No edit summary |

|||

| Line 4: | Line 4: | ||

==Introduction== | ==Introduction== | ||

:How to enter the non-refundable deposit accounted to '''Standard Rated''' (SR) and '''Zero Rated'''(ZRL & ZRE) to reflect in GST-03 submission? | :How to enter the non-refundable deposit accounted to '''Standard Rated''' (SR) and '''Zero Rated'''(ZRL & ZRE) to reflect in GST-03 submission? | ||

:This guide will help you | :This guide will help you out. All non-refundable deposit amount are inclusive tax. <br /> | ||

<br /> | <br /> | ||

| Line 18: | Line 17: | ||

2. Total Value of Export Supplies | 2. Total Value of Export Supplies | ||

|} | |} | ||

==Customer Payment== | ==Customer Payment== | ||

Revision as of 02:27, 25 February 2016

GST Treatment-Non-Refundable Deposit

Introduction

- How to enter the non-refundable deposit accounted to Standard Rated (SR) and Zero Rated(ZRL & ZRE) to reflect in GST-03 submission?

- This guide will help you out. All non-refundable deposit amount are inclusive tax.

Type of supplies Tax Rate GST-03 Standard Rated (SR) 6% 1. Total Value of Standard Rated Supply (5a)

2. Total Output Tax (5b)

Zero Rated (ZRL & ZRE) 0% 1. Total Value of Local Zero Rated Supplies

2. Total Value of Export Supplies

Customer Payment

A. Non-Refundable (SR)

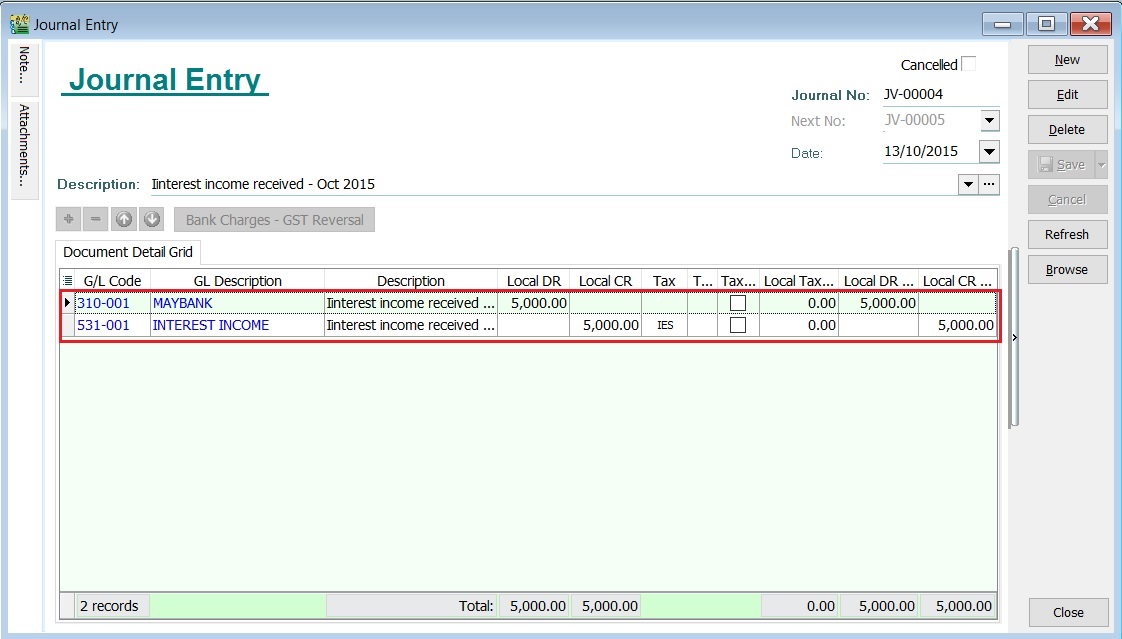

- 1. ES43 - Interest income from deposits placed with a financial institution in Malaysia

