GST Sales/Purchase Deferred Tax Journal Adjustment: Difference between revisions

From eStream Software

(Created page with "==Introduction== :1. Negative value in 5a5b and 6a6b. :2. TAP system not accept negative value. <br /> ==GST Sales Deferred Tax== ''Menu: GL | Journal Entry...'' :1. '''Outp...") |

|||

| (25 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

==Introduction== | ==Introduction== | ||

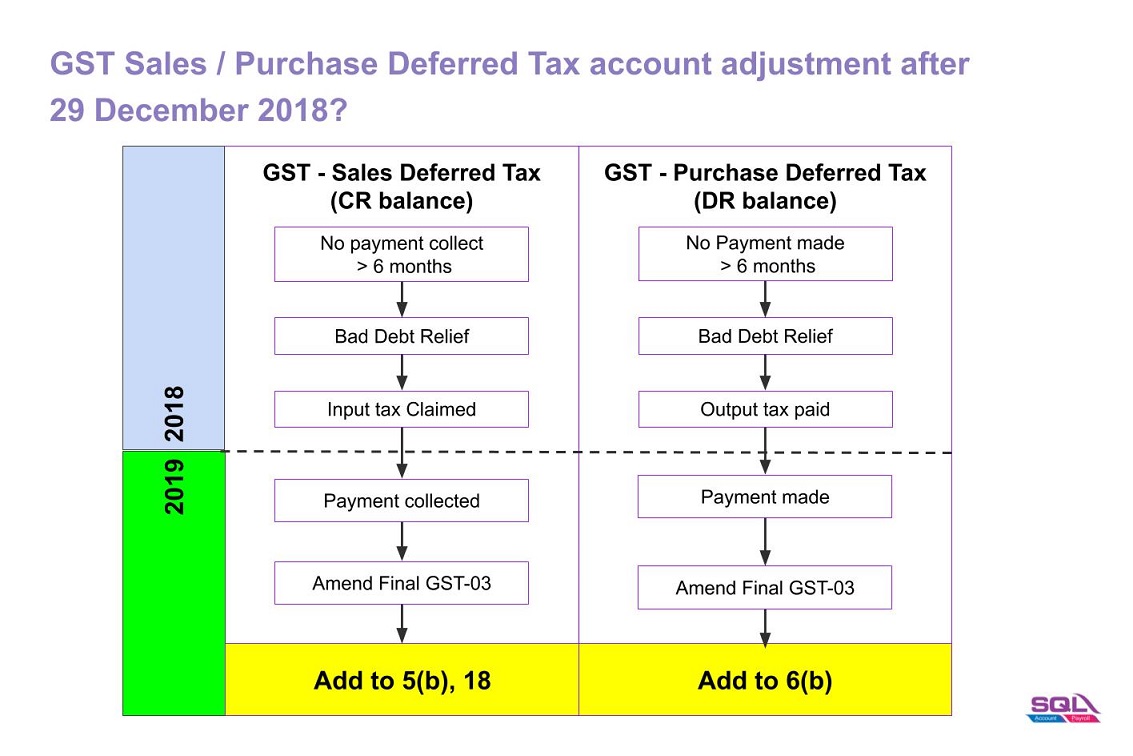

:1. | :1. Double entry adjustment for the balance of GST Sales / Purchase Deferred Tax (Bad Debt Relief) AFTER 29 December 2018. | ||

:2. | :2. Add the adjustment amount into Final GST Return (amendment). | ||

<br /> | <br /> | ||

::[[File: Adjustment for GST Sales Purchase Deferred Tax (Bad Debt Relief Recovered)-00.jpg]] | |||

==GST Sales Deferred Tax== | ==How to check the Sales/Purchase Bad Debt Recovered amount after Final GST Returns?== | ||

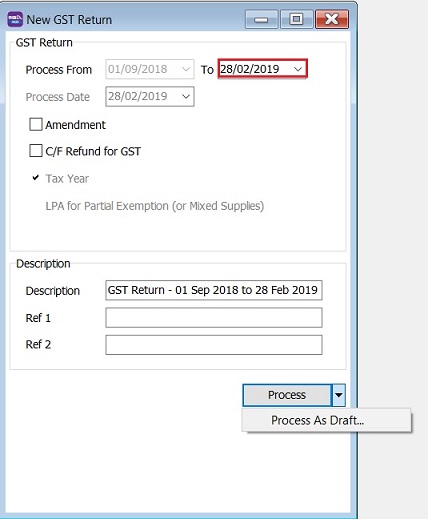

''Menu: SST/GST | New GST Return...'' | |||

:1. Select a date '''AFTER''' the Final GST Return Date, eg. 28/02/2019. | |||

::[[File: Adjustment for GST Sales Purchase Deferred Tax (Bad Debt Relief Recovered)-03.jpg]] | |||

