| Line 28: | Line 28: | ||

==Stanadard Rate and Flat Rate Acquisitions (6a), and Input Tax (6b)== | ==Stanadard Rate and Flat Rate Acquisitions (6a), and Input Tax (6b)== | ||

:Not all input tax claims are allowable. You can claim input tax on your purchases only if the below conditions are fulfilled. | |||

::1. Tax invoice / Simplified Tax Invoice / Custom K1 / Custom K9 | |||

:::a. the buyer can use '''simplified tax invoice''' if the '''total amount GST payable is RM30 or less'''. | |||

:::b. if the '''total amount of GST payable is more than RM30''', the buyer must request for a '''tax invoice''' with the name and address of the buyer. | |||

:::c. tax invoice issued by approved person for Flat Rate Scheme. | |||

:::d. K1 form for imported goods | |||

:::e. K1 and K9 for goods removed from bonded warehouse | |||

<br /> | |||

::2. | |||

==Carry forward refund for GST?== | ==Carry forward refund for GST?== | ||

Revision as of 03:14, 22 September 2016

How to avoid costly GST errors?

Introduction

- This guide will help you to easily identify the common GST errors in GST Returns. To minimize GST amendment and incorrect GST Returns to RMCD.

- You may wish to take note the follow errors commonly made by businesses:

- 1. Standard Rated Supply (5a) and Output Tax (5b)

- 2. Stanadard Rate and Flat Rate Acquisitions (6a), and Input Tax (6b)

- 3. Carry forward refund for GST?

- 4. Local Zero-Rated Supplies

- 5. Export Supplies

- 6. Exempt Supplies

- 7. Supplies Granted GST Relief

- 8. Goods Imported Under Approved Trader Scheme and GST Suspended

- 9. Capital Goods Acquired

- 10. Bad Debt Relief

- 11. Bad Debt Recovered

- 12. Output tax value breakdown into Major Industries Code (MSIC Code)

- 13. Other important info required in GAF

Standard Rated Supply (5a) and Output Tax (5b)

- 1. Sale or disposal of business assets

- 2. Goods given free as gift.

- 3. Inter-company transations

Stanadard Rate and Flat Rate Acquisitions (6a), and Input Tax (6b)

- Not all input tax claims are allowable. You can claim input tax on your purchases only if the below conditions are fulfilled.

- 1. Tax invoice / Simplified Tax Invoice / Custom K1 / Custom K9

- a. the buyer can use simplified tax invoice if the total amount GST payable is RM30 or less.

- b. if the total amount of GST payable is more than RM30, the buyer must request for a tax invoice with the name and address of the buyer.

- c. tax invoice issued by approved person for Flat Rate Scheme.

- d. K1 form for imported goods

- e. K1 and K9 for goods removed from bonded warehouse

- 1. Tax invoice / Simplified Tax Invoice / Custom K1 / Custom K9

- 2.

Carry forward refund for GST?

