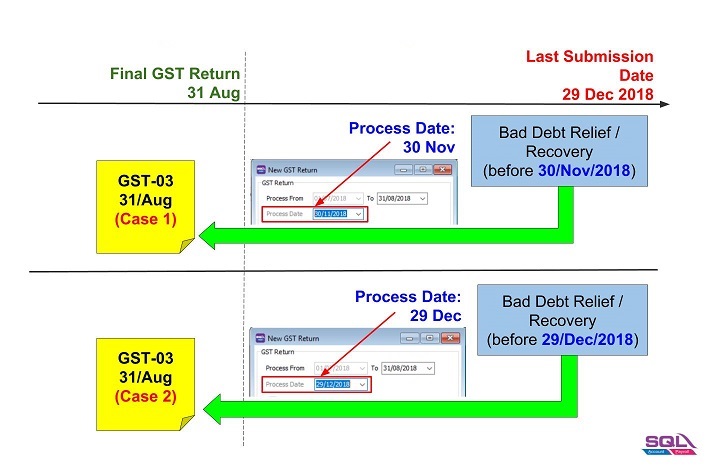

:2. Set the Process Date '''(B)''' as the date submit the Final GST return before 29 December 2018 (within 120 days from the SST effective date). | :2. Set the Process Date '''(B)''' as the date submit the Final GST return before 29 December 2018 (within 120 days from the SST effective date). | ||

::[[File:GSTSST-Transitional_03.jpg | | ::[[File:GSTSST-Transitional_03.jpg | 800PX]] | ||

<br /> | <br /> | ||

::[[File:GSTSST-Transitional_04.jpg]] | ::[[File:GSTSST-Transitional_04.jpg]] | ||

Revision as of 03:47, 11 October 2018

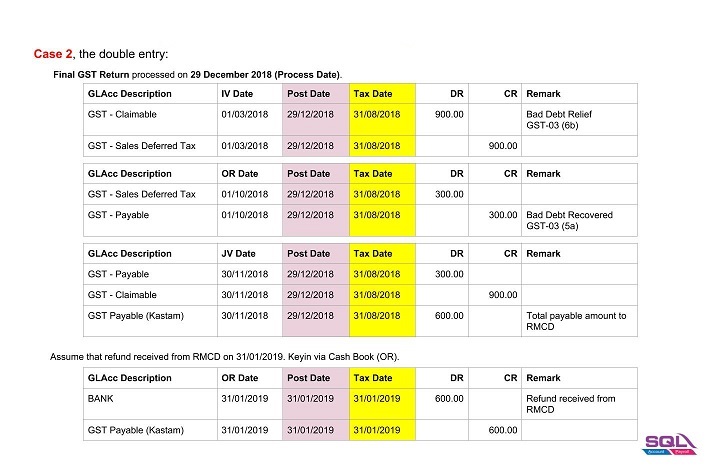

Bad Debt Relief/Recovered

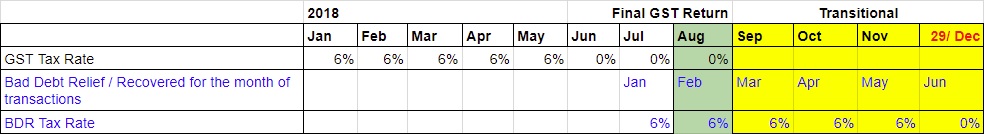

- GST registered person is eligble to claim the bad debt relief even if it spans on or after 1 September 2018.

- Bad Debt Relief is allowed to be claimed within 120 days from the SST effective date (eg. 1 September 2018).

- Bad Debt Recovery made on or after 1 September 2018 must to be paid as output tax to RMCD within 120 days from the SST effective date by amending the Final GST Return.

Final GST Return Processor

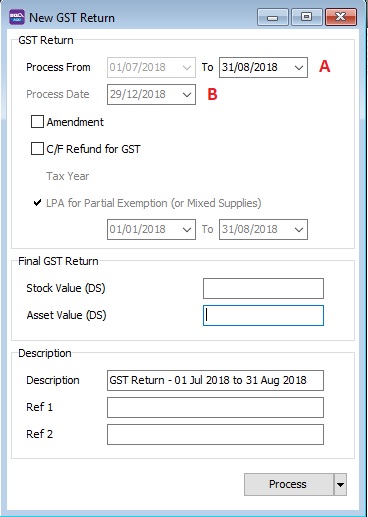

Menu: SST/GST | New GST Return...

- 1. System will AUTO define the last taxable period (A), eg...

Process From Process To 01/07/2018 31/08/2018

- 2. Set the Process Date (B) as the date submit the Final GST return before 29 December 2018 (within 120 days from the SST effective date).