No edit summary |

|||

| (20 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

==Introduction== | ==Introduction== | ||

: | |||

<big>Update: | |||

< | For year of assessment in '''2020 and 2021''', the income tax exemption limit '''has increased from RM10,000 to RM20,000'''.</big> | ||

'''Rules:''' | '''Rules:''' | ||

:1. Compensation exempted from income tax is RM10,000 x no of years of service. | :1. Compensation exempted from income tax is RM10,000 x no of years of service. | ||

:2. Determine the number of completed year of service. For example, employee has | :2. Determine the number of completed year of service. For example, employee has served for 5 completed year of service | ||

<br /> | <br /> | ||

* 1/5/2004 - 30/4/2005 (year 1) | * 1/5/2004 - 30/4/2005 (year 1) | ||

| Line 26: | Line 27: | ||

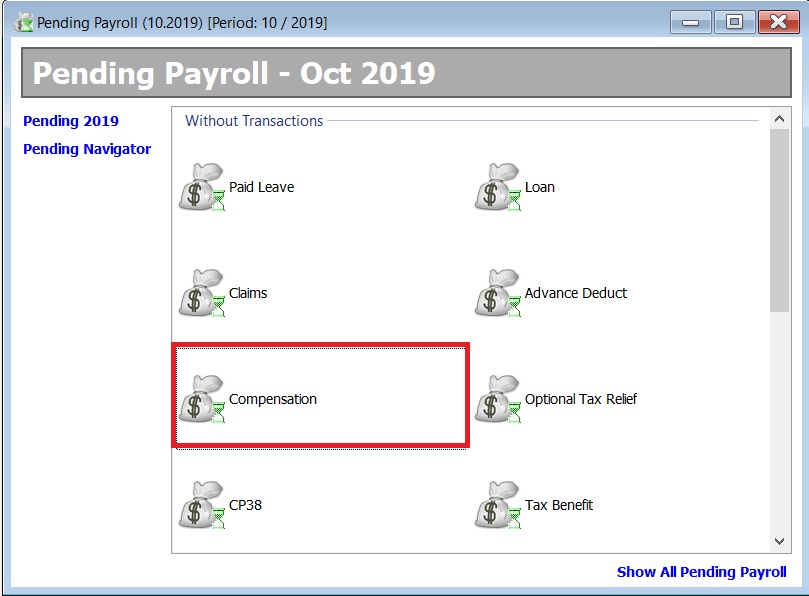

==Pending Compensation== | ==Pending Compensation== | ||

'' | ''Menu : Payroll | Open Pending Payroll...'' | ||

<br /> | <br /> | ||

:Key-in the total compensation amount in pending '''compensation'''. eg. compensation aamount RM75,000. | |||

:[[File:Compensation-01.jpg | 400PX]] | :[[File:Compensation-01.jpg | 400PX]] | ||

<br /> | <br /> | ||

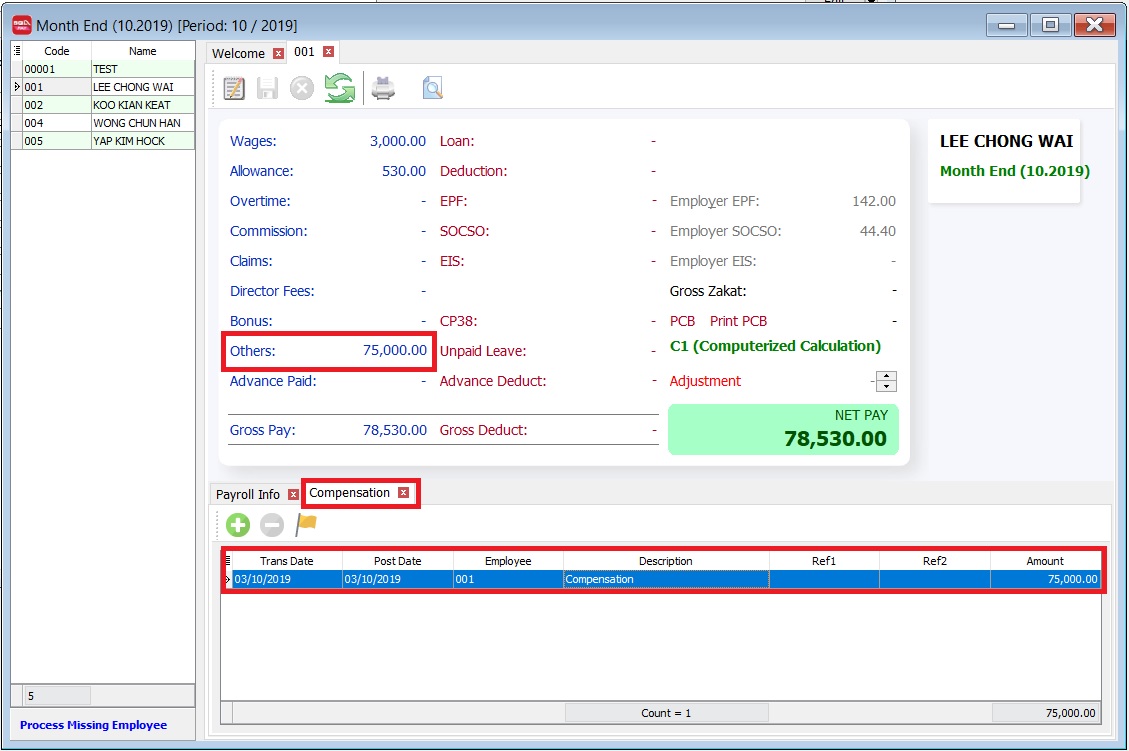

==Payroll Process== | ==Payroll Process== | ||

'' | ''Menu : Payroll | New Payroll...'' | ||

<br /> | <br /> | ||

:[[File:Compensation-02.jpg | | :Compensation amount RM75,0000 will process in the month of pay. | ||

