| Line 55: | Line 55: | ||

! Item No. !! Description || Guidelines | ! Item No. !! Description || Guidelines | ||

|- | |- | ||

| 01 || GST No. || Enter the company '''GST No''' at menu path: '''File -> Company Profile...''' | | 01 || GST No.* || Enter the company '''GST No''' at menu path: '''File -> Company Profile...''' | ||

|- | |- | ||

| 02 || Name of Business || Enter the '''Company Name''' at menu path: '''File -> Company Profile...''' | | 02 || Name of Business* || Enter the '''Company Name''' at menu path: '''File -> Company Profile...''' | ||

|} | |} | ||

<br /> | <br /> | ||

| Line 67: | Line 67: | ||

! Item No. !! Description || Guidelines | ! Item No. !! Description || Guidelines | ||

|- | |- | ||

| 03 || Taxable Period || GST Returns - Process date range. | | 03 || Taxable Period* || GST Returns - Process date range. | ||

|- | |- | ||

| 04 || Return and Payment Due Date || Follow the RMCD due date. | | 04 || Return and Payment Due Date* || Follow the RMCD due date. | ||

|- | |- | ||

| 05a || | | 05a || Output Tax - Total Value of Standard Rated Supply* || SR + DS (Taxable Amount) | ||

|- | |- | ||

| 05b || | | 05b || Output Tax - Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments)* || SR +DS + AJS (Tax Amount) | ||

|- | |- | ||

| 06a || | | 06a || Input Tax - Total Value of Standard Rate and Flat Rate Acquisitions* || TX + IM + TX-E43 + TX-RE (Taxable Amount) | ||

|- | |- | ||

| 06b || | | 06b || Input Tax - Total Input Tax (Inclusive of Tax Value on Bad Debt Relief & other Adjustments)* || TX + IM + TX-E43 + TX-RE + AJP (Tax Amount) | ||

|- | |- | ||

| 07 || GST | | 07 || GST Amount Payable (Item 5b - Item 6b)* || Output Tax Value > Input Tax Value | ||

|- | |- | ||

| 08 || GST | | 08 || GST Amunt Claimable (Item 6b - Item 5b)* || Input Tax Value > Output Tax Value | ||

|- | |- | ||

| 09 || GST | | 09 || Do you choose to carry forward refund for GST? || Mark '''X''' on YES if you have '''Tick''' on C/F Refund for GST. | ||

|} | |} | ||

<br /> | <br /> | ||

Revision as of 04:27, 8 January 2016

Introduction

- To generate the GST-03 data for submission via TAP.

