| Line 10: | Line 10: | ||

* To record miscellaneous collections, eg. interest/loan received from bank. | * To record miscellaneous collections, eg. interest/loan received from bank. | ||

* Enable to print the Official Receipt. | * Enable to print the Official Receipt. | ||

* Select the correct tax code . | |||

* Example : If the tax code for rental received is SR , then select SR in the tax column. | |||

::[[File:GL-Cash Book-Receipt Voucher.jpg|640px]] | ::[[File:GL-Cash Book-Receipt Voucher.jpg|640px]] | ||

Revision as of 03:05, 18 January 2016

Menu: GL | Cash Book Entry...

- Cash Book Entry is used to record collection/payment transactions other than customer/supplier payment. For example, payment for sales person expenses.

- You can switch the entry form into either Payment Voucher or Official Receipt.

- You can print the payment voucher/official receipt after save the entry.

- Enable to quick create entry to Customer Payment, Supplier Payment, Customer Refund or Supplier Refund.

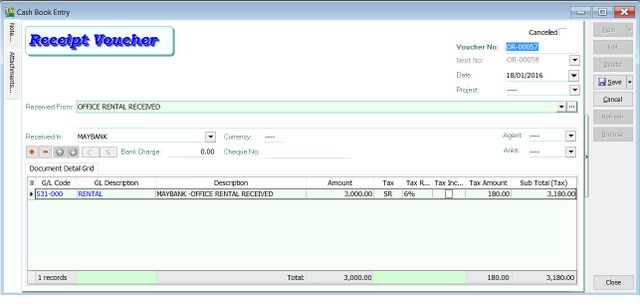

Receipt Voucher

- To record miscellaneous collections, eg. interest/loan received from bank.

- Enable to print the Official Receipt.

- Select the correct tax code .

- Example : If the tax code for rental received is SR , then select SR in the tax column.

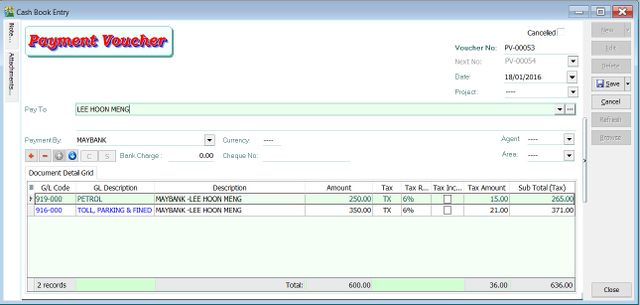

Payment Voucher

- To record miscellaneous payments, eg. pay salary, sales person claims, etc.

- Enable to print the Payment Voucher.

- Select correct tax code.

- Example : If the tax code for petrol and parking are TX , then in the tax column select TX.