No edit summary |

|||

| Line 45: | Line 45: | ||

|} | |} | ||

<br /> | <br /> | ||

==See also== | |||

* [[Maintain Asset Item]] | |||

* [[Process Depreciation]] | |||

* [[Open Depreciation]] | |||

* [[Asset Disposal]] | |||

* [[Print Yearly Depreciation]] | |||

* [[Print Asset Analysis]] | |||

* [[Print Asset Disposal Listing]] | |||

* [[How to tally my Asset with the GL Maintain Opening Balance]] | |||

Revision as of 01:44, 29 October 2022

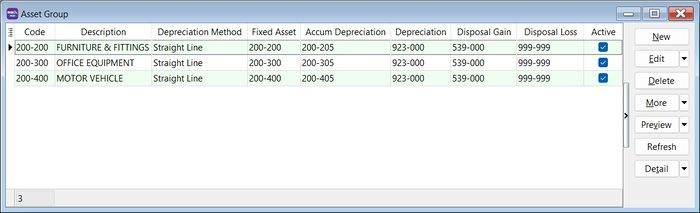

Menu: Asset | Asset Group...

Introduction

- Group the asset items based on the following considerations.

Maintain Asset Group

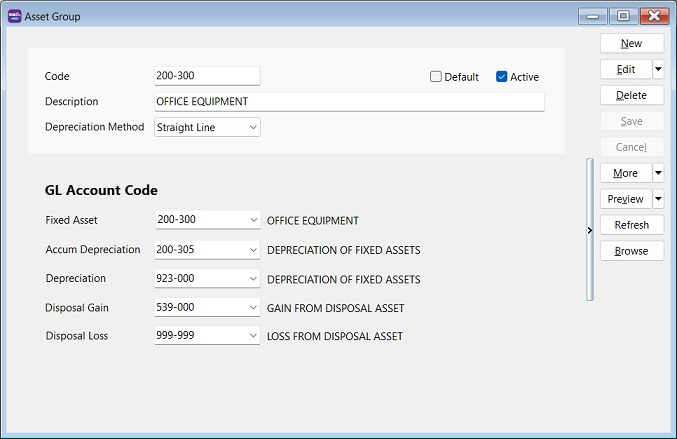

Field Name Explanation & Properties Code - Input the new Asset Group Code

- Field type : Alphanumerical

- Length : 20

Description - Input the Asset Group description, eg. Furniture, Motor Vehicle

- Field type : Alphanumerical

- Length : 200

Depreciation Method - Select an appropriate Depreciation Method to generate depreciation value

Fixed Asset - Select Balance Sheet GL Account code for Fixed Asset.

Accum Depreciation - Select Balance Sheet GL Account code for Accumulated Depreciation.

Depreciation - Select P&L GL Account for Depreciation of Asset.

Disposal Gain - Select P&L GL Account for Gain from Disposal Asset.

Disposal Loss - Select P&L GL Account for Loss from Disposal Asset.