No edit summary |

|||

| Line 33: | Line 33: | ||

===GST Returns (LPA)=== | ===GST Returns (LPA)=== | ||

''[GST | New GST Return...]'' or ''[GST | Open GST Return...]'' | |||

<br /> | |||

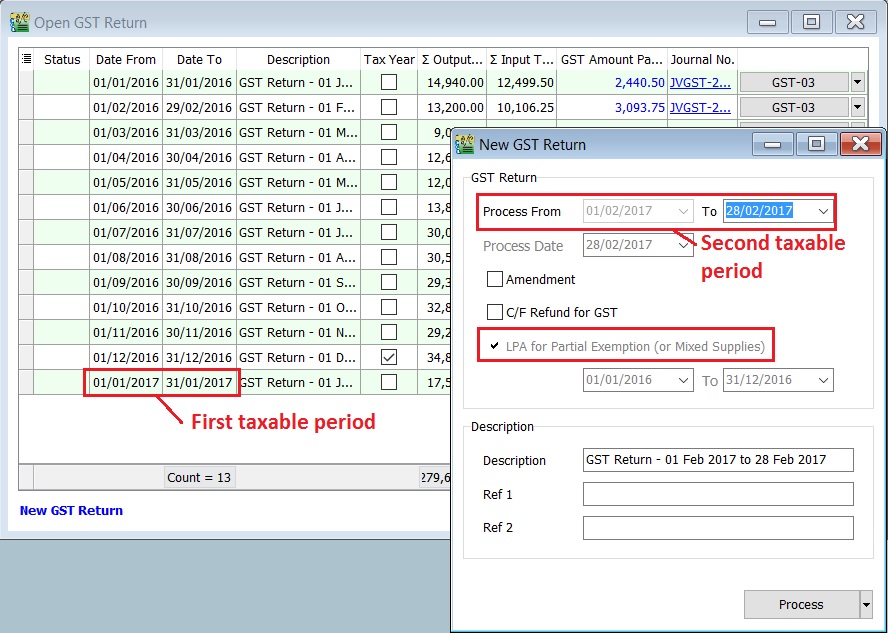

:1. Process GST Return | :1. Process the GST Return.For example, process the '''Second Taxable Period''' (01/02/2017 - 28/02/2017). | ||

:2. LPA will tick automatically. | |||

: | |||

::[[File: GST-Set Tax Year & LPA-05.jpg| 30PX]] | ::[[File: GST-Set Tax Year & LPA-05.jpg| 30PX]] | ||

<br /> | <br /> | ||

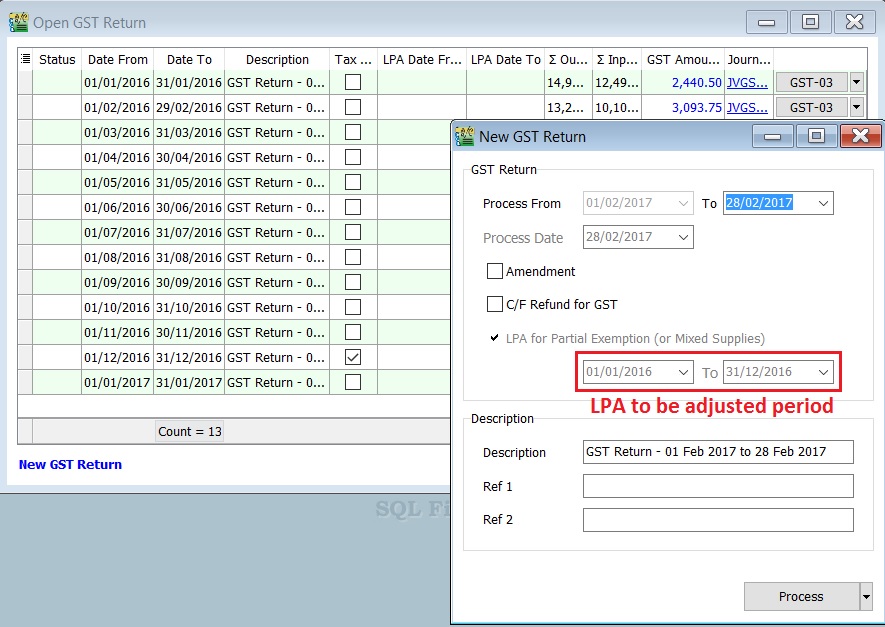

: | :3. Suggested period to be adjusted for LPA. | ||

::[[File: GST-Set Tax Year & LPA-06.jpg| 30PX]] | ::[[File: GST-Set Tax Year & LPA-06.jpg| 30PX]] | ||

<br /> | <br /> | ||

| Line 46: | Line 47: | ||

User allow to overwrite the suggested period for LPA. | User allow to overwrite the suggested period for LPA. | ||

: | :4. You can insert the '''LPA Date From''' and '''LPA Date To''' columns to check. | ||

::[[File: GST-Set Tax Year & LPA-06.jpg| 30PX]] | ::[[File: GST-Set Tax Year & LPA-06.jpg| 30PX]] | ||

<br /> | <br /> | ||

Revision as of 05:06, 30 April 2016

Introduction

- To set the tax year and longer period adjustment (LPA).

