Initial Setup

Withholding Tax Account

Menu : GL | Maintain Account...

GL Account Description Remark 460-XXX WITHHOLDING TAX PAYABLE Under Current Liabilities

NOTE: GL Account not compulsory to follow.

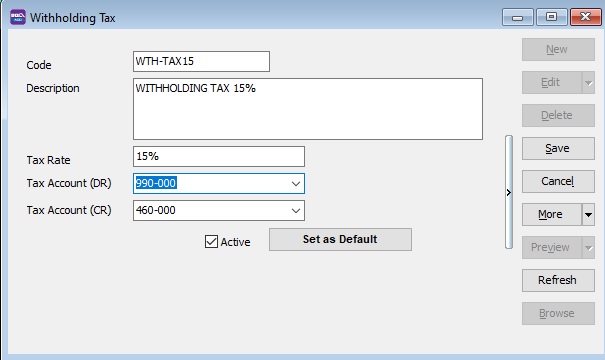

Maintain Withholding Tax

Menu : Tools | Maintain Withholding Tax...

- 1. Click New.

- 2. Input the following data:

Field Name Explanation Remark Code Set a code WTH-TAX15 Description Describe the meaning/usage of this code Withholding Tax 15% Tax Rate Withholding Tax Rate 15% Tax Account (DR) Set to Withholding Tax Payable account At GL\Maintain Account, create the Withholding Tax Payable account under Current Liabilities Tax Account (CR) Set to Withholding Tax Payable account At GL\Maintain Account, create the Withholding Tax Payable account under Current Liabilities

- 3. Click on Save.

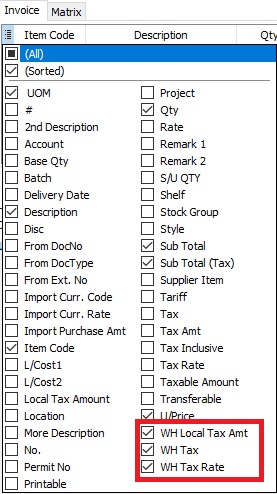

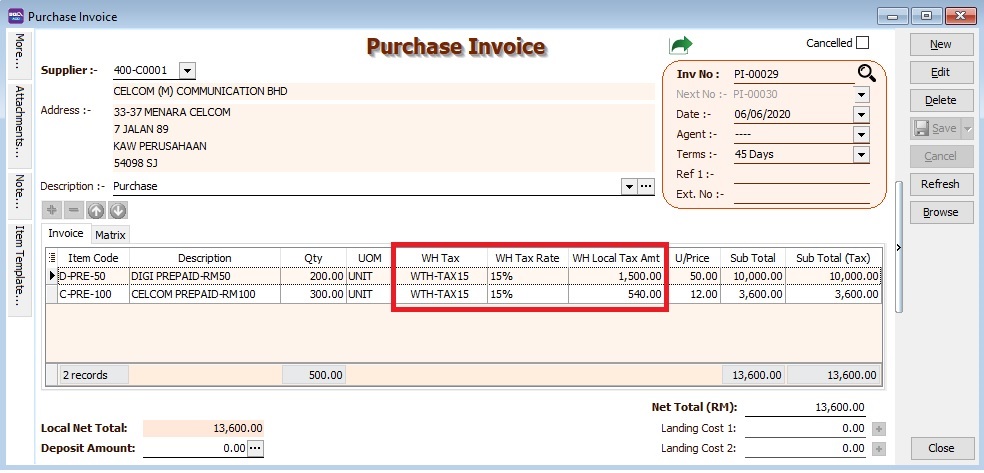

Withholding Tax Purchase Entry

Available in:

Menu : [Purchase | Purchase Invoice...] or [Supplier | Supplier Invoice...]

Menu : [Purchase | Cash Purchase...] or [Supplier | Supplier Invoice...]

Menu : [Purchase | Purchase Debit Note...] or [Supplier | Supplier Debit Note...]

Menu : [Purchase | Purchase Returned ...] or [Supplier | Supplier Credit Note...]

