| Line 5: | Line 5: | ||

:For example: | :For example: | ||

::'''GST-03 (June 2018)''' | ::'''GST-03 (June 2018)''' | ||

::{| class="wikitable" | |||

|- | |||

! Output Tax !! style="text-align:right;"| Amount | |||

|- | |||

| 5a || style="text-align:right;"| -2000 | |||

|- | |||

| 5b || style="text-align:right;"| -120 | |||

|} | |||

:: 5a = '''-2000''' | :: 5a = '''-2000''' | ||

:: 5b = '''-120''' | :: 5b = '''-120''' | ||

Revision as of 09:20, 26 July 2018

Introduction

- 1. Negative value in 5a5b and 6a6b.

- 2. TAP system not accept negative value.

- For example:

- GST-03 (June 2018)

Output Tax Amount 5a -2000 5b -120

- 5a = -2000

- 5b = -120

- 6a = -1000

- 6b = -60

Negative in 5a5b

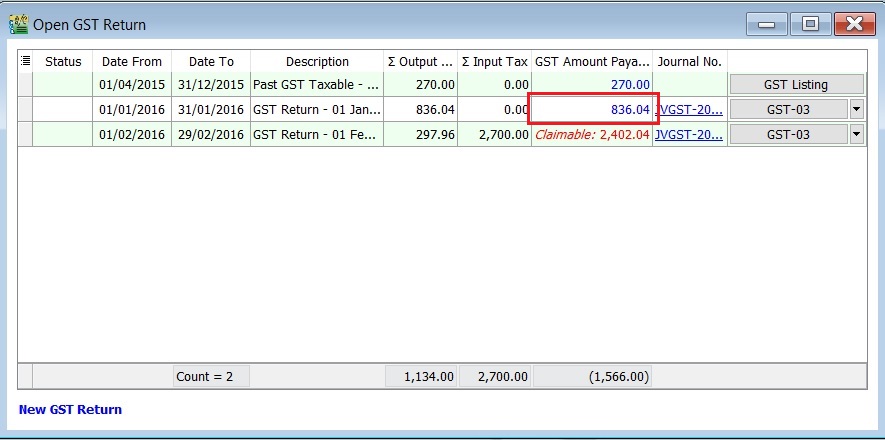

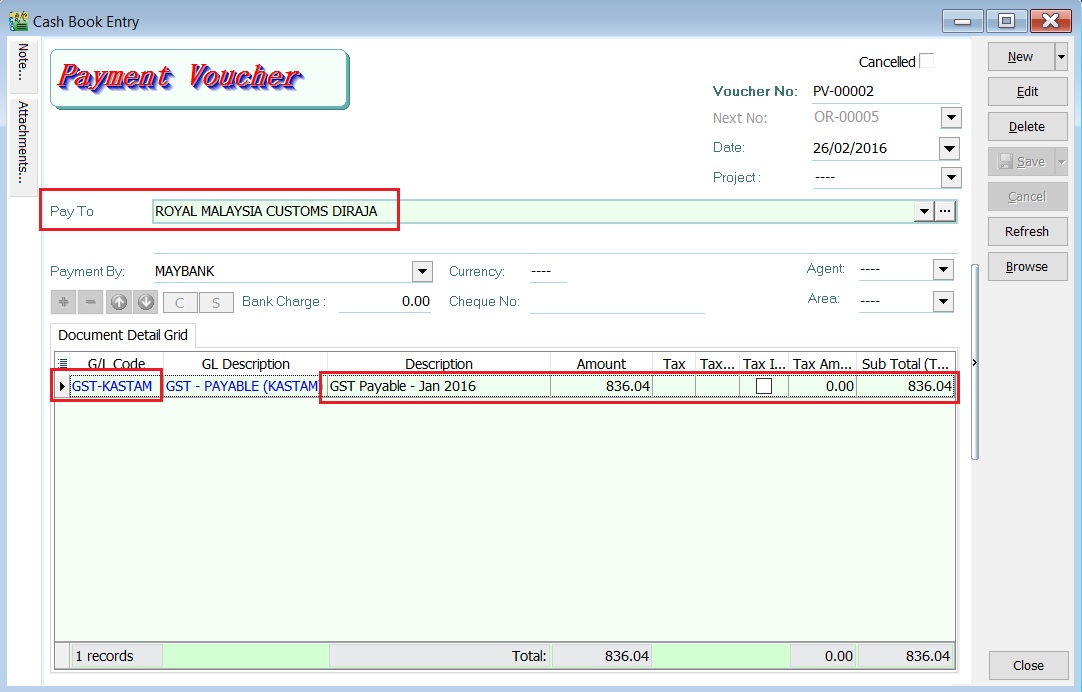

Menu: GL | Cash Book Entry (PV)...

