Introduction

- Tariff classification is a complex yet extremely important aspect of cross-border trading.

- Goods imported from or to Malaysia are classified by the Harmonized Tariff Schedule (HTS) or commonly referred to as HS Codes.

- The codes, created by World Customs Organization (WCO), categorize up to 5,000 commodity

- HS Codes are made of 6-digit numbers that are recognized internationally, though different countries can extend the numbers by two or four digits to define commodities at a more detailed level.

To search the tariff code list, click here.

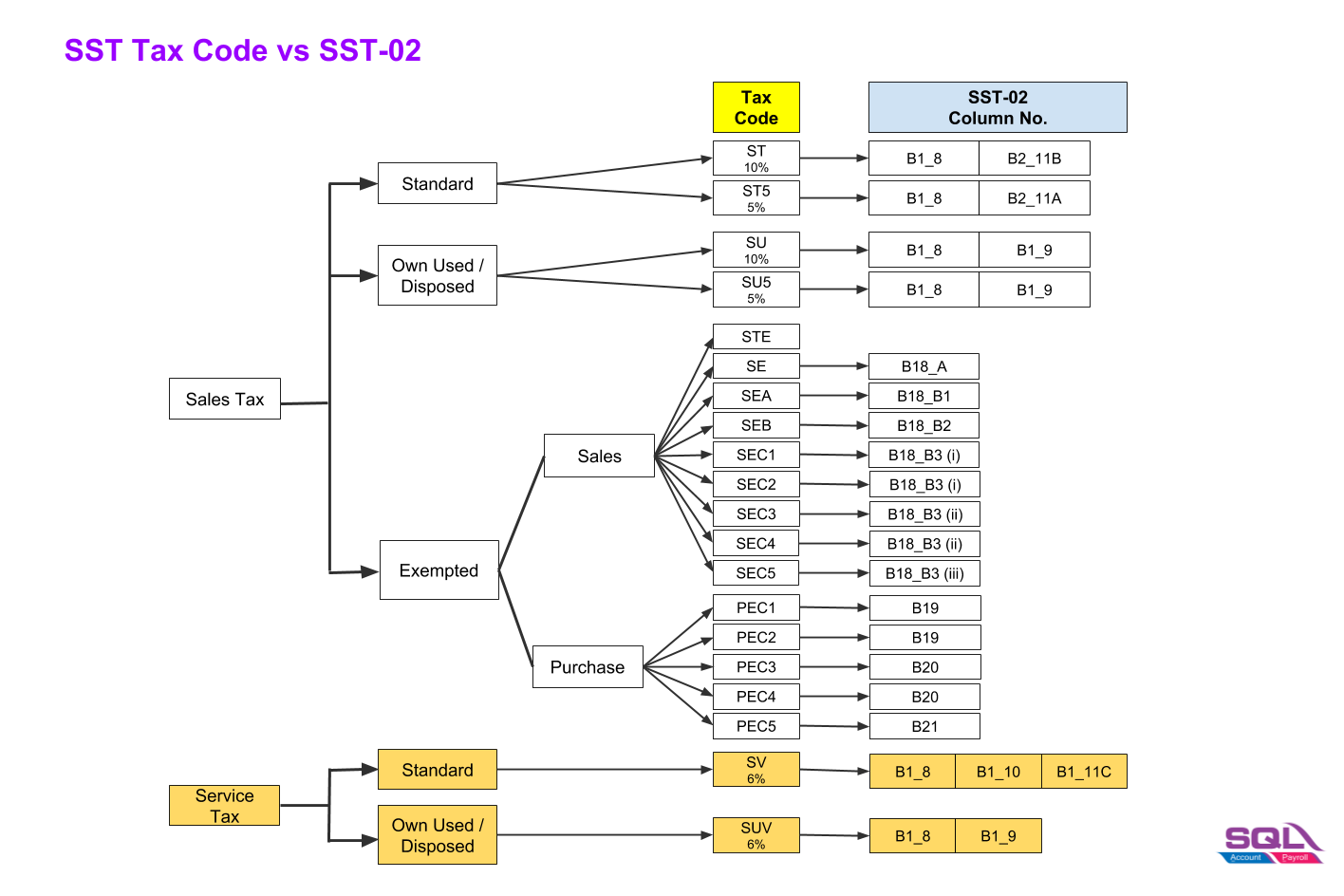

SST Tax Code

- SST tax code consists of Sales Tax and Service Tax.

Sales

1) Standard

No Tax Code Description Tax Rate SST-02 column 01 ST Sales Tax 10% 10% B1_8

B2_11B02 ST5 Sales Tax 5% 5% B1_8

B2_11A

2) Deemed Supply (Own Used/Disposed)

No Tax Code Description Tax Rate SST-02 column 01 SU Goods Own Used/Disposed 10% 10% B1_8

B1_902 SU5 Goods Own Used/Disposed 5% 5% B1_8

B1_9

3) Sales - Exempted

No Tax Code Description Tax Rate SST-02 column 01 STE Sales Tax Exempted 02 SE Sales Tax Export/Special Area/Designated Area B18_A 03 SEA Sales Tax Exempted - Schedule A More on Government & Local Authority Dept B18_B1 04 SEB Sales Tax Exempted - Schedule B More on Control Product & Medical Product B18_B2 05 SEC1 Sales Tax Exempted - Schedule C (Item 1) B18_B3 (i) 06 SEC2 Sales Tax Exempted - Schedule C (Item 2) B18_B3 (i) 07 SEC3 Sales Tax Exempted - Schedule C (Item 3) B18_B3 (ii) 08 SEC4 Sales Tax Exempted - Schedule C (Item 4) B18_B3 (ii) 09 SEC5 Sales Tax Exempted - Schedule C (Item 5) B18_B3 (iii)

4) Purchase - Exempted

No Tax Code Description Tax Rate SST-02 column 01 PEC1 Purchase Tax Exempted - Schedule C (Item 1) B19 02 PEC2 Purchase Tax Exempted - Schedule C (Item 2) B19 03 PEC3 Purchase Tax Exempted - Schedule C (Item 3) B20 04 PEC2 Purchase Tax Exempted - Schedule C (Item 4) B20 05 PEC3 Purchase Tax Exempted - Schedule C (Item 5) B21

Service

1) Standard

No Tax Code Description Tax Rate SST-02 column 01 SV Service Tax 6% 6% B1_8

B1_10

B2_11C

2) Deemed Supply (Own Used/Disposed)

No Tax Code Description Tax Rate SST-02 column 01 SUV Service Own Use 6% 6% B1_8

B1_9