No edit summary |

|||

| (5 intermediate revisions by the same user not shown) | |||

| Line 9: | Line 9: | ||

==Quick Setup for Tariff Code== | ==Quick Setup for Tariff Code== | ||

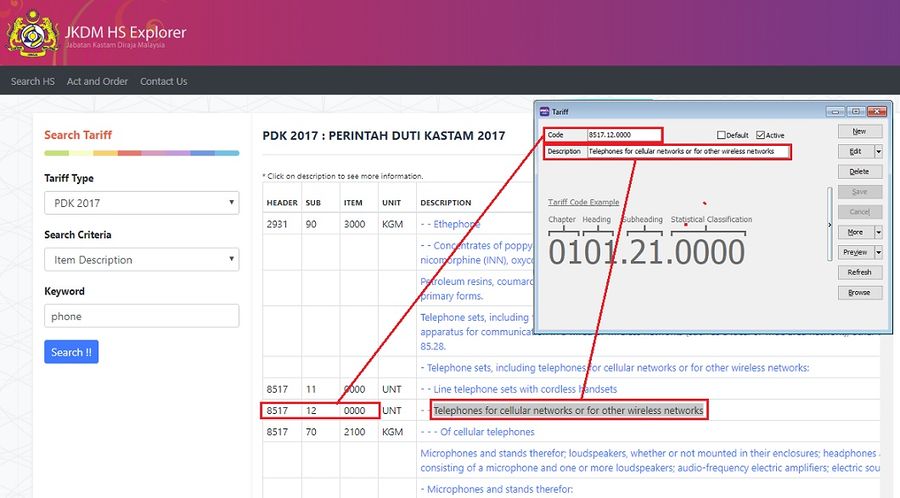

:1. | :1. Create the tariff code applicable to your product at [[Maintain Tariff]]. | ||

: | :[[File:SST-Tariff Code-01.jpg |900px]] | ||

: | <br /> | ||

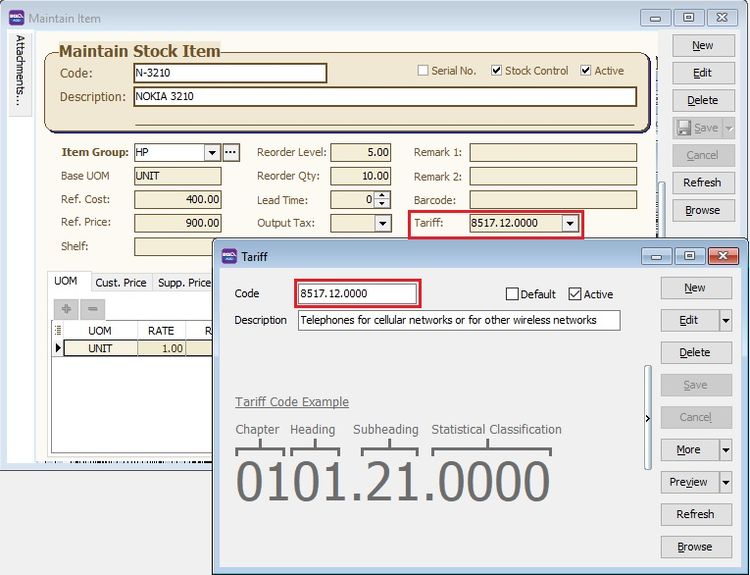

:2. Pick a tariff code for an items at [[Maintain Stock Item]]. | |||

:[[File:SST-Tariff Code-02.jpg |750px]] | |||

<br /> | <br /> | ||

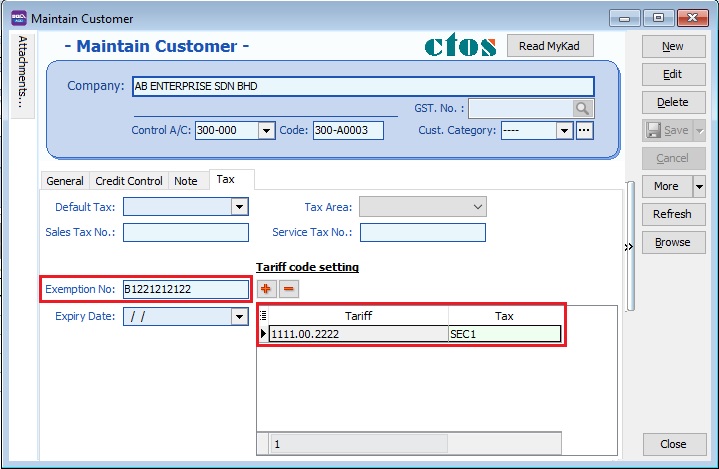

:3. For exemption certificate case (under Schedule A, B, C), a tariff and tax code (SEA, SEB, SEC1, SEC2, SEC3, SEC4, SEC5) should set in [[Maintain Customer]] and [[Maintain Supplier]] (Tariff code setting under Tax Tab). | |||

:[[File:SST-Tariff Code-03.jpg |750px]] | |||

<br /> | |||

==See also== | ==See also== | ||

Latest revision as of 02:13, 13 February 2019

Introduction

- Tariff classification is a complex yet extremely important aspect of cross-border trading.

- Goods imported from or to Malaysia are classified by the Harmonized Tariff Schedule (HTS) or commonly referred to as HS Codes.

- The codes, created by World Customs Organization (WCO), categorize up to 5,000 commodity

- HS Codes are made of 6-digit numbers that are recognized internationally, though different countries can extend the numbers by two or four digits to define commodities at a more detailed level.

- Click here to search the tariff code list from Kastam system.

Quick Setup for Tariff Code

- 1. Create the tariff code applicable to your product at Maintain Tariff.

- 2. Pick a tariff code for an items at Maintain Stock Item.

- 3. For exemption certificate case (under Schedule A, B, C), a tariff and tax code (SEA, SEB, SEC1, SEC2, SEC3, SEC4, SEC5) should set in Maintain Customer and Maintain Supplier (Tariff code setting under Tax Tab).