GST-03 Item 12 (ES + IES) : How to compare the Total Value of Exempt Supplies between GST-03 and Ledger

From eStream Software

How to compare the Total Value of Exempt Supplies between GST-03 and Ledger?

Introduction

- This guide will help you to check the data entry source posted for Item 12 Total Value of Exempt Supplies in GST-03.

- 1. GST Tax Code

Tax Code Tax Description Tax Rate Explanation and examples IES Incidental Exempt Supplies 0% Incidental exempt supplies under GST legislations (Note: Replace ES43). Incidental Exempt Financial Services Supplies (IEFS) include:-

- interest income from deposits placed with a financial institution in Malaysia

- realized foreign exchange gains or losses

ES Exempt Supplies under GST 0% This refers to supplies which are EXEMPTED UNDER GST.

These supply includes:-

- Selling of Residential Properties to consumer

- Selling of tickets for Public Transportation (Taxis, Stage Buses, Ferries)

- Financial Institution’s interest charges to customers for loan.

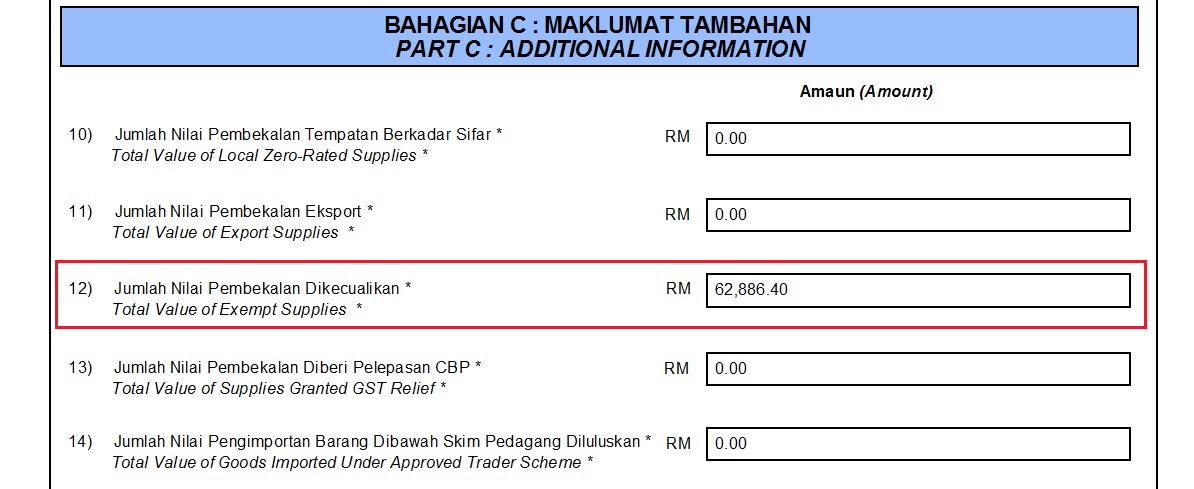

- 2. GST-03

Item No. Description Guidelines 12 Total Value of Exempt Supplies IES + ES (Taxable Amount)

