GST-03 Item 12 (ES + ES43) : How to compare the Total Value of Exempt Supplies between GST-03 and Ledger

From eStream Software

How to compare the Total Value of Exempt Supplies between GST-03 and Ledger?

Introduction

- This guide will help to check the data entry source posted for Item 12 Total Value of Exempt Supplies in GST-03.

- 1. GST Tax Code

Tax Code Tax Description Tax Rate Explanation and examples ES43 Incidental Exempt Supplies 0% This refers to Exempt Supplies made under Incidental Exempt Supplies. Incidental Exempt Financial Services Supplies (IEFS) include:-

- interest income from deposits placed with a financial institution in Malaysia

- realized foreign exchange gains or losses

ES Exempt Supplies under GST 0% This refers to supplies which are EXEMPTED UNDER GST.

These supply includes:-

- Selling of Residential Properties to consumer

- Selling of tickets for Public Transportation (Taxis, Stage Buses, Ferries)

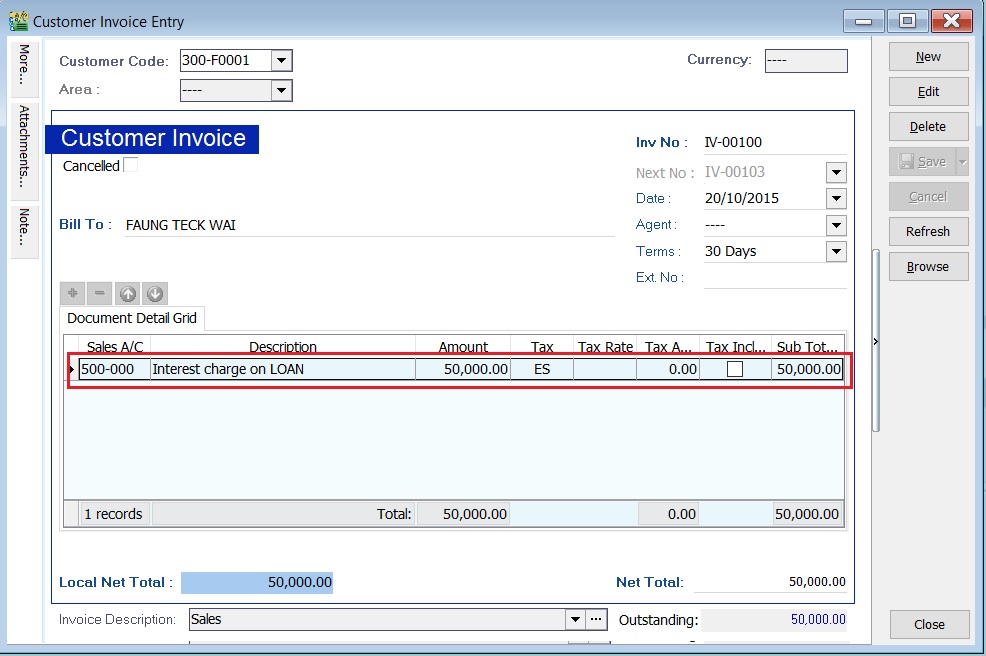

- Financial Institution’s interest charges to customers for loan.

- 2. GST-03

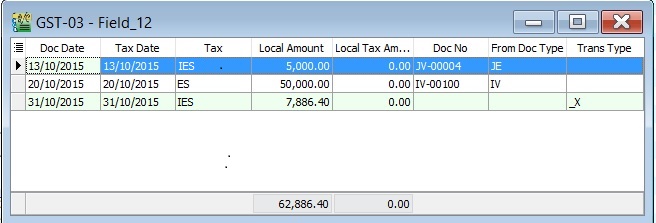

Item No. Description Guidelines 12 Total Value of Exempt Supplies ES43 + ES (Taxable Amount)

