| Line 34: | Line 34: | ||

:::{| class="wikitable" | :::{| class="wikitable" | ||

|- | |- | ||

! GL Code!! Tax !! Tax Rate !! style="text-align:right;"| Local DR !! style="text-align:right;"| Local CR !! style="text-align:right;"| Local DR(Tax) !! style="text-align:right;"| Local CR(Tax) | ! GL Code!! Tax !! Tax Rate !! style="text-align:right;"| Local DR !! style="text-align:right;"| Local CR !! style="text-align:right;"| Local DR(Tax) !! style="text-align:right;"| Local CR(Tax) | ||

|- | |- | ||

| GST-103 || SR || 6% || style="text-align:right;"| 2,000 || || style="text-align:right;"| 2,120 || | | GST-103 || SR || 6% || style="text-align:right;"| 2,000 || || style="text-align:right;"| 2,120 || | ||

Revision as of 10:06, 26 July 2018

Introduction

- 1. Negative value in 5a5b and 6a6b.

- 2. TAP system not accept negative value.

- For example:

- GST-03 (June 2018)

- Output Tax

Items Value 5a -2000 5b -120

- Input Tax

Items Value 6a -1000 6b -60

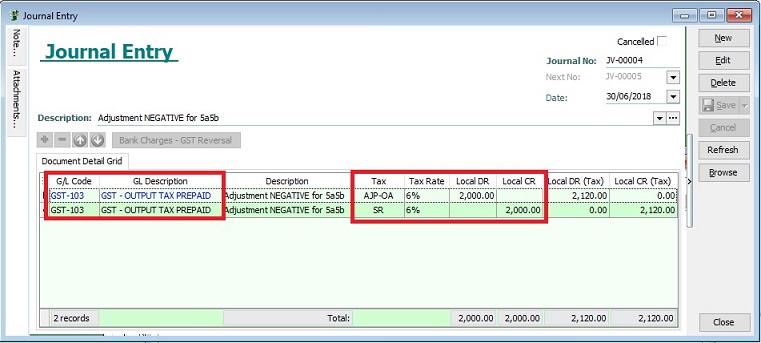

Negative in 5a5b

Menu: GL | Journal Entry...

- Journal Adjustment:

GL Code Tax Tax Rate Local DR Local CR Local DR(Tax) Local CR(Tax) GST-103 SR 6% 2,000 2,120 GST-103 AJP-OA 6% 2,000 2,120

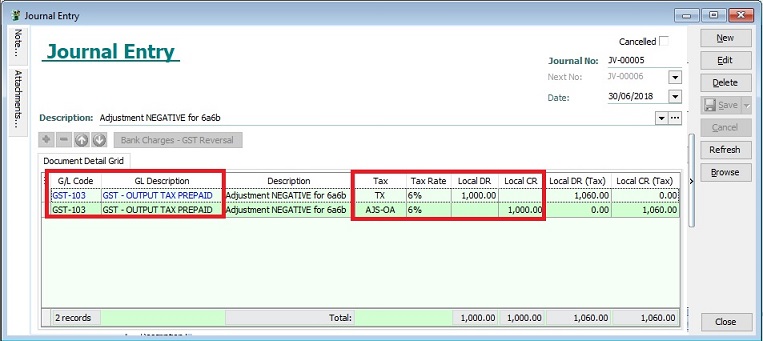

Negative in 6a6b

Menu: GL | Journal Entry...