Introduction

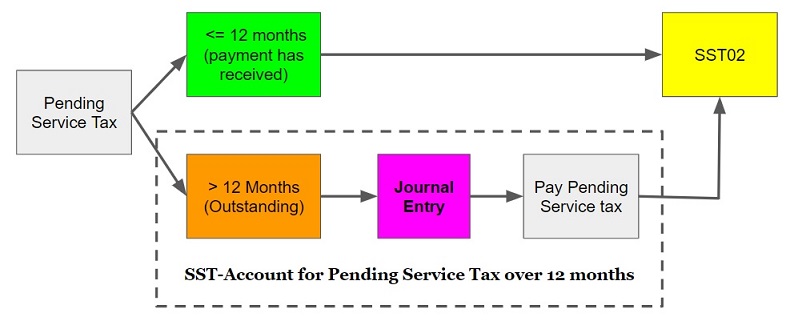

- Service Tax required to be accounted if on the day following period of 12 month when any whole or part of the payment is not received from the date of the invoice for the taxable service provided.

Journal Entry Adjustment

[Invoice] Pending Service Tax To Be Paid

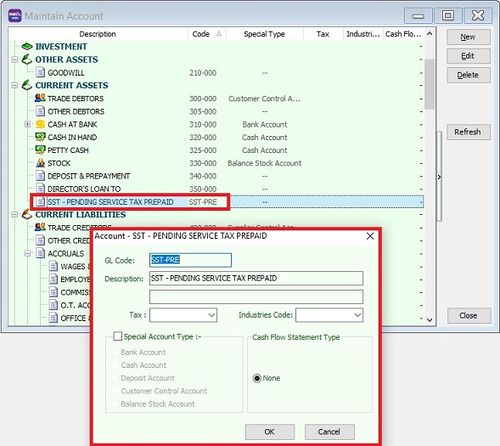

GL Acc Description Account Type SST-PRE SST - PENDING SERVICE TAX PREPAID CURRENT ASSETS

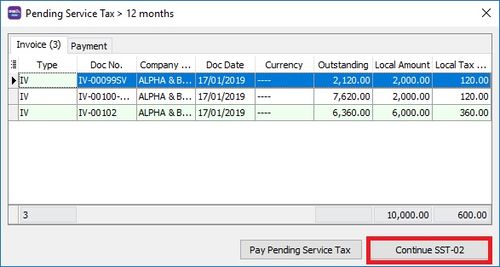

- 2. Process SST Return, system will prompt the Pending Service Tax > 12 months if have found the outstanding service invoices has over 12 months.

- 3. Follow the Service Tax rules, click Pay Pending Service Tax button.

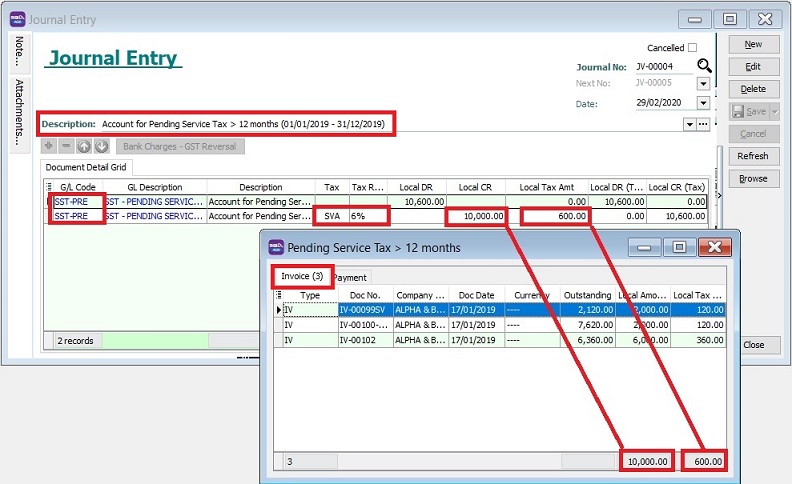

- 6. Post the journal entry and follow the double entry below to account the service tax pending over 12 months to be paid.

GL Code GL Description Tax Local DR Local CR Tax Amount Local DR (Tax) Local CR (Tax) SST-PRE SST - PENDING SERVICE TAX PREPAIRD 10,600.00 10,600.00 SST-PRE SST - PENDING SERVICE TAX PREPAIRD SVA 10,000.00 600.00 10,600.00

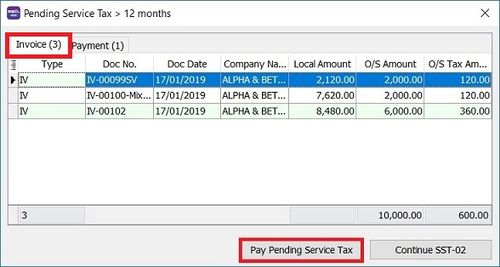

NOTE: For partial payment, should refer to Outstanding Amount instead of Local Amount. Active the tax code : SVA 1. Go to SST/GST | Maintain Tax. 2. Look for tax code: SVA or SV. 3. Edit and tick Active. 4. Save it.

