(Created page with "''Menu: Supplier | Supplier Refund...'' ==Introduction== * To receive the refund for the amount over paid to supplier. * To off-set against the unapplied amount for Supplier...") |

|||

| Line 23: | Line 23: | ||

Double Entry will be:- | Double Entry will be:- | ||

DR CR | DR CR | ||

Bank Acc | Bank Acc RM3,590.00 | ||

Supplier Control Acc | Supplier Control Acc RM3,590.00 | ||

<br /> | <br /> | ||

Revision as of 04:46, 5 March 2016

Menu: Supplier | Supplier Refund...

Introduction

- To receive the refund for the amount over paid to supplier.

- To off-set against the unapplied amount for Supplier Payment and Credit Note.

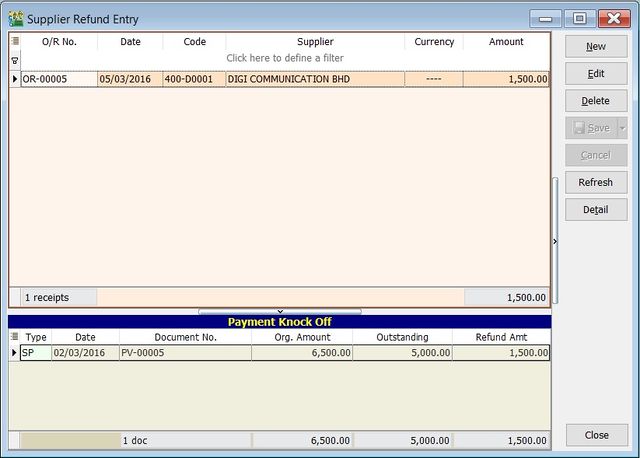

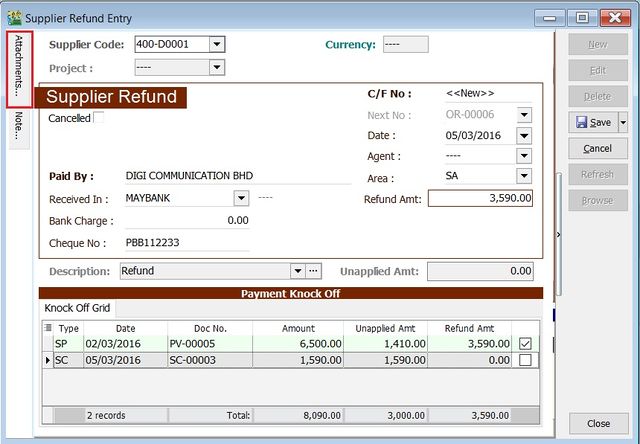

Supplier Refund - Basic Entry

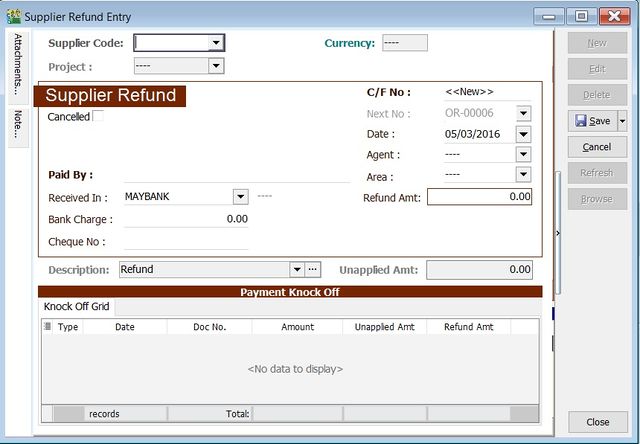

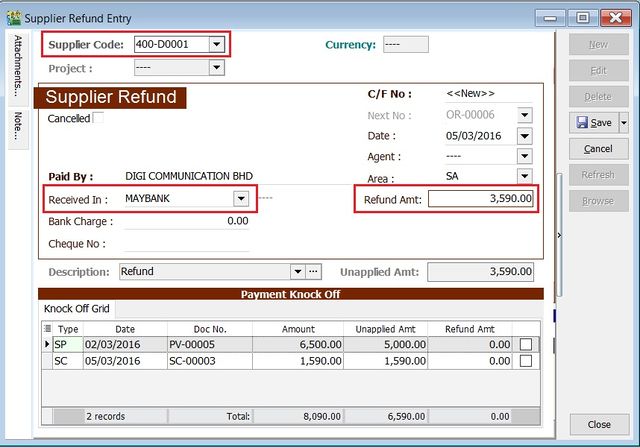