Note: Net Loss in Forex (ES43)= 0.00

Example of Data Entry

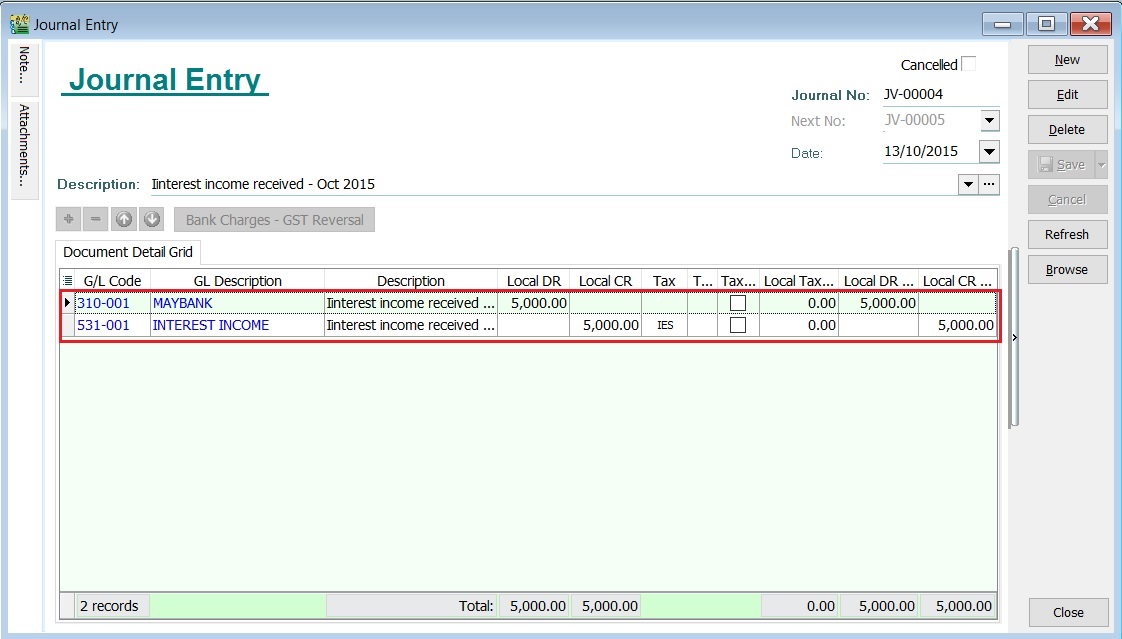

- 1. IES - Interest income from deposits placed with a financial institution in Malaysia