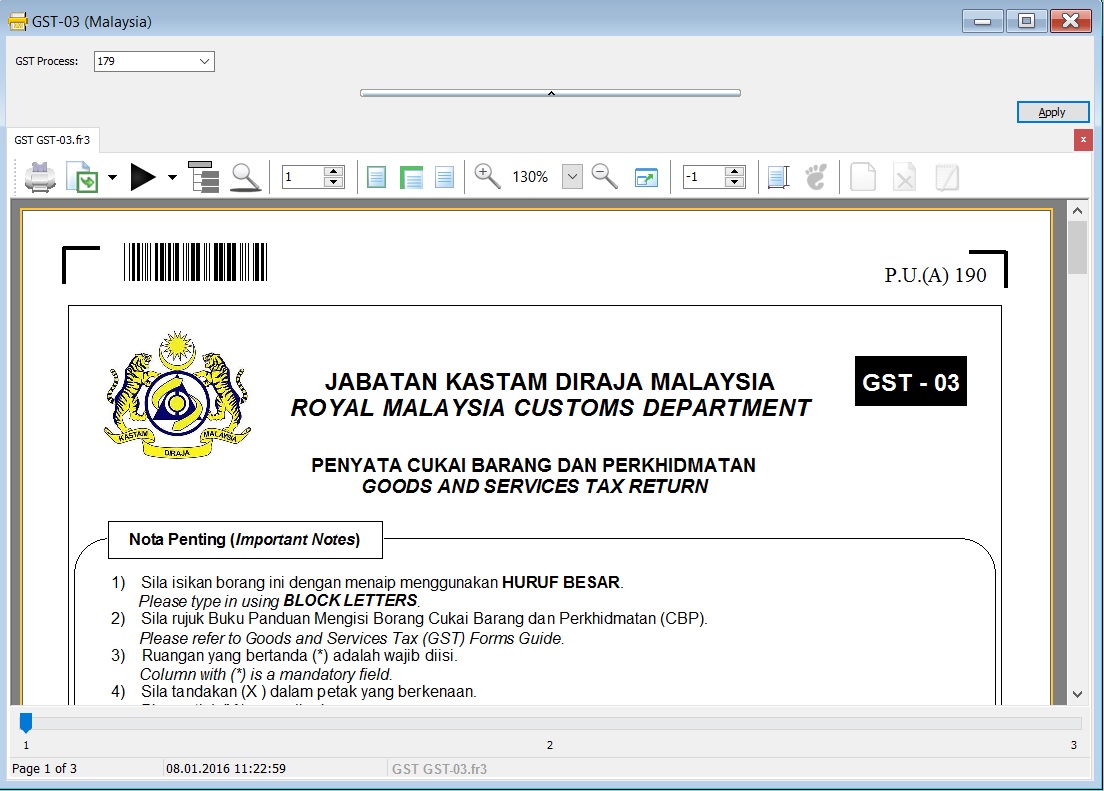

GST-03

[GST | Print GST-03...]

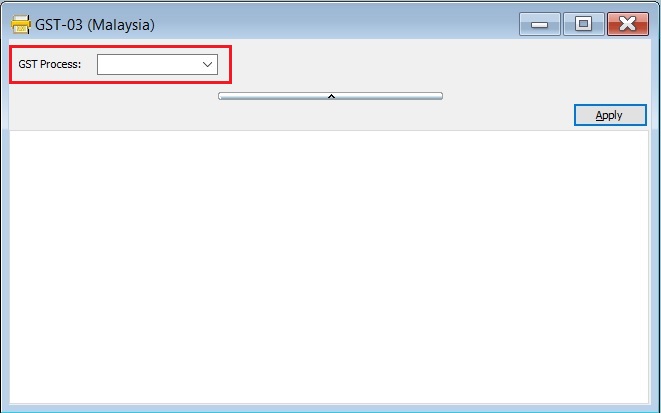

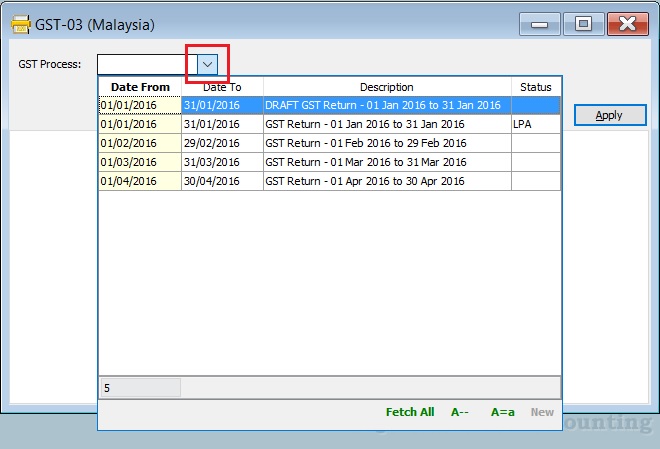

GST-03-Parameter

Parameter Type Explanation GST Process Lookup To select the GST Process Period.