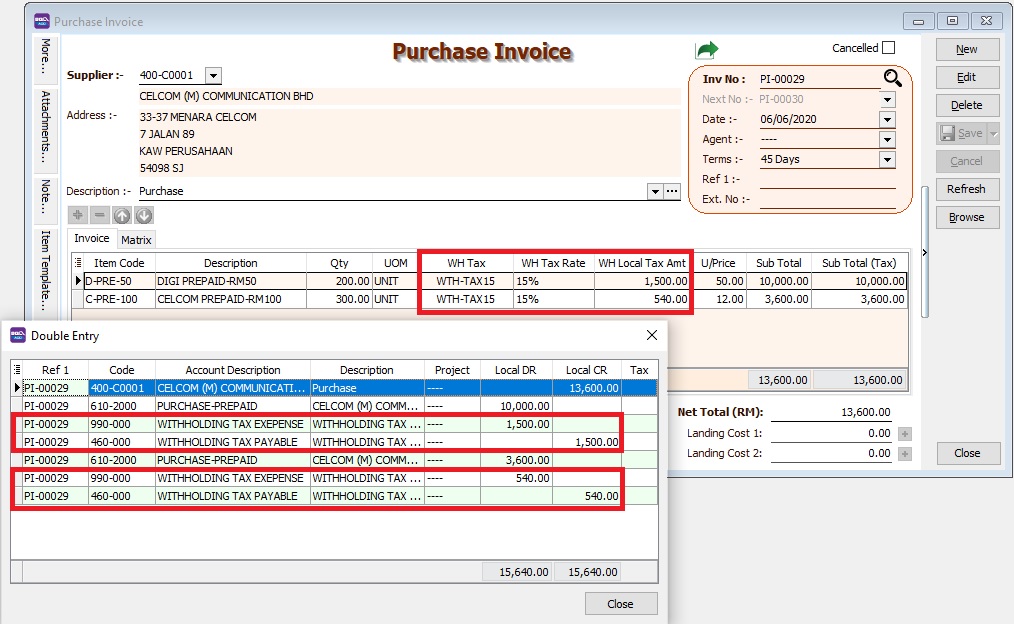

- 3. System will auto post the withholding tax double entry. Press CTRL + O to check the double entry.

GL Description Local DR Local CR Withholding Tax Expense XXX Withholding Tax Payable XXX

NOTE: Withholding tax amount will not add into the purchase invoice amount.

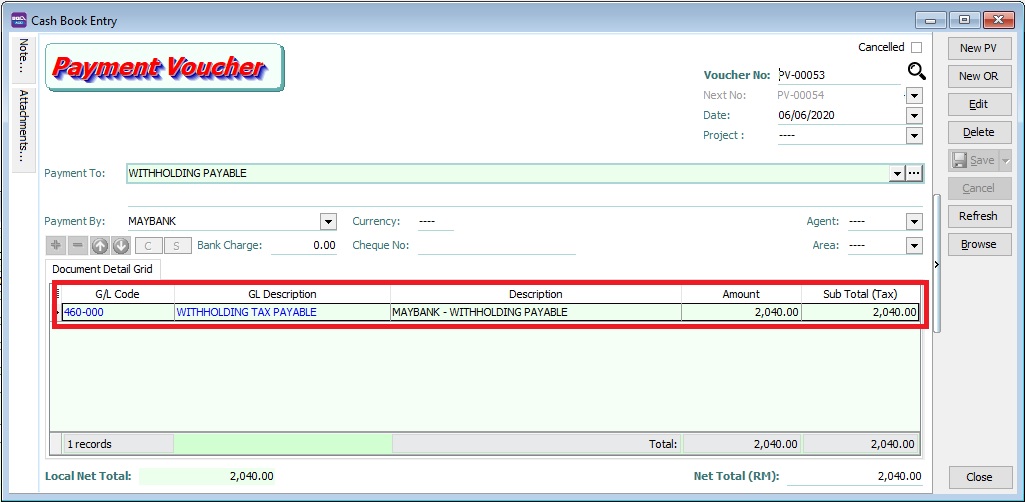

Payment of Withholding Tax

[ GL | Cash Book Entry..]

- 1. Create new PV.

- 2. Enter Payee name.

- 3. Select bank account to pay.

- 4. In detail grid, select the GL Account (Withholding Tax Payable).

- 5. Enter the withholding tax amount to be paid. Save it.

- 6. You can check the ledger report for Withholding Tax Payable outstanding balance.