:[[File:Compensation-02.jpg | 300PX]] | |||

<br /> | <br /> | ||

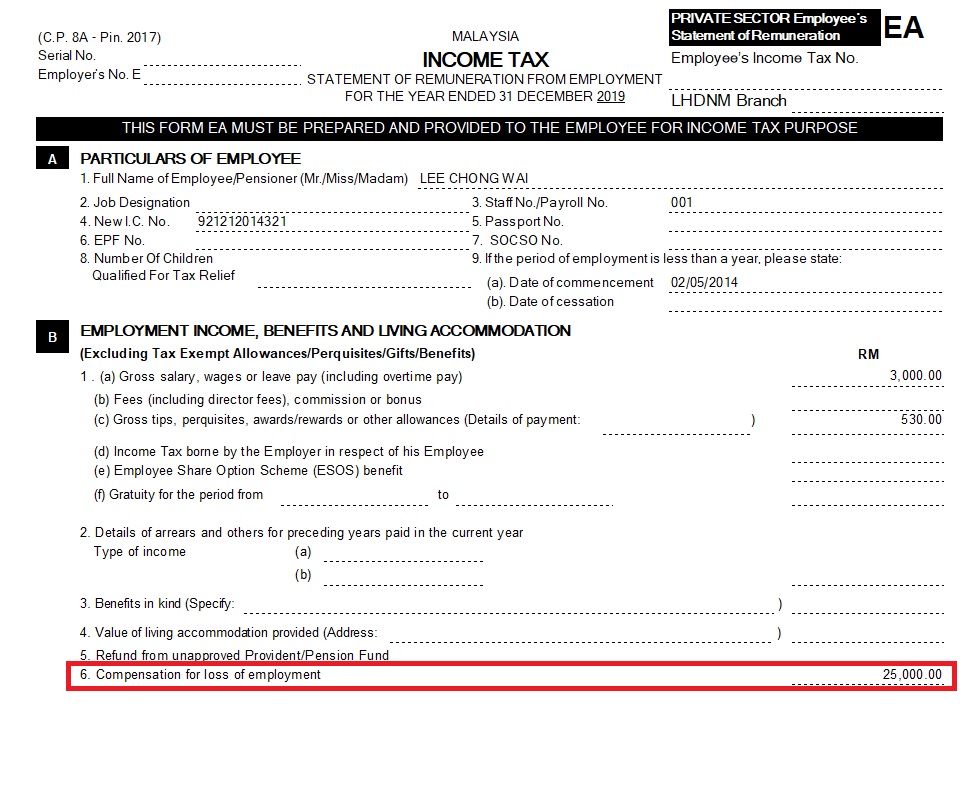

==EA Form== | ==EA Form== | ||

'' | ''Menu : Payroll | Government Reports | Print Income Tax EA Form...'' | ||

<br /> | |||

:Compensation paid = RM75,0000 | |||

:''Less:'' Amount of exemption = RM50,000.00 | |||

:Balance of compensation taxable will be shown in '''EA (B6)''' = RM25,000.00 | |||

<br /> | <br /> | ||

:[[File:Compensation-03.jpg | 400PX]] | :[[File:Compensation-03.jpg | 400PX]] | ||

<br /> | <br /> | ||

==See also== | |||

* [[New Payroll]] | |||

* [[Open Pending Payroll]] | |||

* [[Print Income Tax EA Form]] | |||

Latest revision as of 09:40, 26 March 2021

Introduction

Update: For year of assessment in 2020 and 2021, the income tax exemption limit has increased from RM10,000 to RM20,000.

Rules:

- 1. Compensation exempted from income tax is RM10,000 x no of years of service.

- 2. Determine the number of completed year of service. For example, employee has served for 5 completed year of service

- 1/5/2004 - 30/4/2005 (year 1)

- 1/5/2005 - 30/4/2006 (year 2)

- 1/5/2006 - 30/4/2007 (year 3)

- 1/5/2007 - 30/4/2008 (year 4)

- 1/5/2008 - 30/4/2009 (year 5)

- 1/5/2009 - 25/3/2010 (n/a, less than one completed year of service)

- 3. Tax exemption on compensation

- RM10,000 x 5 years of service = RM50,000

Workings:

- Compensation paid (key in Pending Compensation) = RM75,0000

- Less: Amount of exemption RM50,000.00

- Balance of compensation subject to MTD RM25,000.00

- Balance of compensation of RM25,000.00 after deducting the qualifying exemption will be subject to MTD and the MTD shall be calculated using Additional Remuneration PCB (A) Formula and report in EA form (B6).

Pending Compensation

Menu : Payroll | Open Pending Payroll...

Payroll Process

Menu : Payroll | New Payroll...

EA Form

Menu : Payroll | Government Reports | Print Income Tax EA Form...

- Compensation paid = RM75,0000

- Less: Amount of exemption = RM50,000.00

- Balance of compensation taxable will be shown in EA (B6) = RM25,000.00