No edit summary |

No edit summary |

||

| Line 124: | Line 124: | ||

Lets assume the asset : TOYOTA VIOS 1.5 / RED<br> | Lets assume the asset : TOYOTA VIOS 1.5 / RED<br> | ||

{| class="wikitable" | {| class="wikitable" | ||

|+ | |+ | ||

| Line 138: | Line 137: | ||

| Residual || 10,000.00 | | Residual || 10,000.00 | ||

|} | |} | ||

{| class="wikitable" | {| class="wikitable" | ||

Revision as of 04:35, 20 September 2023

Quick Import Asset List

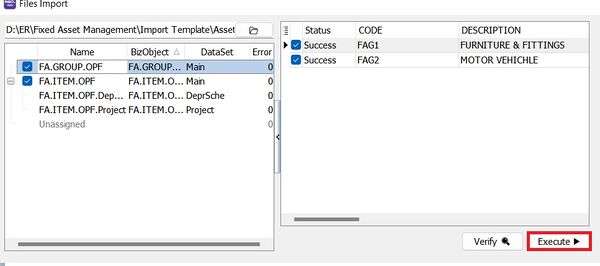

Menu: File | Import | Excel Files...

- 1. Download the Asset Master Template

- 3. Select the Asset Template excel file...

NOTE: Asset import function available in SQL Account version 5.2022.948.826 and above.

Preparation-Asset Master Import Excel Template

Download the Asset Master Template

Asset Master Template (xlsx) Sheet Name Refer to FA.GROUP.OPF Maintain Asset Group FA.ITEM.OPF Maintain Asset Item FA.ITEM.OPF.DeprSche Maintain Asset Item - Depreciation Schedule tab FA.ITEM.OPF.Project Maintain Asset Item - Project tab

NOTE: DO NOT rename the sheet name.

1. FA.GROUP.OPF (Maintain Asset Group)

FA.GROUP.OPF Column Length Note Code 20 Asset Group Code, eg. Furniture) Description 160 Asset Group Description, eg. Furniture & Fittings DeprMethod 1 (Integer) Depreciation Method, eg. 1 : Straight Line Method AssetAcc 10 Eg. Furniture & Fittings under Non-Current Assets (B/S) AccumDeprAcc 10 Eg. Accumulated Depreciation - Furniture & Fittings under Non-Current Assets (B/S) DeprAcc 10 Eg. Depreciation account under Expenses (P&L) DisposalGainAcc 10 Eg. Disposal Gain account under Other Income / Expenses (P&L) DisposalLossAcc 10 Eg. Disposal Loss account under Expenses (P&L)

| Code | Description | DeprMethod | AssetAcc | AccumDeprAcc | DeprAcc | DisposalGainAcc | DisposalLossAcc |

|---|---|---|---|---|---|---|---|

| Furniture | Furniture & Fittings | 1 | 200-200 | 200-205 | 923-000 | 530-999 | 980-999 |

| MV | Motor Vehicle | 1 | 200-400 | 200-405 | 923-000 | 530-999 | 980-999 |

2. FA.ITEM.OPF (Maintain Asset Item)

| Column | Length | Note |

|---|---|---|

| Code | 20 | Asset Code, eg. FF-0001 |

| Description | 160 | Asset Description, eg. Chairs, Table |

| Asset Group | 20 | Asset Group, eg. Furniture |

| Agent | 10 | Assigned an agent if any |

| Area | 10 | Assigne an area if any |

| AcquireDate | Date | Purchase date |

| Cost | Currency | Purchase cost |

| UsefulLife | Float | Useful life in year, eg. 5 years, 3.3 years |

| DeprFrequency | 1 (Integer) | 1 : Monthly 2 : Quarterly 3 : Half Yearly 4 : Yearly |

| Residual | Float | Resellable value |

| Code | Description | Asset Group | Agent | Area | AcquireDate | Cost | UsefulLife | DeprFrequency | Residual |

|---|---|---|---|---|---|---|---|---|---|

| FF-001 | Chairs | Furniture | ---- | KL | 13/10/2022 | 12,000.00 | 10 | 1 | 100.00 |

| FF-002 | Meeting Table | Furniture | ---- | KL | 23/01/20021 | 15,000.00 | 10 | 2 | 0.01 |

| MV-001 | TOYOTA VIOS 1.5 / RED | MV | YUKI | SEL | 17/03/2020 | 88,000.00 | 5 | 4 | 10,000.00 |

3. FA.ITEM.OPF.DeprSche (Maintain Asset item-Depreciation Schedule)

| Column | Length | Note |

|---|---|---|

| Code | 20 | Asset Code, eg. FF-0001 |

| ScheDate | Date | Schedule depreciation posting date |

| Description | 160 | Depreciation description |

| Amount | Currency | Depreciation amount base on the depreciation frequency |

Lets assume the asset : TOYOTA VIOS 1.5 / RED

| Field | Data |

|---|---|

| Cost | 88,000.00 |

| Acquire Date | 17/03/2020 |

| UsefuiLife | 5 years |

| Residual | 10,000.00 |

| Header text | Header text | Header text | Header text |

|---|---|---|---|

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |

| Example | Example | Example | Example |