No edit summary |

|||

| (8 intermediate revisions by the same user not shown) | |||

| Line 8: | Line 8: | ||

<br /> | <br /> | ||

==How to | |||

==How to enter the input tax 6% claimable from Purchase/Supplier invoice after 1 Sept 2018?== | |||

:For example, on '''13 SEPT 2018''', my company has received a supplier tax invoice dated '''07 MAY 2018''' and amount inclusive GST is '''RM10,600'''. | :For example, on '''13 SEPT 2018''', my company has received a supplier tax invoice dated '''07 MAY 2018''' and amount inclusive GST is '''RM10,600'''. | ||

[[File:GST-FinalReturn 02.jpg]] | ::[[File:GST-FinalReturn 02.jpg]] | ||

<br /> | <br /> | ||

===Enter at Purchase Invoice=== | ===Enter at Purchase Invoice=== | ||

| Line 35: | Line 35: | ||

::[[File:GST-FinalReturn 05.jpg]] | ::[[File:GST-FinalReturn 05.jpg]] | ||

<br /> | <br /> | ||

:1. Set '''Date'''.... to record the original invoice date (eg. 07 MAY 2018). | :1. Set '''Date'''.... to record the original invoice date (eg. '''07 MAY 2018'''). | ||

:2. Set '''Posting Date'''... to post this transaction as 13 | :2. Set '''Posting Date'''... to post this transaction into GL reporting as '''13 SEP 2018'''. | ||

Note: | Note: | ||

To enable to set Posting Date, the '''Double Document Module''' is required. | To enable to set Posting Date, the '''Double Document Module''' is required. | ||

:3. Set '''Tax Date'''...to declare this GST input tax into '''Final GST Returns (31 | :3. Set '''Tax Date'''...to declare this GST input tax into '''Final GST Returns (31 AUG 2018)'''. | ||

::[[File:GST-FinalReturn 06.jpg]] | ::[[File:GST-FinalReturn 06.jpg]] | ||

<br /> | <br /> | ||

==Final GST Returns (31 AUG 2018)== | |||

===Enter at Cash Book (PV)=== | |||

''Menu: GL | Cash Book Entry...'' | |||

::[[File:GST-FinalReturn 07.jpg]] | |||

<br /> | |||

:1. Set '''Date'''.... to record the original invoice date (eg. '''07 MAY 2018'''). | |||

:2. Set '''Posting Date'''... to post this transaction into GL reporting as at '''13 SEP 2018'''. | |||

:3. Set '''Tax Date'''...to declare this GST input tax into '''Final GST Returns (31 AUG 2018)'''. | |||

::[[File:GST-FinalReturn 08.jpg]] | |||

<br /> | |||

==Final GST Returns== | |||

''Menu: GST | New GST Return'' | ''Menu: GST | New GST Return'' | ||

: | :Process GST Returns up to '''31 AUG 2018'''. | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

