| Line 33: | Line 33: | ||

==Exempt Supplies== | ==Exempt Supplies== | ||

This refer to the following types according to Goods and Services Tax (Exempt Supplies) Order 2014:- | This refer to the following types according to Goods and Services Tax (Exempt Supplies) Order 2014:- | ||

:''' | :'''1. Services:-''' | ||

:: | ::a. Private education | ||

:: | ::b. Private health services | ||

:: | ::c. Childcare services | ||

:: | ::d. Domestic transportation of passengers for mass Public Transports (eg. by rail, ship, boat, ferry, express bus, stage bus, school bus, feeder bus, workers bus and taxi) | ||

:: | ::e. Toll highway | ||

:''' | :'''2. Financial Services:-''' | ||

:: | ::a. Interest income from deposits placed with a financial institution in Malaysia | ||

:: | ::b. Interest received from loans provided to employees (factoring receivables) | ||

:: | ::c. [http://www.sql.com.my/wiki/GST-03_Item_12_(ES_%2B_IES)_:_How_to_compare_the_Total_Value_of_Exempt_Supplies_between_GST-03_and_Ledger#Special_Posting_for_Net_Realized_Gain_Forex_.28IES.29 Realized foreign exchange gains]. | ||

:''' | :'''3. Goods:-''' | ||

:: | ::a. Residential properties | ||

:: | ::b. Land for agricultural use | ||

:: | ::c. Land for general user (ie. burial ground, playground or religious building) | ||

