No edit summary |

|||

| Line 82: | Line 82: | ||

:[[File: WTH-Tax_08.jpg| 500PX]] | :[[File: WTH-Tax_08.jpg| 500PX]] | ||

<br /> | <br /> | ||

:6. You can check the ledger report for Withholding Tax balance. | |||

:[[File: WTH-Tax_09.jpg| 500PX]] | |||

<br /> | |||

==See also== | ==See also== | ||

* [[Print SST Listing]] | * [[Print SST Listing]] | ||

* [[SST-Account for Pending Service Tax over 12 months]] | * [[SST-Account for Pending Service Tax over 12 months]] | ||

Revision as of 10:47, 1 October 2019

Initial Setup

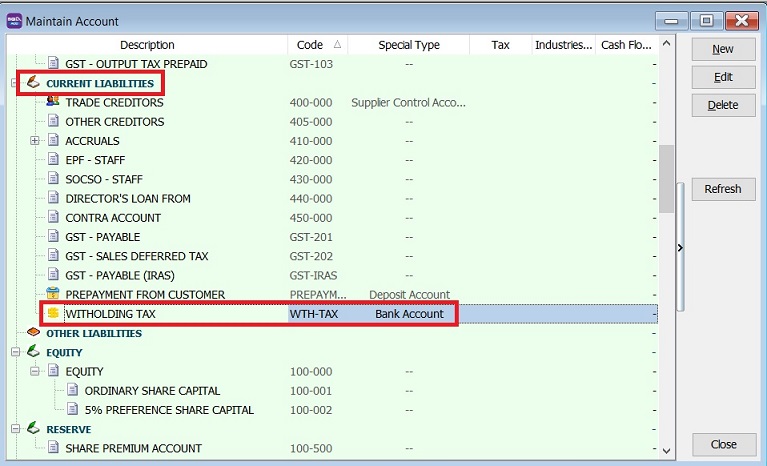

Create Withholding Tax Account

[GL | Maintain Account...]

- Create the following GL Account under Current Liability.

GL Account Description Special Type WTH-Tax Withholding Tax Bank Account

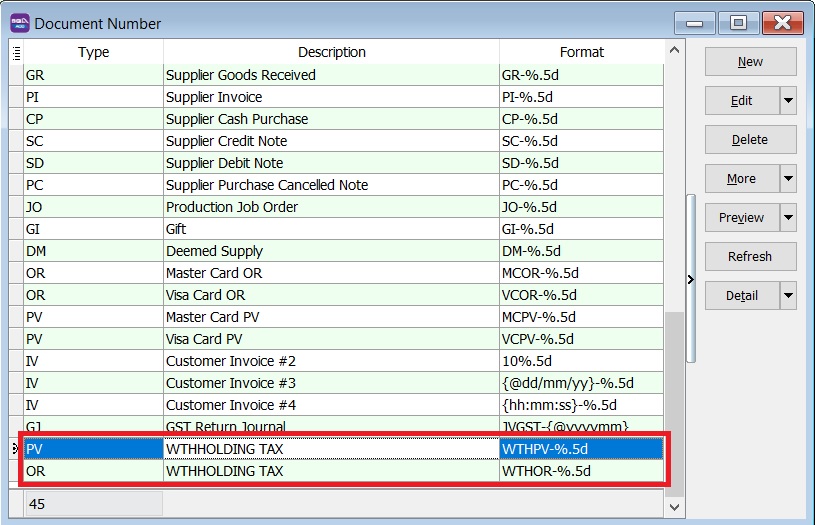

Withholding Document Number Set

[Tools | Maintain Document Number...]