Local Zero-Rated Supplies

Export Supplies

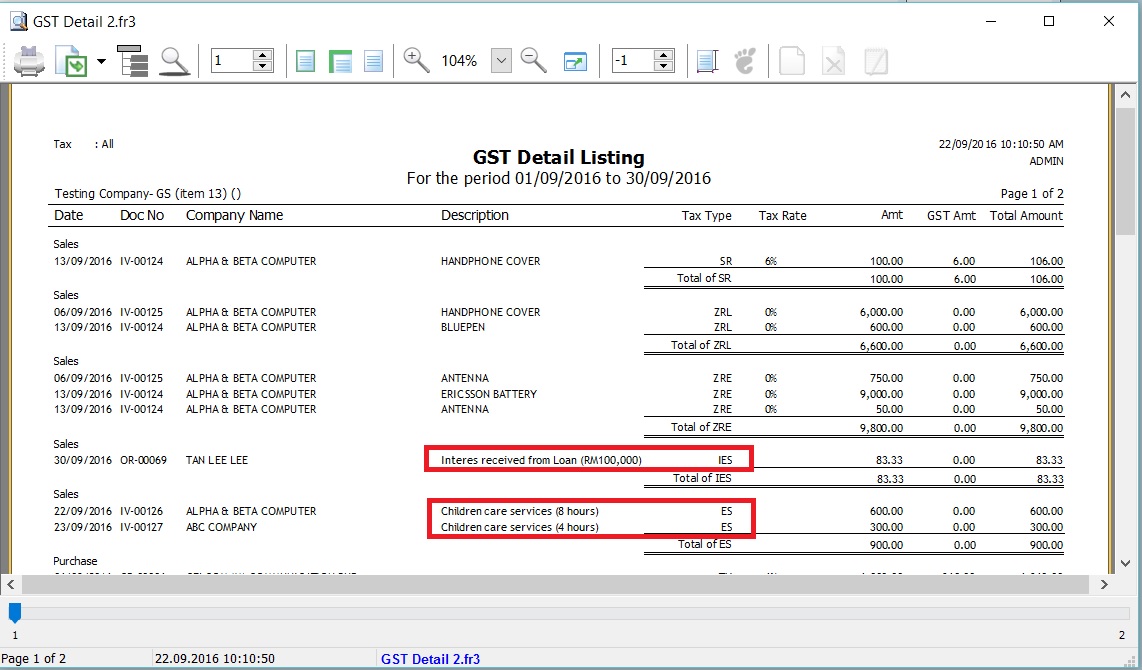

Exempt Supplies

This refer to the following types according to Goods and Services Tax (Exempt Supplies) Order 2014:-

- 1. Services:-

- a. Private education

- b. Private health services

- c. Childcare services

- d. Domestic transportation of passengers for mass Public Transports (eg. by rail, ship, boat, ferry, express bus, stage bus, school bus, feeder bus, workers bus and taxi)

- e. Toll highway

- 2. Financial Services:-

- a. Interest income from deposits placed with a financial institution in Malaysia

- b. Interest received from loans provided to employees (factoring receivables)

- c. Realized foreign exchange gains.

- 3. Goods:-

- a. Residential properties

- b. Land for agricultural use

- c. Land for general user (ie. burial ground, playground or religious building)

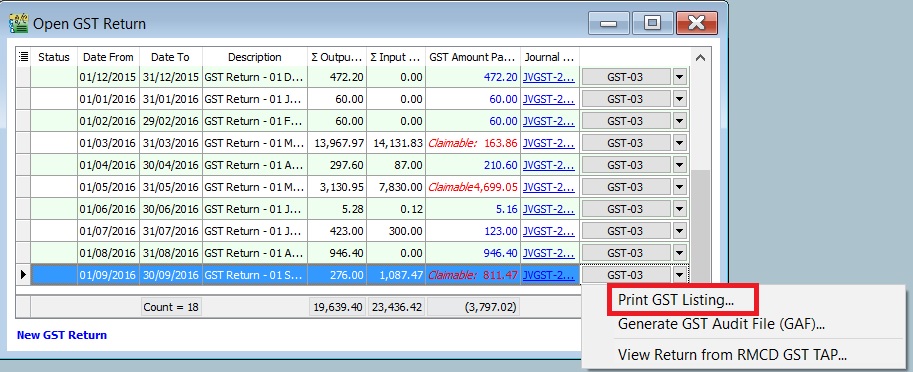

GST Listing

- 2. Preview and select the report name GST Detail 2.

- 3. To ensure the document detail descriptions are clearly stated and map to the correct tax code.

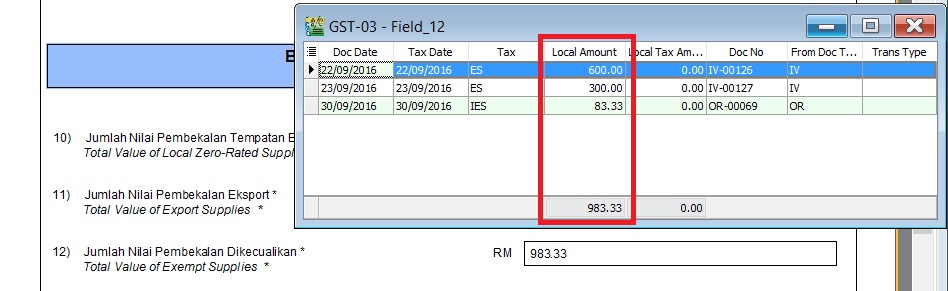

GST-03

- 1. To quick do amendment before submit the GST-03 to RMCD. Click here to learn more about the GST amendment.

- 2. Double click on the item 12 in GST-03.

- 3. Drill down the documents to open and correct it accordingly.

- 4. Lastly, you have to Recalculate the amended GST Return.