| Line 142: | Line 142: | ||

:3. For example, | :3. For example, | ||

::Supplier invoice date (15 Sept 2016) received in Oct 2016 and GST-03 Sept 2016 has submitted. Input tax will be claim in Oct 2016 by set the tax date (31 Oct 2016). In GL Ledger, the input tax will be posted in Sept 2016. However, this input tax will be appear in GT-03 Oct 2016. | ::Supplier invoice date (15 Sept 2016) received in Oct 2016 and GST-03 Sept 2016 has submitted. Input tax will be claim in Oct 2016 by set the tax date (31 Oct 2016). In GL Ledger, the input tax will be posted in Sept 2016. However, this input tax will be appear in GT-03 Oct 2016. <br /> | ||

<br /> | |||

::With this '''GST-Ledger-Vs-GST-03''' report, you can very easy identify out the reasons. See the screenshot below. | ::With this '''GST-Ledger-Vs-GST-03''' report, you can very easy identify out the reasons. See the screenshot below. | ||

::[[File:GST-LEDGERvsGST-03-01.jpg ]] | ::[[File:GST-LEDGERvsGST-03-01.jpg ]] | ||

Revision as of 08:01, 22 September 2016

How to avoid costly GST errors?

Introduction

- This guide will help you to easily identify the common GST errors in GST Returns. To minimize GST amendment and incorrect GST Returns to RMCD.

- You may wish to take note the follow errors commonly made by businesses:

- 1. Standard Rated Supply (5a) and Output Tax (5b)

- 2. Stanadard Rate and Flat Rate Acquisitions (6a), and Input Tax (6b)

- 3. Local Zero-Rated Supplies

- 4. Export Supplies

- 5. Exempt Supplies

- 6. Supplies Granted GST Relief

- 7. Goods Imported Under Approved Trader Scheme and GST Suspended

- 8. Capital Goods Acquired

- 9. Bad Debt Relief

- 10. Bad Debt Recovered

- 11. Output tax value breakdown into Major Industries Code (MSIC Code)

- 12. Other important info required in GAF

- 13. GL Ledger vs GST-03

Standard Rated Supply (5a) and Output Tax (5b)

- 1. Sale or disposal of business assets

- 2. Goods given free as gift.

- 3. Inter-company transations

- 4. Margin Scheme

Stanadard Rate and Flat Rate Acquisitions (6a), and Input Tax (6b)

Not all input tax claims are allowable. You can claim input tax on your purchases only if the below conditions are fulfilled.

- 1. Tax invoice / Simplified Tax Invoice / Custom K1 / Custom K9

- a. the buyer can use simplified tax invoice if the total amount GST payable is RM30 or less.

- b. if the total amount of GST payable is more than RM30, the buyer must request for a tax invoice with the name and address of the buyer.

- c. tax invoice issued by approved person for Flat Rate Scheme.

- d. K1 form for imported goods

- e. K1 and K9 for goods removed from bonded warehouse

- 2. Supplies made outside Malaysia which would be taxable supplies if made in Malaysia.

- 3. Disregarded supplies (supplies within group, supplies made in warehouse, supplies between venture operator and venturers and supplies between toll manufacturer and overseas principal).

- 4. Directly attributable to taxable supplies (ie. standard rated supplies and zero rated supplies). Click here to learn more about Partial Exemption.

- 5. Must not be disallowed expenses (or known as Blocked Input Tax).

- a. Passenger motor cars (not more than 9 passengers including driver and unladen weight does not exceed 3,000 kg) including hiring of car

- b. Repair and maintenance for motor cars

- c. Family benefits

- d. Club subscription fee

- e. Medical and personal accident insurance

- f. Medical expenses

- g. Entertainment expenses for potential customer or others than employees.

- 6. Must be taxable purchases (ie. purchases made from GST registered suppliers)

Local Zero-Rated Supplies

This refer to the following types according to GST (Zero Rate Supplies) Order 2014:-

- 1. Local supply of goods and services

- a) Zero-rated supply of goods of any of the descriptions as in Appendix (Zerorated Supply) Order 2014 based on tariff code in such as milled-rice, fresh fruit, and live animals (cattle, buffalo, goat, sheep and swine),

- b) Medicaments and medical gases in the National Essential Medicines List issued by the Ministry of Health and approved by the Minister and put up in measured doses or in forms of packaging for retail sale,

- c) The supply of treated water by a person who is licensed under the Water Services Industry Act 2006 [Act 655] to domestic consumers irrespective of minimum or non-usage,

- d) The supply of raw materials and components made to a person who belongs in a country other than Malaysia for the treatment and processing of goods by any taxable person under the Approved Toll Manufacturer Scheme, and etc.

- 2. Supply of goods from Malaysia to Designated Area (Pulau Langkawi, Labuan, & Pulau Tioman).

Export Supplies

This refer to the Supply of goods or services from Malaysia to Oversea according to GST (Zero Rate Supplies) Order 2014.

- 1. Movement of goods is supported with Customs K2 form which must stated the following:-

- a. Supplier's name and address as the consignor.