| Line 66: | Line 78: | ||

==See also== | ==See also== | ||

* [[New GST Return]] | * [[New GST Return]] | ||

* [[Print GST-03]] | * [[Print GST-03]] | ||

* [[Print GST Listing]] | * [[Print GST Listing]] | ||

Latest revision as of 10:38, 24 August 2018

Introduction

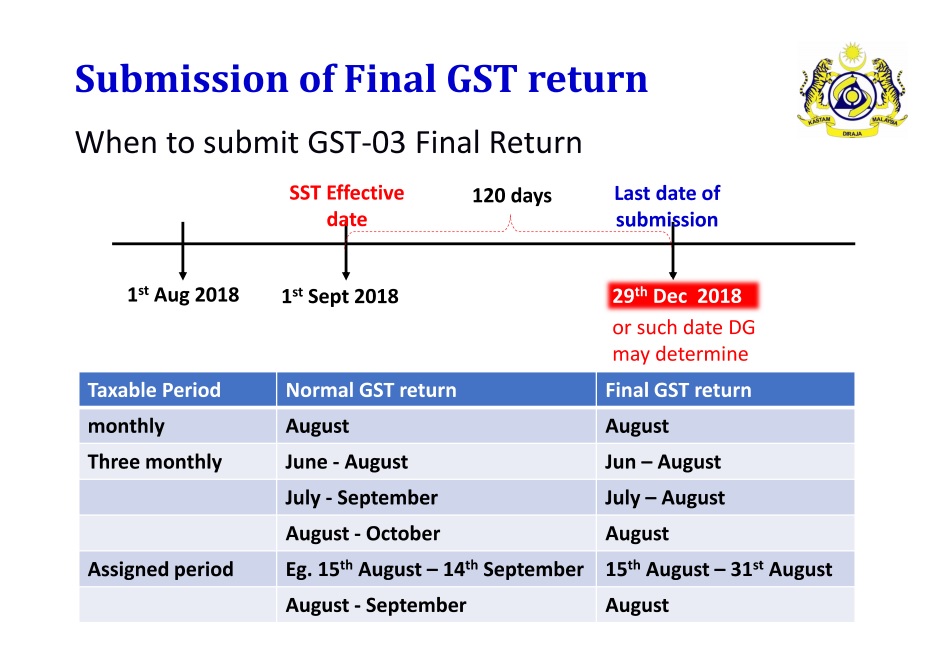

- Pursuant to Section 6, Goods and Service Tax (Repeal) Act 2018, all GST Registrants are required to submit the GST-03 Return on the final taxable period (ie. 31 Aug 2018) and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days (29 December 2018) from 01 Sept 2018.

- Any input tax claimable from the purchase/supplier invoice received after 1 Sept 2018. It can be claim and must submit into the Final GST Returns (31 Aug 2018).

- Input tax claim will be subjected to verification and audit.

- Refund will be made within 6 years.

How to enter the input tax 6% claimable from Purchase/Supplier invoice after 1 Sept 2018?