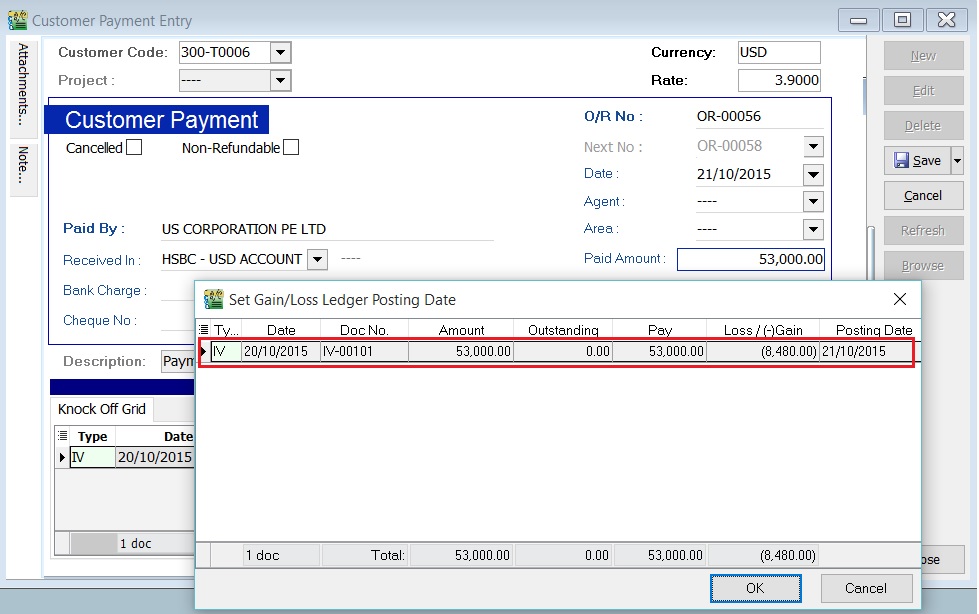

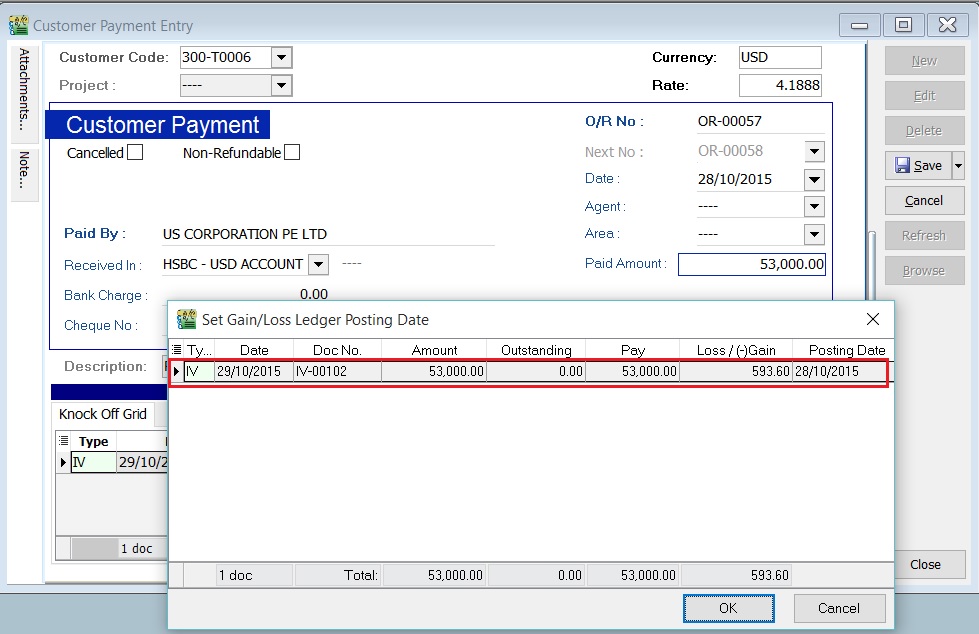

- 2. IES - Realized foreign exchange gains or losses

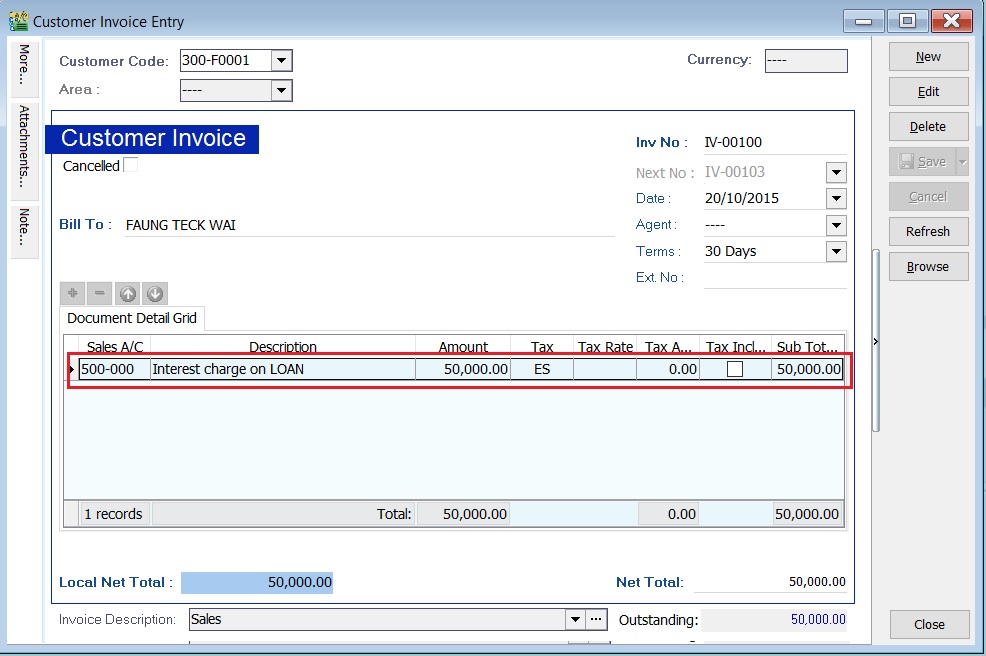

- 3. ES - Financial Institution’s interest charges to customers for loan

GST-03 Item 12: Total Value of Exempt Supplies

[GST | Print GST-03...]

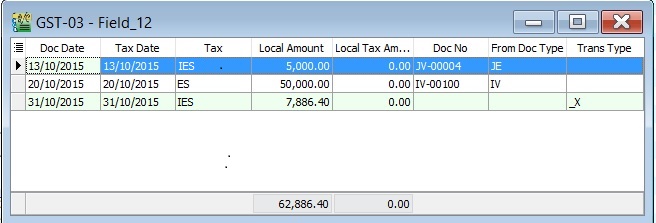

- 2. You can check the details by double click on the amount in Item 12.

- 3. Pop-up the item 12 detail.

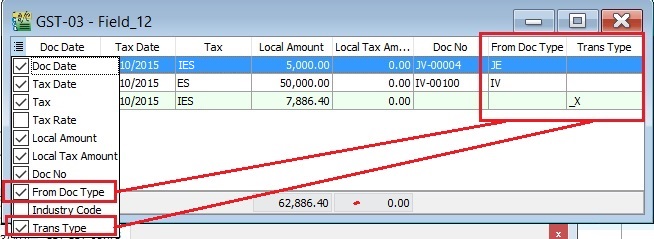

- 4. You can insert additional column, ie. From Doc Type and Trans Type.