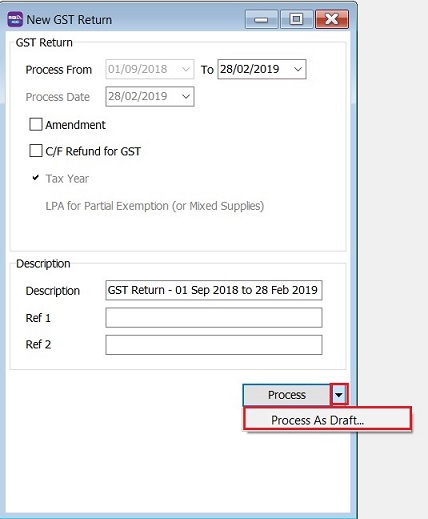

:2. Choose '''Process As Draft'''. | |||

::[[File: Adjustment for GST Sales Purchase Deferred Tax (Bad Debt Relief Recovered)-04.jpg]] | |||

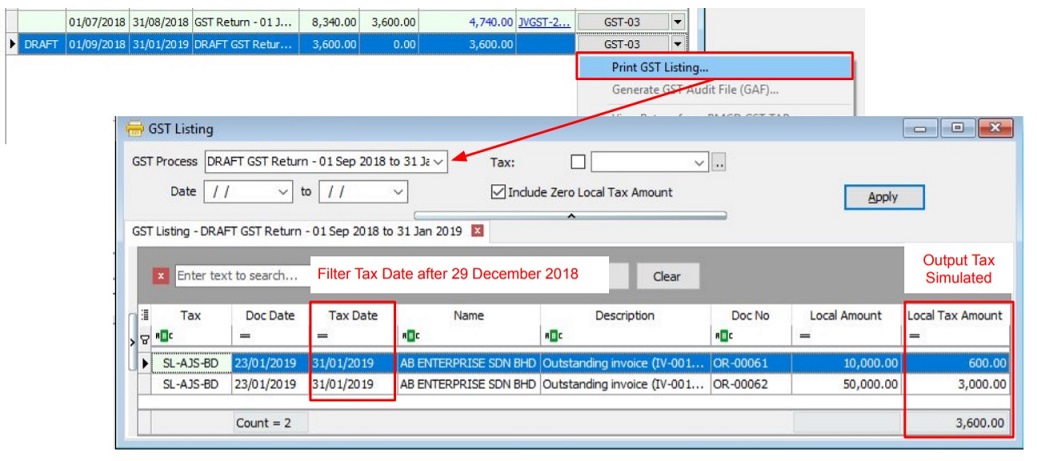

:3. Click on '''GST Return Draft''' and '''print GST Listing'''. | |||

:4. Filter the '''Tax Date''' (ie. greater than or equal to 30 December 2018). | |||

::[[File: Adjustment for GST Sales Purchase Deferred Tax (Bad Debt Relief Recovered)-05.jpg]] | |||

'''SL-AJS-BD''' : Sales Bad Debt Recovered (Output Tax). | |||

'''PH-AJP-BD''' : Purchase Bad Debt Recovered (Input Tax). | |||

==Adjustment for GST Sales Deferred Tax (SL-AJS-BD)== | |||

''Menu: GL | Journal Entry...'' | ''Menu: GL | Journal Entry...'' | ||

: | ::[[File: Adjustment for GST Sales Purchase Deferred Tax (Bad Debt Relief Recovered)-01.jpg]] | ||

: | :1. Based on the '''GST Listing (Draft)''', post the GST Bad Debt Recovered double entry using '''Journal Entry'''. | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! GL Code!! | ! GL Code !! GL Description !! style="text-align:right;"| Local DR !! style="text-align:right;"| Local CR !! Add to Final GST-03 | ||

|- | |- | ||

| GST- | | GST-202 || GST - Sales Deferred Tax || style="text-align:right;"| 3,600 || || | ||

|- | |- | ||

| GST- | | GST-KASTAM || GST - Payable (KASTAM) || || style="text-align:right;"| 3,600 || 5(b), 18 | ||

|} | |} | ||

:2. Amend the Final GST Return (Aug 2018) at TAP. | |||

:: | :3. Add the amount into | ||

::a. 5(b) | |||

::b. 18 | |||

<br /> | <br /> | ||

==GST Purchase == | ==Adjustment for GST Purchase Deferred Tax (PH-AJP-BD) == | ||