Descripion Document Type Format WITHHOLDING TAX Payment Voucher WTHPV-%.5d WITHHOLDING TAX Official Receipt WTHOR-%.5d

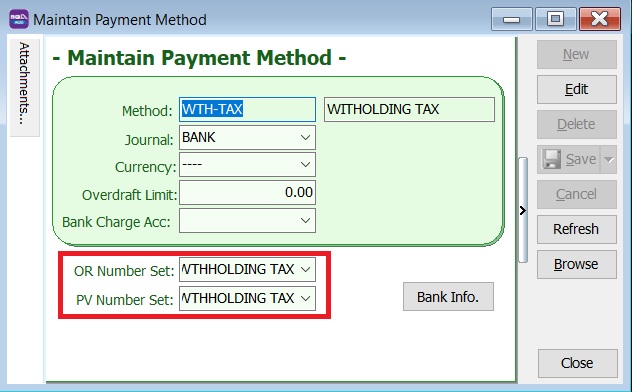

- 2. Next, Go to Tools | Maintain Payment Method...

- 3. Edit the WITHHOLDING TAX.

- 4. Set OR and PV number Set to WITHHOLDING TAX. Click Save.

Withholding Tax Entries

Withholding Tax (AP)

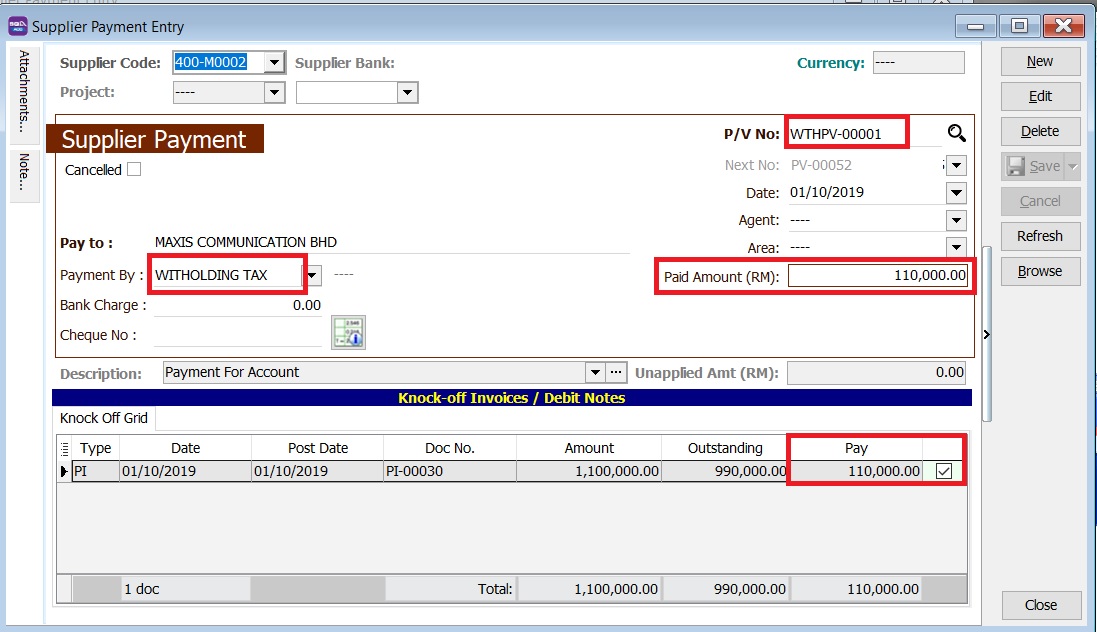

[Supplier | Supplier Payment...]

- 1. Create new Supplier Payment.

- 2. Select the Supplier Code.

- 3. Select the Payment by: WITHHOLDING TAX.

- 4. Enter the Paid Amount: 110,000.00 (Withholding tax amount 10% of supplier invoice value).

- 5. Knock-off the supplier invoice.

