(Created page with "==Introduction== ::Pursuant to Section 6, '''Goods and Service Tax (Repeal) Act 2018''', all GST Registrants are required: ::1. to submit the GST-03 Return on the final taxabl...") |

|||

| Line 1: | Line 1: | ||

==Introduction== | ==Introduction== | ||

:Pursuant to Section 6, '''Goods and Service Tax (Repeal) Act 2018''', all GST Registrants are required: | |||

::1. to submit the GST-03 Return on the final taxable period and | ::1. to submit the GST-03 Return on the final taxable period and | ||

::2. make full payment for the amount of tax payable in connection with the supply, for the last taxable period within 120 days from 01.09.2018 | ::2. make full payment for the amount of tax payable in connection with the supply, for the last taxable period within 120 days from 01.09.2018 | ||

Revision as of 08:46, 24 August 2018

Introduction

- Pursuant to Section 6, Goods and Service Tax (Repeal) Act 2018, all GST Registrants are required:

- 1. to submit the GST-03 Return on the final taxable period and

- 2. make full payment for the amount of tax payable in connection with the supply, for the last taxable period within 120 days from 01.09.2018

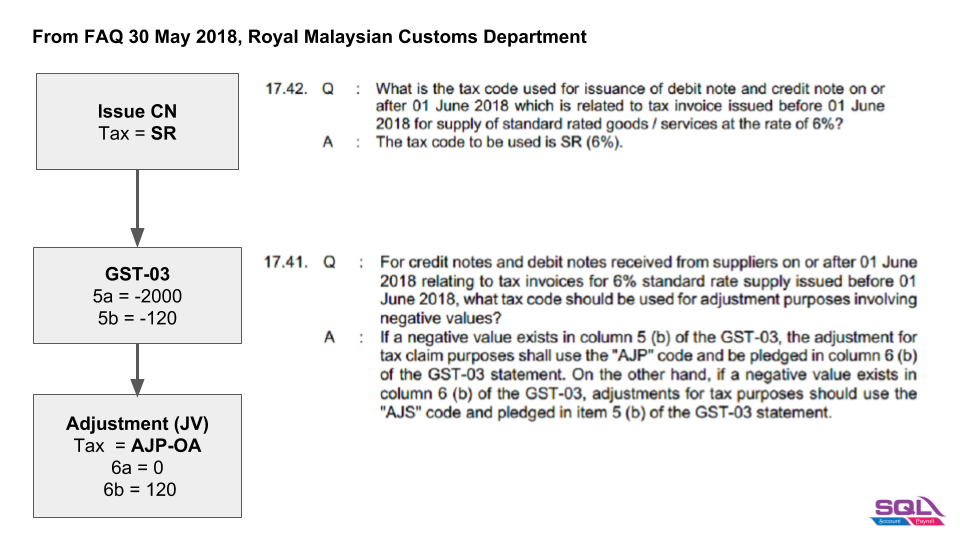

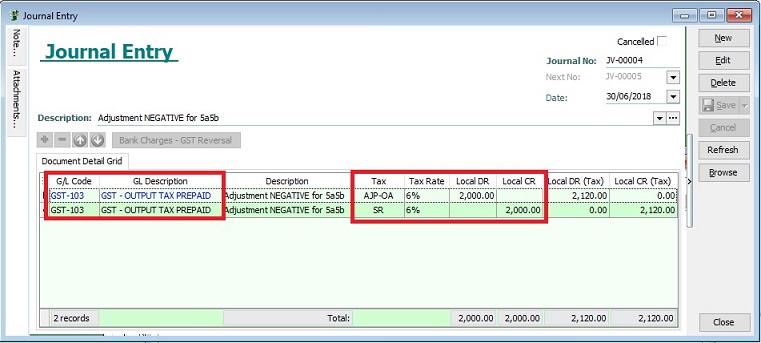

Negative in 5a5b

Menu: GL | Journal Entry...

- 1. Output Tax (Negative)

GST-03 Value 5a -2,000 5b -120

- 2. Journal Adjustment:

GL Code Tax Tax Rate Local DR Local CR Local DR(Tax) Local CR(Tax) GST-03 GST-103 AJP-OA 6% 2,000 2,120 6a = 0

6b = 120GST-103 SR 6% 2,000 2,120 5a = 0

5b = 0

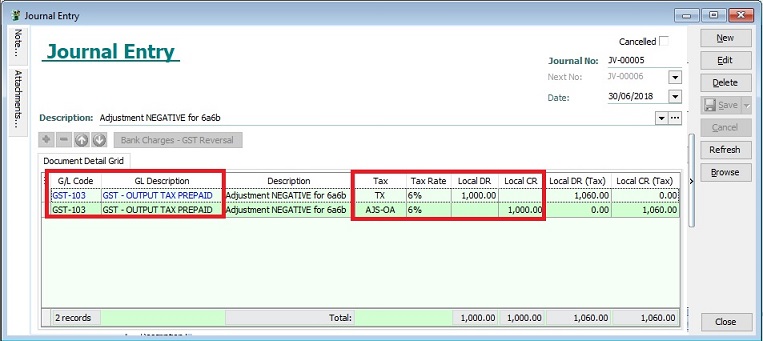

Negative in 6a6b

Menu: GL | Journal Entry...

- 1.Input Tax (Negative)

Items Value 6a -1,000 6b -60

- 2.Journal Adjustment:

GL Code Tax Tax Rate Local DR Local CR Local DR(Tax) Local CR(Tax) GST-03 GST-103 TX 6% 1,000 1,060 6a = 0

6b = 0GST-103 AJS-OA 6% 1,000 1,060 5a = 0

5b = 60