<br /> | <br /> | ||

'''GST Listing''' | |||

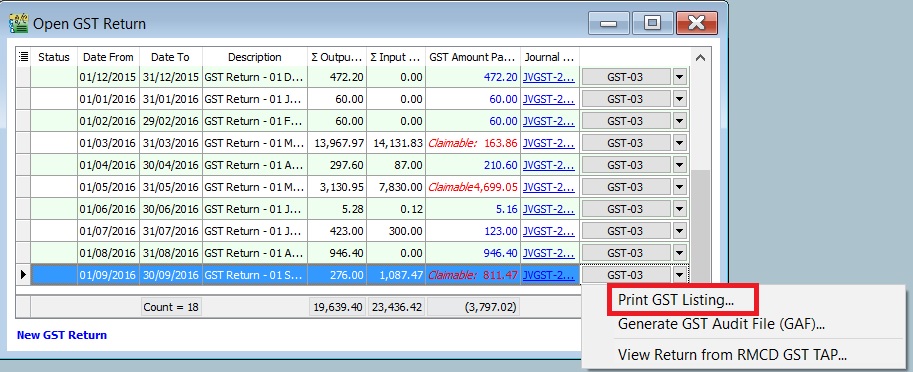

:1. After GST Return processed, go to Print GST Listing... | |||

::[[File: GST-ES-03.jpg]] | |||

<br /> | |||

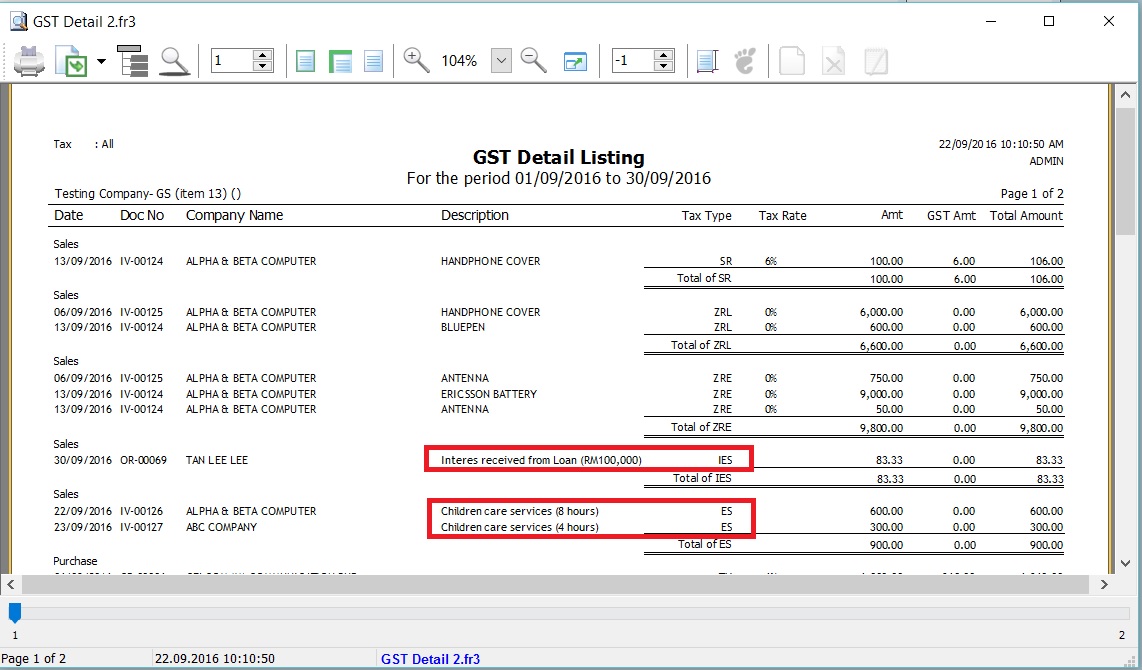

:2. To ensure the document descriptions are clearly stated and map to the correct tax code. | |||

::[[File: GST-ES-04.jpg]] | |||

<br /> | |||

: | |||

'''GST-03''' | |||

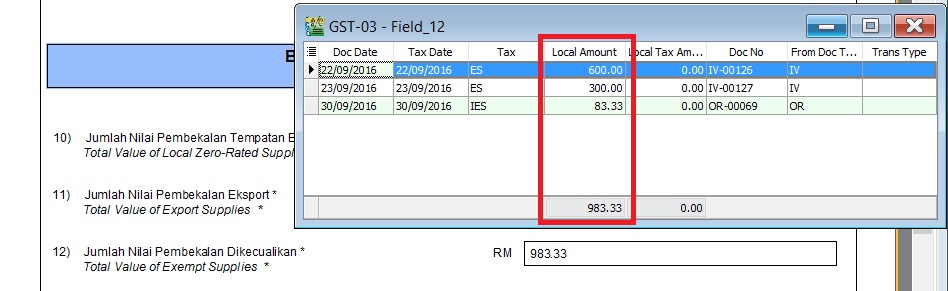

:1. To quick do amendment before submit the GST-03 to RMCD. Click [http://www.sql.com.my/wiki/GST_-_GST-03_Amendment here] to learn more about the GST amendment. | |||

:2. Double click on the item 12 in GST-03. | |||

::[[File: GST-ES-01.jpg]] | |||

<br /> | |||

:3. Drill down the documents to open and correct it accordingly. | |||

:4. Lastly, you have to '''Recalculate''' the amended GST Return. | |||

==Supplies Granted GST Relief== | ==Supplies Granted GST Relief== | ||

Revision as of 02:34, 22 September 2016

How to avoid costly GST errors?

Introduction

- This guide will help you to easily identify the common GST errors in GST Returns. To minimize GST amendment and incorrect GST Returns to RMCD.

- You may wish to take note the follow errors commonly made by businesses:

- 1. Standard Rated Supply (5a) and Output Tax (5b)

- 2. Stanadard Rate and Flat Rate Acquisitions (6a), and Input Tax (6b)

- 3. Carry forward refund for GST?

- 4. Local Zero-Rated Supplies

- 5. Export Supplies

- 6. Exempt Supplies

- 7. Supplies Granted GST Relief

- 8. Goods Imported Under Approved Trader Scheme and GST Suspended

- 9. Capital Goods Acquired

- 10. Bad Debt Relief

- 11. Bad Debt Recovered

- 12. Output tax value breakdown into Major Industries Code (MSIC Code)

- 13. Disallowed Input Tax

- 14. Other important info required in GAF

Standard Rated Supply (5a) and Output Tax (5b)

Stanadard Rate and Flat Rate Acquisitions (6a), and Input Tax (6b)

Carry forward refund for GST?

Local Zero-Rated Supplies

Export Supplies

Exempt Supplies

This refer to the following types according to Goods and Services Tax (Exempt Supplies) Order 2014:-

- 1. Services:-

- a. Private education

- b. Private health services

- c. Childcare services

- d. Domestic transportation of passengers for mass Public Transports (eg. by rail, ship, boat, ferry, express bus, stage bus, school bus, feeder bus, workers bus and taxi)

- e. Toll highway

- 2. Financial Services:-

- a. Interest income from deposits placed with a financial institution in Malaysia

- b. Interest received from loans provided to employees (factoring receivables)

- c. Realized foreign exchange gains.

- 3. Goods:-

- a. Residential properties

- b. Land for agricultural use

- c. Land for general user (ie. burial ground, playground or religious building)

GST Listing

GST-03

- 1. To quick do amendment before submit the GST-03 to RMCD. Click here to learn more about the GST amendment.

- 2. Double click on the item 12 in GST-03.

- 3. Drill down the documents to open and correct it accordingly.

- 4. Lastly, you have to Recalculate the amended GST Return.