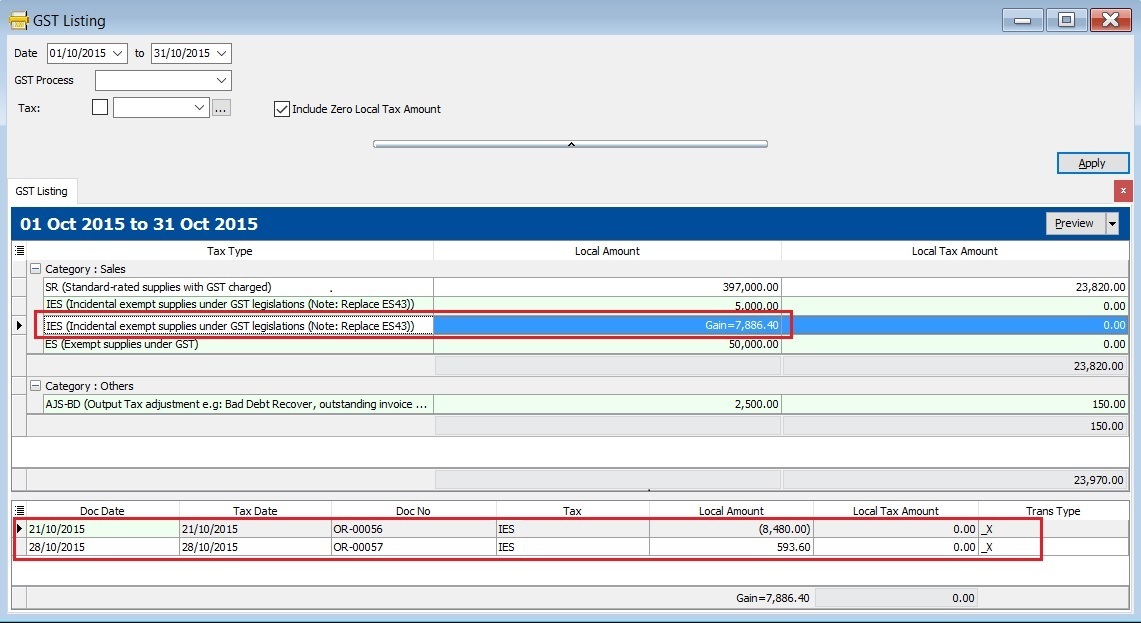

NOTE: Trans Type = _X, it means the posting entry related to Realized Gain or Loss in Foreign Exchange.

