Introduction

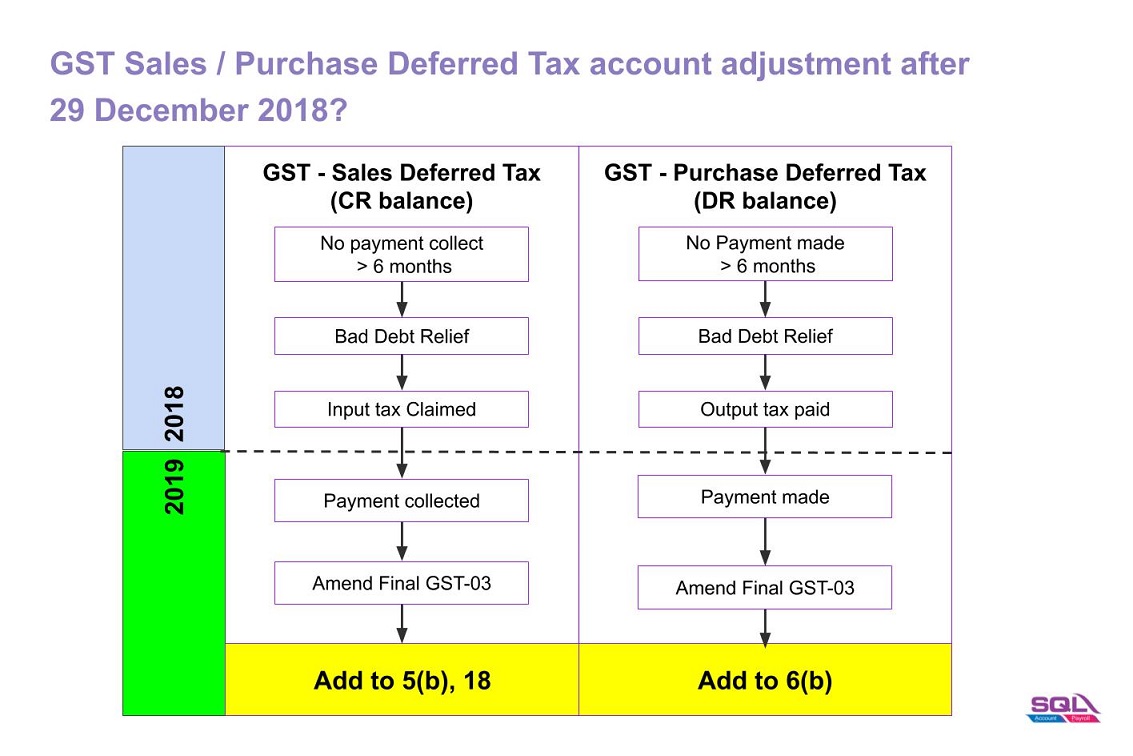

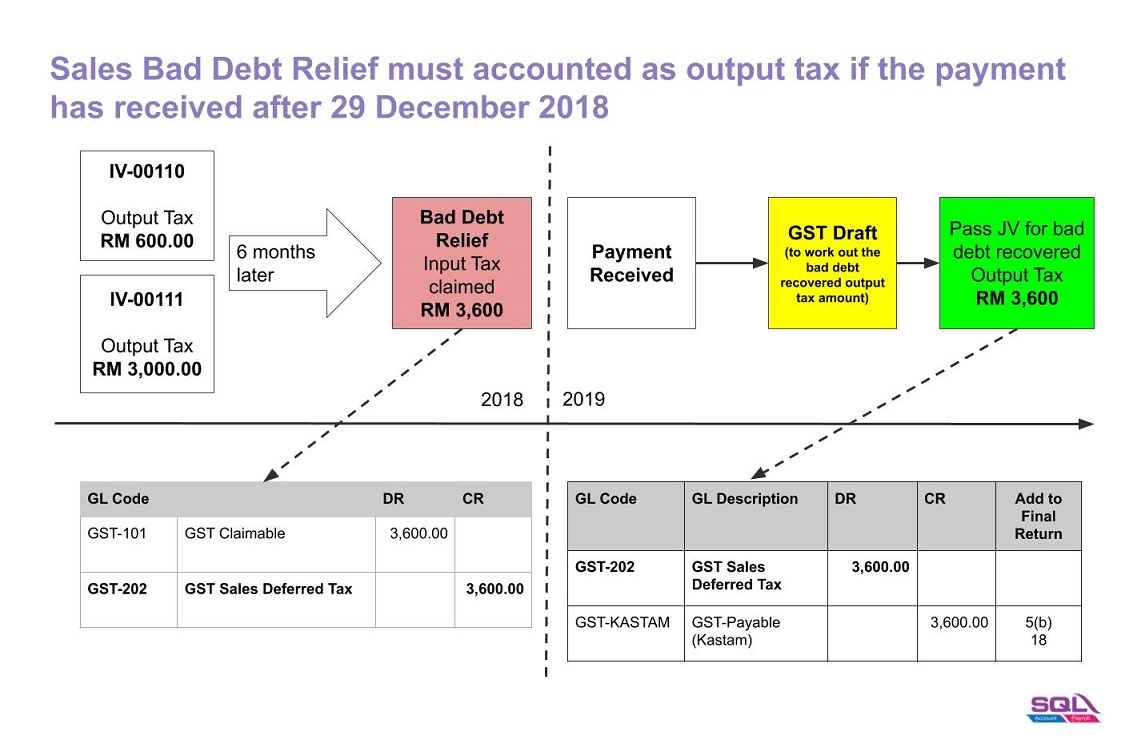

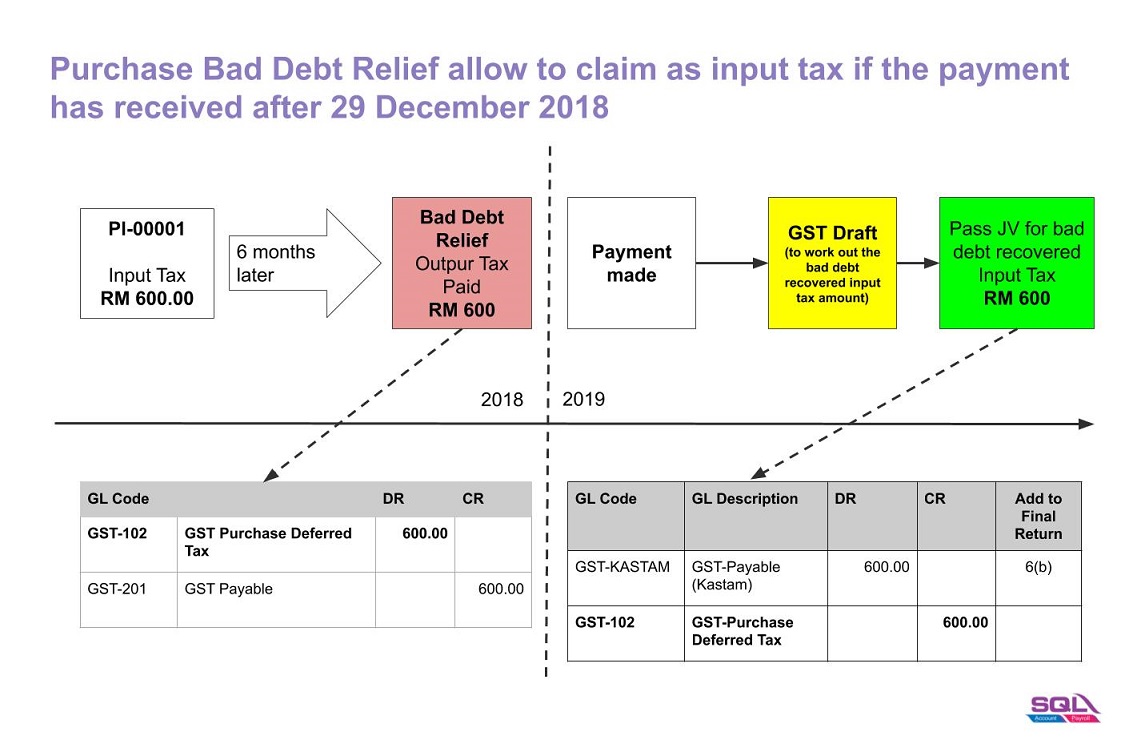

- 1. Double entry adjustment for the balance of GST Sales / Purchase Deferred Tax (Bad Debt Relief) AFTER 29 December 2018.

