Introduction

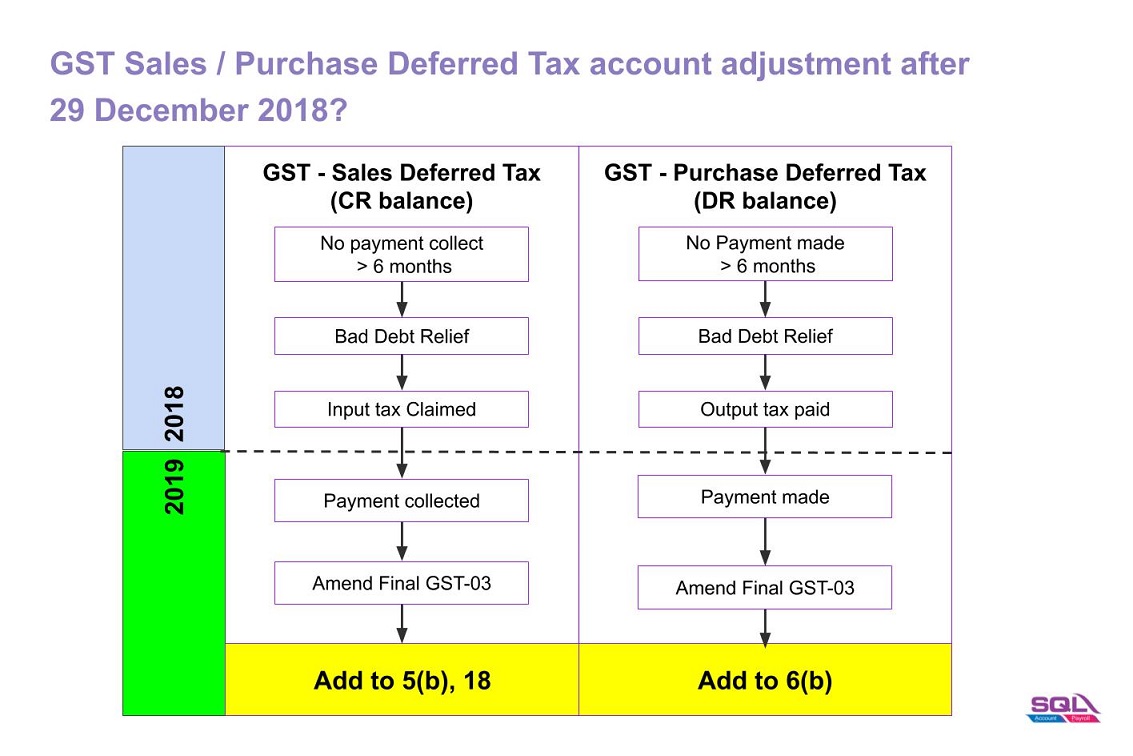

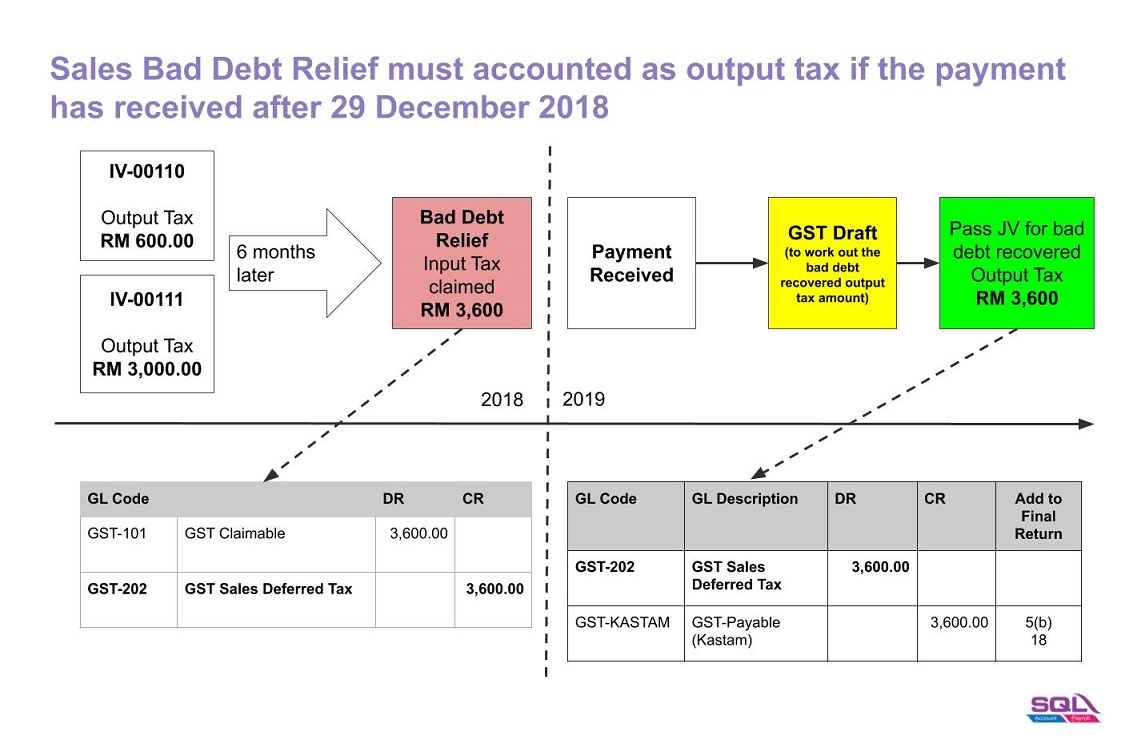

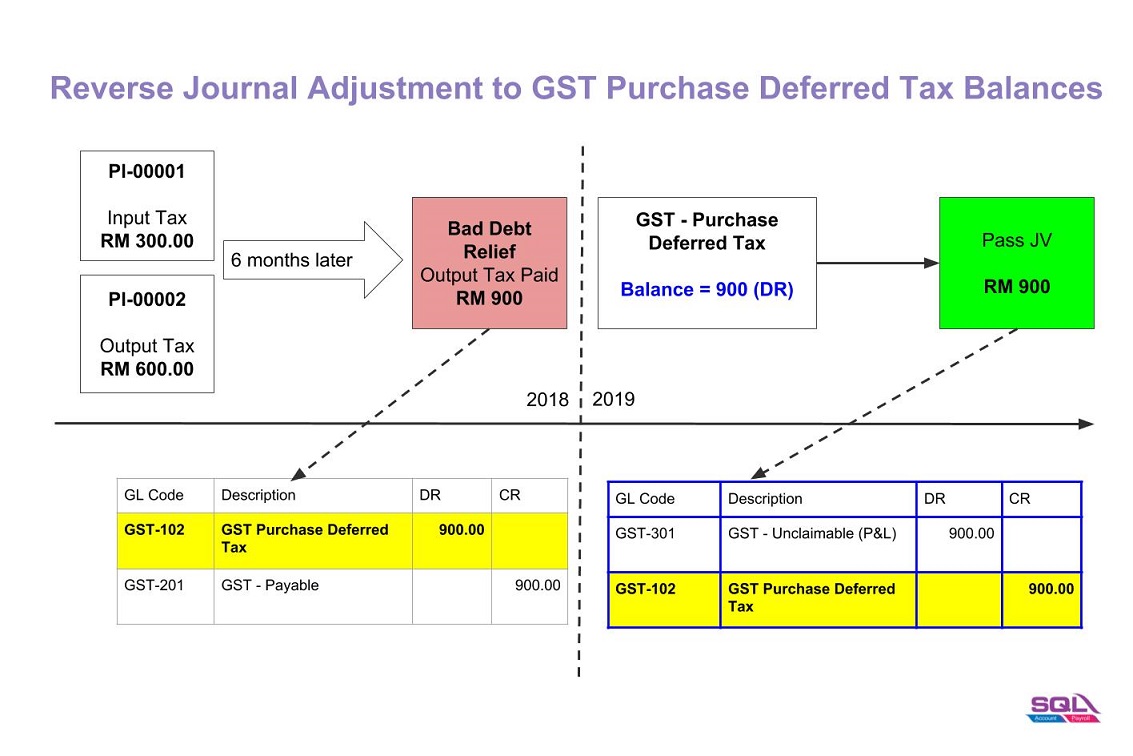

- 1. Double entry adjustment for the balance of GST Sales / Purchase Deferred Tax (Bad Debt Relief) AFTER 29 December 2018.

- 2. Add the adjustment amount into Final GST Return (amendment).

GST Sales Deferred Tax

Menu: GL | Journal Entry...

GST Purchase Deferred Tax

Menu: GL | Journal Entry...