| Line 27: | Line 27: | ||

<br /> | <br /> | ||

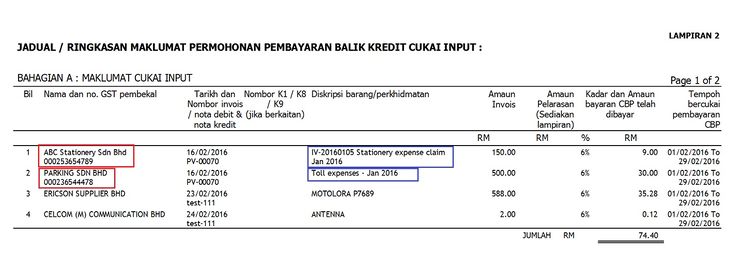

* Enter the '''GST No. (No. GST Pembekal)''' only into '''Tax Ref'''. | * Enter the '''GST No. (No. GST Pembekal)''' only into '''Tax Ref'''. | ||

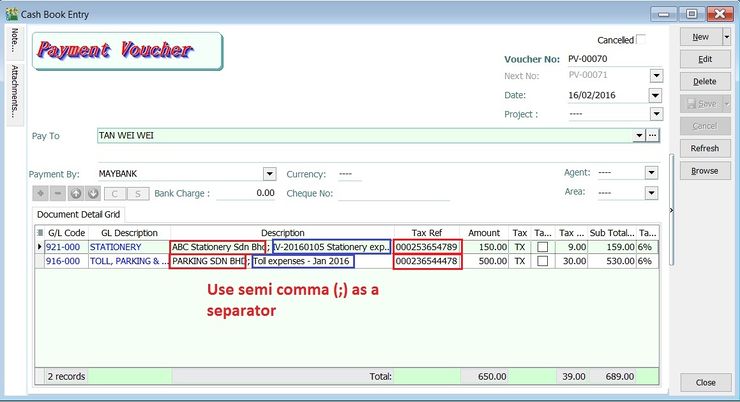

* Enter the detail description as '''Supplier Name (Name Pembekal)''' follow by '''semi comma (;)''' then '''description of the goods and services (diskripsi barang/perkhidmatan)'''. See the screenshot below. | * Enter the detail description as '''Supplier Name (Name Pembekal)''' follow by '''semi comma (;)''' then '''description of the goods and services (diskripsi barang/perkhidmatan)'''. | ||

* For example, '''ABC Stationery Sdn Bhd; IV-20160105 Stationery expense claim Jan 2016'''. See the screenshot below. | |||

::[[File:GL-Cash Book-01.jpg|740px]] | ::[[File:GL-Cash Book-01.jpg|740px]] | ||

<br /> | <br /> | ||

Revision as of 04:19, 23 March 2016

Menu: GL | Cash Book Entry...

- Cash Book Entry is used to record collection/payment transactions other than customer/supplier payment. For example, payment for sales person expenses.

- You can switch the entry form into either Payment Voucher or Official Receipt.

- You can print the payment voucher/official receipt after save the entry.

- Enable to quick create entry to Customer Payment, Supplier Payment, Customer Refund or Supplier Refund.

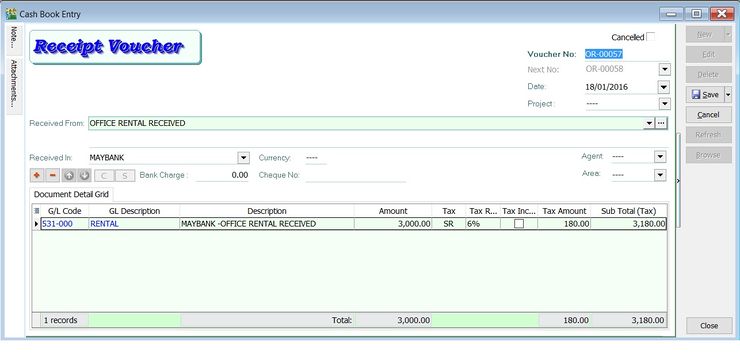

Receipt Voucher

- To record miscellaneous collections, eg. interest/loan received from bank.

- Enable to print the Official Receipt.

- Select the correct tax code .

- Example : If the tax code for rental received is SR , then select SR in the tax column.

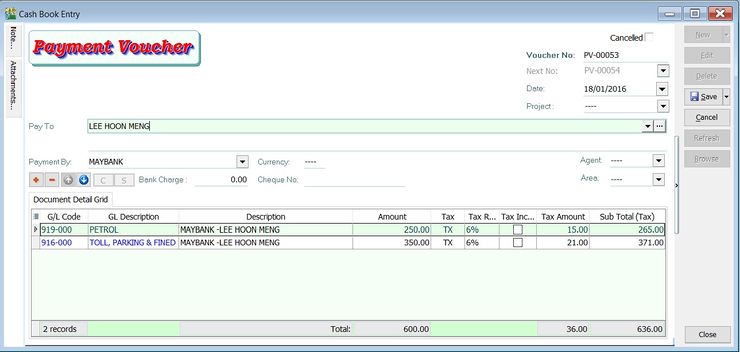

Payment Voucher

- To record miscellaneous payments, eg. pay salary, sales person claims, etc.

- Enable to print the Payment Voucher.

- Select correct tax code.

- Example : If the tax code for petrol and parking are TX , then in the tax column select TX.

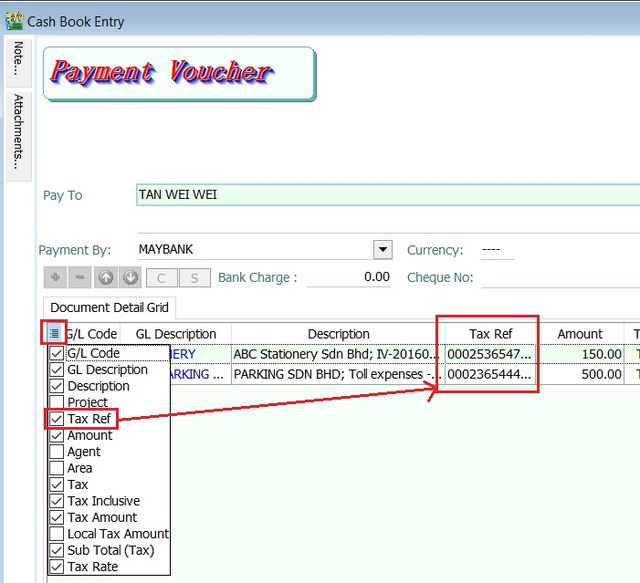

How to enter Simplified Tax Invoice details to show in Lampiran 2

- Insert the Tax Ref column.

- Enter the GST No. (No. GST Pembekal) only into Tax Ref.

- Enter the detail description as Supplier Name (Name Pembekal) follow by semi comma (;) then description of the goods and services (diskripsi barang/perkhidmatan).

- For example, ABC Stationery Sdn Bhd; IV-20160105 Stationery expense claim Jan 2016. See the screenshot below.

- Lampiran 2 will be shown as the screenshot below.