GST Sales/Purchase Deferred Tax Journal Adjustment: Difference between revisions

From eStream Software

No edit summary |

|||

| Line 3: | Line 3: | ||

:2. Add the adjustment amount into Final GST Return (amendment). | :2. Add the adjustment amount into Final GST Return (amendment). | ||

<br /> | <br /> | ||

::[[File: GST | ::[[File: Adjustment for GST Sales _ Purchase Deferred Tax (Bad Debt Relief Recovered)-00 .jpg]] | ||

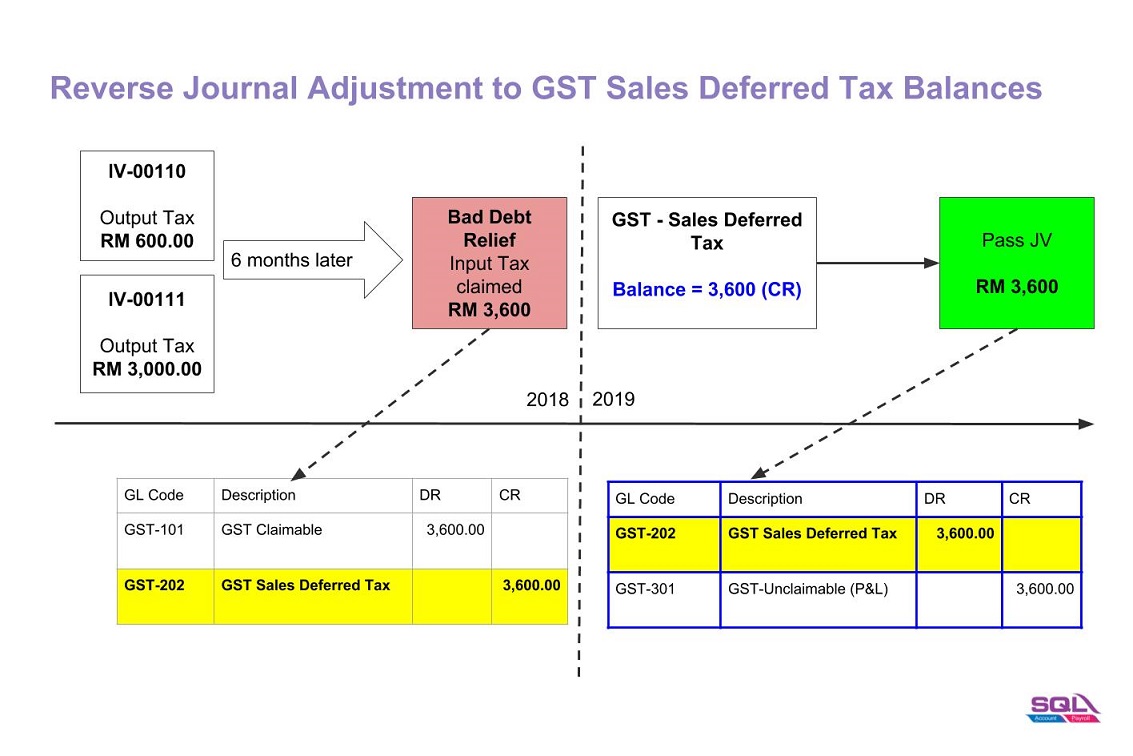

==GST Sales Deferred Tax== | ==GST Sales Deferred Tax== | ||

Revision as of 07:26, 24 April 2019

Introduction

- 1. Double entry adjustment for the balance of GST Sales / Purchase Deferred Tax (Bad Debt Relief) AFTER 29 December 2018.

- 2. Add the adjustment amount into Final GST Return (amendment).

GST Sales Deferred Tax

Menu: GL | Journal Entry...

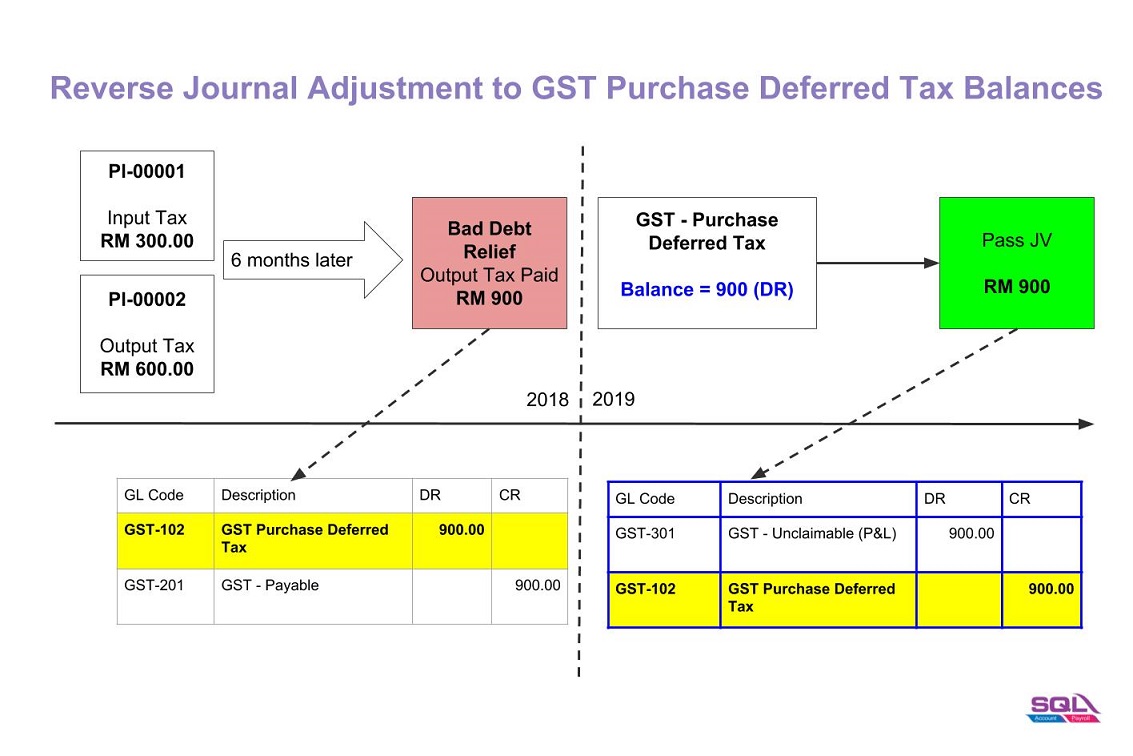

GST Purchase Deferred Tax

Menu: GL | Journal Entry...