(Created page with "<big>Print Ledger Report</big> '''GST Expenditure (Effective from YA 2015)'''<br /> :1. para 39(1)(o): GST input tax paid or to be paid not allowed as deduction if:- ::a. No...") |

|||

| (35 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

< | ==Ledger Report== | ||

''[GL | Print Ledger ...]''<br /> | |||

:This ledger report consists of: | |||

::1. General Ledger | |||

::2. Sales Ledger (Customer Ledger) | |||

::3. Purchase Ledger (Supplier Ledger)<br /> | |||

::[[File:GL-Ledger-01.jpg | 440PX]]<br /> | |||

<br /> | |||

==Parameter 1== | |||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! | ! Parameter 1 !! Purpose | ||

|- | |||

| Filter By: '''Post Date''' || Parameter date to be filtered by '''Post Date'''. | |||

|- | |||

| Filter By: '''Tax Date''' || Parameter date to be filtered by '''Tax Date'''. | |||

|- | |||

| Date || Define the date range. | |||

|- | |||

| Account || Select the '''GL Account''' (for General Ledger), '''Customer Account''' (for Sales Ledger) and '''Supplier Account''' (for Purchase Ledger) | |||

|- | |||

| Project || Select the '''Project'''. | |||

|- | |- | ||

| | | Agent || Select the '''Agent'''. | ||

|- | |- | ||

| | | Area || Select the '''Area'''. | ||

|- | |- | ||

| | | Control A/c || Select the '''Customer/Supplier Control Account'''. (Applicable to Sales Ledger and Purchase Ledger only) | ||

|- | |- | ||

| | | Tax || Select all tax code (including '''non-GST''' Tax type) | ||

|- | |- | ||

| | | General Ledger || To generate the '''general''' transactions, eg. bank, cash, sales, purchase, fixed assets, etc.) | ||

|- | |- | ||

| | | Sales Ledger (Customer Control) || To generate the transactions related to '''Customers'''. | ||

|} | |- | ||

<br /> | | Purchase Ledger (Supplier Control) || To generate the transactions related to '''Suppliers'''. | ||

|}<br /> | |||

== | ==Parameter 2== | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! | ! Parameter 2 !! Purpose | ||

|- | |||

| Group By || To be group by...Account Code, Post Date, Tax Date, Ref 1 (Doc No), Tax, etc. | |||

|- | |||

| Merge GL Code for same document || Same documents and GL Account will be merged together. | |||

|- | |- | ||

| | | Option: '''Exclude Project''' When Merging || Same documents and GL Account but '''different Project Code''' will be merged together. | ||

|- | |- | ||

| Description || | | Use 2nd Description || To use 2nd description. | ||

|- | |- | ||

| | | Include '''Zero Closing Balance''' || To show the accounts has zero closing balance. | ||

|- | |- | ||

| | | Include '''Zero B/F with Transactions Before''' || To show the accounts has zero balance from B/F which has transactions before. | ||

|- | |- | ||

| | | '''Local''' Currency || All transactions converted into local currency value. | ||

|- | |- | ||

| | | '''Foreign''' Currency || All transactions remain as the original currency value, eg. USD, AUD, etc. | ||

|} | |||

<br /> | <br /> | ||

==Ledger (based on Tax Date)== | |||

:1. | :1. Select '''Tax Date''' at Filter By. | ||

:2. Select the | :2. Select the Date ('''Tax Date''') range. | ||

:3. | :3. Apply the Ledger report to generate the GL transactions by '''Tax Date'''. | ||

::[[File: | ::[[File:GL-Ledger-02a.jpg | 440PX]]<br /> | ||

<br /> | <br /> | ||

:4. You can select all the tax code (including non-GST) to apply, eg. TX-NC. | |||

::[[File:GL-Ledger-02b.jpg | 440PX]]<br /> | |||

<br /> | <br /> | ||

NOTE: | |||

'' | You can compare the ledger based on '''Tax Date''' (GST taxable period) with GST Listing. | ||

