How to avoid costly GST errors?

Introduction

- This guide will help you to easily identify the common GST errors in GST Returns. To minimize GST amendment and incorrect GST Returns to RMCD.

- You may wish to take note the follow errors commonly made by businesses:

- 1. Standard Rated Supply (5a) and Output Tax (5b)

- 2. Stanadard Rate and Flat Rate Acquisitions (6a), and Input Tax (6b)

- 3. Carry forward refund for GST?

- 4. Local Zero-Rated Supplies

- 5. Export Supplies

- 6. Exempt Supplies

- 7. Supplies Granted GST Relief

- 8. Goods Imported Under Approved Trader Scheme and GST Suspended

- 9. Capital Goods Acquired

- 10. Bad Debt Relief

- 11. Bad Debt Recovered

- 12. Output tax value breakdown into Major Industries Code (MSIC Code)

Standard Rated Supply (5a) and Output Tax (5b)

Stanadard Rate and Flat Rate Acquisitions (6a), and Input Tax (6b)

Cross Check Reports

GST Listing

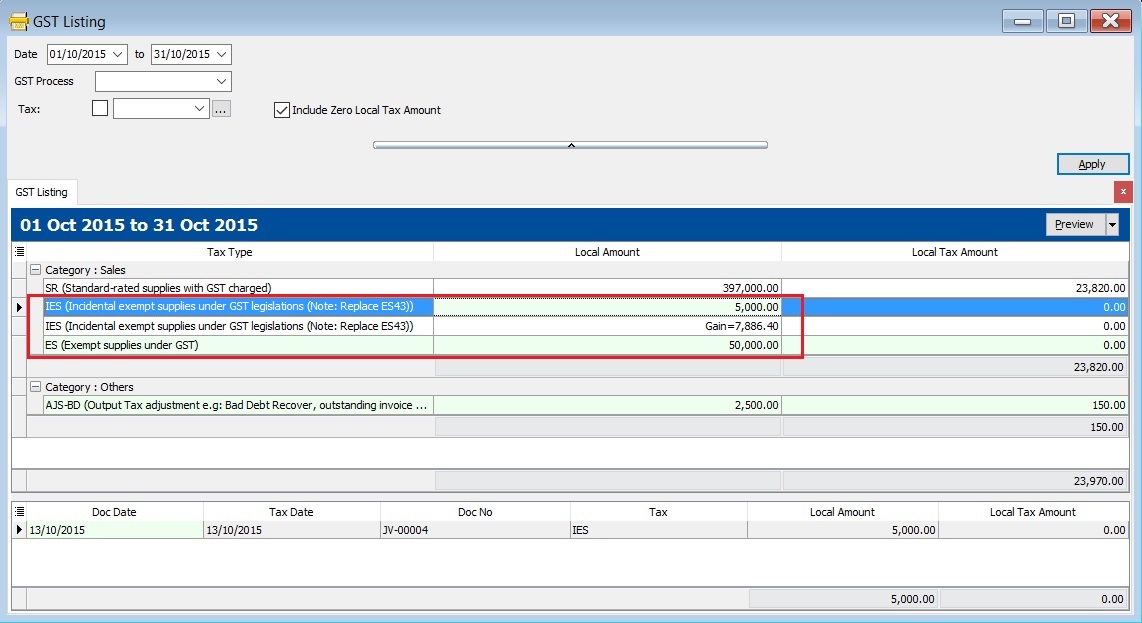

[GST | Print GST Listing...]

- 1. Select the date range or GST Process.

- 2. You can select the tax parameter for ES and IES.

- 3. Apply the GST Listing.