- b. Recipient's name and address in overseas recipient as the consignee.

- c. Supply of services must attached with supporting documents such as invoice for an international services. Examples includes sales of air-tickets and international freight charges.

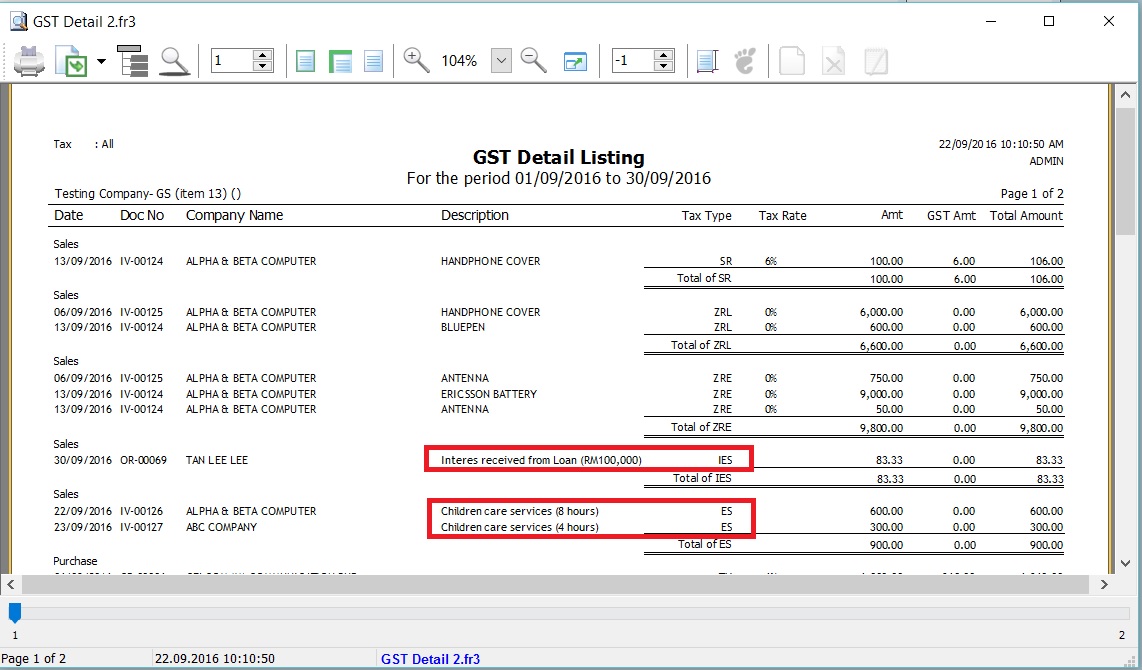

Exempt Supplies

This refer to the following types according to GST (Exempt Supplies) Order 2014:-

- 1. Services:-

- a. Private education

- b. Private health services

- c. Childcare services

- d. Domestic transportation of passengers for mass Public Transports (eg. by rail, ship, boat, ferry, express bus, stage bus, school bus, feeder bus, workers bus and taxi)

- e. Toll highway

- 2. Financial Services:-

- a. Interest income from deposits placed with a financial institution in Malaysia

- b. Interest received from loans provided to employees (factoring receivables)

- c. Realized foreign exchange gains.

- 3. Goods:-

- a. Residential properties

- b. Land for agricultural use

- c. Land for general user (ie. burial ground, playground or religious building)

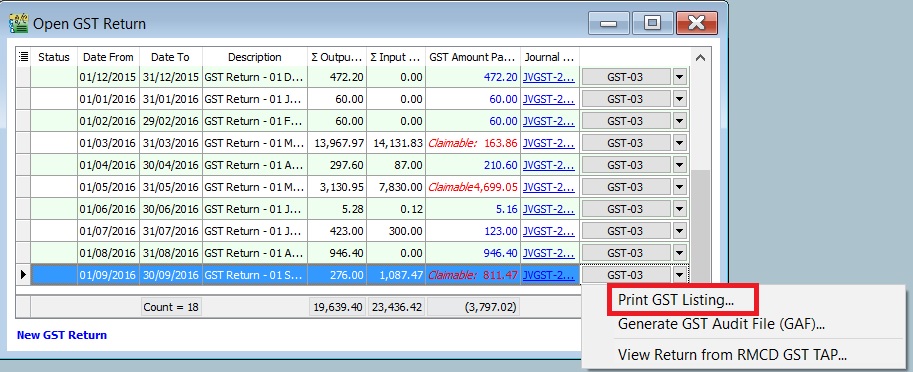

GST Listing

- 2. Preview and select the report name GST Detail 2.

- 3. To ensure the document detail descriptions are clearly stated and map to the correct tax code.