Cross Check Reports

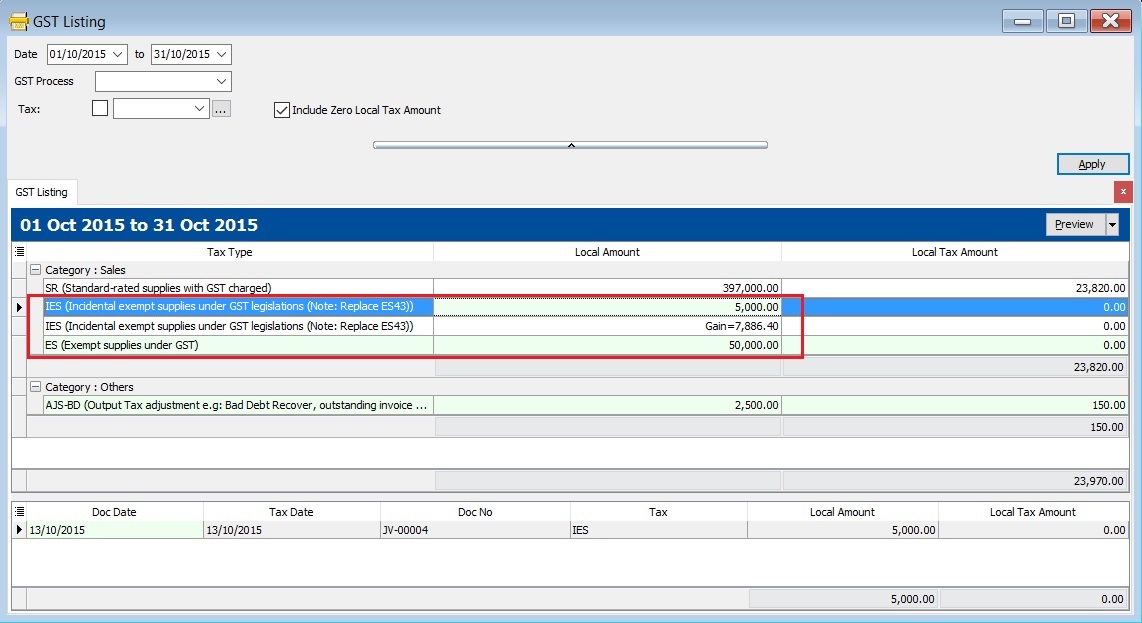

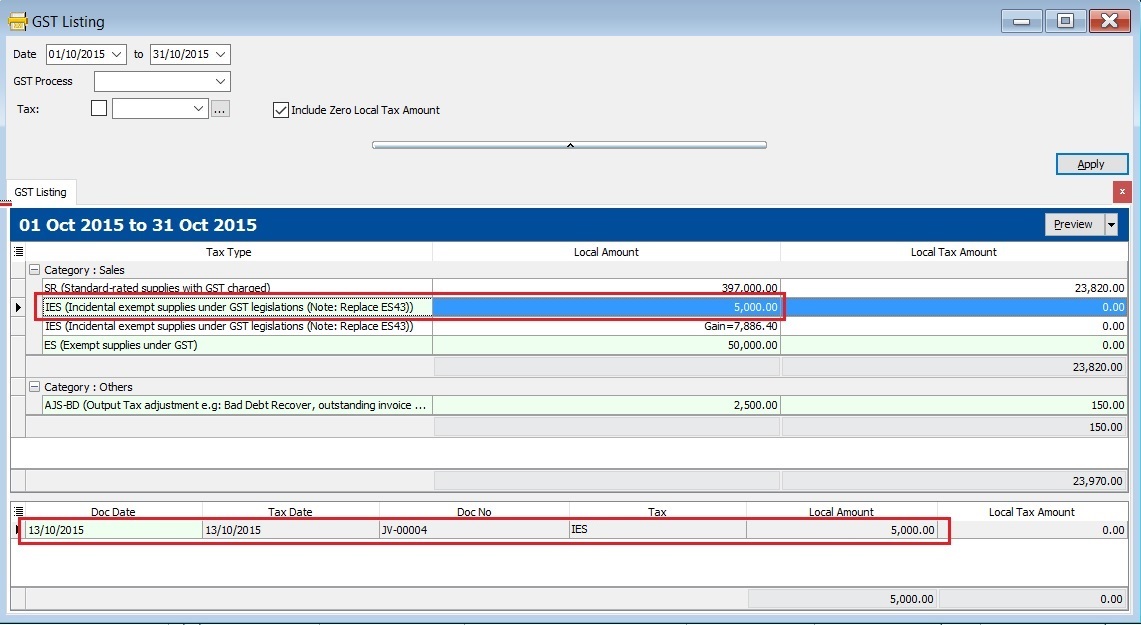

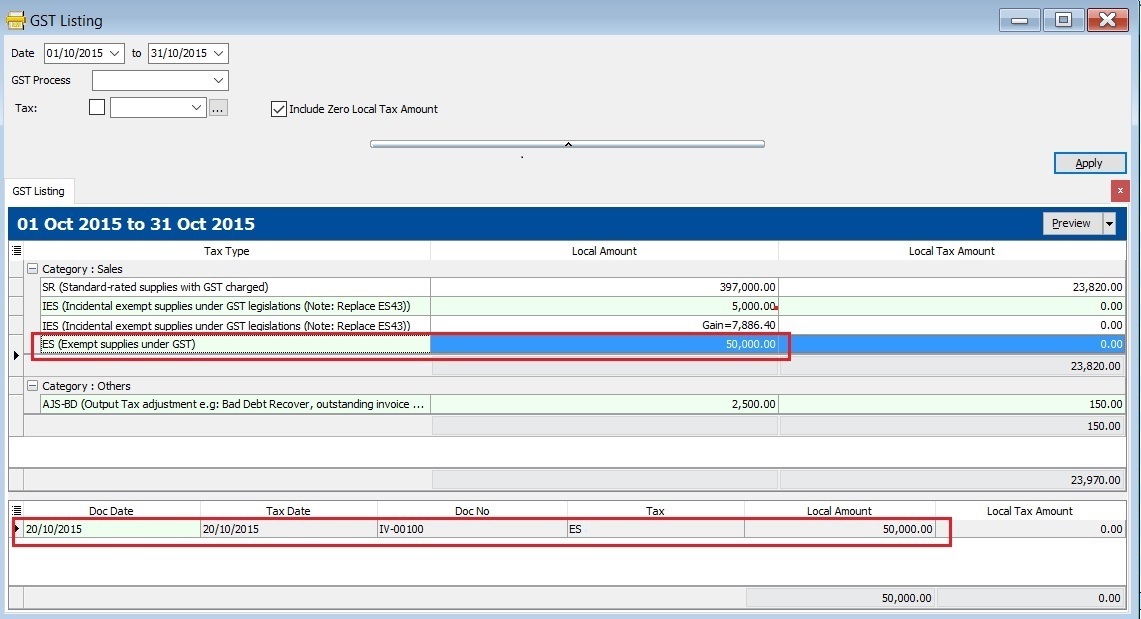

GST Listing

[GST | Print GST Listing...]

- 1. Select the date range or GST Process.

- 2. You can select the tax parameter for ES and IES.

- 3. Apply the GST Listing.

Tax Code Local Amount Explanation IES 5,000.00 Local amount from Sales/Customer/Journal Entry/Cash Book (OR) documents related to tax code : IES IES Gain=7,886.40 Net realized forex gain calculated ES 50,000.00 Local amount from Sales/Customer/Journal Entry/Cash Book (OR) documents related to tax code : ES Total 62,886.40 Total value shown in GST-03 Item 12

- 4. Click on each tax type, you able to view the details. See the example in the screenshot below.

