| (6 intermediate revisions by the same user not shown) | |||

| Line 20: | Line 20: | ||

* Example : If the tax code for petrol and parking are TX , then in the tax column select TX. | * Example : If the tax code for petrol and parking are TX , then in the tax column select TX. | ||

::[[File:GL-Cash Book-Payment Voucher.jpg|740px]] | ::[[File:GL-Cash Book-Payment Voucher.jpg|740px]] | ||

==How to enter Simplified Tax Invoice details to show in Lampiran 2== | |||

* Insert the '''Tax Ref''' column. | |||

::[[File:GL-Cash Book-00.jpg|640px]] | |||

<br /> | |||

* Enter the '''GST No. (No. GST Pembekal)''' only into '''Tax Ref'''. | |||

* Enter the detail description as '''Supplier Name (Name Pembekal)''' follow by '''semi comma (;)''' then '''description of the goods and services (diskripsi barang/perkhidmatan)'''. | |||

* For example,'''ABC Stationery Sdn Bhd; IV-20160105 Stationery expense claim Jan 2016''' in first description line. See the screenshot below. | |||

::[[File:GL-Cash Book-01.jpg|740px]] | |||

<br /> | |||

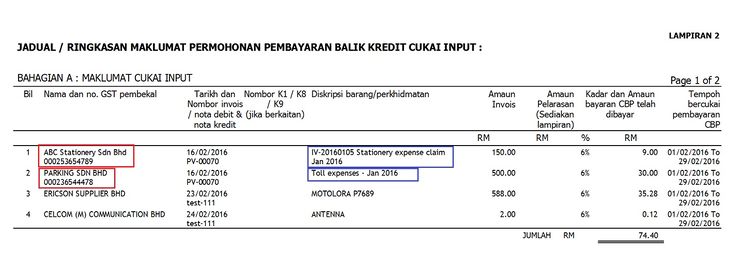

* '''Lampiran 2''' will be shown as the screenshot below. | |||

::[[File:GL-Cash Book-02.jpg|740px]] | |||

<br /> | |||

==See Also== | |||

*[[Print GST Listing]] | |||

Latest revision as of 04:20, 23 March 2016

Menu: GL | Cash Book Entry...

- Cash Book Entry is used to record collection/payment transactions other than customer/supplier payment. For example, payment for sales person expenses.

- You can switch the entry form into either Payment Voucher or Official Receipt.

- You can print the payment voucher/official receipt after save the entry.

- Enable to quick create entry to Customer Payment, Supplier Payment, Customer Refund or Supplier Refund.

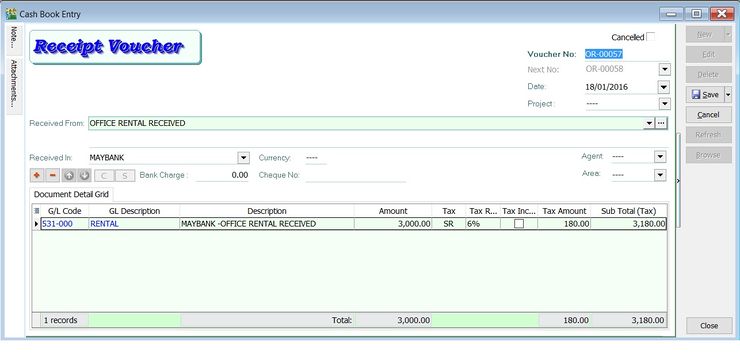

Receipt Voucher

- To record miscellaneous collections, eg. interest/loan received from bank.

- Enable to print the Official Receipt.

- Select the correct tax code .

- Example : If the tax code for rental received is SR , then select SR in the tax column.

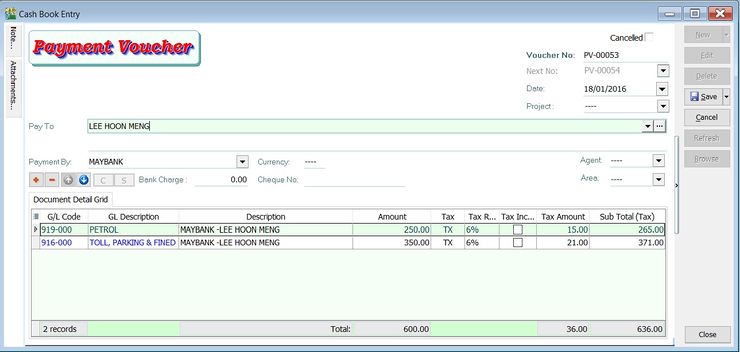

Payment Voucher

- To record miscellaneous payments, eg. pay salary, sales person claims, etc.

- Enable to print the Payment Voucher.

- Select correct tax code.

- Example : If the tax code for petrol and parking are TX , then in the tax column select TX.

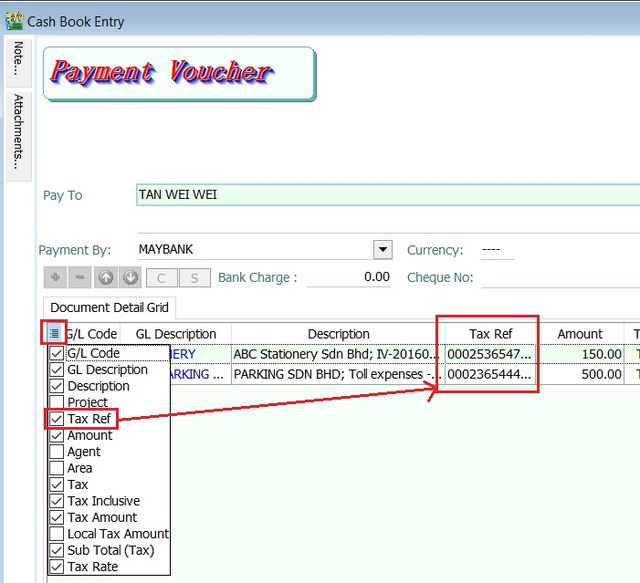

How to enter Simplified Tax Invoice details to show in Lampiran 2

- Insert the Tax Ref column.

- Enter the GST No. (No. GST Pembekal) only into Tax Ref.

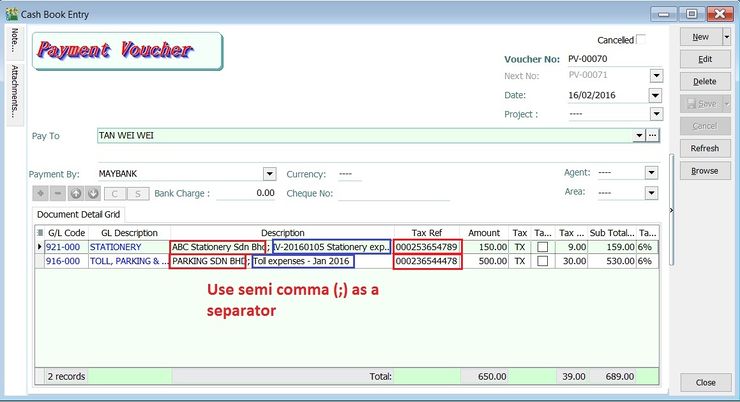

- Enter the detail description as Supplier Name (Name Pembekal) follow by semi comma (;) then description of the goods and services (diskripsi barang/perkhidmatan).

- For example,ABC Stationery Sdn Bhd; IV-20160105 Stationery expense claim Jan 2016 in first description line. See the screenshot below.

- Lampiran 2 will be shown as the screenshot below.