Introduction

- To set the tax year and longer period adjustment (LPA).

Set Tax Year

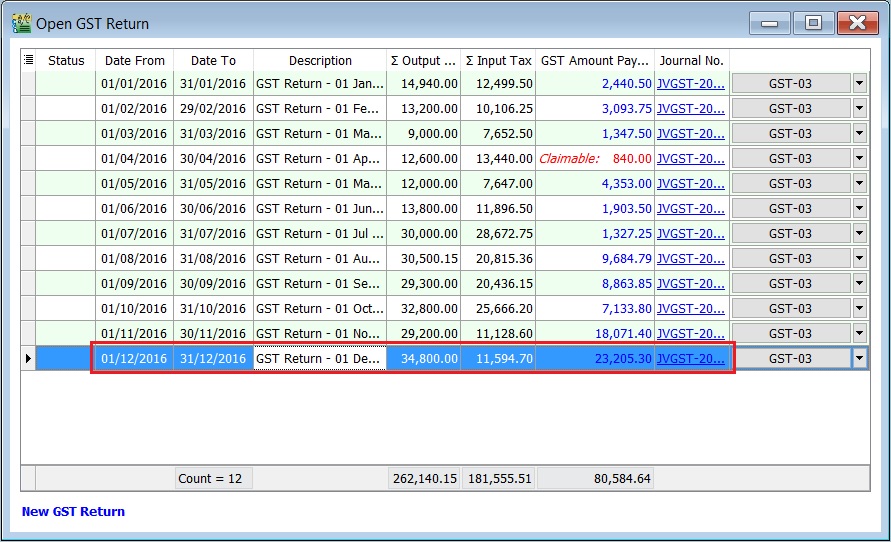

[GST | Open GST Return...]

- 1. Highlight the final taxable period to be set as your First Tax Year, eg. final taxable period 01 Dec - 31 Dec 2016.