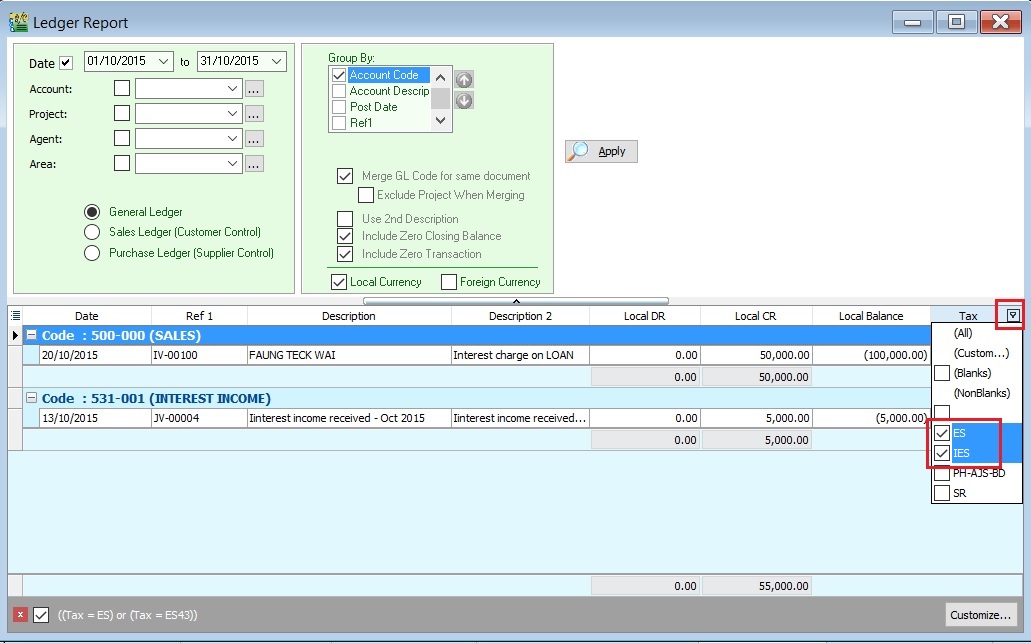

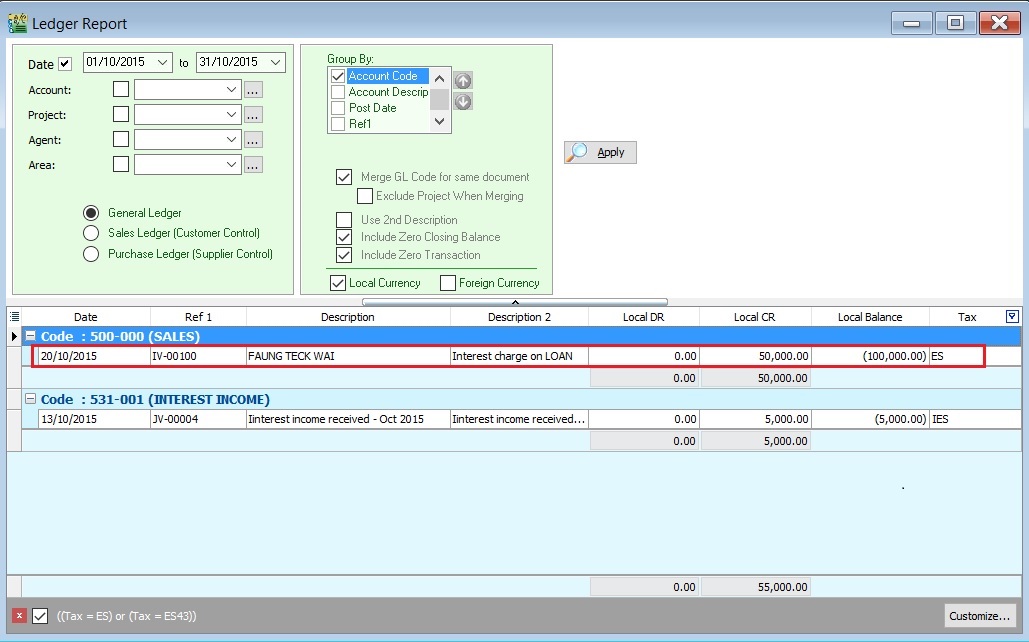

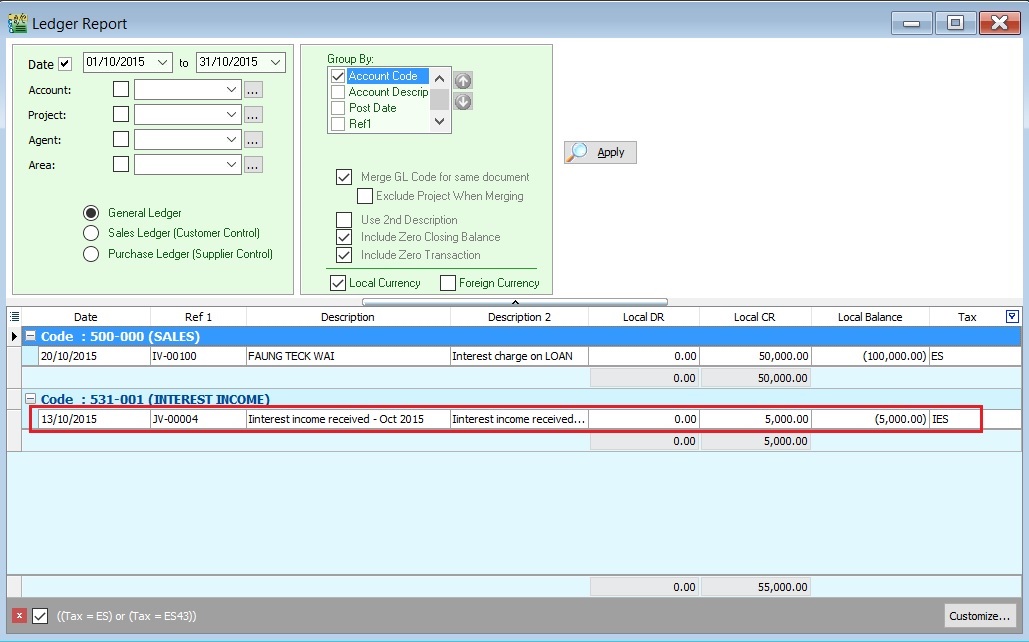

GL Ledger

[GL | Print Ledger Report...]

General Posting for IES & ES

- 1. In the General Ledger report, you have to insert the Tax grid column.