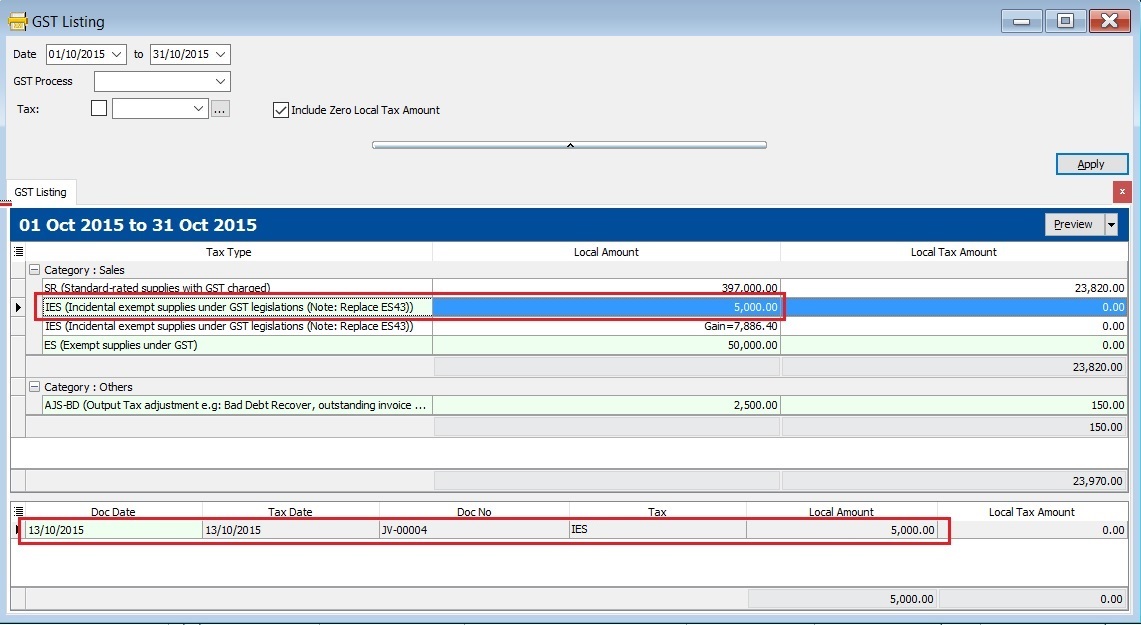

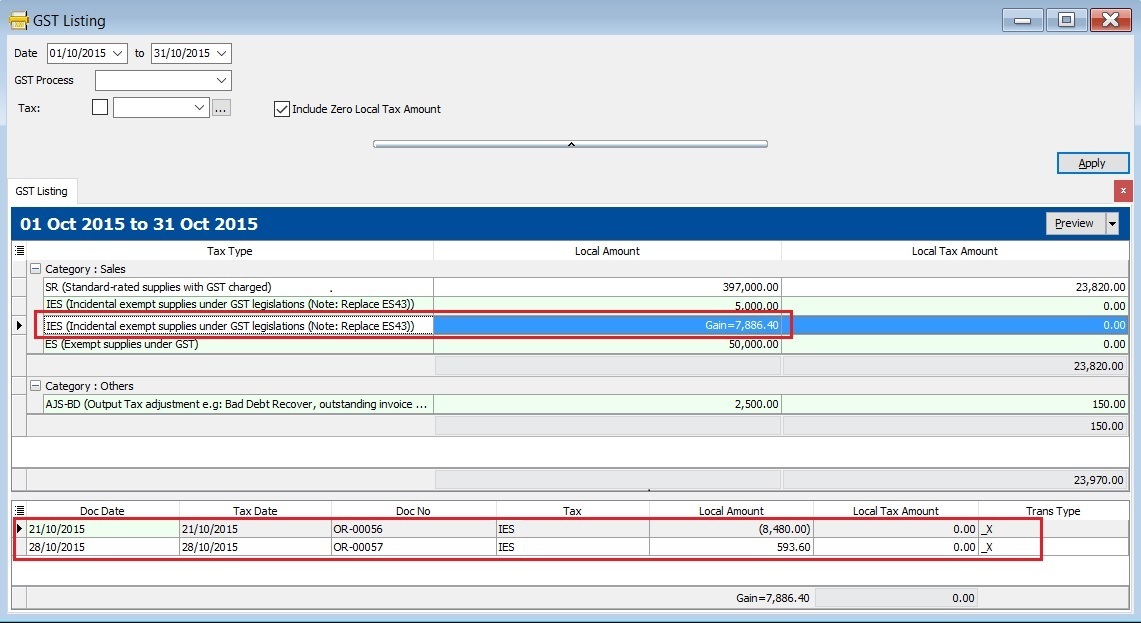

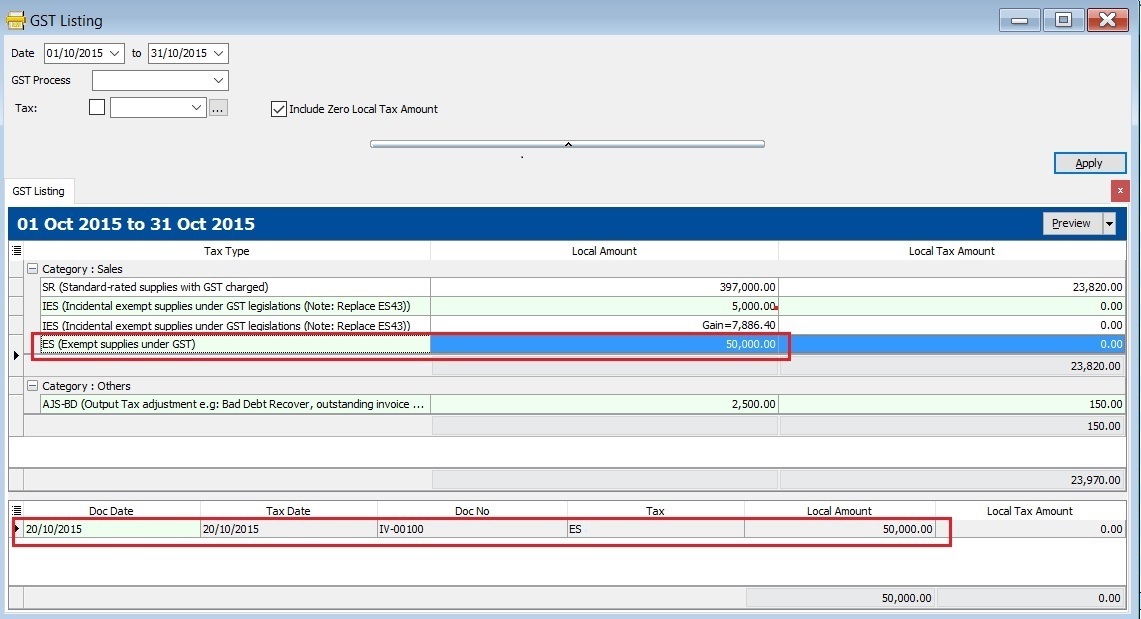

Tax Code Local Amount Explanation IES 5,000.00 Local amount from Sales/Customer/Journal Entry/Cash Book (OR) documents related to tax code : IES IES Gain=7,886.40 Net realized forex gain calculated ES 50,000.00 Local amount from Sales/Customer/Journal Entry/Cash Book (OR) documents related to tax code : ES Total 62,886.40 Total value shown in GST-03 Item 12

