| (9 intermediate revisions by the same user not shown) | |||

| Line 75: | Line 75: | ||

| 05b || Output Tax - Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments)* || '''SR + DS + AJS''' (Tax Amount) | | 05b || Output Tax - Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments)* || '''SR + DS + AJS''' (Tax Amount) | ||

|- | |- | ||

| 06a || Input Tax - Total Value of Standard Rate and Flat Rate Acquisitions* || '''TX + IM + TX-E43 + TX-RE''' | | 06a || Input Tax - Total Value of Standard Rate and Flat Rate Acquisitions* || '''TX + IM + TX-E43 + TX-RE''' | ||

|- | |- | ||

| 06b || Input Tax - Total Input Tax (Inclusive of Tax Value on Bad Debt Relief & other Adjustments)* || '''TX + IM + TX-E43 + TX-RE + AJP''' (Tax Amount) | | 06b || Input Tax - Total Input Tax (Inclusive of Tax Value on Bad Debt Relief & other Adjustments)* || '''TX + IM + TX-E43 + TX-RE + AJP''' (Tax Amount) | ||

| Line 93: | Line 93: | ||

! Item No. !! Description || Guidelines | ! Item No. !! Description || Guidelines | ||

|- | |- | ||

| 10 || Total Value of Local Zero-Rated Supplies* || '''ZRL''' (Taxable Amount) | | 10 || Total Value of Local Zero-Rated Supplies* || '''ZRL + NTX''' (Taxable Amount) | ||

|- | |- | ||

| 11 || Total Value of Export Supplies* || '''ZRE''' (Taxable Amount) | | 11 || Total Value of Export Supplies* || '''ZRE + ZDA''' (Taxable Amount) | ||

|- | |- | ||

| style="vertical-align: top;" | 12 || Total Value of Exempt Supplies* || ''' | | style="vertical-align: top;" | 12 || style="vertical-align: top;" | Total Value of Exempt Supplies* || '''IES + ES''' (Taxable Amount) <br /> ''Note: Net Loss in Forex (IES)= 0.00'' | ||

|- | |- | ||

| 13 || Total Value of Supplies Granted GST Relief* || '''RS''' (Taxable Amount) | | 13 || Total Value of Supplies Granted GST Relief* || '''RS''' (Taxable Amount) | ||

| Line 105: | Line 105: | ||

| 15 || Total Value of GST Suspended under item 14* || '''IS x 6%''' (value of tax) | | 15 || Total Value of GST Suspended under item 14* || '''IS x 6%''' (value of tax) | ||

|- | |- | ||

| 16 || Total Value of Capital Goods Acquired* || '''TX + IM''' (value excluding tax) <br /> ''Note: Purchase doc/Cash Book PV/ JV using "Fixed Asset" GL Account (exclude Block Tax)'' | | style="vertical-align: top;" | 16 || style="vertical-align: top;" | Total Value of Capital Goods Acquired* || '''TX + TX-CG + IM''' (value excluding tax) <br /> ''Note: Regardless purchase asset value. Purchase doc/Cash Book PV/ JV using "Fixed Asset" GL Account (exclude Block Tax)'' | ||

|- | |- | ||

| 17 || Total Value of Bad Debt Relief Inclusive Tax* || '''AJP''' (value including tax) - Only Debtor (106 x AJP Input Tax/6 ) | | 17 || Total Value of Bad Debt Relief Inclusive Tax* || '''AJP''' (value including tax) - Only Debtor (106 x AJP Input Tax/6 ) | ||

| Line 114: | Line 114: | ||

'' - MSIC Code is an item code (5 digits) representing your business nature (Major Industry Code).'' <br /> | '' - MSIC Code is an item code (5 digits) representing your business nature (Major Industry Code).'' <br /> | ||

'' - MSIC code will be used in Form GST-03 (Item 19) as Major Industries Code. The total GST amount of the respective MSIC Code(s) will be shown.''<br /> | '' - MSIC code will be used in Form GST-03 (Item 19) as Major Industries Code. The total GST amount of the respective MSIC Code(s) will be shown.''<br /> | ||

'' - | '' - '''Others''' will be fill-up automatically if exceeding 5 MISC code.<br /> | ||

Refer to list of [ | Refer to list of [http://www.hasil.gov.my/pdf/pdfam/NewBusinessCodes_MSIC2008_2.pdf MSIC 2008]<br /> | ||

|} | |} | ||

<br /> | <br /> | ||

Latest revision as of 02:08, 31 October 2017

Introduction

- To generate the GST-03 data for submission via TAP.