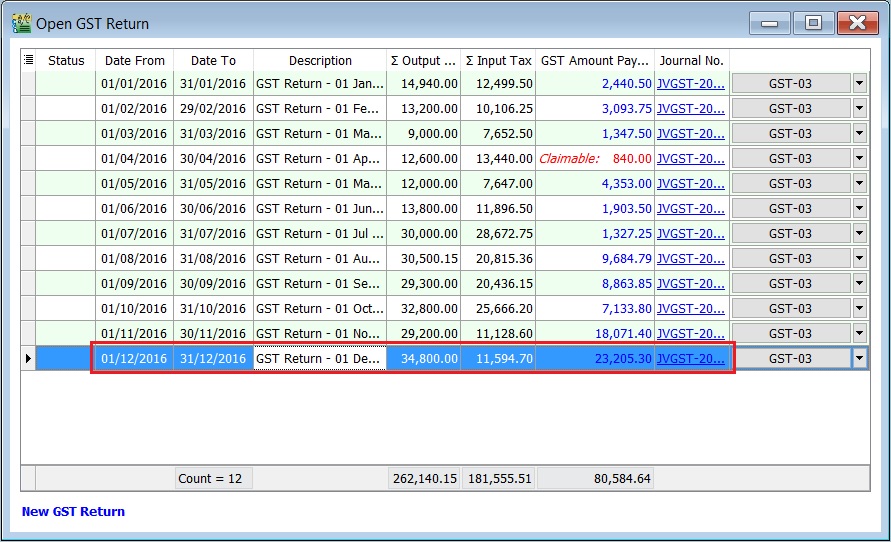

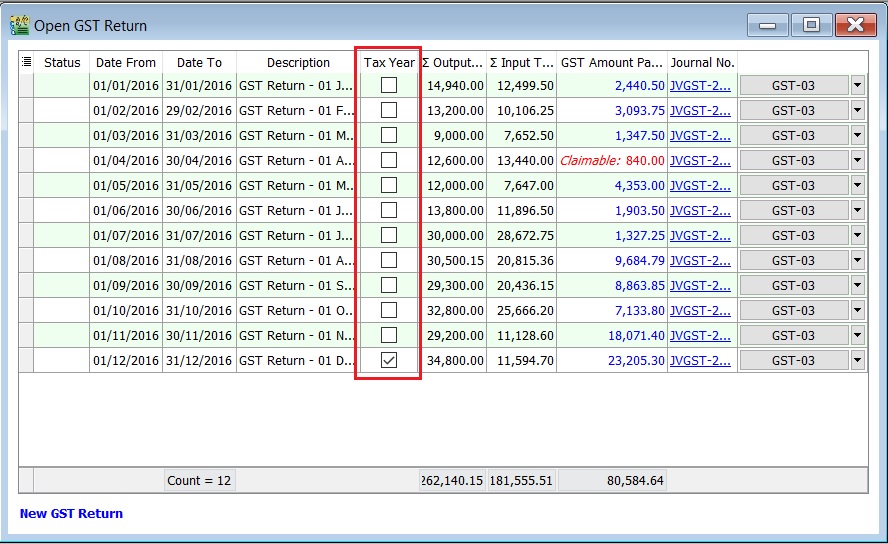

Set Tax Year

[GST | Open GST Return...]

- 1. Highlight the final taxable period to be set as your First Tax Year, eg. final taxable period 01 Dec - 31 Dec 2016.