Note: Net Loss in Forex (ES43)= 0.00

Example of Data Entry

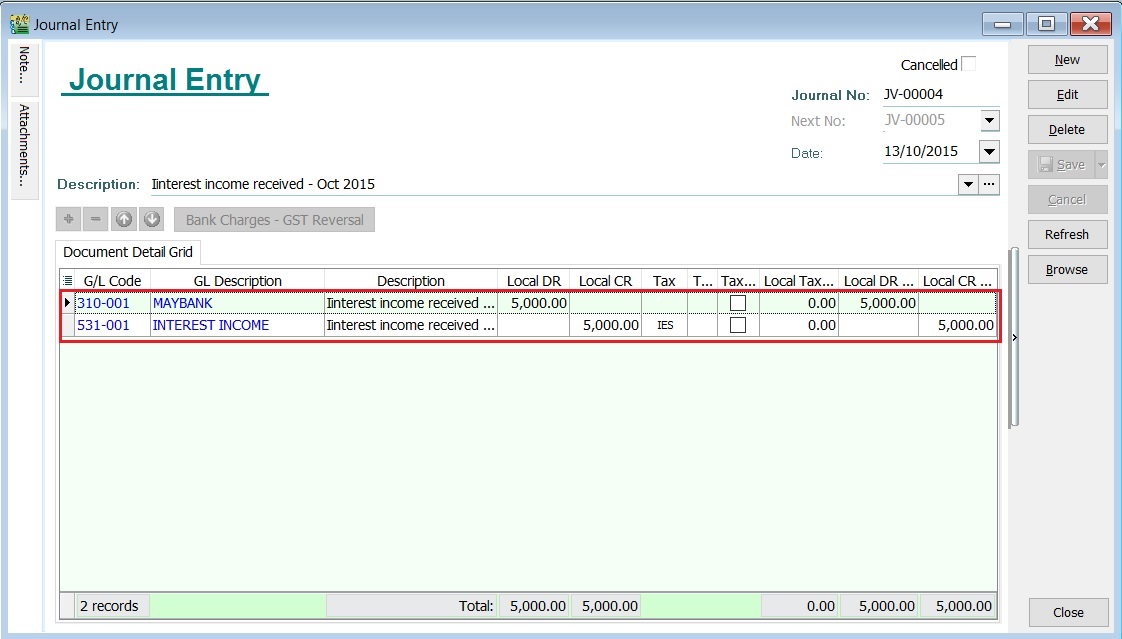

- 1. ES43 - Interest income from deposits placed with a financial institution in Malaysia