''Menu: GL | Journal Entry...'' | ''Menu: GL | Journal Entry...'' | ||

:1.''' | ::[[File: Adjustment for GST Sales Purchase Deferred Tax (Bad Debt Relief Recovered)-02.jpg]] | ||

<br /> | |||

:1. Based on the '''GST Listing (Draft)''', post the GST Bad Debt Recovered double entry using '''Journal Entry'''. | |||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! | ! GL Code !! GL Description !! style="text-align:right;"| Local DR !! style="text-align:right;"| Local CR !! Add to Final GST-03 | ||

|- | |- | ||

| | | GST-KASTAM || GST - Payable (KASTAM) || style="text-align:right;"| 600 || || 6(b) | ||

|- | |- | ||

| | | GST-102 || GST - Purchase Deferred Tax || || style="text-align:right;"| 600 || | ||

|} | |} | ||

:2. Amend the Final GST Return (Aug 2018) at TAP. | |||

:3. Add the amount into | |||

::a. 6(b) | |||

: | ==Payment to RMCD== | ||

''Menu: GL | Cash Book Entry...'' | |||

:Made payment to RMCD, use '''Cash Book Entry (PV)'''. | |||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! GL Code!! | ! GL Code !! GL Description !! style="text-align:right;"| Local DR !! style="text-align:right;"| Local CR | ||

|- | |- | ||

| GST- | | GST-KASTAM || GST - Payable (KASTAM) - Nett Balance || style="text-align:right;"| 3,000 || | ||

|- | |- | ||

| | | BANK || Bank Name || || style="text-align:right;"| 3,000 | ||

|} | |} | ||

<br /> | <br /> | ||

Latest revision as of 08:45, 24 April 2019

Introduction

- 1. Double entry adjustment for the balance of GST Sales / Purchase Deferred Tax (Bad Debt Relief) AFTER 29 December 2018.

- 2. Add the adjustment amount into Final GST Return (amendment).

How to check the Sales/Purchase Bad Debt Recovered amount after Final GST Returns?

Menu: SST/GST | New GST Return...

- 1. Select a date AFTER the Final GST Return Date, eg. 28/02/2019.

- 2. Choose Process As Draft.

- 3. Click on GST Return Draft and print GST Listing.

- 4. Filter the Tax Date (ie. greater than or equal to 30 December 2018).

SL-AJS-BD : Sales Bad Debt Recovered (Output Tax). PH-AJP-BD : Purchase Bad Debt Recovered (Input Tax).

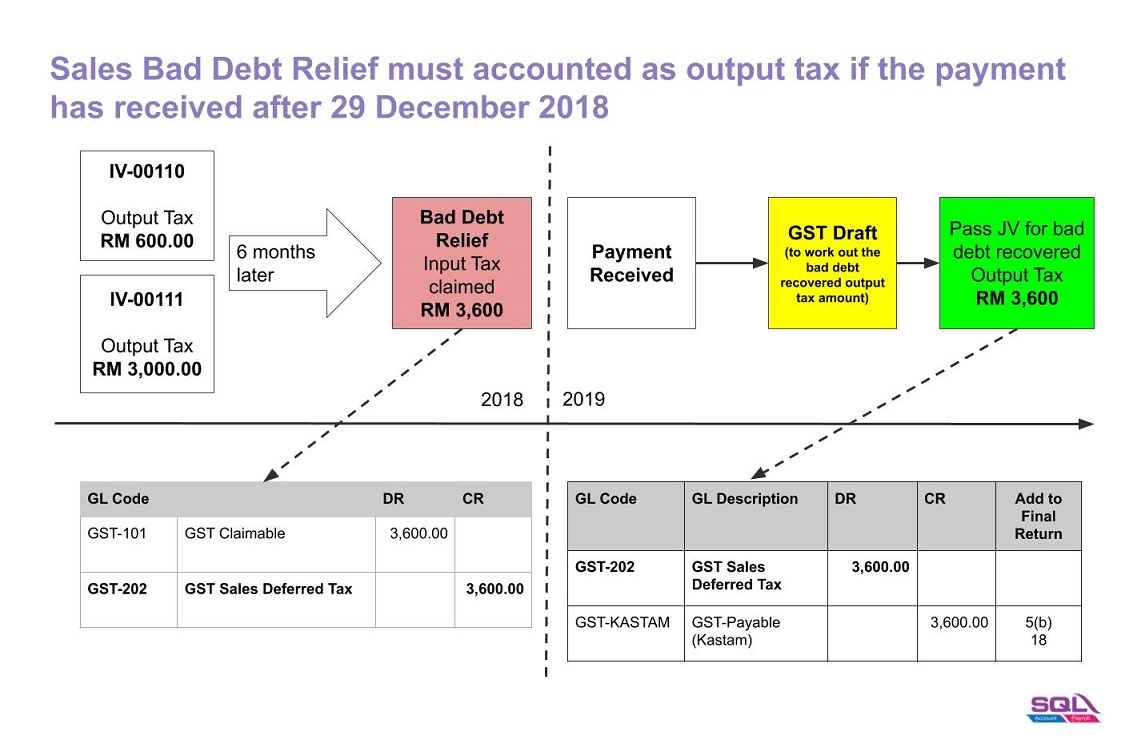

Adjustment for GST Sales Deferred Tax (SL-AJS-BD)

Menu: GL | Journal Entry...