- 2. Filter the Tax Code (ES and IES).

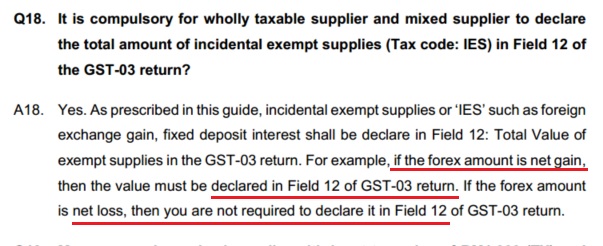

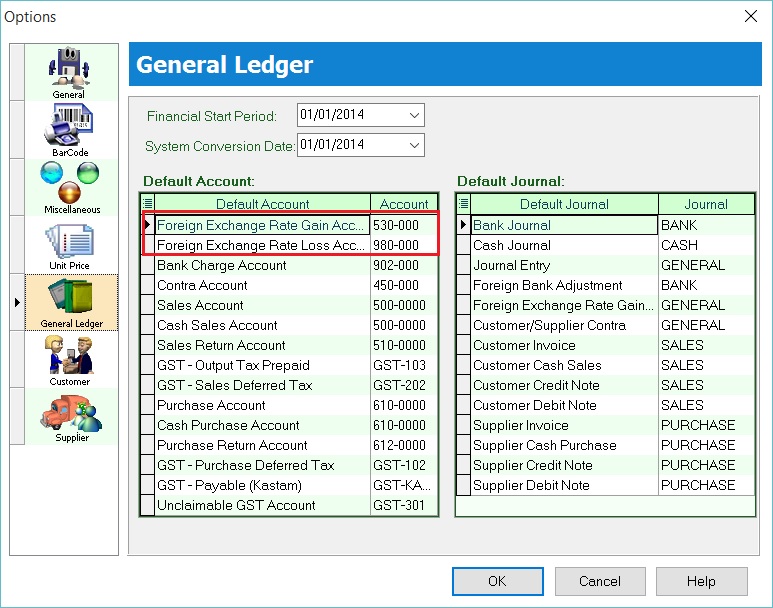

Special Posting for Net Realized Gain Forex (IES)

- Below question and answer extract from GUIDE ACCOUNTING SOFTWARE ENHANCEMENT TOWARDS GST COMPLIANCE.