GST-03

[GST | Print GST-03...]

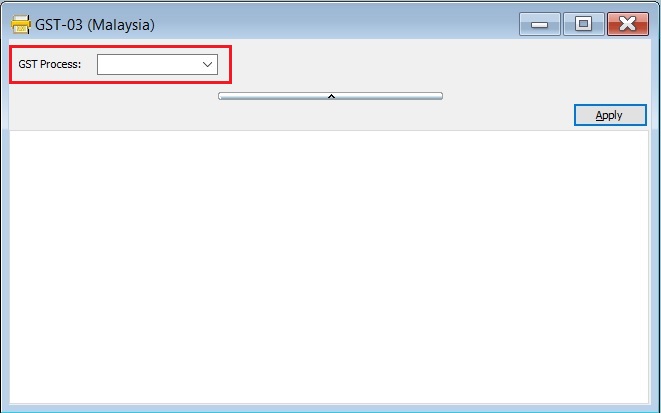

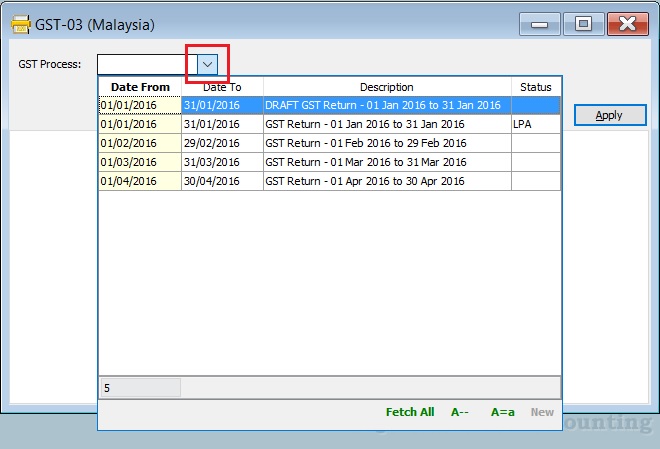

GST-03-Parameter

Parameter Type Explanation GST Process Lookup To select the GST Process Period.