- 1. Based on the GST Listing (Draft), post the GST Bad Debt Recovered double entry using Journal Entry.

GL Code GL Description Local DR Local CR Add to Final GST-03 GST-202 GST - Sales Deferred Tax 3,600 GST-KASTAM GST - Payable (KASTAM) 3,600 5(b), 18

- 2. Amend the Final GST Return (Aug 2018) at TAP.

- 3. Add the amount into

- a. 5(b)

- b. 18

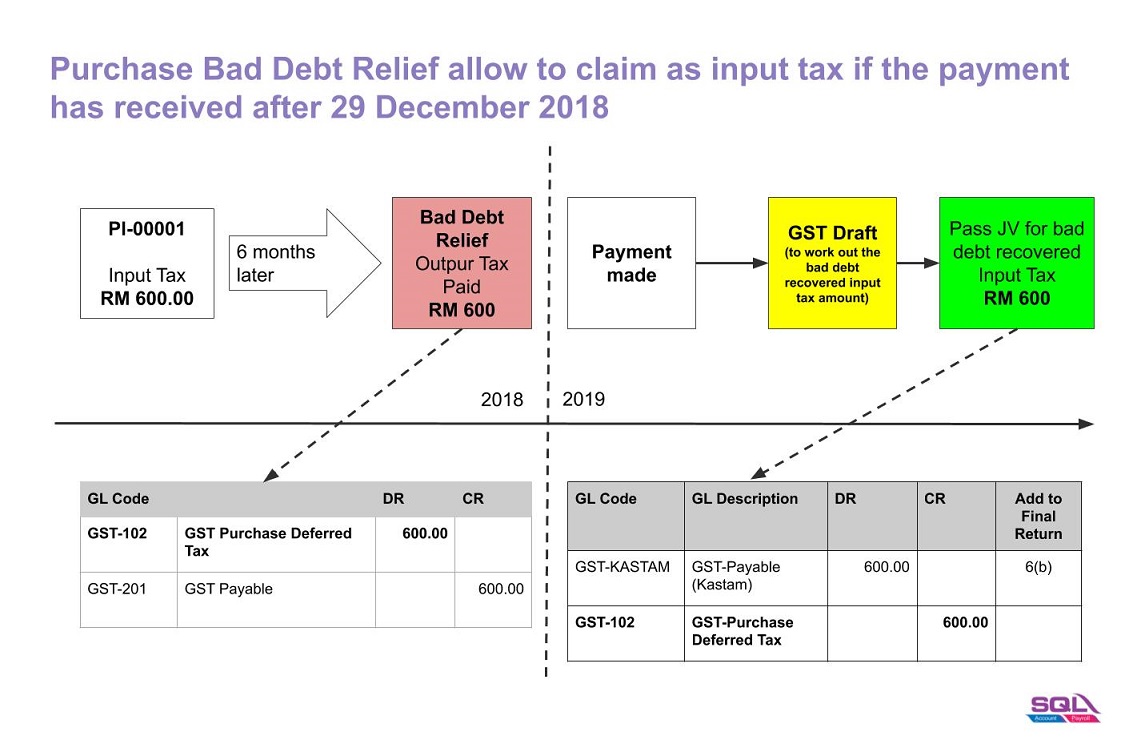

Adjustment for GST Purchase Deferred Tax (PH-AJP-BD)

Menu: GL | Journal Entry...

- 1. Based on the GST Listing (Draft), post the GST Bad Debt Recovered double entry using Journal Entry.

GL Code GL Description Local DR Local CR Add to Final GST-03 GST-KASTAM GST - Payable (KASTAM) 600 6(b) GST-102 GST - Purchase Deferred Tax 600

- 2. Amend the Final GST Return (Aug 2018) at TAP.

- 3. Add the amount into

- a. 6(b)

Payment to RMCD

Menu: GL | Cash Book Entry...

- Made payment to RMCD, use Cash Book Entry (PV).

GL Code GL Description Local DR Local CR GST-KASTAM GST - Payable (KASTAM) - Nett Balance 3,000 BANK Bank Name 3,000