<br /> | <br /> | ||

:3. | ==Ledger (based on Post Date)== | ||

::[[File: | :1. Select '''Post Date''' at Filter By. | ||

:2. Select the Date ('''Post Date''') range. | |||

:3. Apply the Ledger report to generate the GL transactions by '''Post Date'''. | |||

::[[File:GL-Ledger-03.jpg | 440PX]]<br /> | |||

<br /> | <br /> | ||

==See also== | ==See also== | ||

:[[Print GST Listing]] | |||

Latest revision as of 01:55, 10 January 2017

Ledger Report

[GL | Print Ledger ...]

- This ledger report consists of:

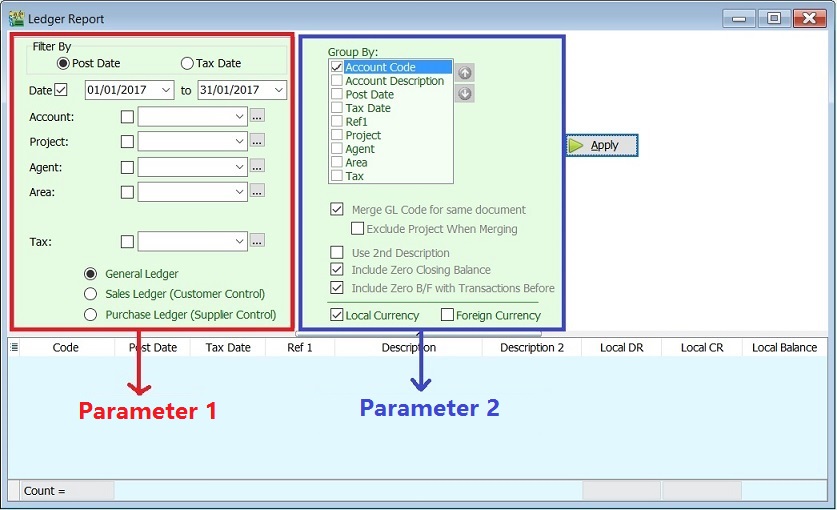

Parameter 1

Parameter 1 Purpose Filter By: Post Date Parameter date to be filtered by Post Date. Filter By: Tax Date Parameter date to be filtered by Tax Date. Date Define the date range. Account Select the GL Account (for General Ledger), Customer Account (for Sales Ledger) and Supplier Account (for Purchase Ledger) Project Select the Project. Agent Select the Agent. Area Select the Area. Control A/c Select the Customer/Supplier Control Account. (Applicable to Sales Ledger and Purchase Ledger only) Tax Select all tax code (including non-GST Tax type) General Ledger To generate the general transactions, eg. bank, cash, sales, purchase, fixed assets, etc.) Sales Ledger (Customer Control) To generate the transactions related to Customers. Purchase Ledger (Supplier Control) To generate the transactions related to Suppliers.

Parameter 2

Parameter 2 Purpose Group By To be group by...Account Code, Post Date, Tax Date, Ref 1 (Doc No), Tax, etc. Merge GL Code for same document Same documents and GL Account will be merged together. Option: Exclude Project When Merging Same documents and GL Account but different Project Code will be merged together. Use 2nd Description To use 2nd description. Include Zero Closing Balance To show the accounts has zero closing balance. Include Zero B/F with Transactions Before To show the accounts has zero balance from B/F which has transactions before. Local Currency All transactions converted into local currency value. Foreign Currency All transactions remain as the original currency value, eg. USD, AUD, etc.