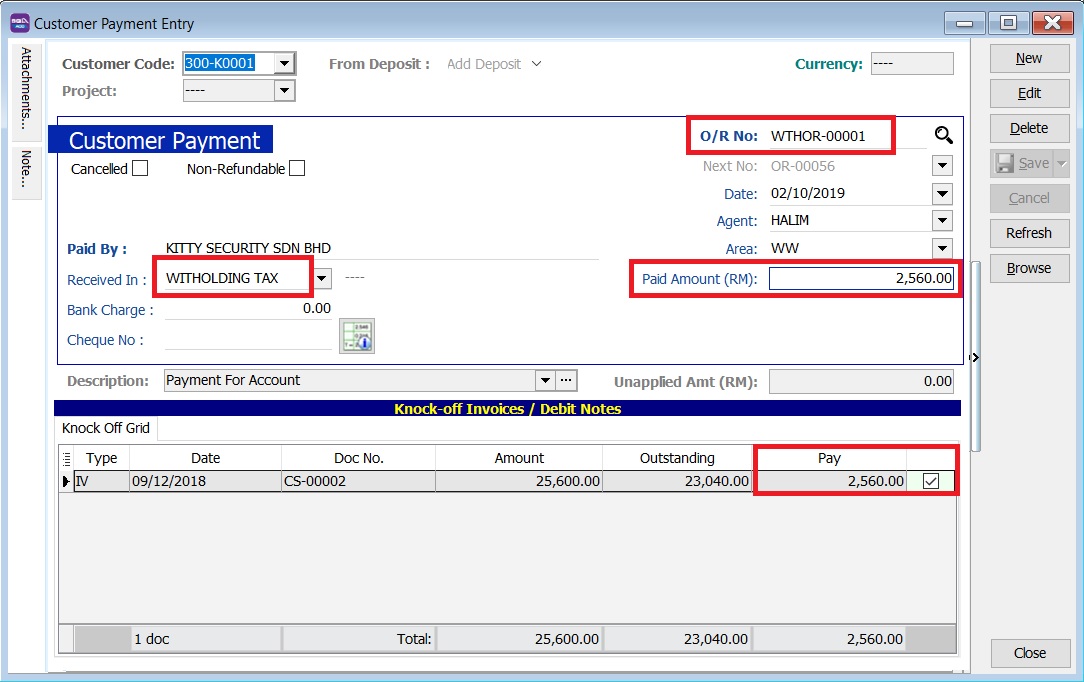

Withholding Tax (AR)

[Customer | Customer Payment...]

- 1. Create new Customer Payment.

- 2. Select the Customer Code.

- 3. Select the Received In: WITHHOLDING TAX.

- 4. Enter the Paid Amount: 2,560.00 (Withholding tax amount 10% of customer invoice value).

- 5. Knock-off the customer invoice.