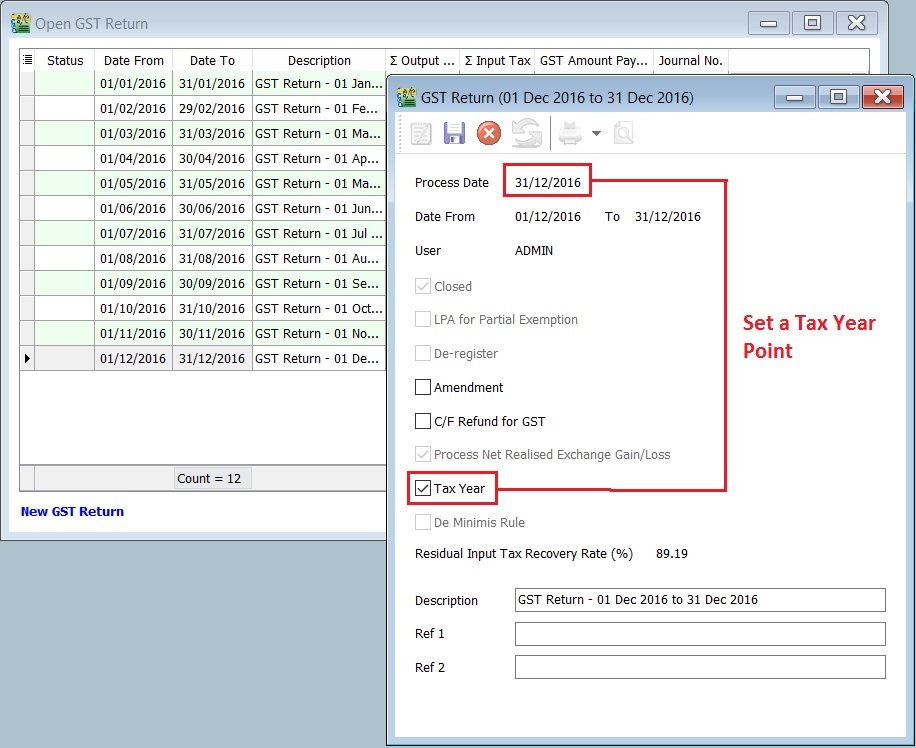

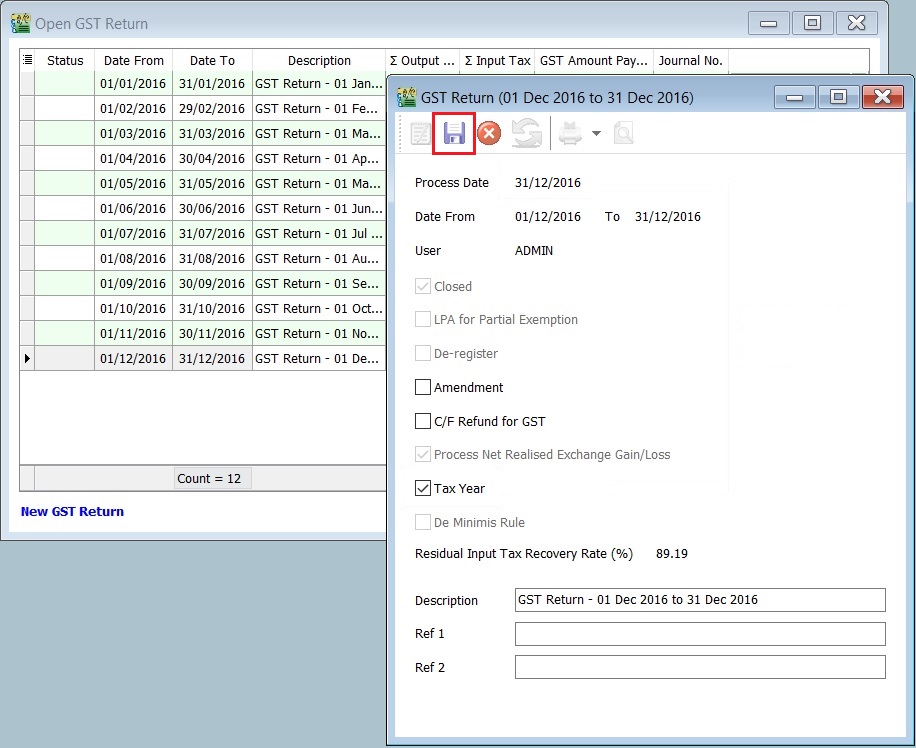

- 2. Double click on the GST Returns highlight in step 1.

- 3. System will prompt you a dialog box.

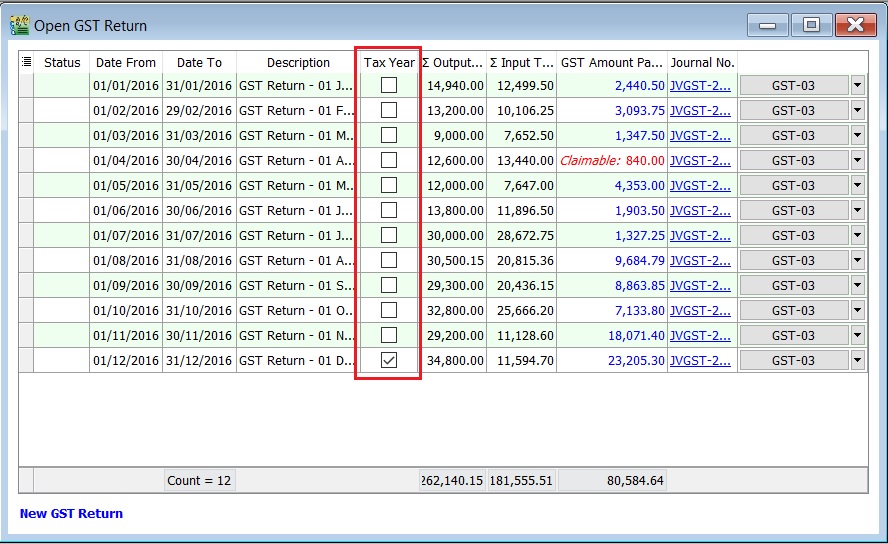

- 4. Tick on the Tax Year to set a tax year point. See the screenshot below.

Note: You can direct set the tax year without delete/purge the GST Returns.

Longer Period Adjustment

- Declaration of annual adjustment amount:

- • Regulation 43 – in a GST Return for the second taxable period next following the longer period.

- For example,

- Assumed the tax year set on 31 Dec 2016, LPA should be declared in:

- 1) For monthly taxable period , the second taxable period is Feb 2017 and the submission is before or on 31/3/2017

- 2) For quarterly taxable period, the second taxable period is Apr-Jun 2017 and the submission is before or on 31/7/2017

GST Returns (LPA)

[GST | New GST Return...] or [GST | Open GST Return...]