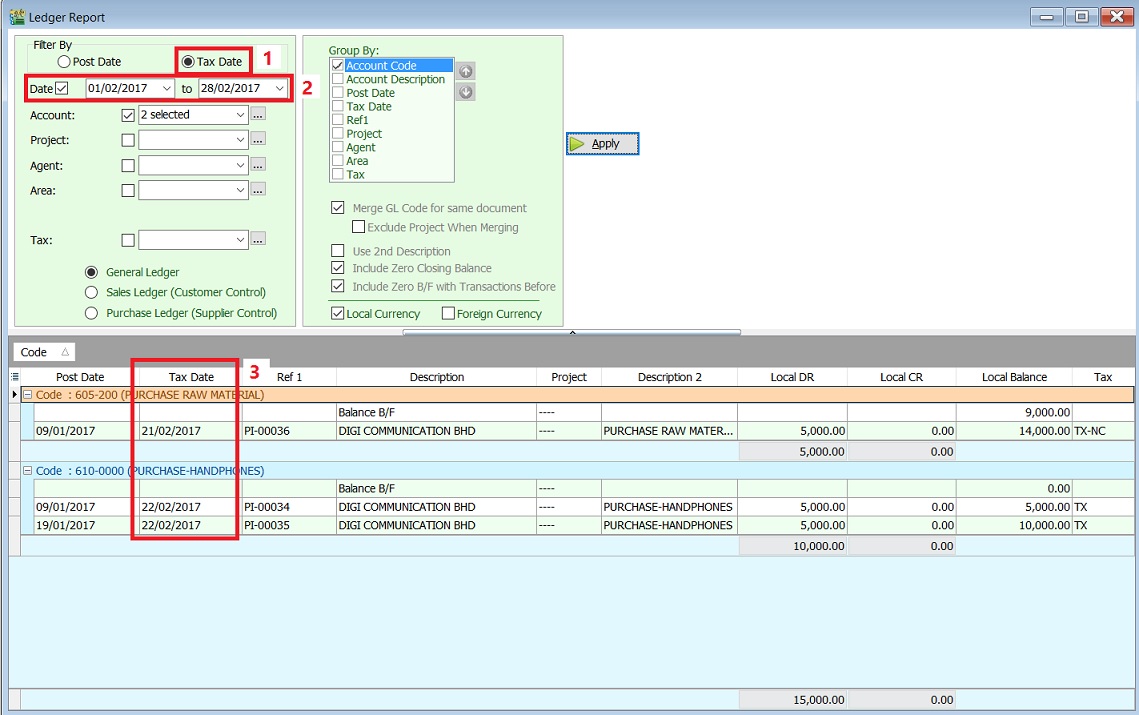

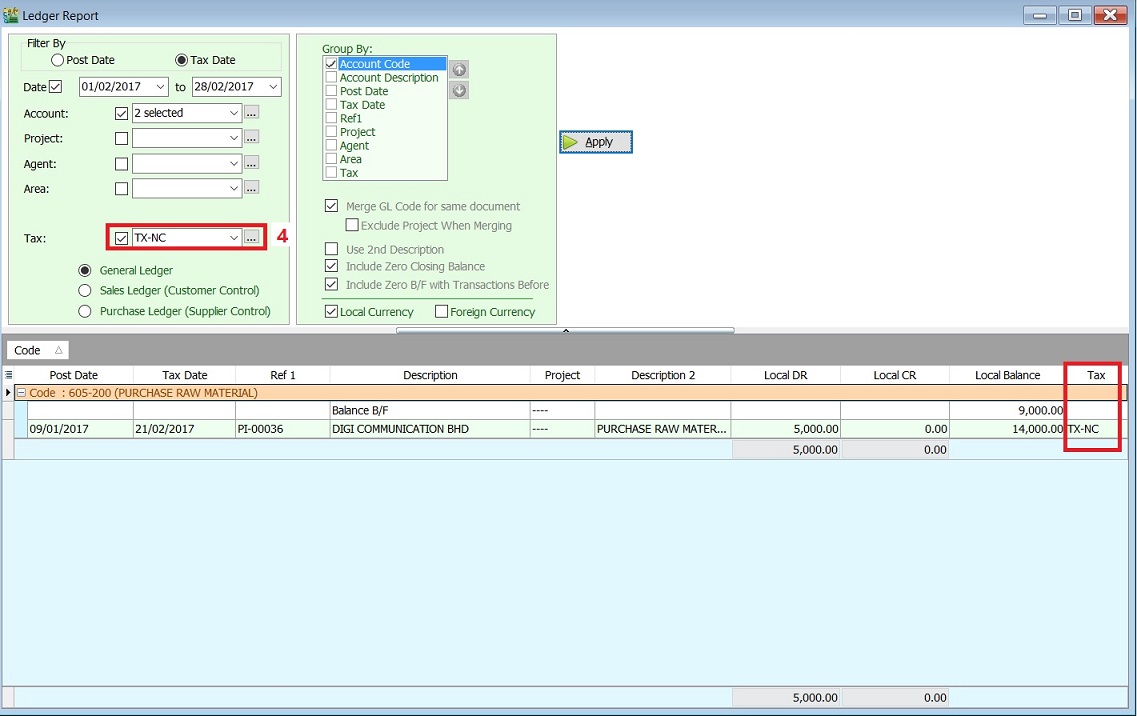

Ledger (based on Tax Date)

- 1. Select Tax Date at Filter By.

- 2. Select the Date (Tax Date) range.

- 3. Apply the Ledger report to generate the GL transactions by Tax Date.