- 1. Click on the New follow by select select Payment Voucher.

- 2. Enter the ROYAL MALAYSIA CUSTOMS DIRAJA' into Pay To field.

- 3. At the detail, select GL Code: GST-KASTAM.

- 4. Enter the description to describe the GST Payable for the period, eg. GST Payable - Jan 2016.

- 5. Based on the GST Returns, enter the GST amount payable (Rm836.04) into the Amount column.

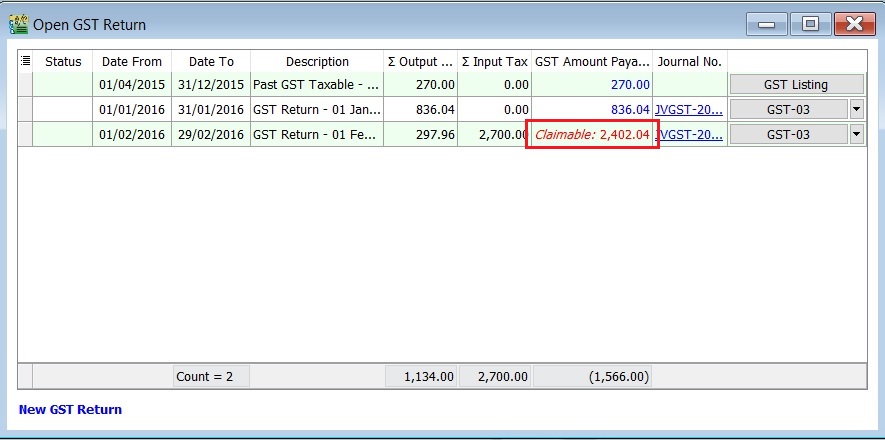

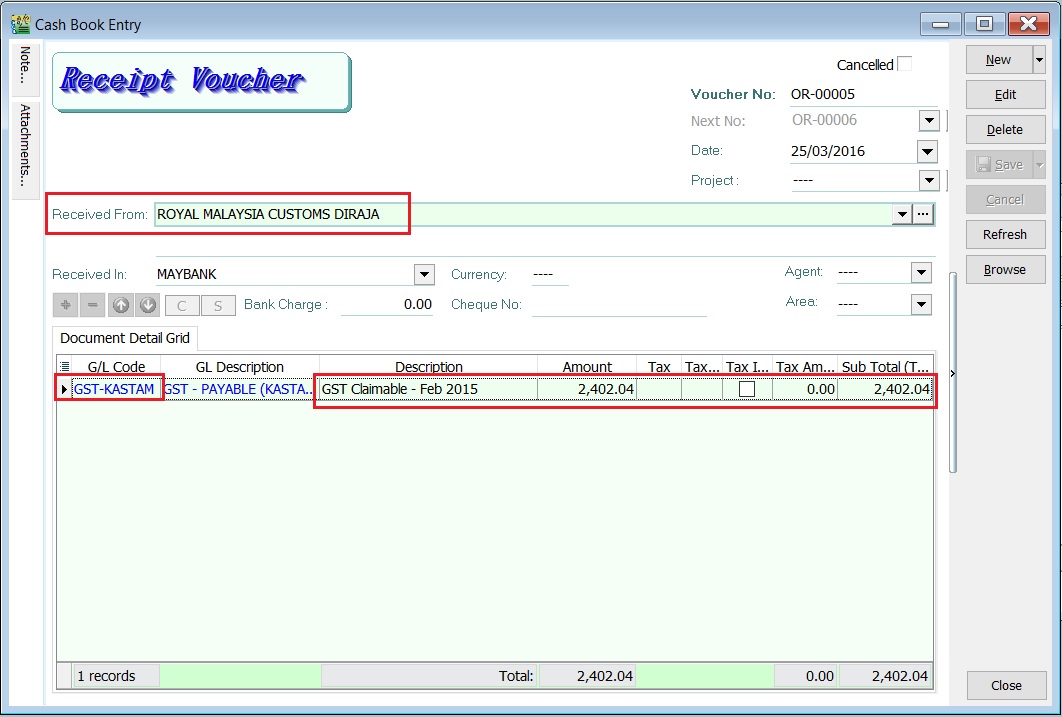

Negative in 6a6b

Menu: GL | Cash Book Entry (OR)...

- 1. Click on the New follow by select Official Receipt.

- 2. Enter the ROYAL MALAYSIA CUSTOMS DIRAJA' into Received From field.

- 3. At the detail, select GL Code: GST-KASTAM.

- 4. Enter the description to describe the GST Claimable for the period, eg. GST Claimable - Feb 2016.

- 5. Based on the GST Returns, enter the GST amount claimable (Rm2,402.04) into the Amount column.