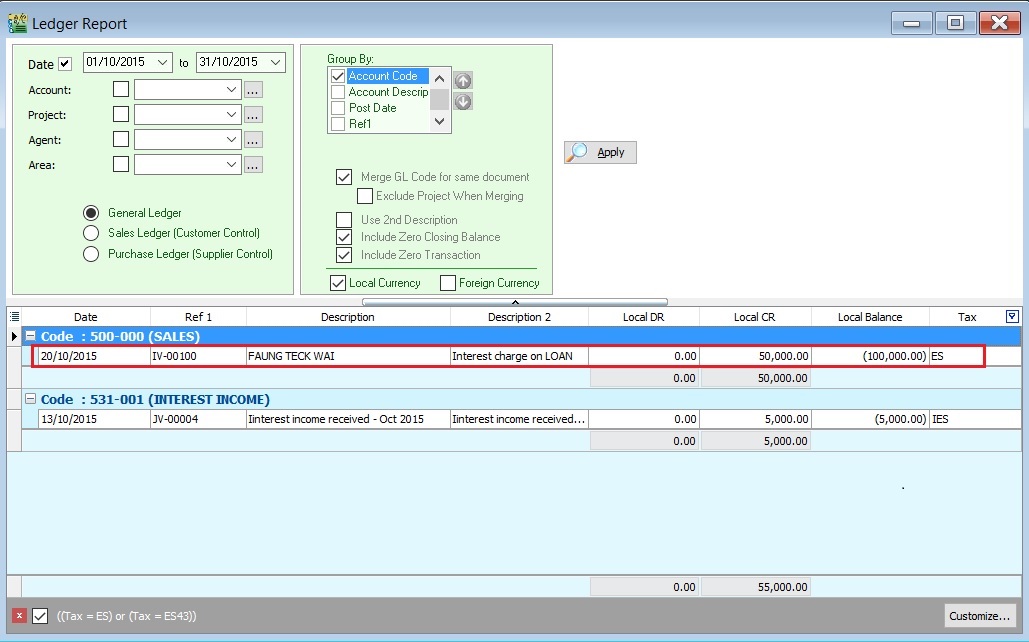

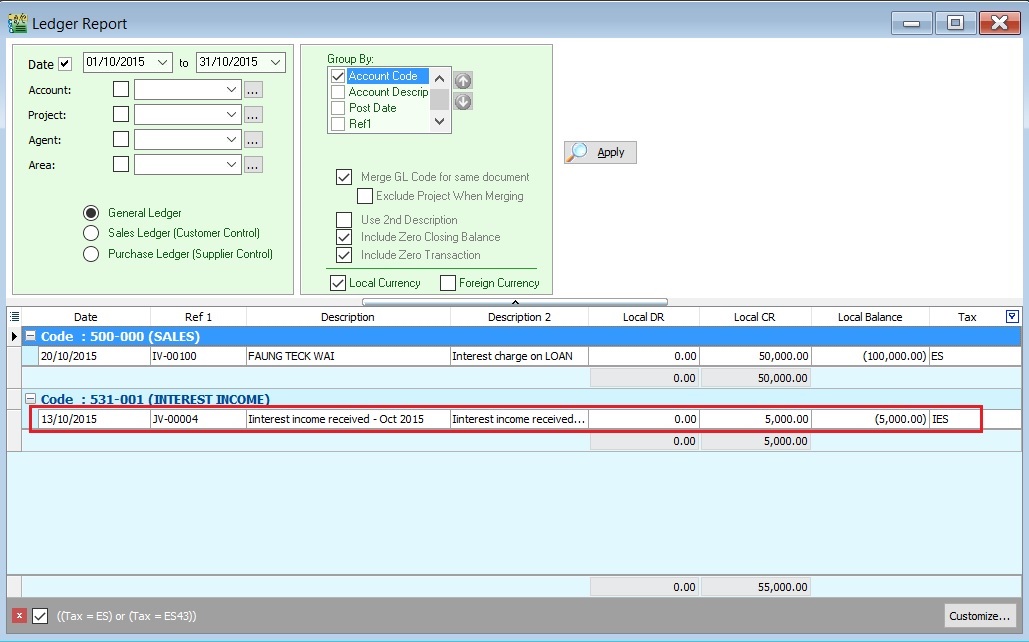

- 4. Click on each tax type, you able to view the details. See the example in the screenshot below.

GL Ledger

[GL | Print Ledger Report...]