- 2. Add the adjustment amount into Final GST Return (amendment).

How to check the Sales/Purchase Bad Debt Recovered amount after Final GST Returns?

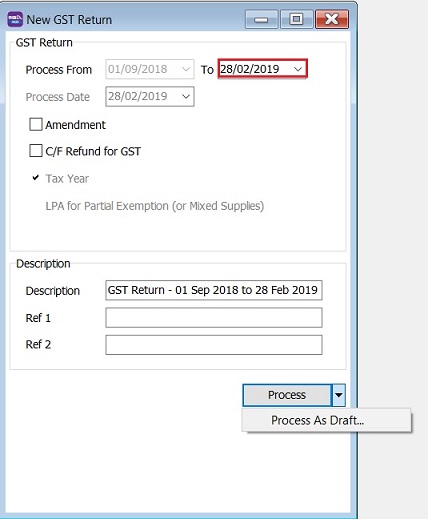

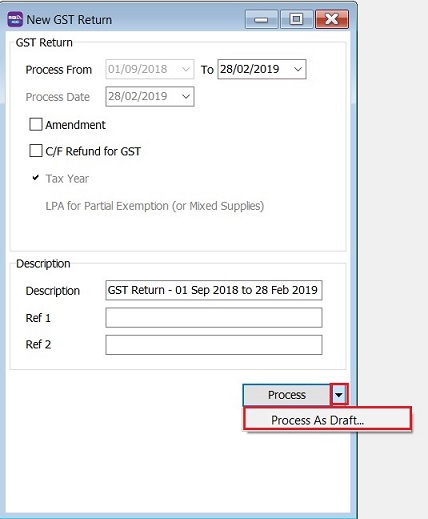

Menu: SST/GST | New GST Return...

- 1. Select a date AFTER the Final GST Return Date, eg. 28/02/2019.

- 2. Choose Process As Draft.

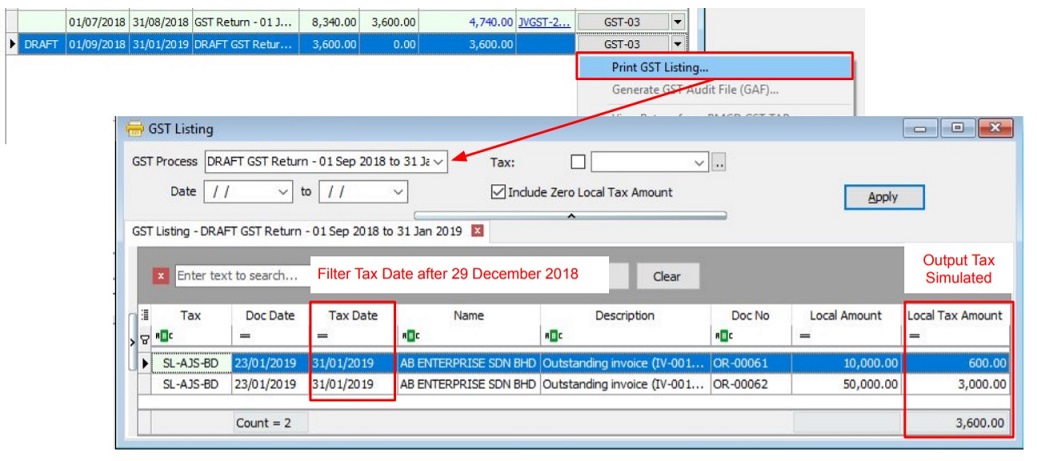

- 3. Click on GST Return Draft and print GST Listing.

- 4. Filter the Tax Date (ie. greater than or equal to 30 December 2018).

GST Sales Deferred Tax

Menu: GL | Journal Entry...

GST Purchase Deferred Tax

Menu: GL | Journal Entry...