No edit summary |

|||

| Line 13: | Line 13: | ||

! Parameter Name !! Purpose to filter | ! Parameter Name !! Purpose to filter | ||

|- | |- | ||

| Filter By: '''Post Date''' || Parameter date to be filtered by Post Date. | | Filter By: '''Post Date''' || Parameter date to be filtered by '''Post Date'''. | ||

|- | |- | ||

| Filter By: '''Tax Date''' || Parameter date to be filtered by Tax Date. | | Filter By: '''Tax Date''' || Parameter date to be filtered by '''Tax Date'''. | ||

|- | |- | ||

| Date || Define the date range. | | Date || Define the date range. | ||

|- | |- | ||

| Account || Select the GL Account (for General Ledger), Customer Account (for Sales Ledger) and Supplier Account (for Purchase Ledger) | | Account || Select the '''GL Account''' (for General Ledger), '''Customer Account''' (for Sales Ledger) and '''Supplier Account''' (for Purchase Ledger) | ||

|- | |- | ||

| Project || Select the Project. | | Project || Select the '''Project'''. | ||

|- | |- | ||

| Agent || Select the Agent. | | Agent || Select the '''Agent'''. | ||

|- | |- | ||

| Area || Select the Area. | | Area || Select the '''Area'''. | ||

|- | |- | ||

| Control A/c || Select the Customer/Supplier Control Account. (Applicable to Sales Ledger and Purchase Ledger only) | | Control A/c || Select the '''Customer/Supplier Control Account'''. (Applicable to Sales Ledger and Purchase Ledger only) | ||

|- | |- | ||

| Tax || Select all tax code (including '''non-GST''' Tax type) | | Tax || Select all tax code (including '''non-GST''' Tax type) | ||

|- | |- | ||

| General Ledger || To generate the general transactions, eg. bank, cash, sales, purchase, fixed assets, etc.) | | General Ledger || To generate the '''general''' transactions, eg. bank, cash, sales, purchase, fixed assets, etc.) | ||

|- | |- | ||

| Sales Ledger (Customer Control) || To generate the transactions related to Customers. | | Sales Ledger (Customer Control) || To generate the transactions related to '''Customers'''. | ||

|- | |- | ||

| Purchase Ledger (Supplier Control) || To generate the transactions | | Purchase Ledger (Supplier Control) || To generate the transactions related to '''Suppliers'''. | ||

|}<br /> | |}<br /> | ||

==Group and other options== | ==Group and other options== | ||

Revision as of 08:10, 9 January 2017

Ledger Report

[GL | Print Ledger ...]

- This ledger report consists of:

- 1. General Ledger

- 2. Sales Ledger (Customer Ledger)

- 3. Purchase Ledger (Supplier Ledger)

- 440PX

Parameters

Parameter Name Purpose to filter Filter By: Post Date Parameter date to be filtered by Post Date. Filter By: Tax Date Parameter date to be filtered by Tax Date. Date Define the date range. Account Select the GL Account (for General Ledger), Customer Account (for Sales Ledger) and Supplier Account (for Purchase Ledger) Project Select the Project. Agent Select the Agent. Area Select the Area. Control A/c Select the Customer/Supplier Control Account. (Applicable to Sales Ledger and Purchase Ledger only) Tax Select all tax code (including non-GST Tax type) General Ledger To generate the general transactions, eg. bank, cash, sales, purchase, fixed assets, etc.) Sales Ledger (Customer Control) To generate the transactions related to Customers. Purchase Ledger (Supplier Control) To generate the transactions related to Suppliers.

Group and other options

- 1.