General Posting for IES & ES

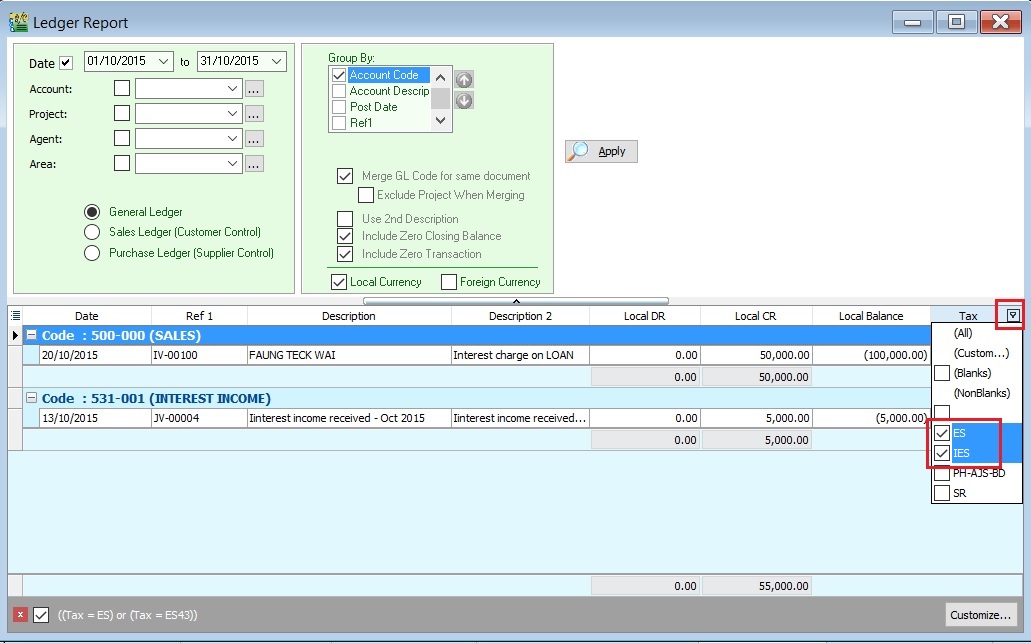

- 1. In the General Ledger report, you have to insert the Tax grid column.

- 2. Filter the Tax Code (ES and IES).

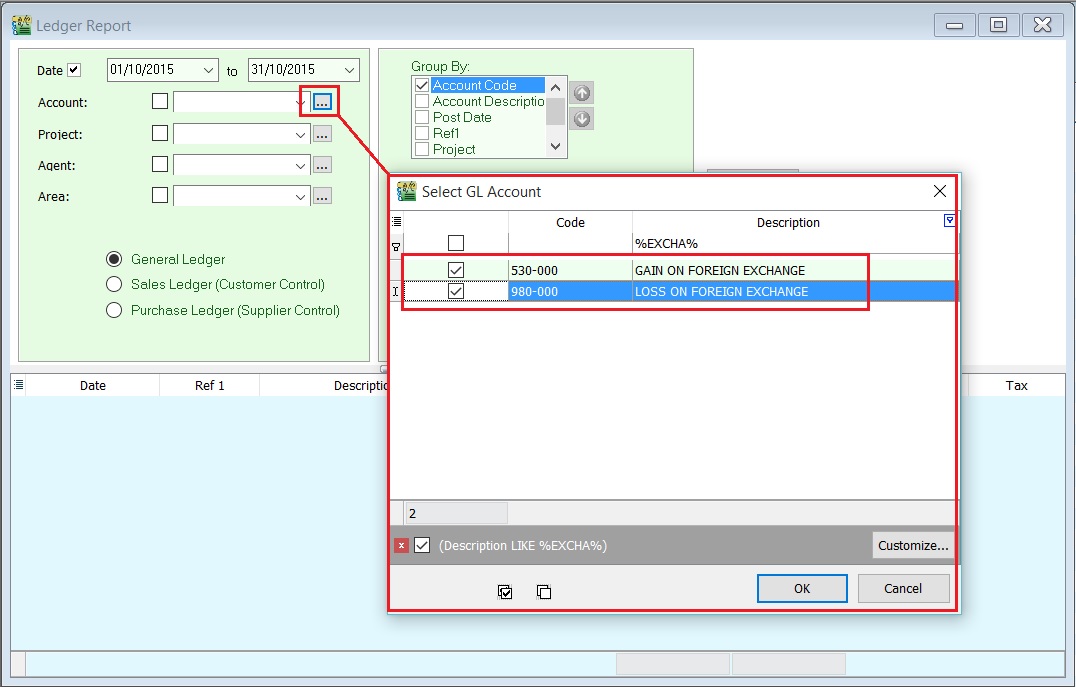

Special Posting for Net Realized Gain Forex (IES)