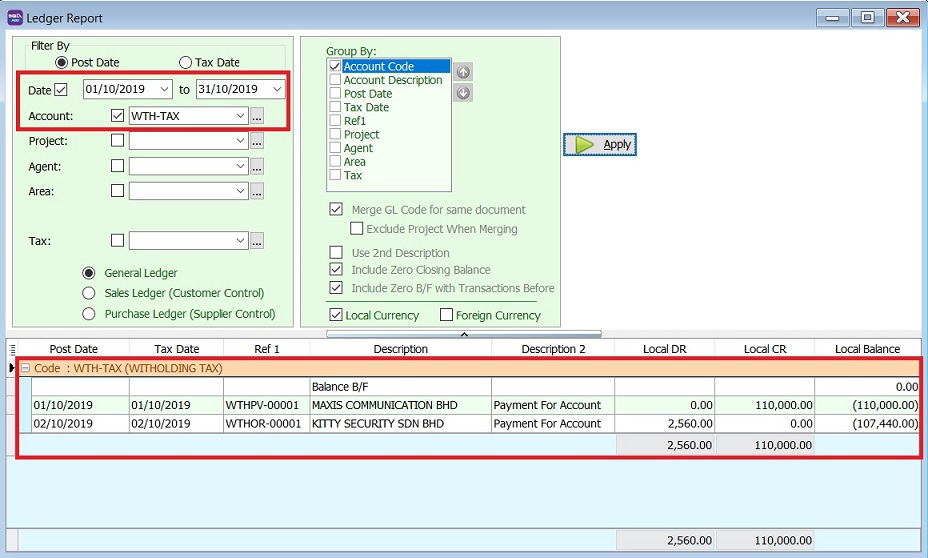

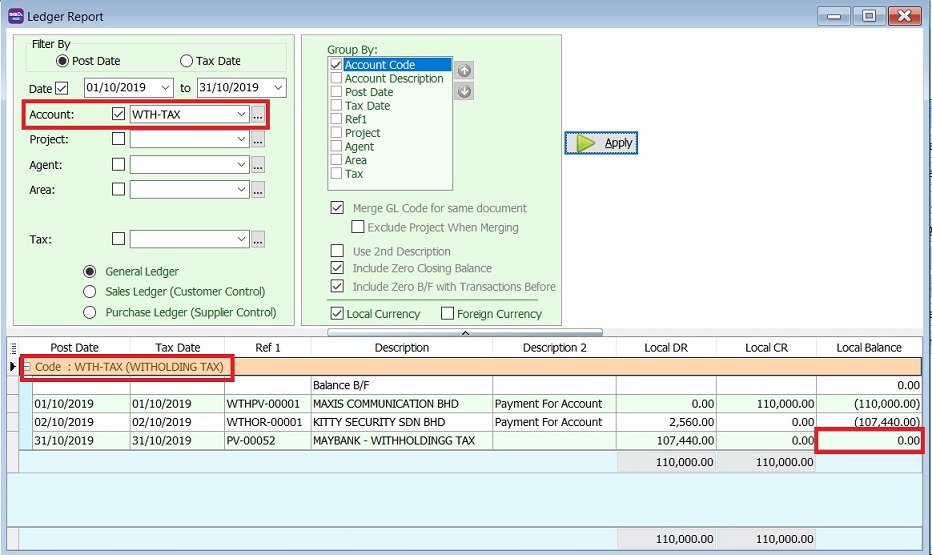

Withholding Balance Report

[ GL | Print Ledger Report...]

[ Inquiry | Account Inquiry...]

Payment of Withholding Tax

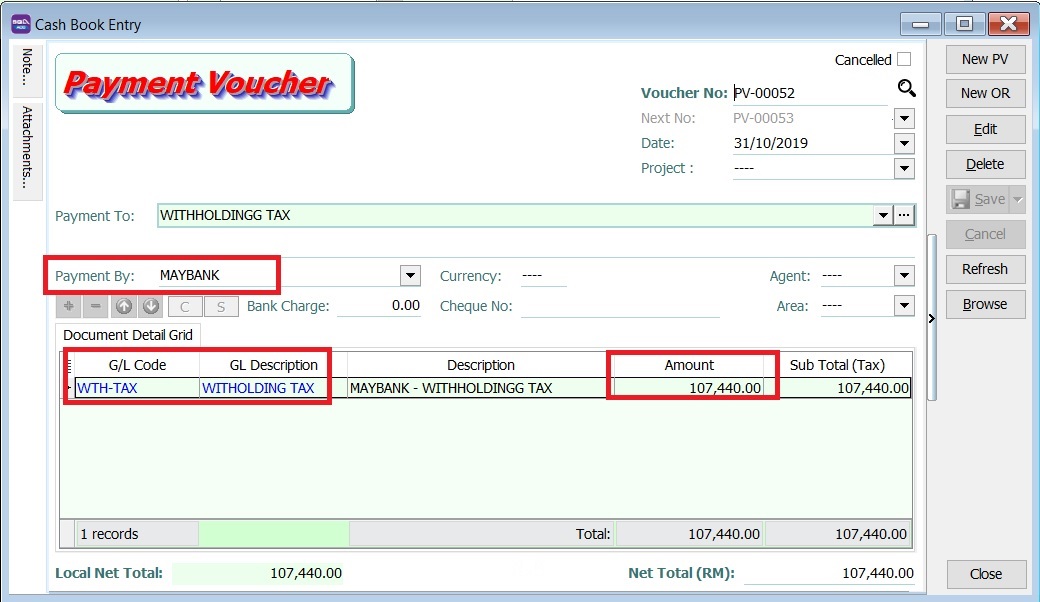

[ GL | Cash Book Entry..]

- 1. Create new PV.

- 2. Enter Payee name.

- 3. Select Payment By: Bank Account

- 4. At detail grid, select GL Code: WTH-TAX

- 5. Enter the withholding tax amount to paid.