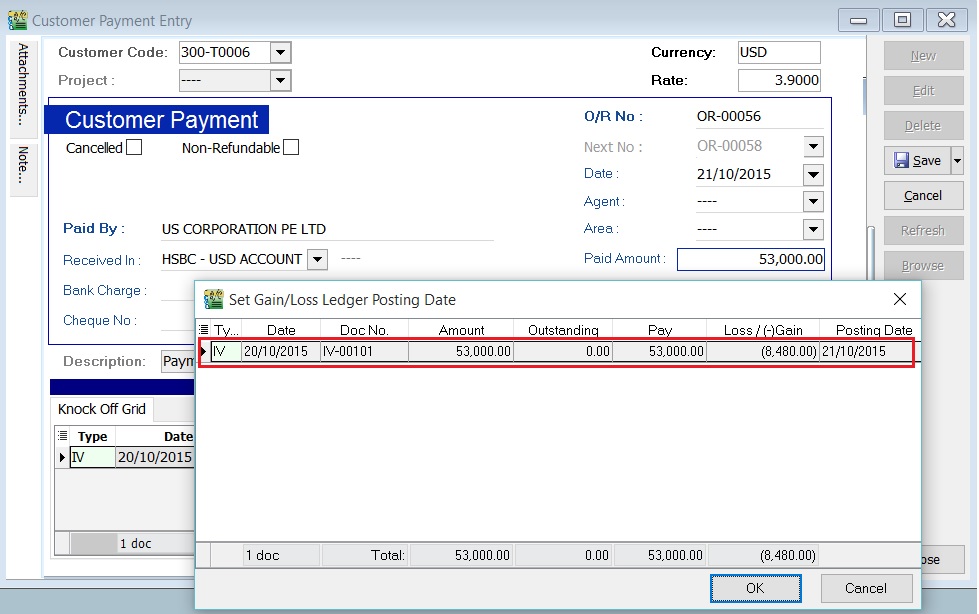

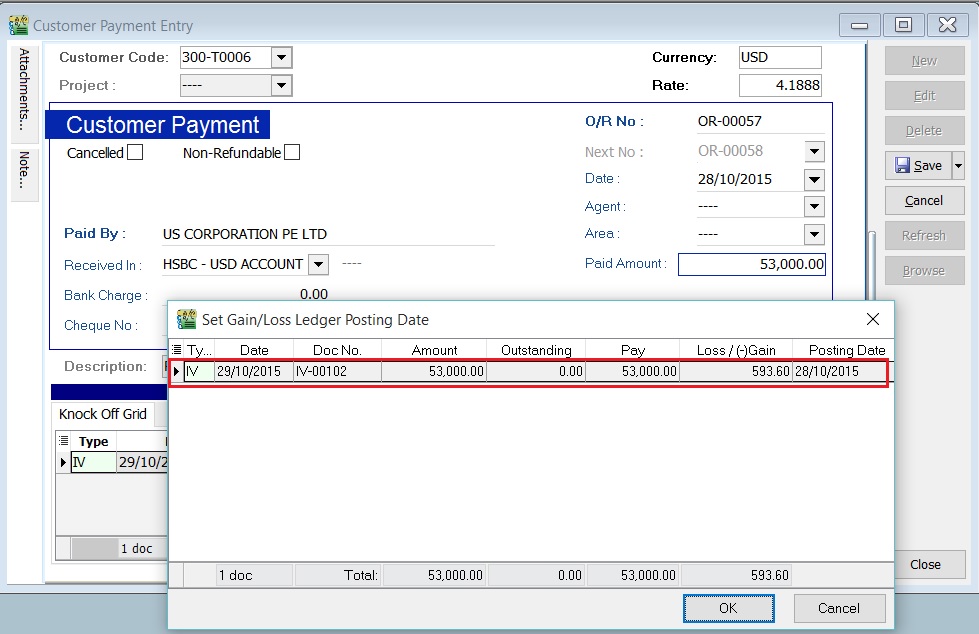

- 2. ES43 - Realized foreign exchange gains or losses

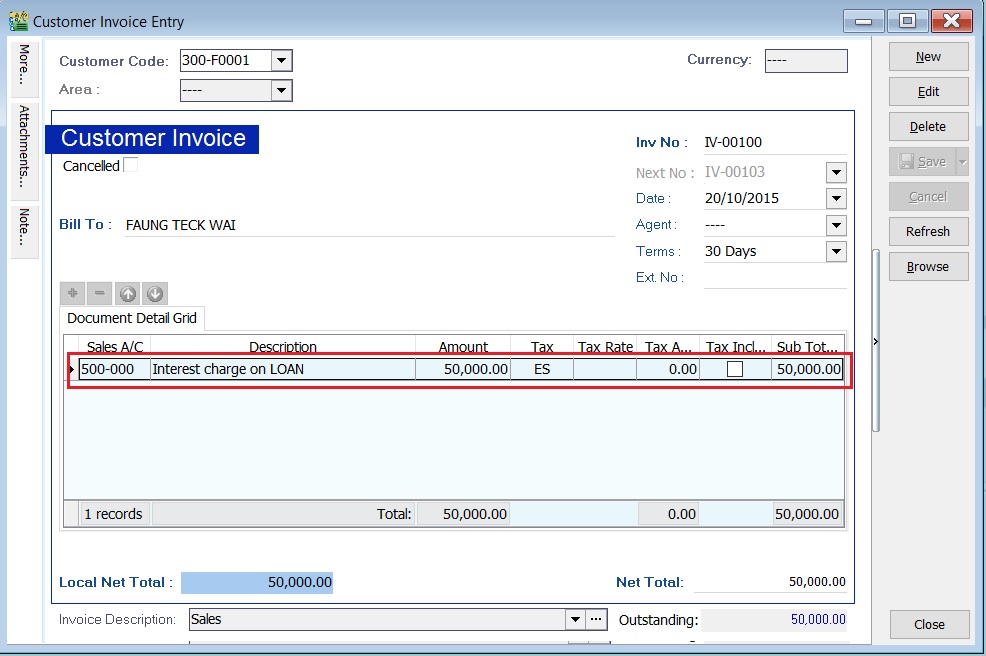

- 3. ES - Financial Institution’s interest charges to customers for loan

B. Non-Refundable (ZR)

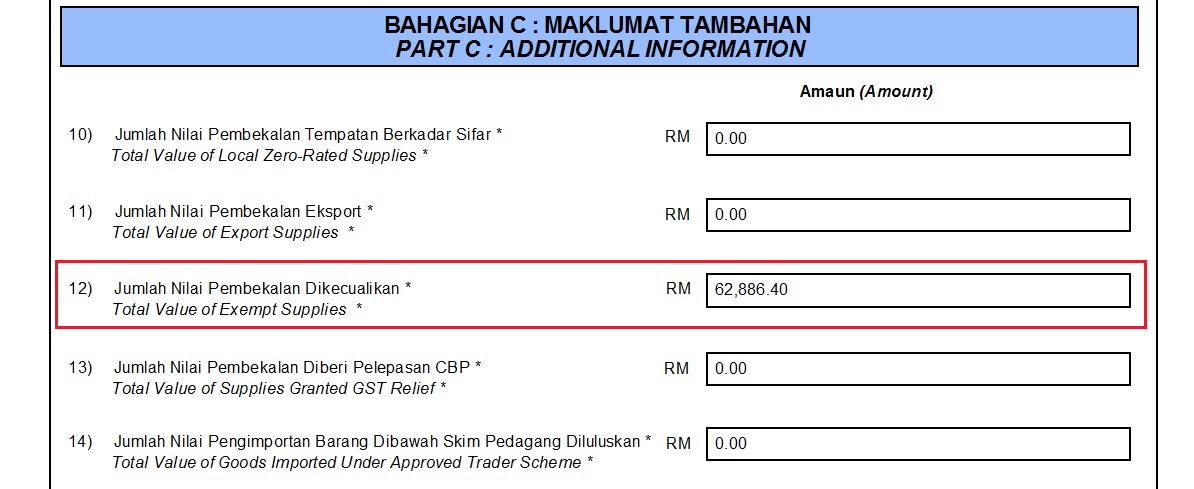

[GST | Print GST-03...]

