| Line 101: | Line 101: | ||

<br /> | <br /> | ||

==See Also | ==See Also== | ||

Latest revision as of 04:51, 5 March 2016

Menu: Supplier | Supplier Payment...

Introduction

- To record the payment amount to Suppliers.

- To off-set against the outstanding supplier invoices.

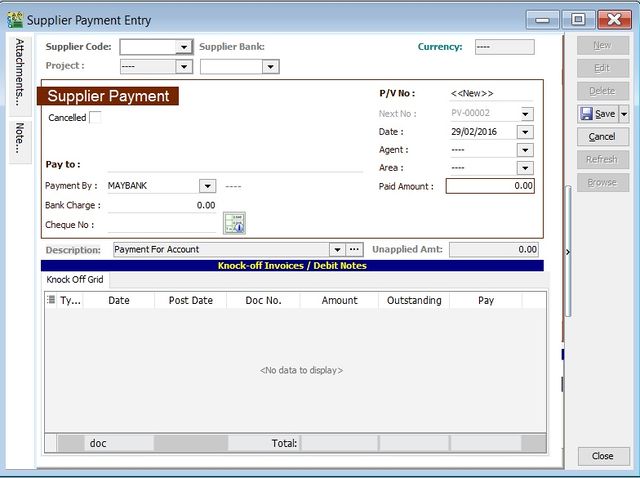

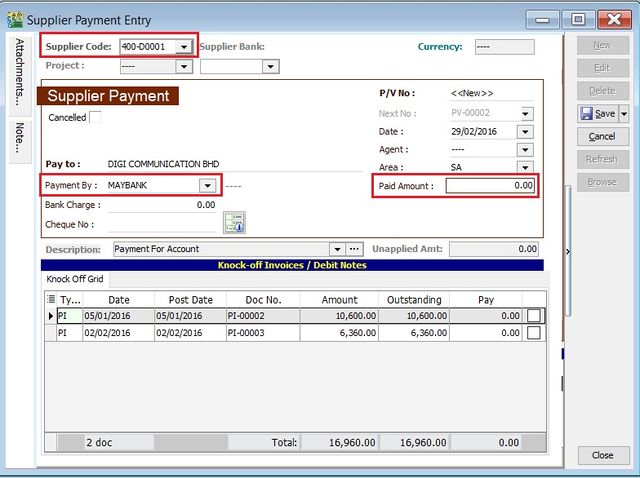

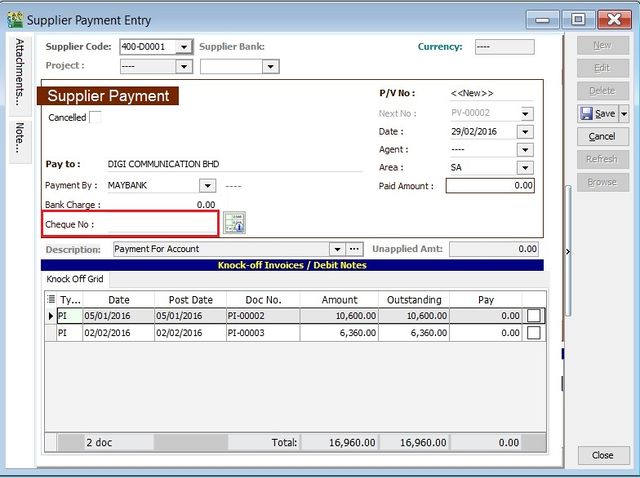

Supplier Payment - Basic Entry

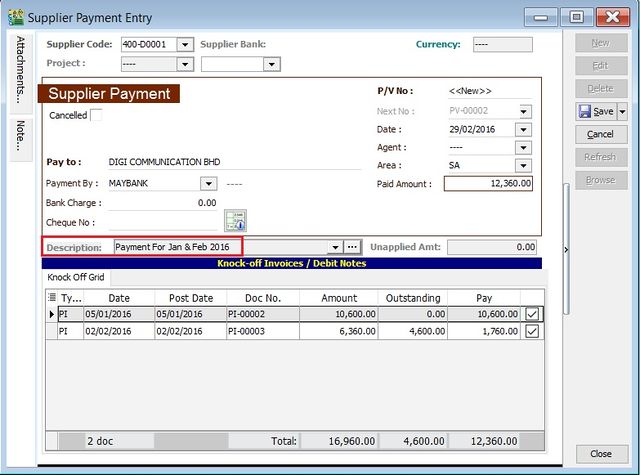

- 3. Select the Supplier Code. Direct key-in and search by either Supplier code or name.

