GST Sales/Purchase Deferred Tax Journal Adjustment: Difference between revisions

From eStream Software

| Line 8: | Line 8: | ||

''Menu: GL | Journal Entry...'' | ''Menu: GL | Journal Entry...'' | ||

::[[File: GST | ::[[File: Adjustment for GST Sales _ Purchase Deferred Tax (Bad Debt Relief Recovered)-01.jpg]] | ||

<br /> | <br /> | ||

Revision as of 07:31, 24 April 2019

Introduction

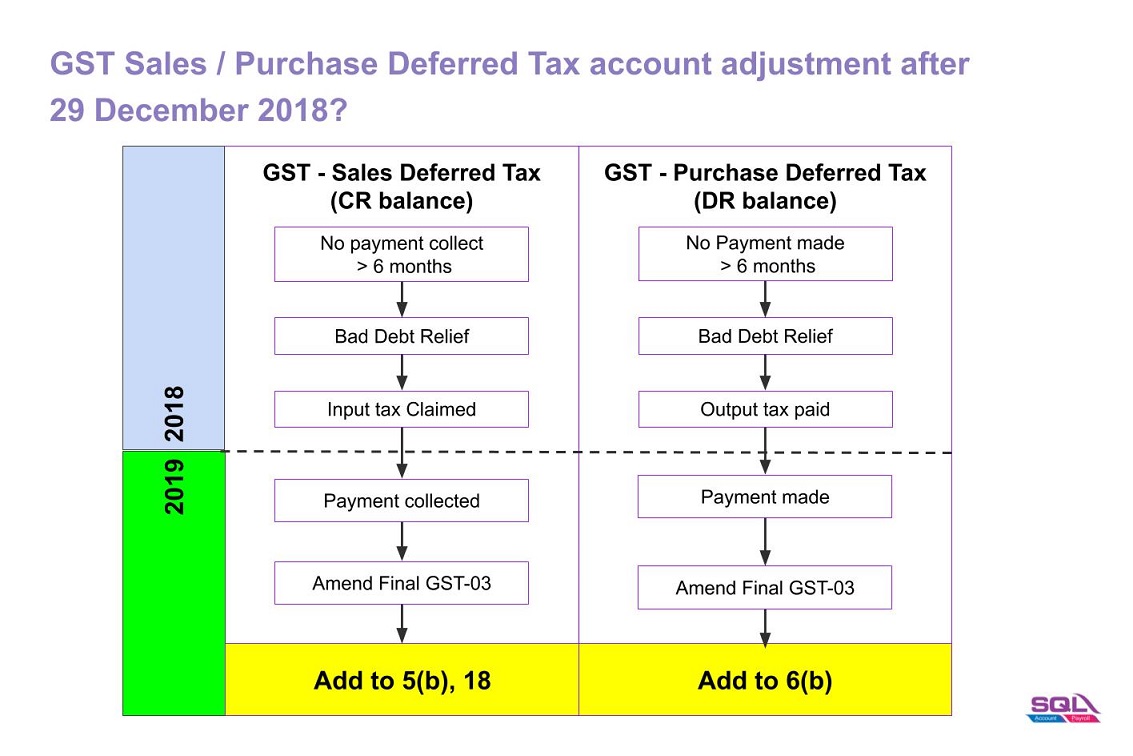

- 1. Double entry adjustment for the balance of GST Sales / Purchase Deferred Tax (Bad Debt Relief) AFTER 29 December 2018.

- 2. Add the adjustment amount into Final GST Return (amendment).