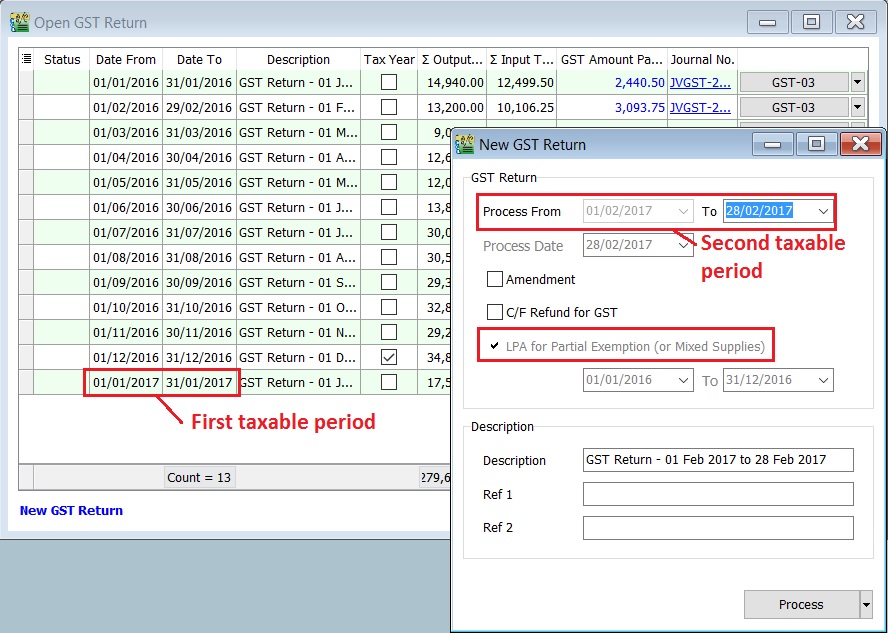

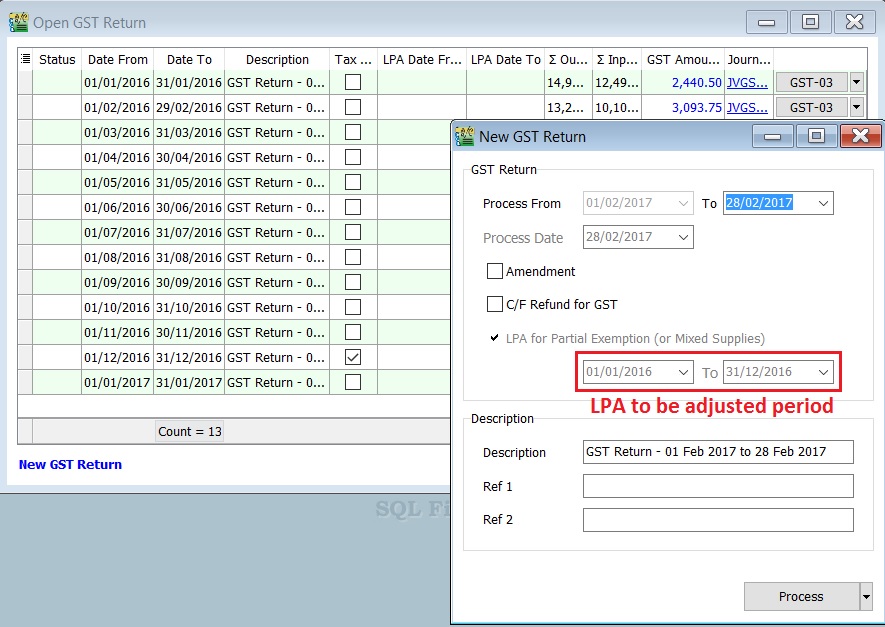

- 1. Process the GST Return.For example, process the Second Taxable Period (01/02/2017 - 28/02/2017).

- 2. LPA will tick automatically.(if you have set the tax year)

Note: User allow to overwrite the suggested period for Longer Period.