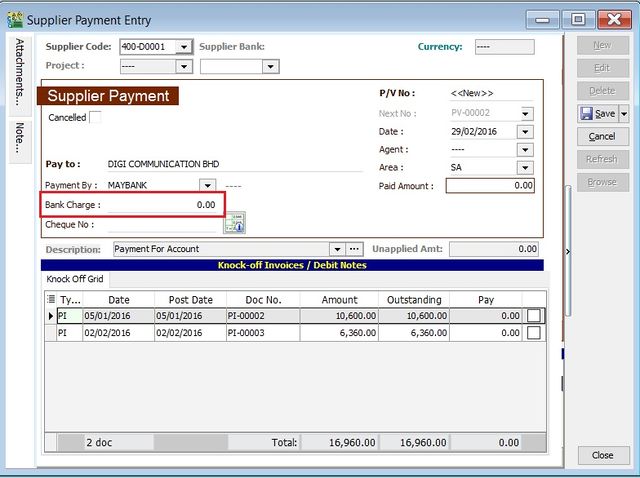

- 4. Select the Payment Method (bank or cash account) in Payment By.

- 5. Enter the Paid Amount (follow the bank account currency).

- 6. Below is the example of the entry created:

Double Entry will be:-

DR CR

Supplier Control Acc RM2,500.00

Bank Account RM2,500.00

- 8. It will auto post the following double entry:-

DR CR Bank Charges RM2.00 Bank Account RM2.00

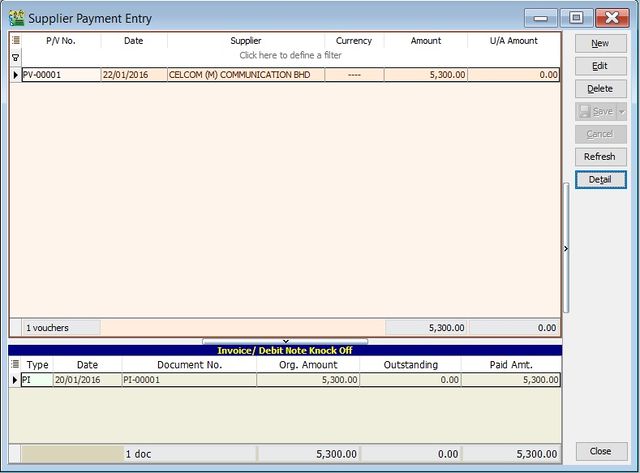

Supplier Payment - Knock-Off

- Purpose to knock-off the invoices:

- 1. To show the outstanding invoices in Supplier Aging Report.

- 2. To indicate the payment knock-off the invoices in Supplier Statement.

- 3. To remove / recover from the GST Bad Debt Relief on outstanding more than 6 months

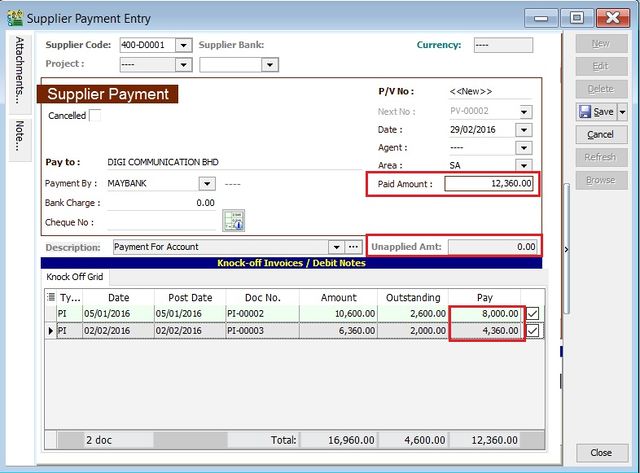

Partial Knock-Off

- 1. You can enter the knock-off amount into Pay column (auto tick).