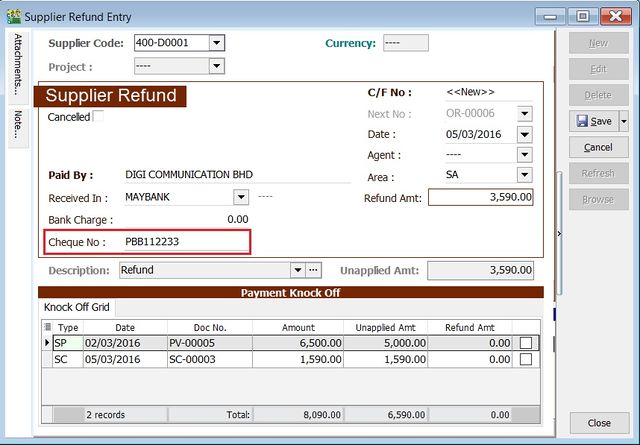

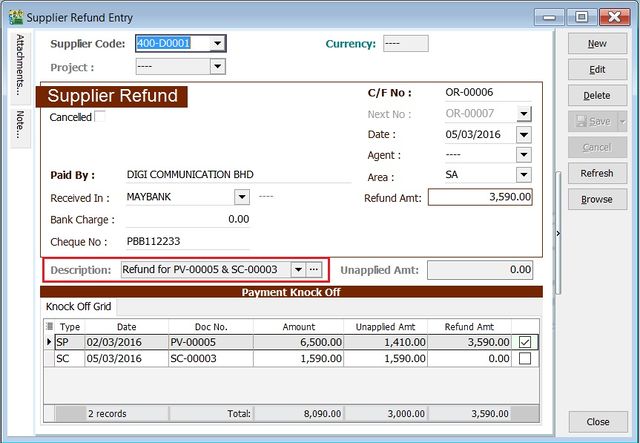

- 3. Select the Supplier Code. Direct key-in and search by either Supplier code or name.

- 4. Select the Payment Method (bank or cash account) in Received In.

- 5. Enter the Refund Amount (follow the bank account currency).

- 6. Below is the example of the entry created:

Double Entry will be:-

DR CR

Bank Acc RM3,590.00

Supplier Control Acc RM3,590.00

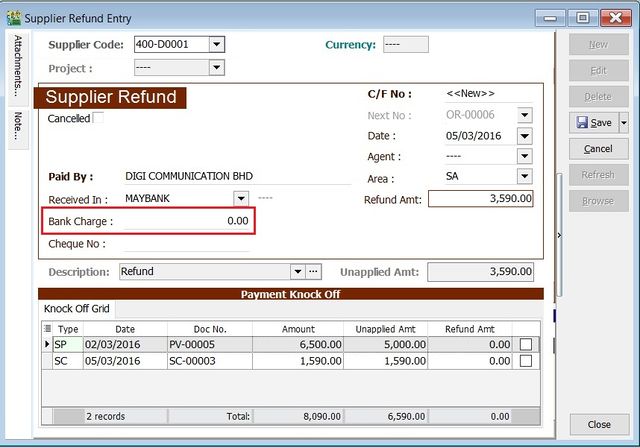

- 8. Lets said the bank charges = Rm2.00, therefore the double entry posting will be:-

DR CR Bank Charges RM2.00 Bank Account RM2.00

Supplier Payment - Knock-Off

- Purpose to knock-off the invoices:

- 1. To show the outstanding invoices in Supplier Aging Report.

- 2. To indicate the payment knock-off the invoices in Supplier Statement.

