Introduction

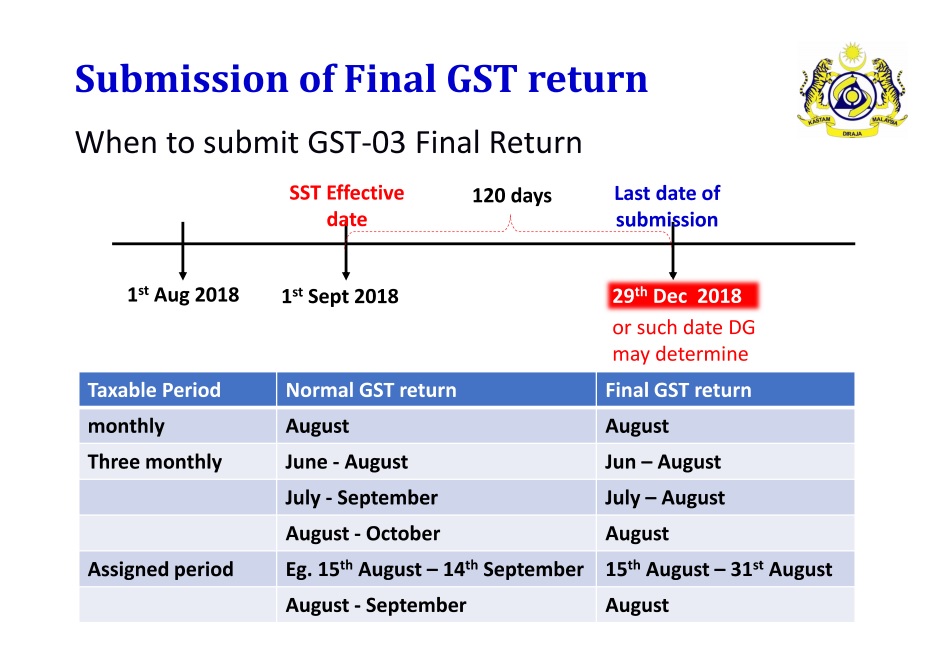

- Pursuant to Section 6, Goods and Service Tax (Repeal) Act 2018, all GST Registrants are required:

- 1. to submit the GST-03 Return on the final taxable period (ie. 31 Aug 2018) and

- 2. make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days (29 December 2018) from 01 Sept 2018.

- Any input tax claimable from the purchase/supplier invoice received after 1 Sept 2018. It can be claim and must submit into the Final GST Returns (31 Aug 2018).

- Input tax claim will be subjected to verification and audit.

- Refund will be made within 6 years.

How to claim the input tax 6% from Purchase/Supplier invoice after 1 Sept 2018?