NOTE: You can compare the ledger based on Tax Date (GST taxable period) with GST Listing.

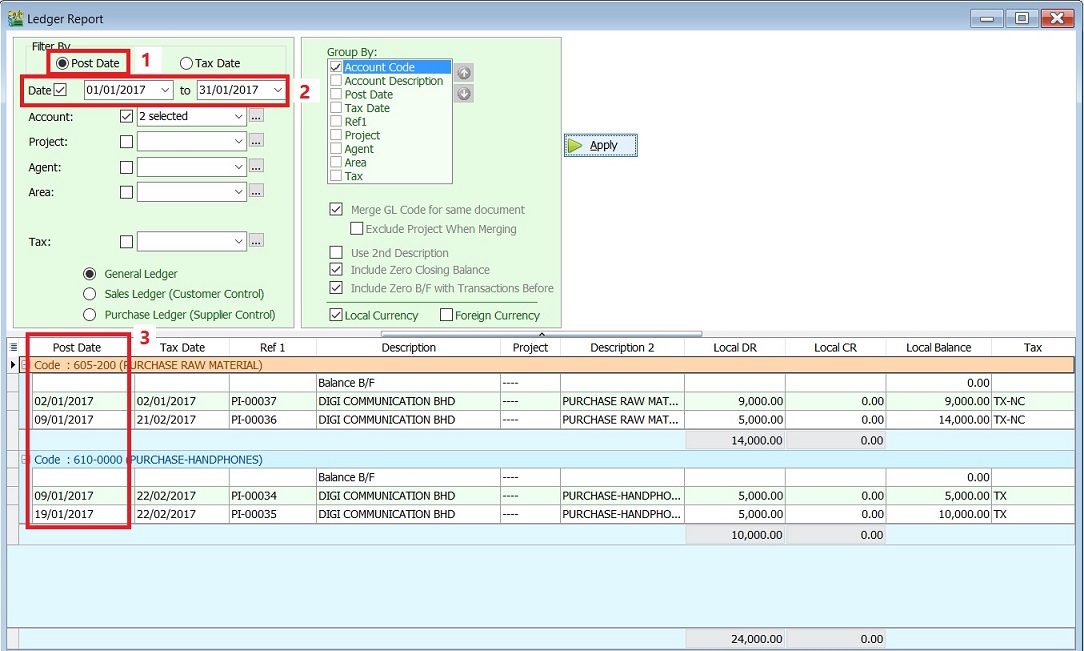

Ledger (based on Post Date)

- 1. Select Post Date at Filter By.

- 2. Select the Date (Post Date) range.

- 3. Apply the Ledger report to generate the GL transactions by Post Date.