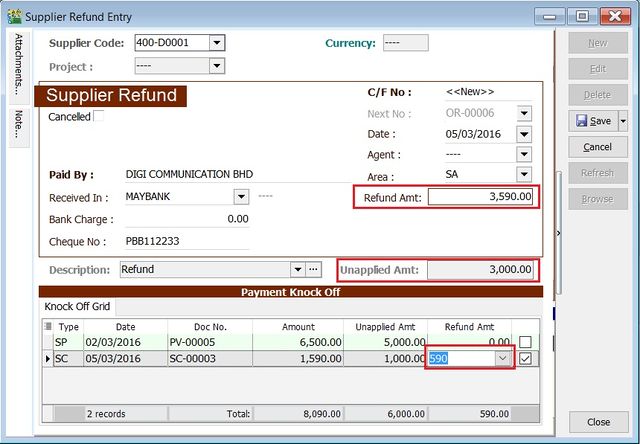

Partial Knock-Off

- 1. You can enter the knock-off amount into Pay column (auto tick).

- 2. Unapplied Amt will be reduced by the knock-off amount entered.

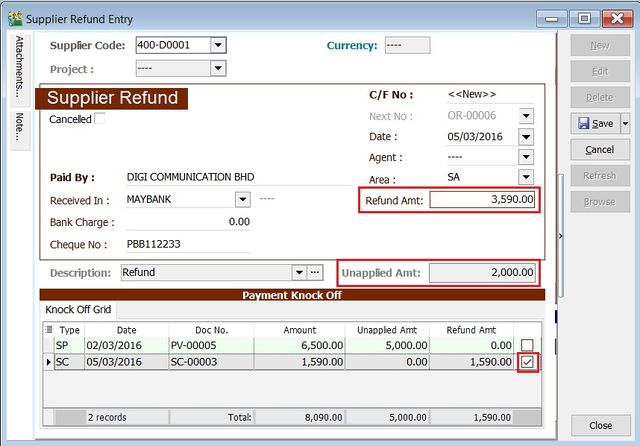

Document Knock-Off

- 1. You can tick on the outstanding documents.

- 2. Unapplied Amt will be reduced by the knock-off amount ticked.

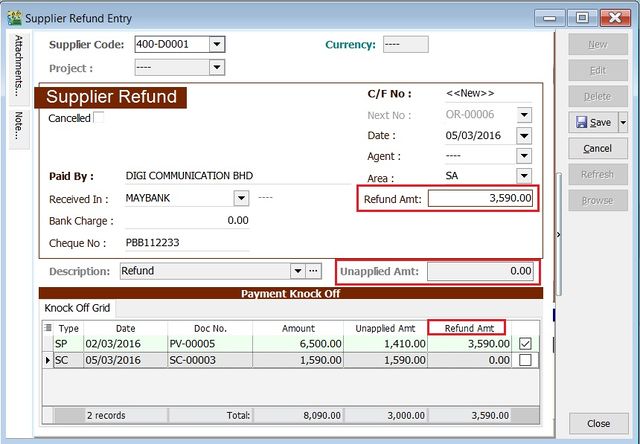

Random Knock-Off

- 1. You can click on the Pay column. It will auto tick on the outstanding documents.

- 2. Unapplied Amt will be reduced according to the outstanding balance.

Note: Refund Unapplied amount shows the supplier refund amount not allocated/knock-off against any unapplied amount in supplier payment and credit note.

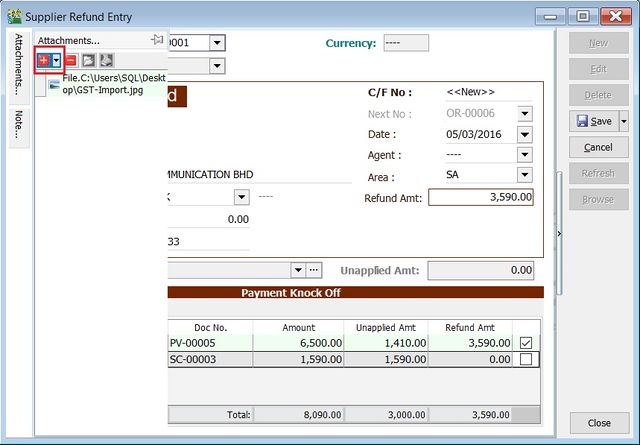

Supplier Refund - Attachment

- It is very useful to attach any supporting documents.