GST-03 Form

GST-03 TAP Upload File

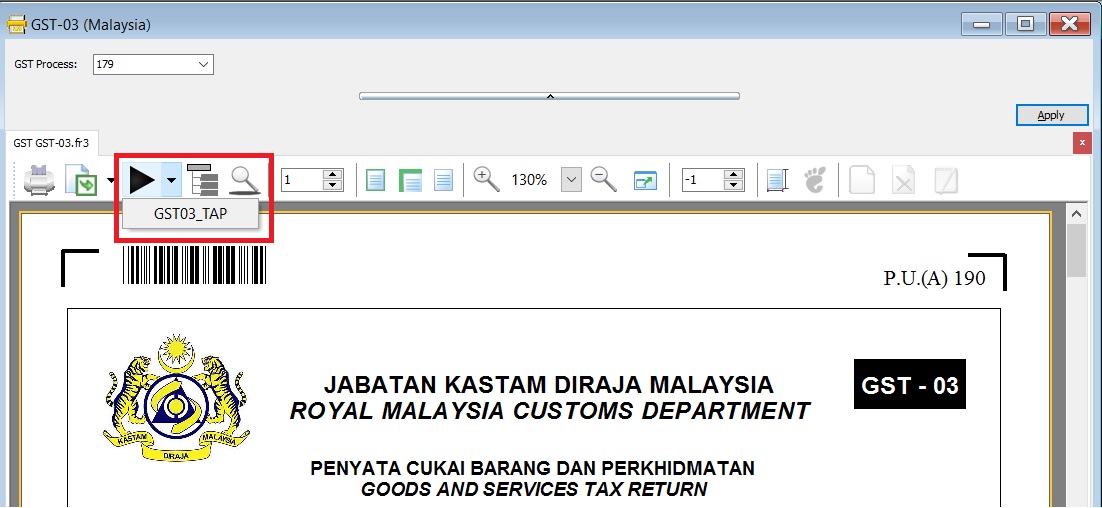

- 1. At the GST-03 on the screen, click on the PLAY button.

- 2. Click on GST03_TAP. See the below screenshot.

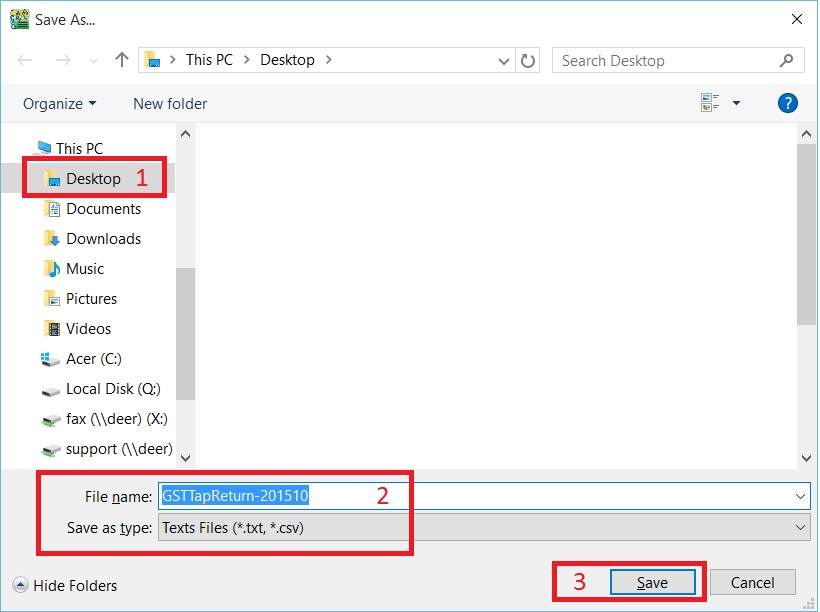

- 3. Select the destination directory to save the TAP-Upload text file, eg. GST Tap Return for Oct 2015 the filename: GSTTapReturn-201510.

- 4. Click on SAVE.

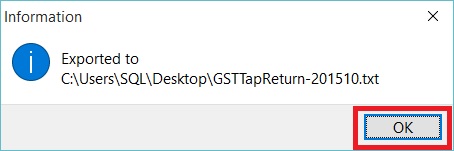

- 5. See the below screenshot.

GST-03 Item Details

Original source from RMCD website: GST-03 Guidelines from RMCD website

PART A : DETAILS OF REGISTERED PERSON

Item No. Description Guidelines 01 GST No.* Enter the company GST No at menu path: File -> Company Profile... 02 Name of Business* Enter the Company Name at menu path: File -> Company Profile...

PART B : DETAILS OF RETURN

Item No. Description Guidelines 03 Taxable Period* GST Returns - Process date range. 04 Return and Payment Due Date* Follow the RMCD due date. 05a Output Tax - Total Value of Standard Rated Supply* SR + DS (Taxable Amount) 05b Output Tax - Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments)* SR +DS + AJS (Tax Amount) 06a Input Tax - Total Value of Standard Rate and Flat Rate Acquisitions* TX + IM + TX-E43 + TX-RE (Taxable Amount) 06b Input Tax - Total Input Tax (Inclusive of Tax Value on Bad Debt Relief & other Adjustments)* TX + IM + TX-E43 + TX-RE + AJP (Tax Amount) 07 GST Amount Payable (Item 5b - Item 6b)* Output Tax Value > Input Tax Value 08 GST Amunt Claimable (Item 6b - Item 5b)* Input Tax Value > Output Tax Value 09 Do you choose to carry forward refund for GST? Mark X on YES if you have Tick on C/F Refund for GST.