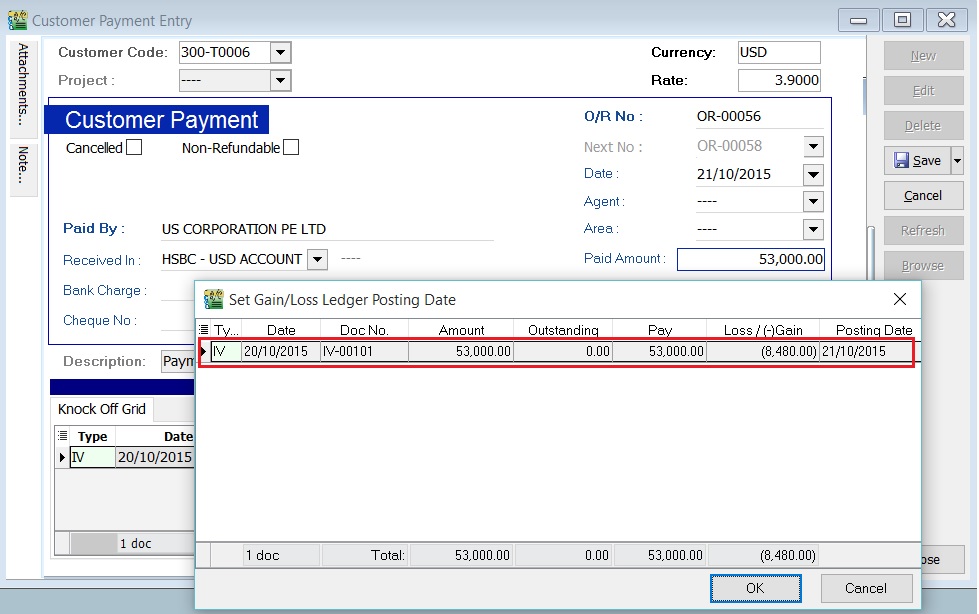

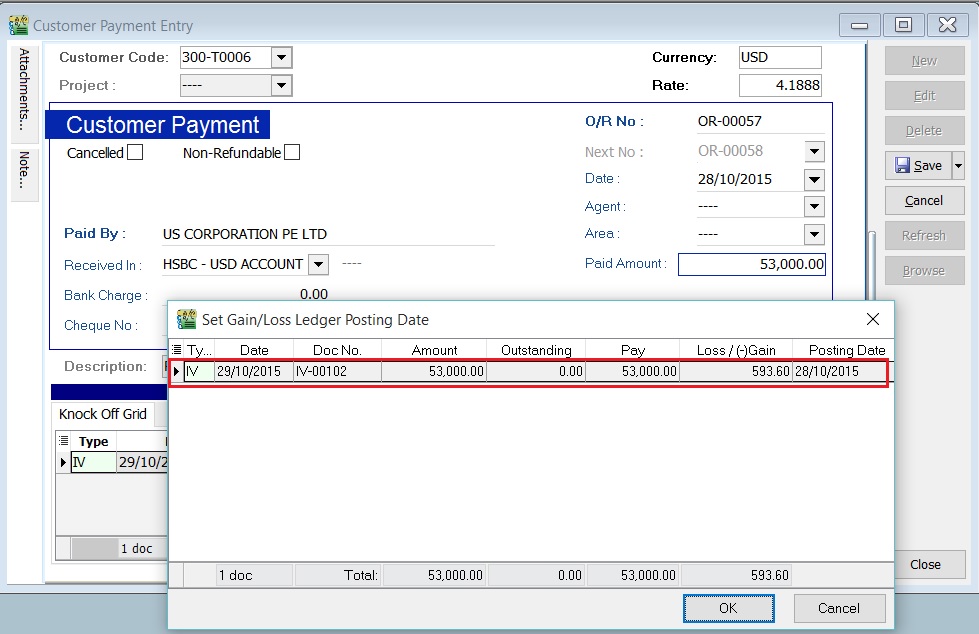

- 2. ES43 - Realized foreign exchange gains or losses

- 3. ES - Financial Institution’s interest charges to customers for loan

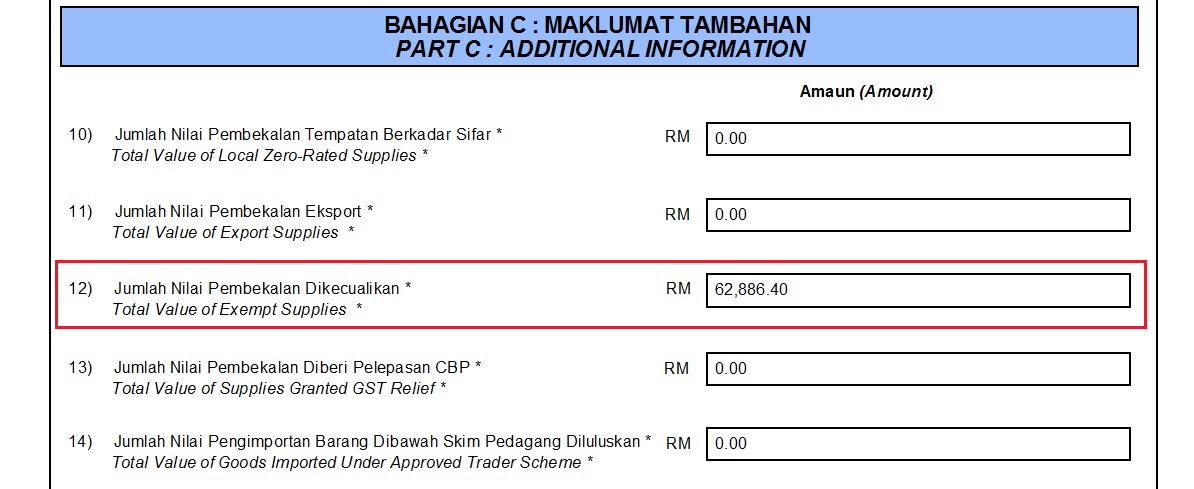

GST-03 Item 12: Total Value of Exempt Supplies

[GST | Print GST-03...]

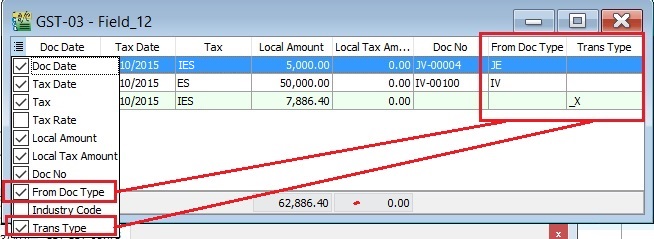

Tips: Trans Type = _X, it means the posting entry related to Realized Gain or Loss in Foreign Exchange.

Cross Check Reports

GST Listing

[GST | Print GST Listing...]

GL Ledger

[GL | Print Ledger Report...]