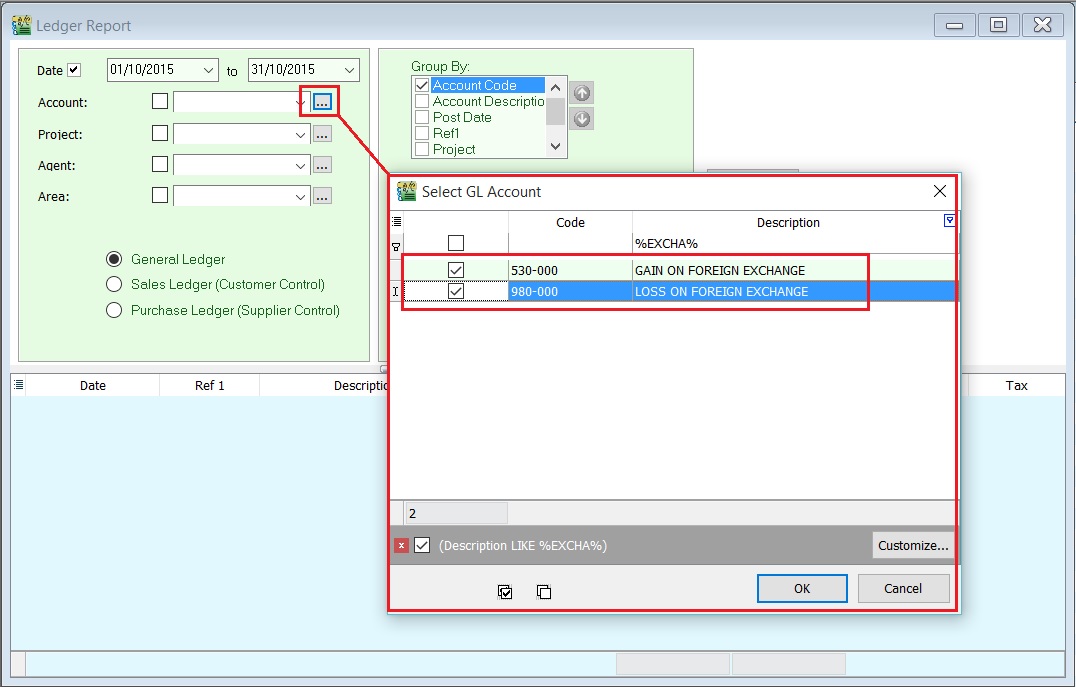

- 1. Check the Foreign Exchange Rate Gain or Loss Account setting at Tools | Options...(General Ledger). For example,

Default Account GL Account Code Foreign Exchange Rate Gain Account 530-000 Foreign Exchange Rate Loss Account 980-000

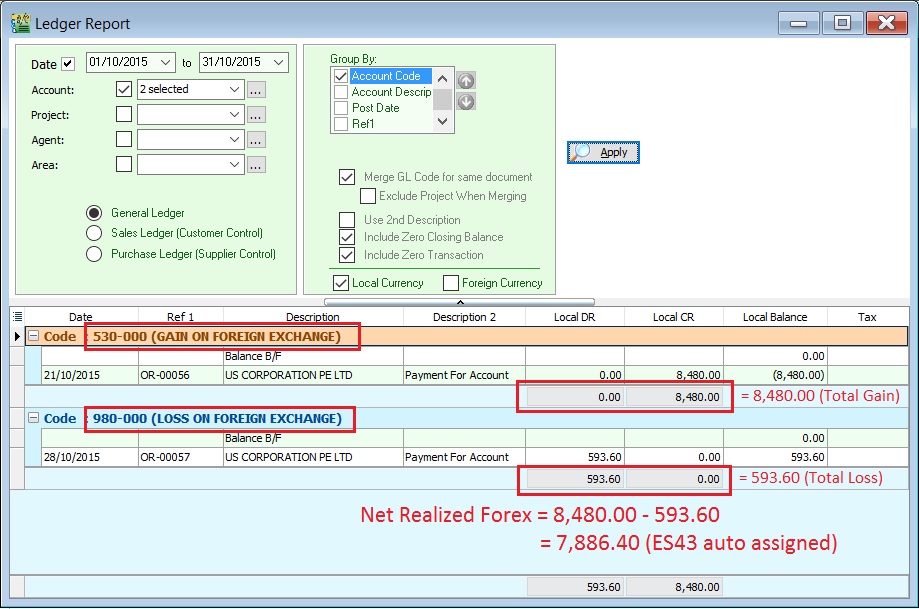

Account Local DR Local CR Explanation Total Gain on Foreign Exchange 0.00 8,480.00 Total Loss on Foreign Exchange 593.60 0.00 Net Realized Forex 593.60 8,480.00 8,480.00 - 593.60 = 7,886.40 GAIN (IES)

NOTE: RMCD has confirmed that Net Realised Gain in Forex ONLY need to add into GST-03 item 12 Total Value of Exempt Supplies. Tax code = IES

Net Realised Loss in Forex will be NIL.

Summary: Comparison between GST-03, GST Listing and Ledger Report

- Here is the result summarized:

Description GST-03 GST Listing Ledger Report IES 5,000.00 5,000.00 IES (Realized Gain Forex) 7,886.40 Forex Gain = 8,480.00

Forex Loss = -593.60

Net Forex Gain = 7,886.40

ES 50,000.00 50,000.00 Total Item 12 (ES + IES) 62,886.40 62,886.40 62,886.40