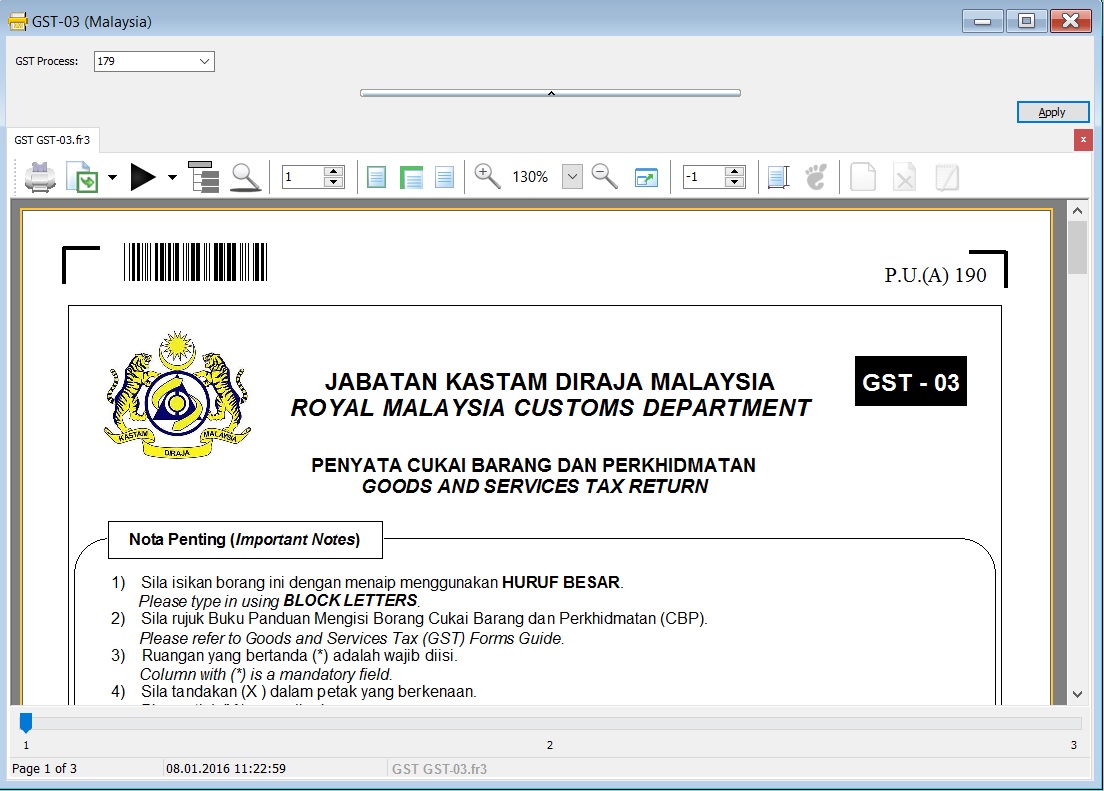

GST-03 Form

GST-03 TAP Upload File

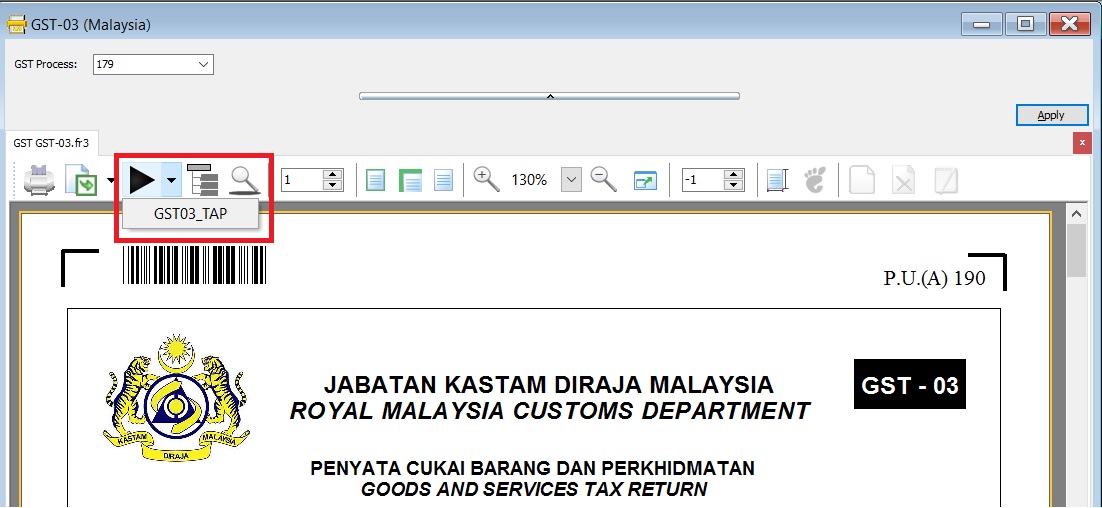

- 1. At the GST-03 on the screen, click on the PLAY button.

- 2. Click on GST03_TAP. See the below screenshot.

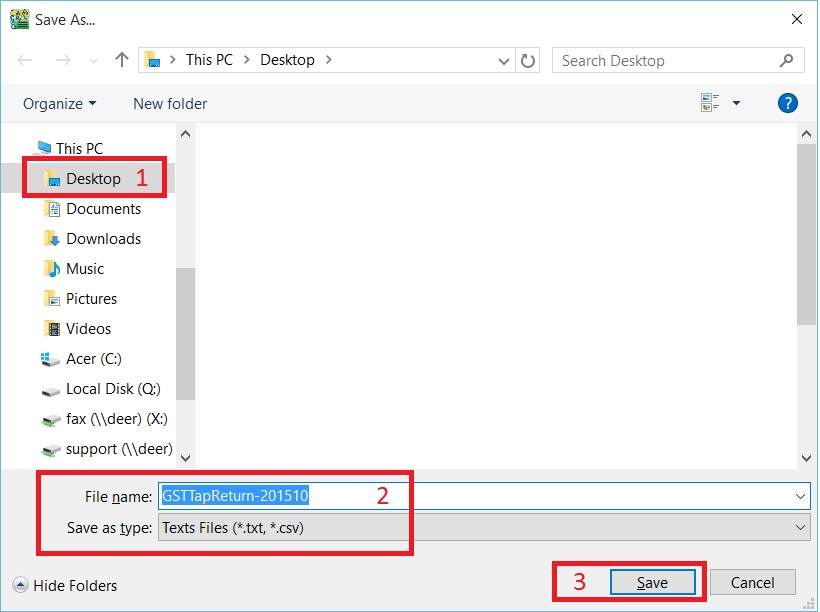

- 3. Select the destination directory to save the TAP-Upload text file, eg. GST Tap Return for Oct 2015 the filename: GSTTapReturn-201510.