- In future, you able to retrieve and refer the attachment file easily.

- 1. You have to point to the attachment section.

- 2. Click on ( + ) button to insert the filename path.

- 3. See the sample screenshot below.

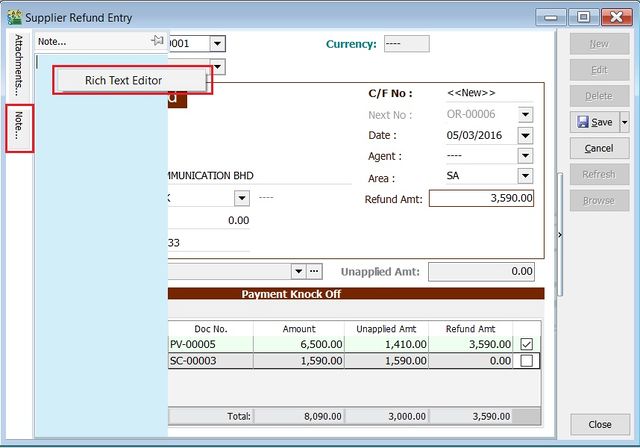

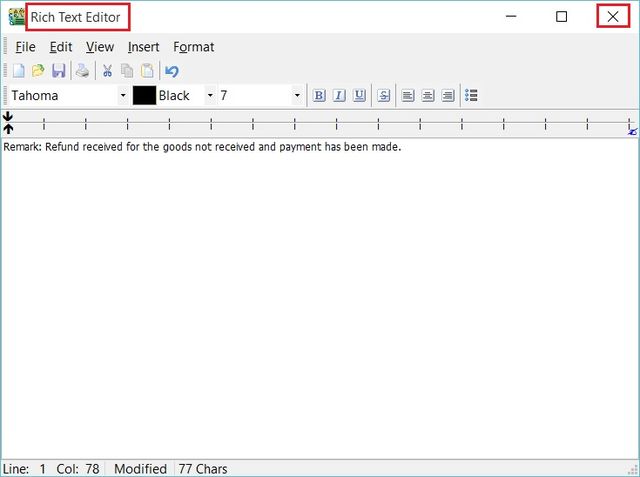

Supplier Refund - Note

1. Click on the Note section (on the LEFT side bar).

2. RIGHT click it, you will see the Rich Text Editor pop-up.

3. You can start key-in the note. See the example screenshot below.

4. Click on X button to save and exit the Rich Text Editor.

5. You will get prompted the Save changes? message. Click YES to save it.

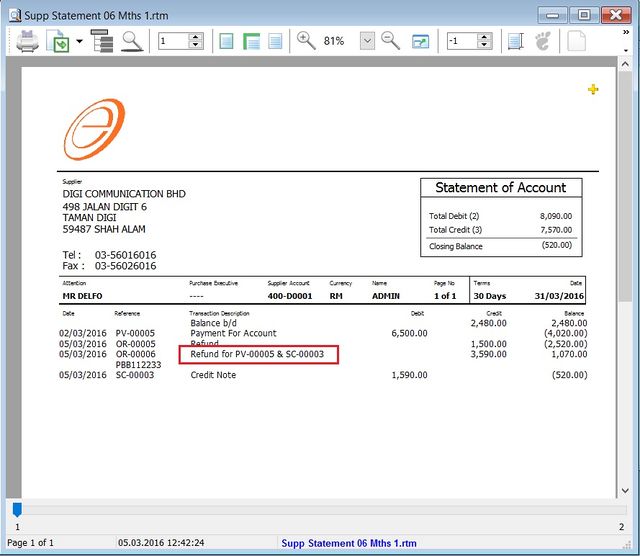

Supplier Refund - Description

- To show the supplier refund description in the Supplier Statement, eg. Refund For SC-00002 & PV-00004..

- Sample of supplier statement screenshot below.