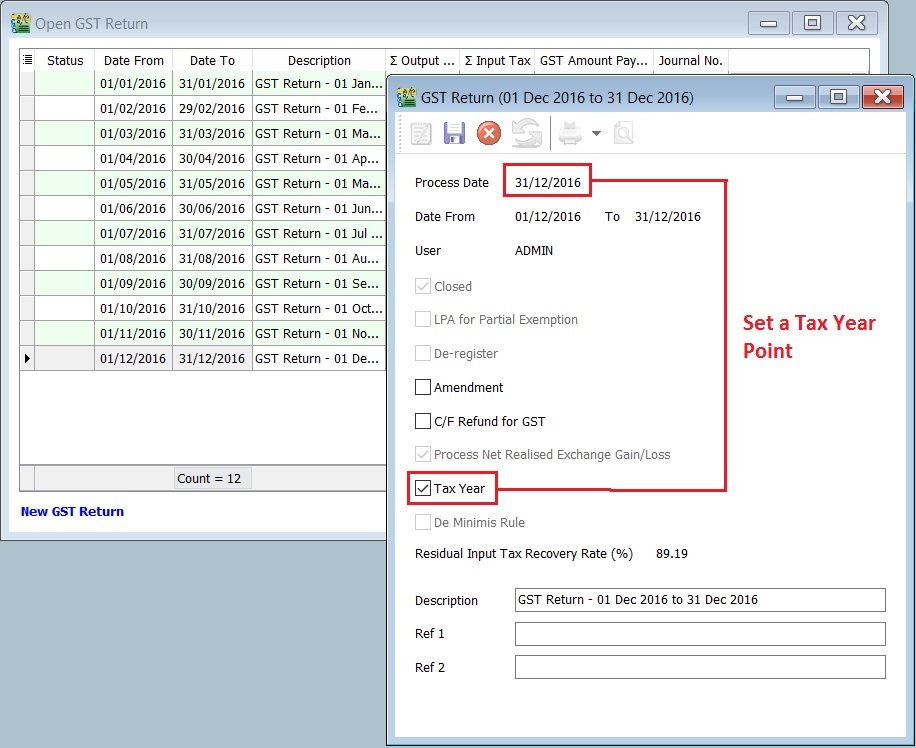

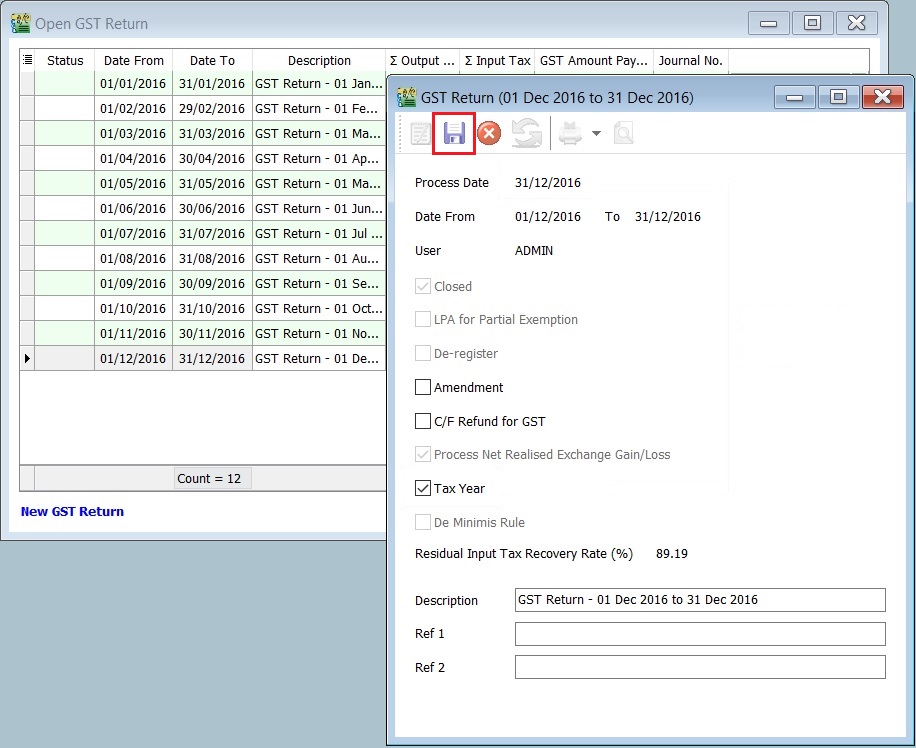

- 2. Double click on the highlight in step 1.

- 3. System will prompt you a dialog box.

- 4. Tick on the Tax Year to set a tax year point. See the screenshot below.

Longer Period Adjustment

- Declaration of annual adjustment amount:

- • Regulation 43 – in a GST Return for the second taxable period next following the longer period.

- For example,

- Assumed the tax year set on 31 Dec 2016, LPA should be declared in:

- 1) For monthly taxable period , the second taxable period is Feb 2017 and the submission is before or on 31/3/2017

- 2) For quarterly taxable period, the second taxable period is Apr-Jun 2017 and the submission is before or on 31/7/2017

GST Returns (LPA)

[GST | New GST Return...] or [GST | Open GST Return...]

- 1. Process the GST Return.For example, process the Second Taxable Period (01/02/2017 - 28/02/2017).

- 2. LPA will tick automatically.

Note: User allow to overwrite the suggested period for LPA.