- 4. Click on SAVE.

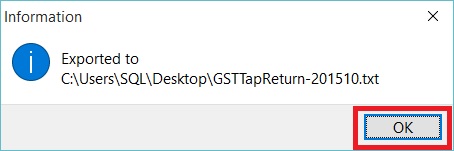

- 5. See the below screenshot.

GST-03 Item Details

- Original source from RMCD website:

- GST-03 Guidelines from RMCD website

PART A : DETAILS OF REGISTERED PERSON

Item No. Description Guidelines 01 GST No.* GST No from File -> Company Profile... 02 Name of Business* Company Name from File -> Company Profile...

PART B : DETAILS OF RETURN

Item No. Description Guidelines 03 Taxable Period* GST Returns - Process date range. 04 Return and Payment Due Date* Follow the RMCD due date. 05a Output Tax - Total Value of Standard Rated Supply* SR + DS (Taxable Amount) 05b Output Tax - Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments)* SR + DS + AJS (Tax Amount) 06a Input Tax - Total Value of Standard Rate and Flat Rate Acquisitions* TX + IM + TX-E43 + TX-RE 06b Input Tax - Total Input Tax (Inclusive of Tax Value on Bad Debt Relief & other Adjustments)* TX + IM + TX-E43 + TX-RE + AJP (Tax Amount) 07 GST Amount Payable (Item 5b - Item 6b)* Output Tax Value > Input Tax Value 08 GST Amunt Claimable (Item 6b - Item 5b)* Input Tax Value > Output Tax Value 09 Do you choose to carry forward refund for GST? Mark X on YES if you have Tick on C/F Refund for GST.

PART C : ADDITIONAL INFORMATION

Item No. Description Guidelines 10 Total Value of Local Zero-Rated Supplies* ZRL + NTX (Taxable Amount) 11 Total Value of Export Supplies* ZRE + ZDA (Taxable Amount) 12 Total Value of Exempt Supplies* IES + ES (Taxable Amount)

Note: Net Loss in Forex (IES)= 0.0013 Total Value of Supplies Granted GST Relief* RS (Taxable Amount) 14 Total Value of Goods Imported Under Approved Trader Scheme* IS (value excluding tax) 15 Total Value of GST Suspended under item 14* IS x 6% (value of tax) 16 Total Value of Capital Goods Acquired* TX + TX-CG + IM (value excluding tax)

Note: Regardless purchase asset value. Purchase doc/Cash Book PV/ JV using "Fixed Asset" GL Account (exclude Block Tax)17 Total Value of Bad Debt Relief Inclusive Tax* AJP (value including tax) - Only Debtor (106 x AJP Input Tax/6 ) 18 Total Value of Bad Debt Recovered Inclusive Tax* AJS (value including tax) - Only Debtor (106 x AJS Input Tax/6 ) 19 Breakdown Value of Output Tax in accordance with the Major Industries Code It picks from GL Accounts that need to assign MSIC Code are Sales Account, Cash Sales Account, Return Inwards and etc.

- MSIC Code is an item code (5 digits) representing your business nature (Major Industry Code).

- MSIC code will be used in Form GST-03 (Item 19) as Major Industries Code. The total GST amount of the respective MSIC Code(s) will be shown.

- Others will be fill-up automatically if exceeding 5 MISC code.

Refer to list of MSIC 2008

PART D : DECLARATION

Item No. Description Guidelines 20 Name of Authorized Peson* User name from Tools -> Maintain User... 21 Identity Card No.* IC (New) from Tools -> Maintain User...(Misc tab) 22 Passport No.* Passport from Tools -> Maintain User...(Misc tab) 23 Nationality* Nationality from Tools -> Maintain User...(Misc tab) 24 Date Process Date 25 Signature Sign on GST-03 print copy.

Note: Column with (*) is a mandatory field.