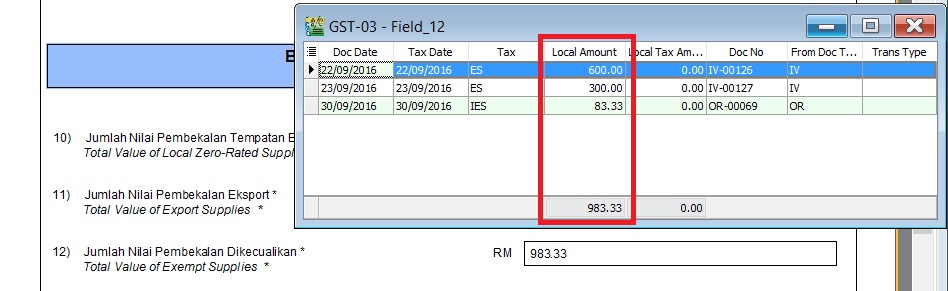

GST-03

- 1. To quick do amendment before submit the GST-03 to RMCD. Click here to learn more about the GST amendment.

- 2. Double click on the item 12 in GST-03.

- 3. Drill down the documents to open and correct it accordingly.

- 4. Lastly, you have to Recalculate the amended GST Return.

Supplies Granted GST Relief

Goods Imported Under Approved Trader Scheme and GST Suspended

Capital Goods Acquired

Bad Debt Relief

Bad Debt Recovered

Output tax value breakdown into Major Industries Code (MSIC Code)

Other important info required in GAF

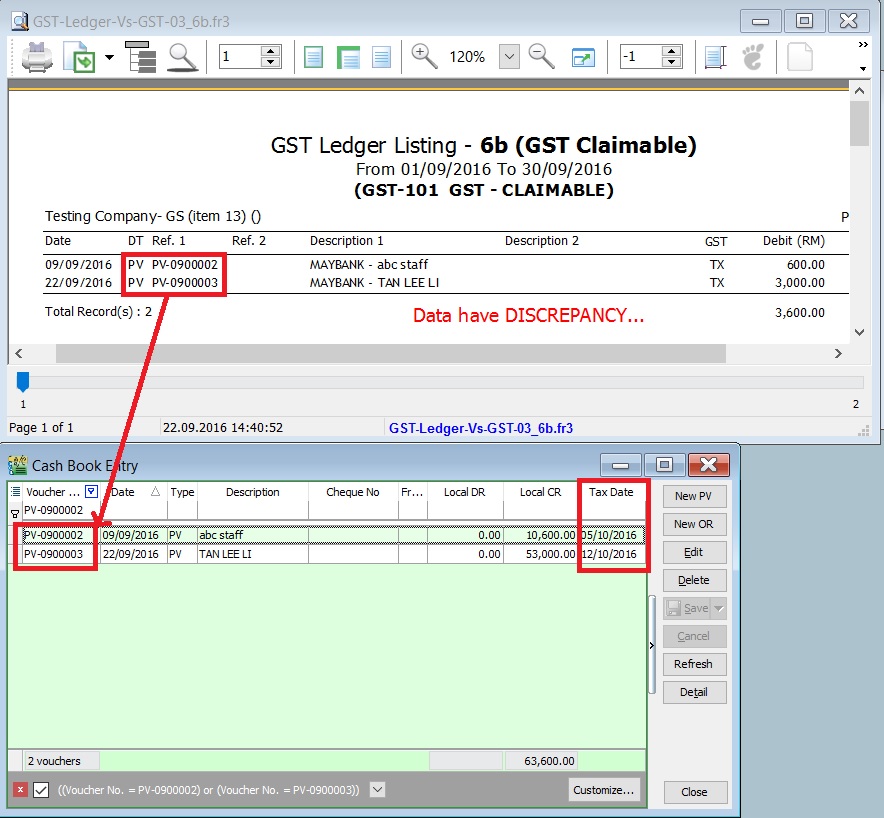

GL Ledger vs GST-03

[GL | Print Ledger Report...]

- 1. GST-Ledger-Vs-GST-03 is a very useful report to identify the unrealized human errors immediately. Possible errors may be due to documents had selected:-

- a. Wrong tax code or category

- b. Wrong account code

- c. Use Tax Date which is different from Document Date

- d. 5 Cents rounding had selected Tax Code.

- 2. It comprises of 2 reports:-

Report Name GL Acc Explanation 1 GST-Ledger-Vs-GST-03_5b GST-201 (GST - Payable) To reconcile the GST Payable account between the GL Ledger and GST-03 2 GST-Ledger-Vs-GST-03_6b GST-101 (GST - Claimable) To reconcile the GST Claimable account between the GL Ledger and GST-03

- 3. For example,

- Supplier invoice date (15 Sept 2016) received in Oct 2016 and GST-03 Sept 2016 has submitted. Input tax will be claim in Oct 2016 by set the tax date (31 Oct 2016). In GL Ledger, the input tax will be posted in Sept 2016. However, this input tax will be appear in GT-03 Oct 2016.

- With this GST-Ledger-Vs-GST-03 report, you can very easy identify out the reasons. See the screenshot below.

- Supplier invoice date (15 Sept 2016) received in Oct 2016 and GST-03 Sept 2016 has submitted. Input tax will be claim in Oct 2016 by set the tax date (31 Oct 2016). In GL Ledger, the input tax will be posted in Sept 2016. However, this input tax will be appear in GT-03 Oct 2016.