[Payment] Recovery from Payment for Pending Service Tax Prepaid

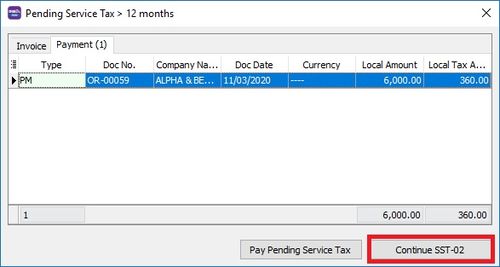

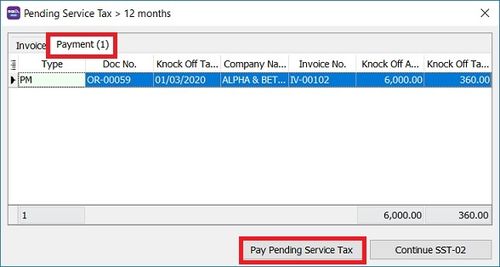

- 1. Under the payment tab, system will list out the prepayment service invoice which has been paid when process SST return.

- 2. If you have follow the Service Tax rules, click Pay Pending Service Tax button.

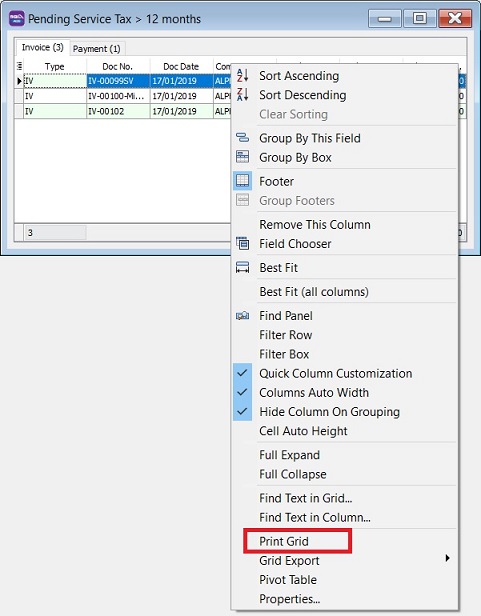

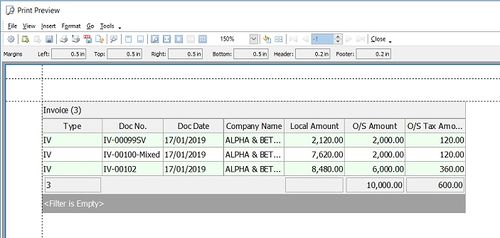

- 3. Right click on the grid column, select Print Grid.

- 4. Print out the list of the prepayment service invoice which has been paid for record purpose.

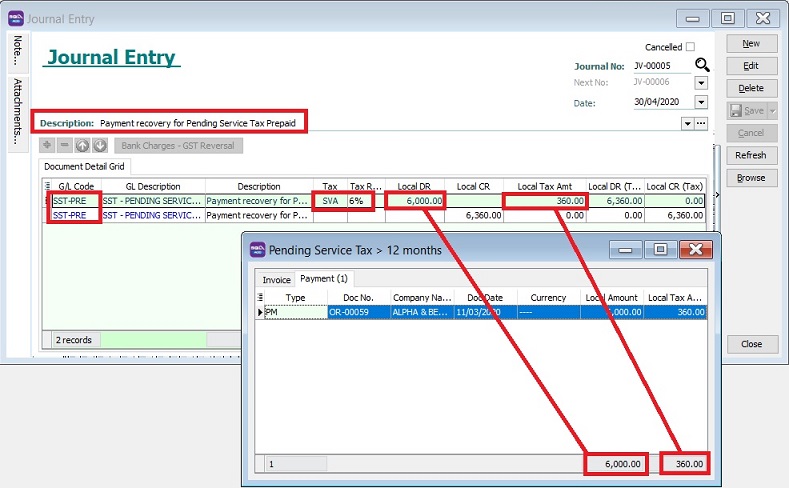

- 5. Post the journal entry and follow the double entry below to recover the service has been paid.

GL Code GL Description Tax Local DR Local CR Tax Amount Local DR (Tax) Local CR (Tax) SST-PRE SST - PENDING SERVICE TAX PREPAIRD SVA 6,000.00 360.00 6,360.00 SST-PRE SST - PENDING SERVICE TAX PREPAIRD 6,360.00 6,360.00