- 2. Unapplied Amt will be reduced by the knock-off amount entered.

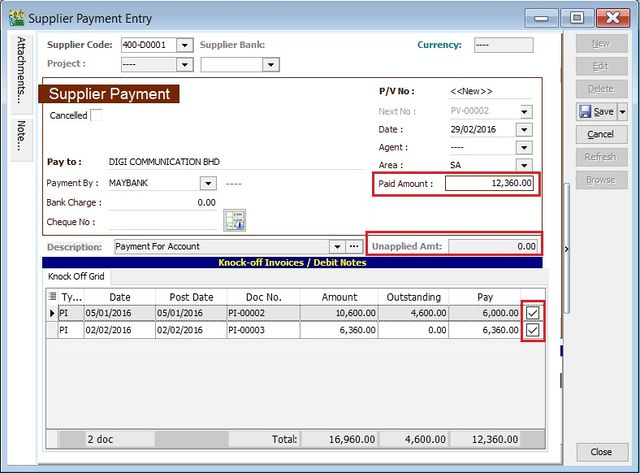

Document Knock-Off

- 1. You can tick on the outstanding documents.

- 2. Unapplied Amt will be reduced by the knock-off amount ticked.

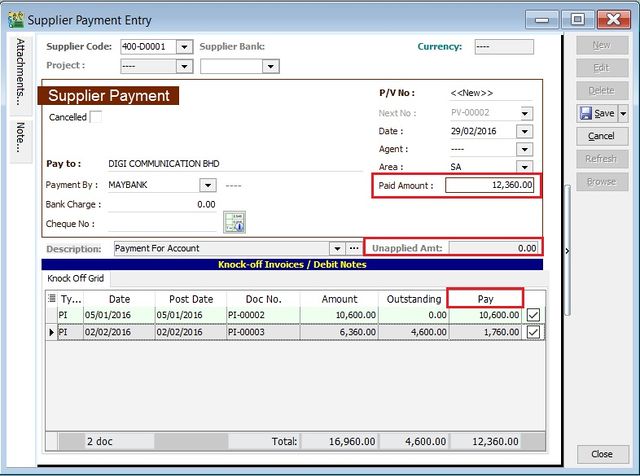

Random Knock-Off

- 1. You can click on the Pay column. It will auto tick on the outstanding documents.

- 2. Unapplied Amt will be reduced according to the outstanding balance.

Note: Unapplied amount shows the Supplier payment amount not allocated/knock-off against any outstanding invoices and debit note.

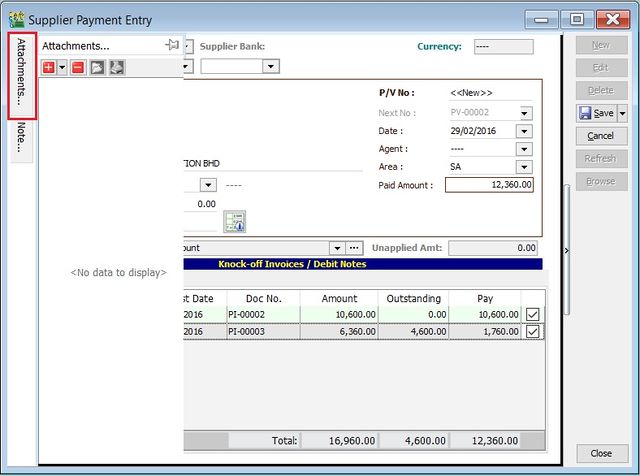

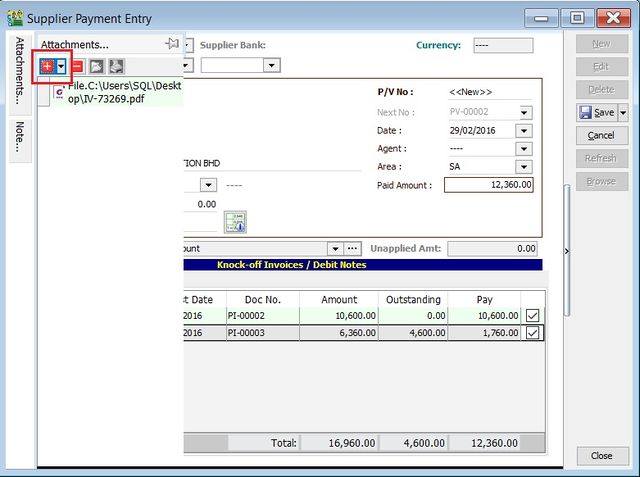

Supplier Payment - Attachment

- It is very useful to attach any supporting documents.