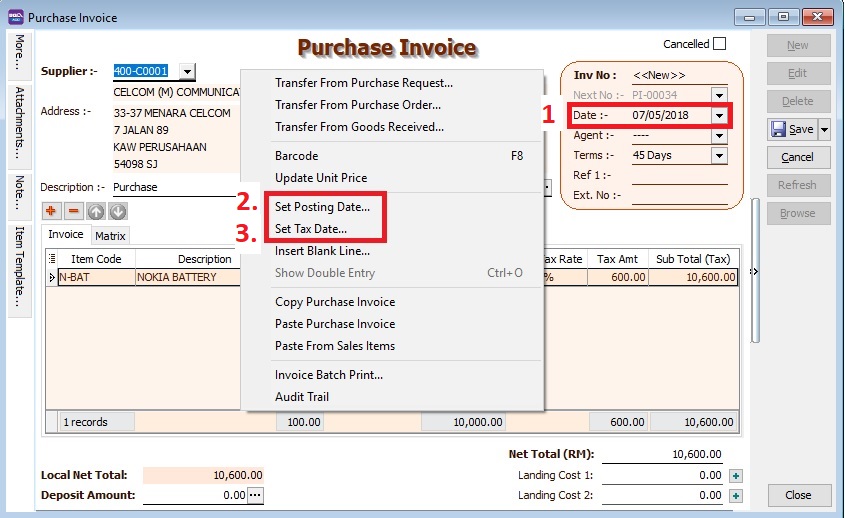

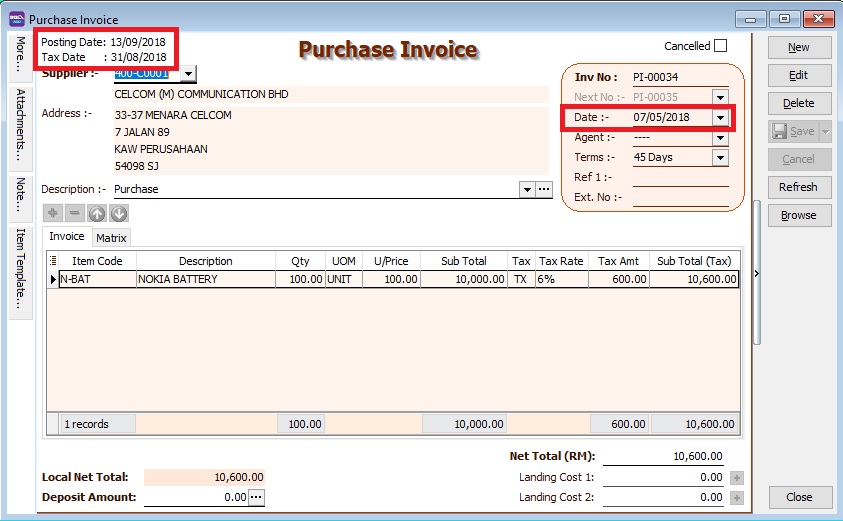

- For example, on 13 SEPT 2018, my company has received a supplier tax invoice dated 07 MAY 2018 and amount inclusive GST is RM10,600.

Purchase Invoice

Menu: Purchase | Purchase Invoice

- 1. Set Date.... to record the original invoice date.

- 2. Set Posting Date... to post this transaction as 13 Sept 2018 in GL reporting.

Note: To enable to set Posting Date, the Double Document Module is required.

- 3. Set Tax Date...to declare this GST input tax into Final GST Returns (31 Aug 2018).

Supplier Invoice

Menu: Supplier | Supplier Invoice

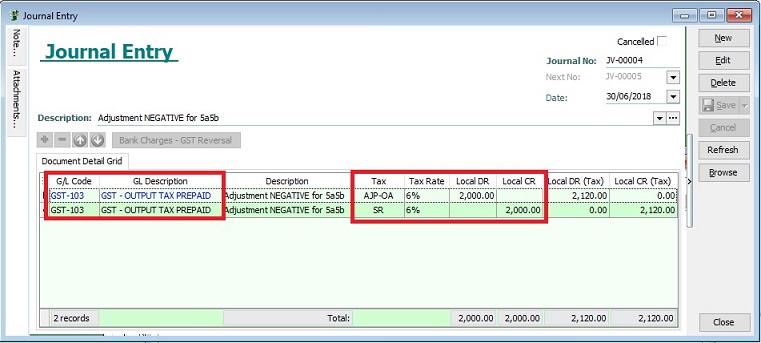

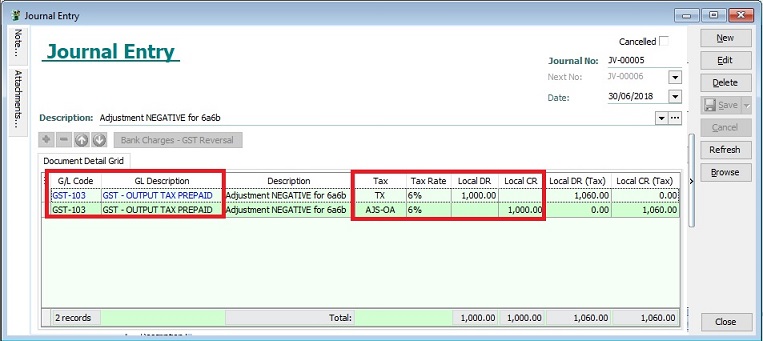

Negative in 6a6b

Menu: GL | Journal Entry...

- 1.Input Tax (Negative)

Items Value 6a -1,000 6b -60

- 2.Journal Adjustment:

GL Code Tax Tax Rate Local DR Local CR Local DR(Tax) Local CR(Tax) GST-03 GST-103 TX 6% 1,000 1,060 6a = 0

6b = 0GST-103 AJS-OA 6% 1,000 1,060 5a = 0

5b = 60