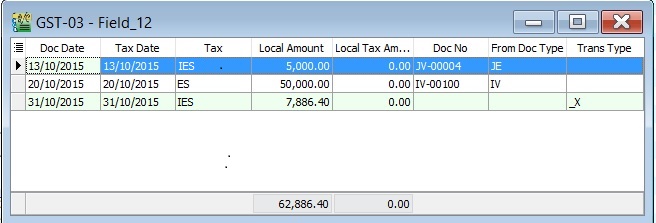

- 2. You can check the details by double click on the amount in Item 12.

- 3. Pop-up the item 12 detail.

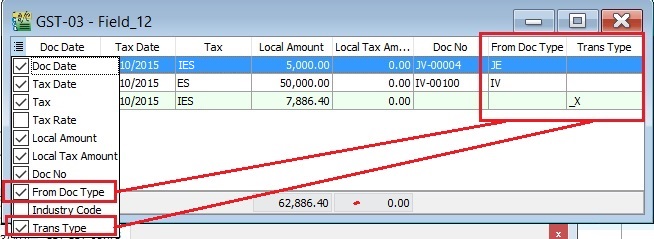

- 4. You can insert additional column, ie. From Doc Type and Trans Type.

NOTE: Trans Type = _X, it means the posting entry related to Realized Gain or Loss in Foreign Exchange.