- In future, you able to retrieve and refer the attachment file easily.

- 1. You have to point to the attachment section.

- 2. Click on ( + ) button to insert the filename path.

- 3. See the sample screenshot below.

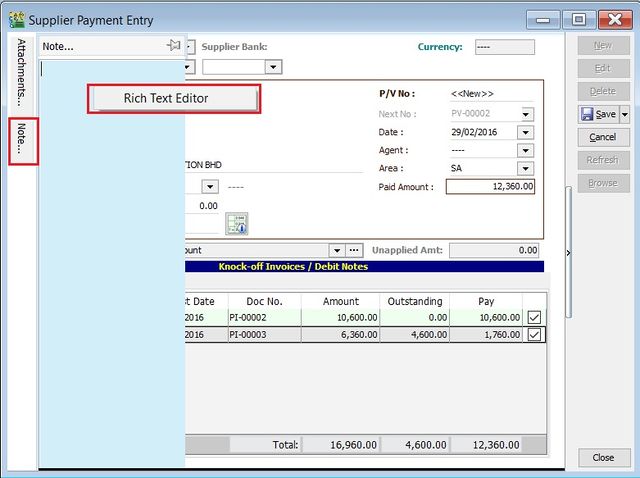

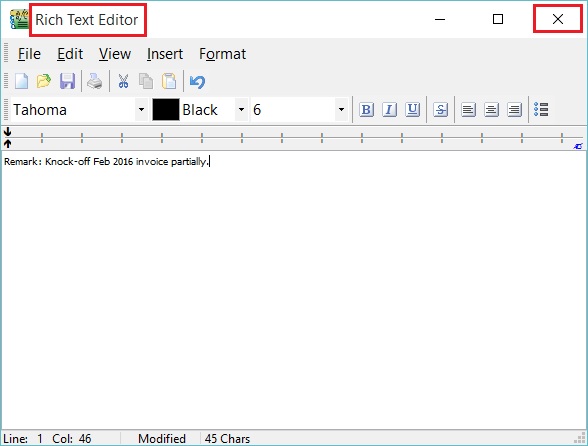

Supplier Payment - Note

1. Click on the Note section (on the LEFT side bar).

2. RIGHT click it, you will see the Rich Text Editor pop-up.

3. You can start key-in the note. See the example screenshot below.

4. Click on X button to save and exit the Rich Text Editor.

5. You will get prompted the Save changes? message. Click YES to save it.

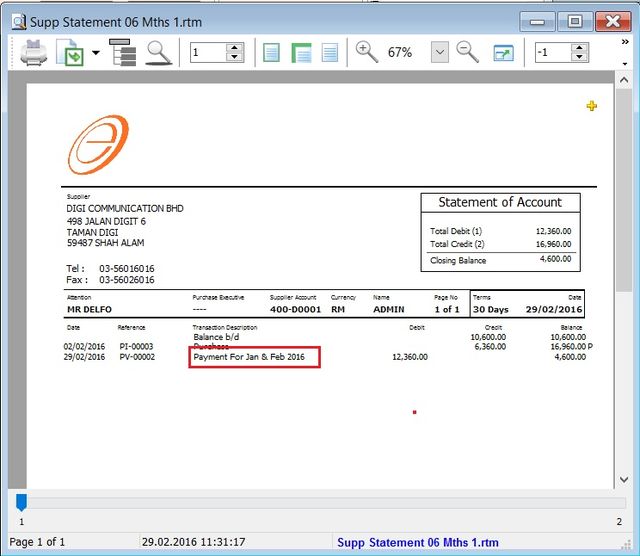

Supplier Payment - Description

- To show the Supplier payment description in the Supplier Statement, eg. Payment For Jan & Feb 2016.

- Sample of Supplier statement screenshot below.