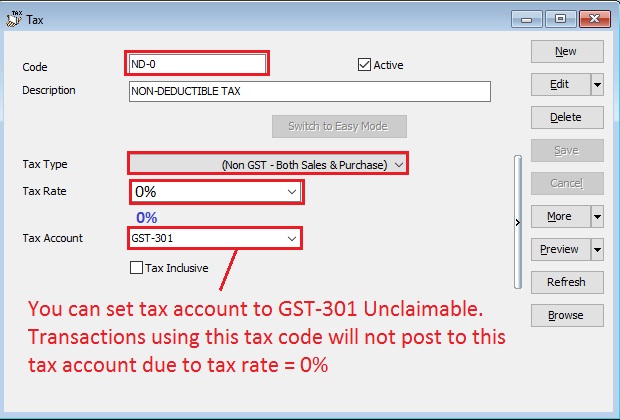

- 2. Follow the below SETTINGS to create.

Field Name Field Contents Code ND-0 (Recommended code) Description Non-Deductible Tax Type (Non GST - Both Sales & Purchase) Tax Rate 0% (please key-in) Tax Account GST-301 (This field is compulsory. Due to tax rate is 0%, therefore no posting) Tax Inclusive Untick

NOTE :

Do not click the tax rate arrow key down if the tax account is not defined yet.

Data Entry for Non-Deductible

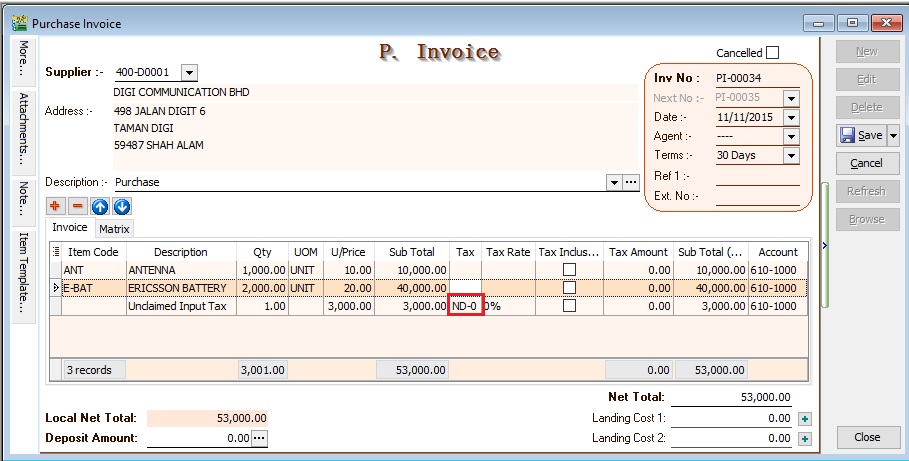

For Purchase Invoice

- 1. Insert a new detail row and key-in the total input tax not going to claim.

- 2. Select the tax code "ND-0".

- 3. See below screenshot.

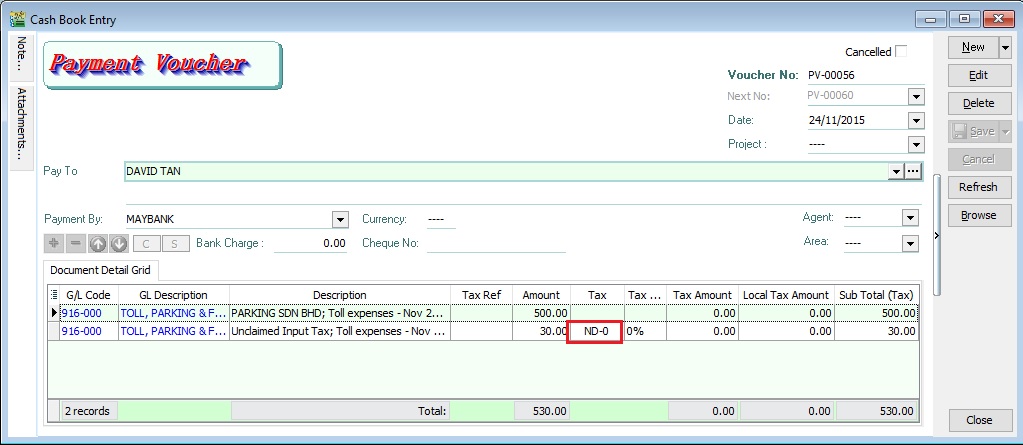

For GL Cash Book

- 1. Insert a new detail row and key-in the total input tax not going to claim.

