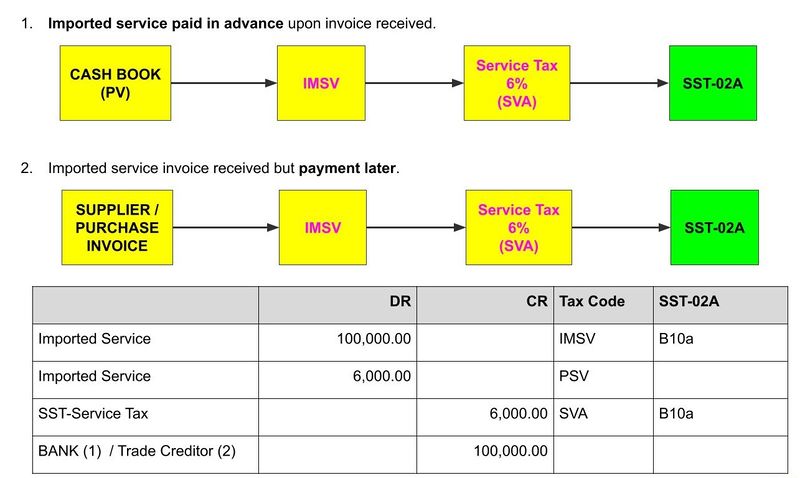

Imported Service Tax (IMSV)

Purchase service from oversea by any companies in Malaysia and it is subject to imported service tax 6%.

- for Service Tax registered ONLY, declare together with other service tax in SST-02

- for non-SST registered, declare imported service in SST-02A

- for Sales Tax registered ONLY, declare imported service in SST-02A

- Enter at Cash Book Entry (PV) or at Supplier/Purchase Invoice. See the illustration below.

- use Tax code : IMSV

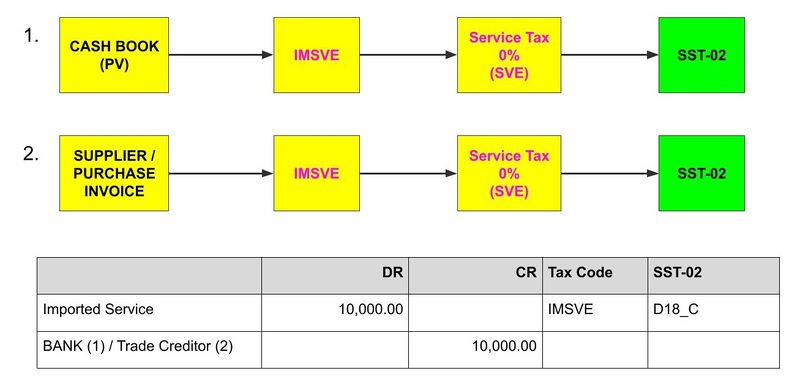

Imported Service Tax Exempted (IMSVE)

Any company in Malaysia who acquires taxable services of Group G item (a), (b), (c), (d), (e), (f), (g), (h) and (i) from any company within the same group of companies outside Malaysia. It is Exempted.

- Need to declare in SST-02

- Enter at Cash Book Entry (PV) or at Supplier/Purchase Invoice. See the illustration below.

- use Tax code : IMSVE

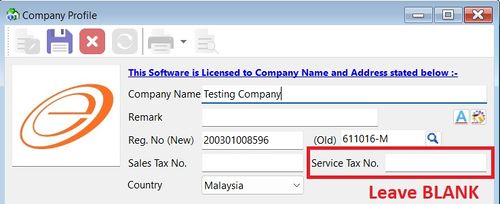

How to get print SST-02A?

1. Go to File | Company Profile...

2. Make sure the Service Tax No field is BLANK.

Note: For Service Tax Registered company, it is declare together with other service tax in SST-02

3. Save it.

4. Logout and login again.

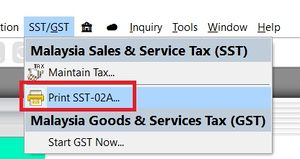

5. Go to menu : SST/GST | Print SST-02A...