| Line 12: | Line 12: | ||

* Select the correct tax code . | * Select the correct tax code . | ||

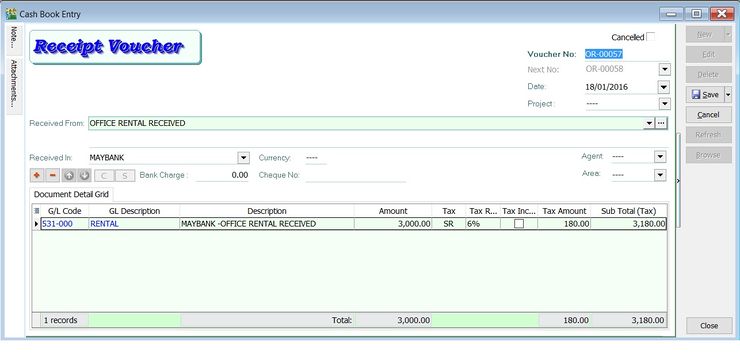

* Example : If the tax code for rental received is SR , then select SR in the tax column. | * Example : If the tax code for rental received is SR , then select SR in the tax column. | ||

::[[File:GL-Cash Book-Receipt Voucher.jpg| | ::[[File:GL-Cash Book-Receipt Voucher.jpg|740px]] | ||

==Payment Voucher== | ==Payment Voucher== | ||

Revision as of 09:35, 25 February 2016

Menu: GL | Cash Book Entry...

- Cash Book Entry is used to record collection/payment transactions other than customer/supplier payment. For example, payment for sales person expenses.

- You can switch the entry form into either Payment Voucher or Official Receipt.

- You can print the payment voucher/official receipt after save the entry.

- Enable to quick create entry to Customer Payment, Supplier Payment, Customer Refund or Supplier Refund.

Receipt Voucher

- To record miscellaneous collections, eg. interest/loan received from bank.

- Enable to print the Official Receipt.

- Select the correct tax code .

- Example : If the tax code for rental received is SR , then select SR in the tax column.

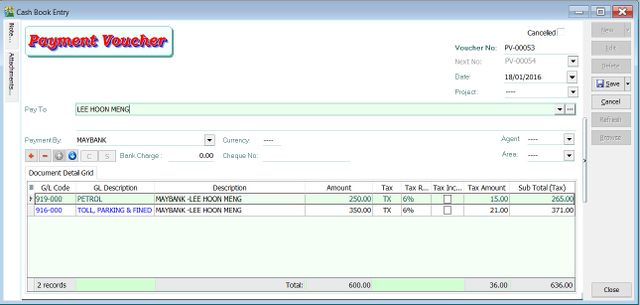

Payment Voucher

- To record miscellaneous payments, eg. pay salary, sales person claims, etc.

- Enable to print the Payment Voucher.

- Select correct tax code.

- Example : If the tax code for petrol and parking are TX , then in the tax column select TX.