- 2. Select the tax code "ND-0".

- 3. See below screenshot.

NOTE: Please ensure you understand the Non-Deductible expenditure from your auditors before you apply this guide.

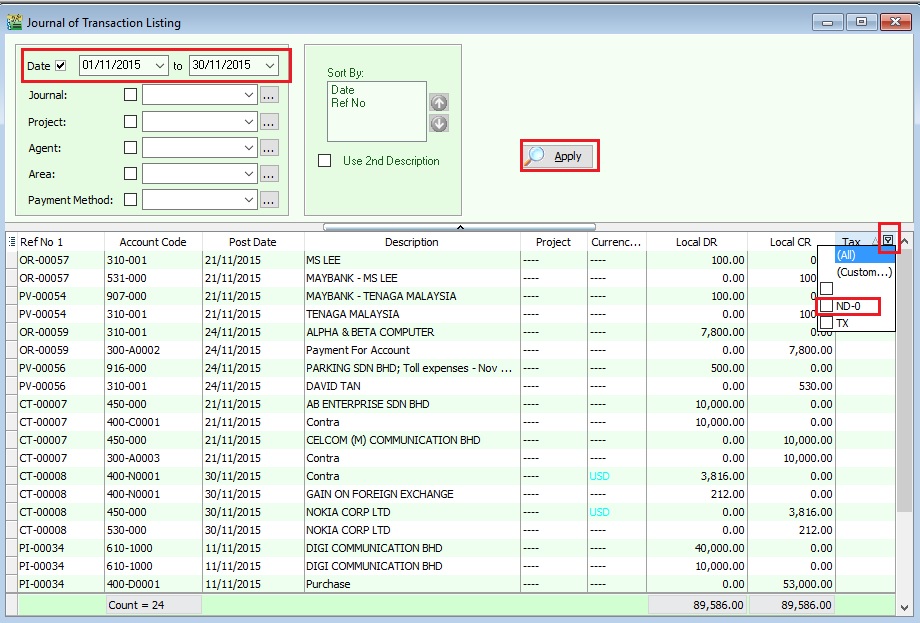

How to analyse the total tax amount from Non-Deductible?

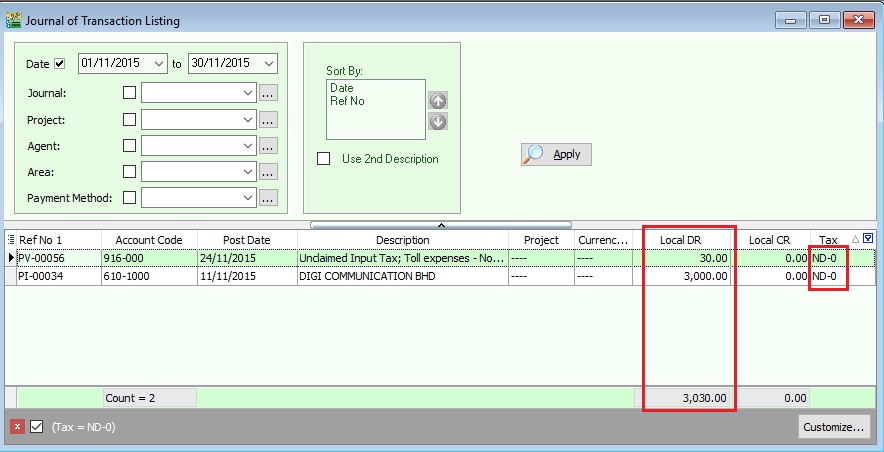

[ GL | Print Journal of Transaction Listing...]

- 4. From this instance, the total non-deductible expenditure amount is Rm3030.00

NOTE: This non-deductible tax amount will not post to GAF.