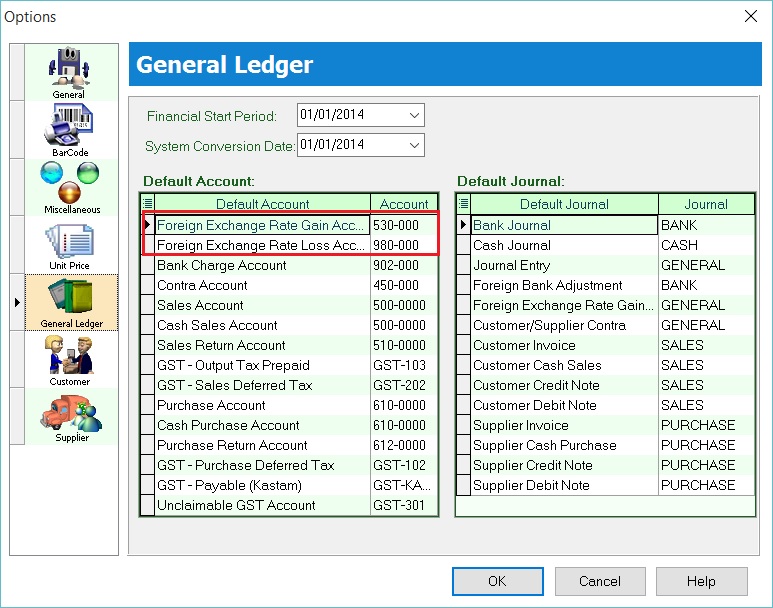

- 1. Check the Foreign Exchange Rate Gain or Loss Account setting at Tools | Options...(General Ledger). For example,

Default Account GL Account Code Foreign Exchange Rate Gain Account 530-000 Foreign Exchange Rate Loss Account 980-000

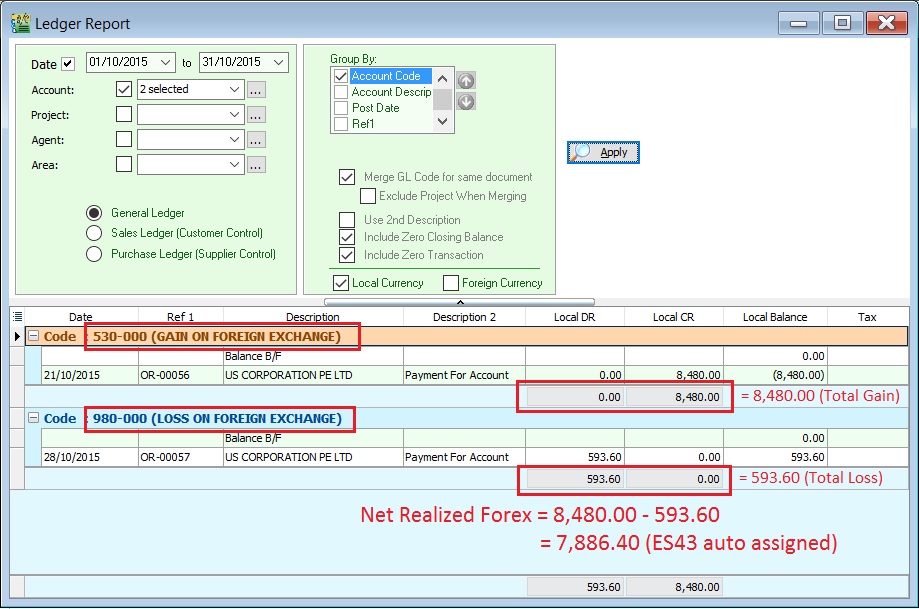

Account Local DR Local CR Explanation Total Gain on Foreign Exchange 0.00 8,480.00 Total Loss on Foreign Exchange 593.60 0.00 Net Realized Forex 593.60 8,480.00 8,480.00 - 593.60 = 7,886.40 GAIN (IES)

NOTE: RMCD has confirmed that Net Realised Gain in Forex ONLY need to add into GST-03 item 12 Total Value of Exempt Supplies. Tax code = IES

Net Realised Loss in Forex will be NIL.

Summary: Comparison between GST-03, GST Listing and Ledger Report

- Here is the result summarized:

Description GST-03 GST Listing Ledger Report IES 5,000.00 5,000.00 IES (Realized Gain Forex) 7,886.40 Forex Gain = 8,480.00

Forex Loss = -593.60

Net Forex Gain = 7,886.40

ES 50,000.00 50,000.00 Total Item 12 (ES + IES) 62,886.40 62,886.40 62,886.40