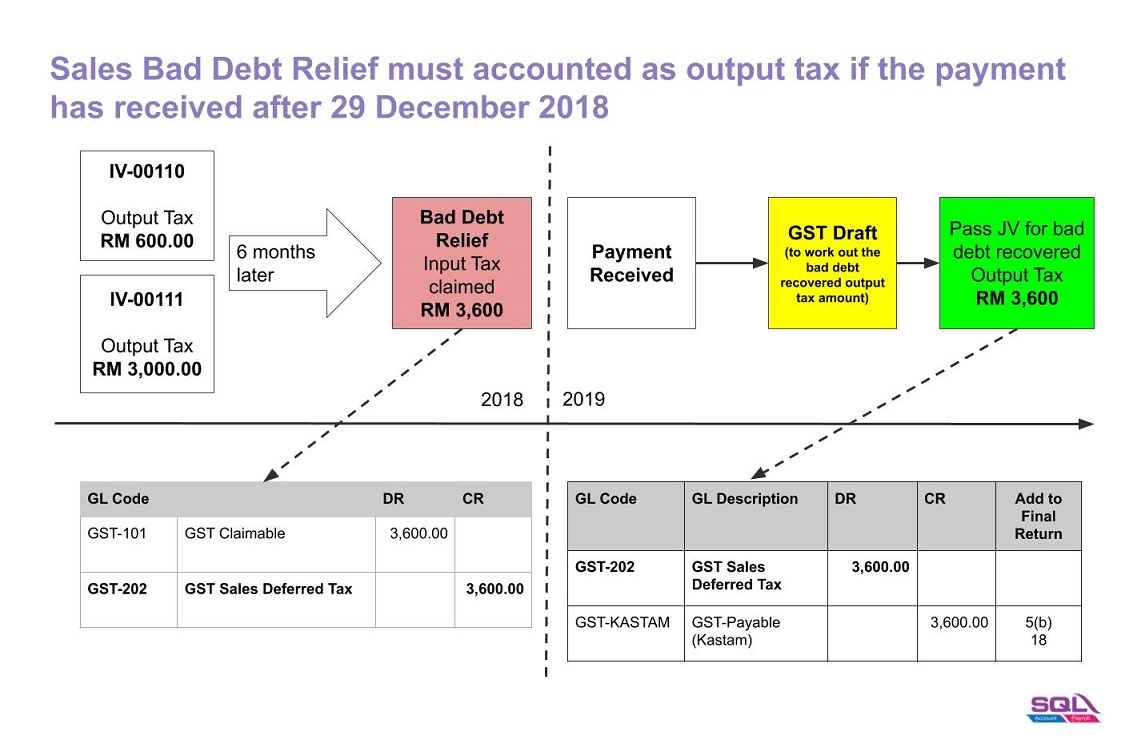

GST Sales Deferred Tax

Menu: GL | Journal Entry...

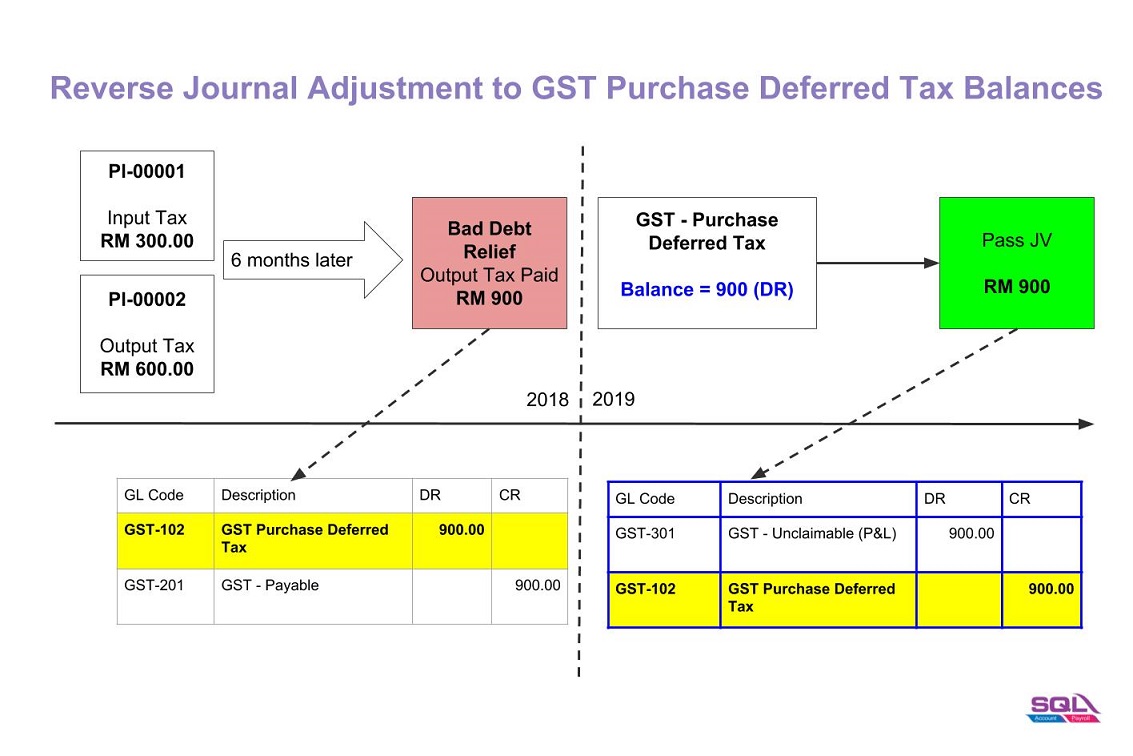

GST Purchase Deferred Tax

Menu: GL | Journal Entry...