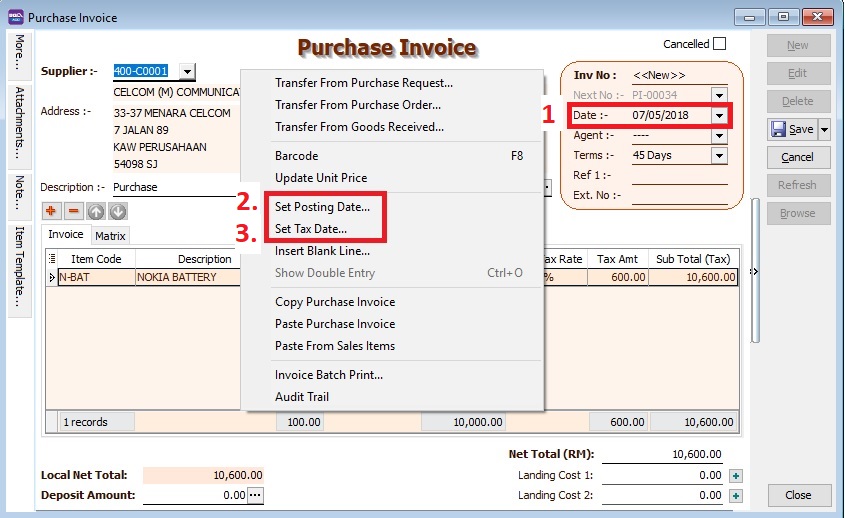

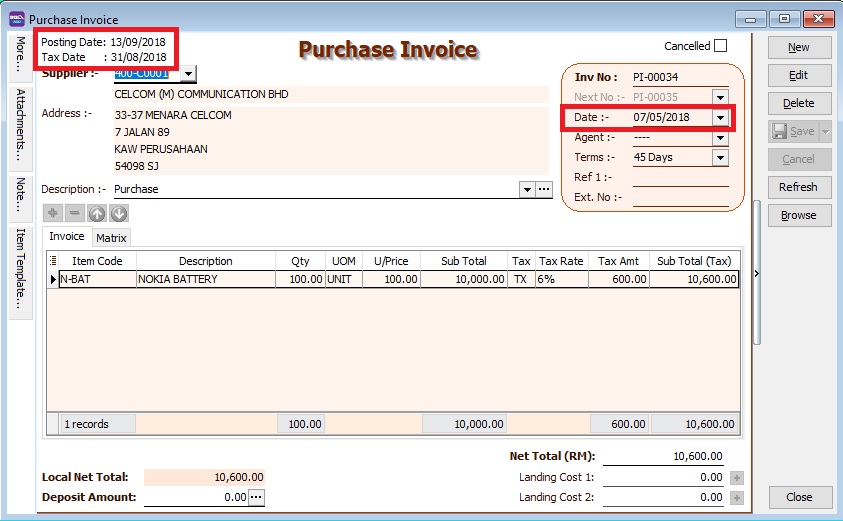

- For example, on 13 SEPT 2018, my company has received a supplier tax invoice dated 07 MAY 2018 and amount inclusive GST is RM10,600.

Enter at Purchase Invoice

Menu: Purchase | Purchase Invoice

- 1. Set Date.... to record the original invoice date (eg. 07 MAY 2018).

- 2. Set Posting Date... to post this transaction into GL reporting as at 13 SEP 2018.

Note: To enable to set Posting Date, the Double Document Module is required.

- 3. Set Tax Date...to declare this GST input tax into Final GST Returns (31 AUG 2018).

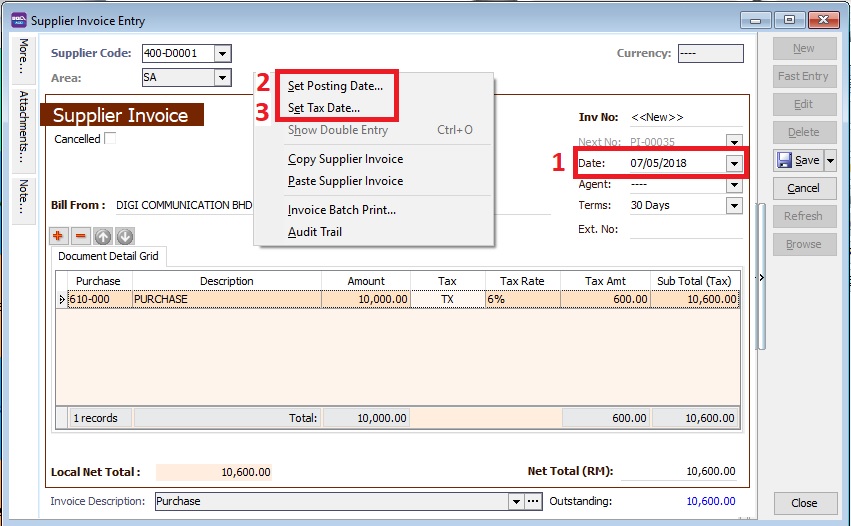

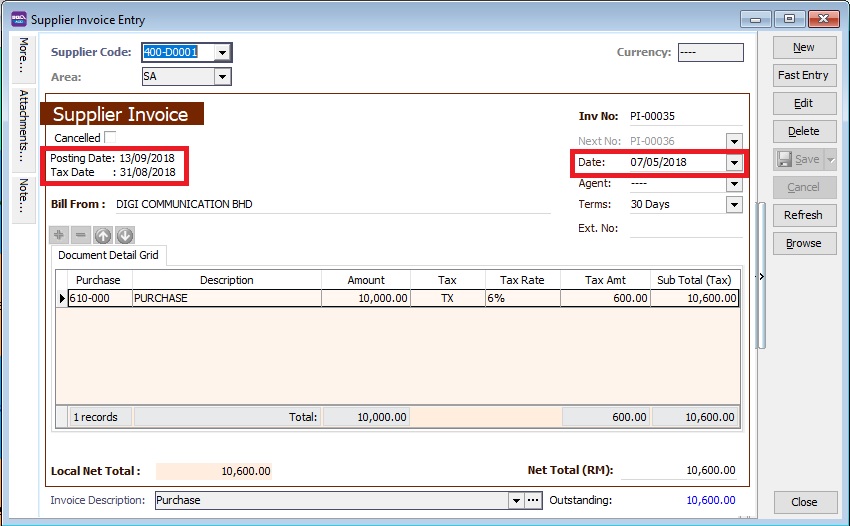

Enter at Supplier Invoice

Menu: Supplier | Supplier Invoice

- 1. Set Date.... to record the original invoice date (eg. 07 MAY 2018).