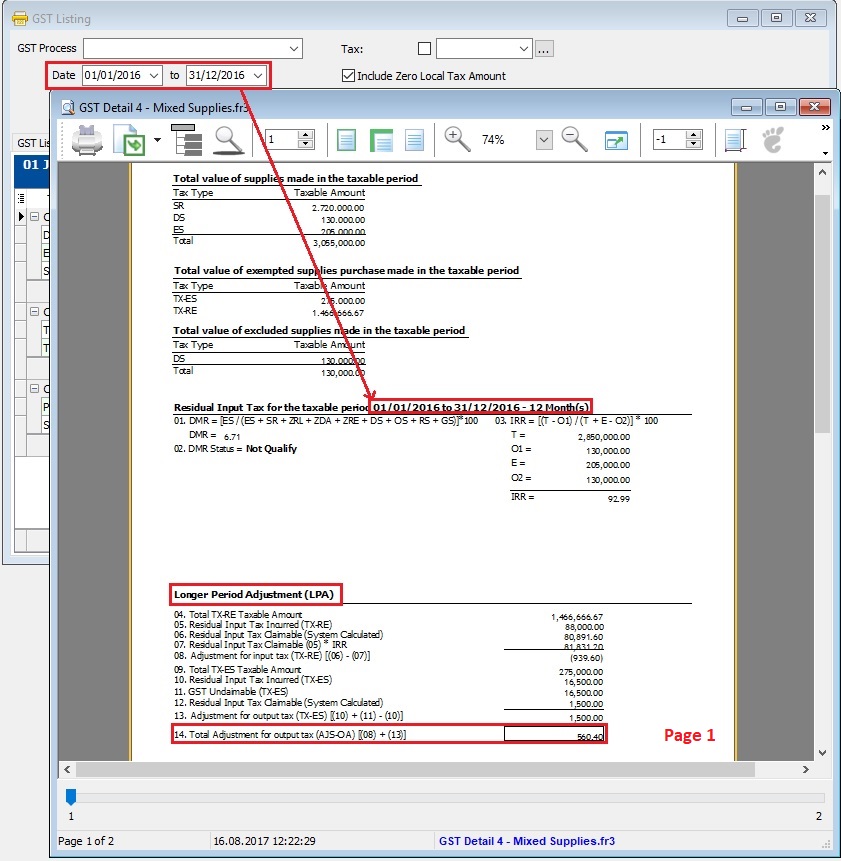

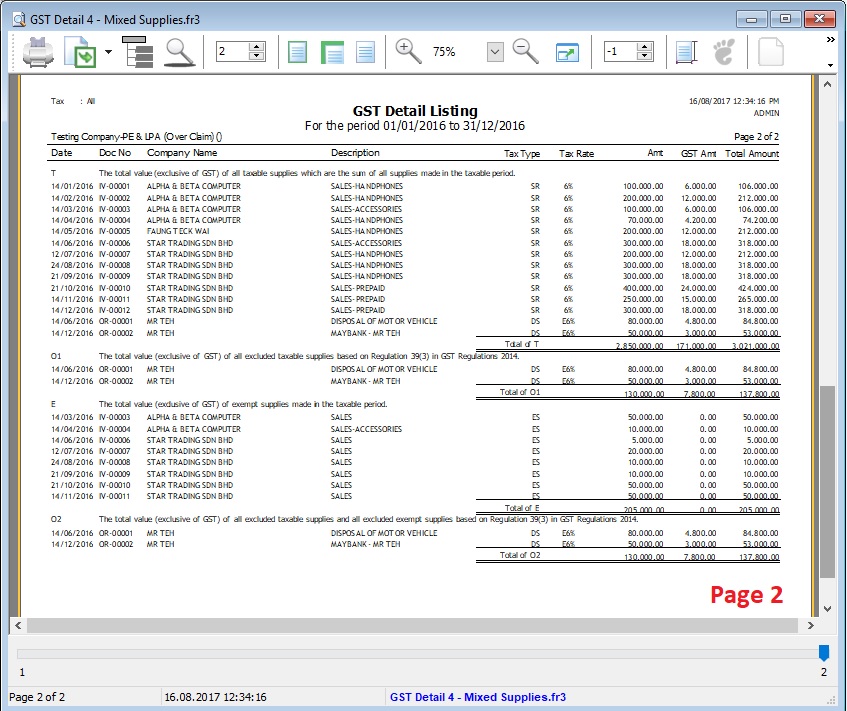

GST Listing - Mixed Supply (LPA)

[GST | Print GST Listing...]

Longer Period Adjustment (LPA)

- 1. Select the Date From and Date To (eg. the financial year is 01/01/2016 - 31/12/2016).

- 2. Click Apply.

- 3. Click Preview.

- 4. Select the report name : GST Detail 4 - Mixed Supplies.

- 5. Press Ok.