- 2. Set Posting Date... to post this transaction into GL reporting as 13 SEP 2018.

Note: To enable to set Posting Date, the Double Document Module is required.

- 3. Set Tax Date...to declare this GST input tax into Final GST Returns (31 AUG 2018).

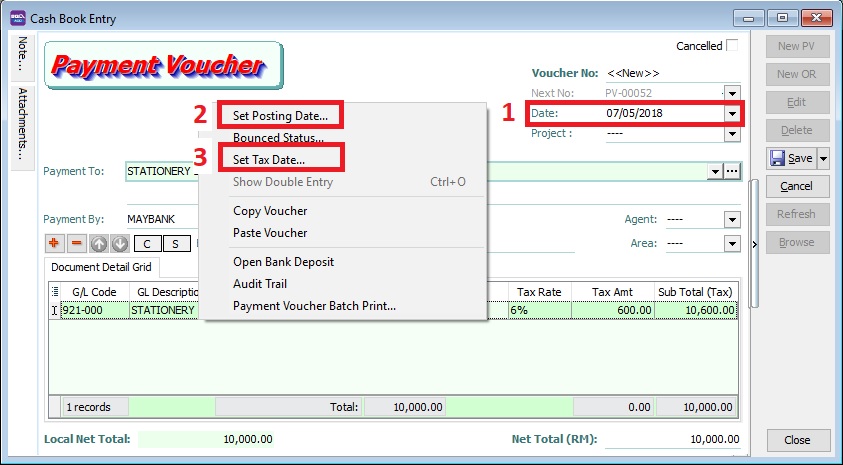

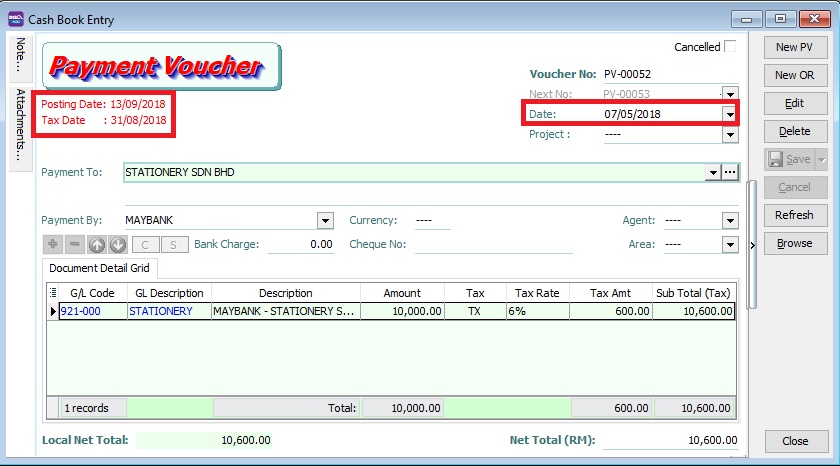

Enter at Cash Book (PV)

Menu: GL | Cash Book Entry...

- 1. Set Date.... to record the original invoice date (eg. 07 MAY 2018).

- 2. Set Posting Date... to post this transaction into GL reporting as at 13 SEP 2018.

- 3. Set Tax Date...to declare this GST input tax into Final GST Returns (31 AUG 2018).

Final GST Returns

Menu: GST | New GST Return

- Process GST Returns up to 31 AUG 2018.

Items Value 6a 10,000 6b 600

NOTE: * Final GST Returns until 31 AUG 2018. * Last date of submission for the Final GST Returns is 29 DEC 2018.