No edit summary |

|||

| Line 39: | Line 39: | ||

==Withholding Tax== | ==Withholding Tax== | ||

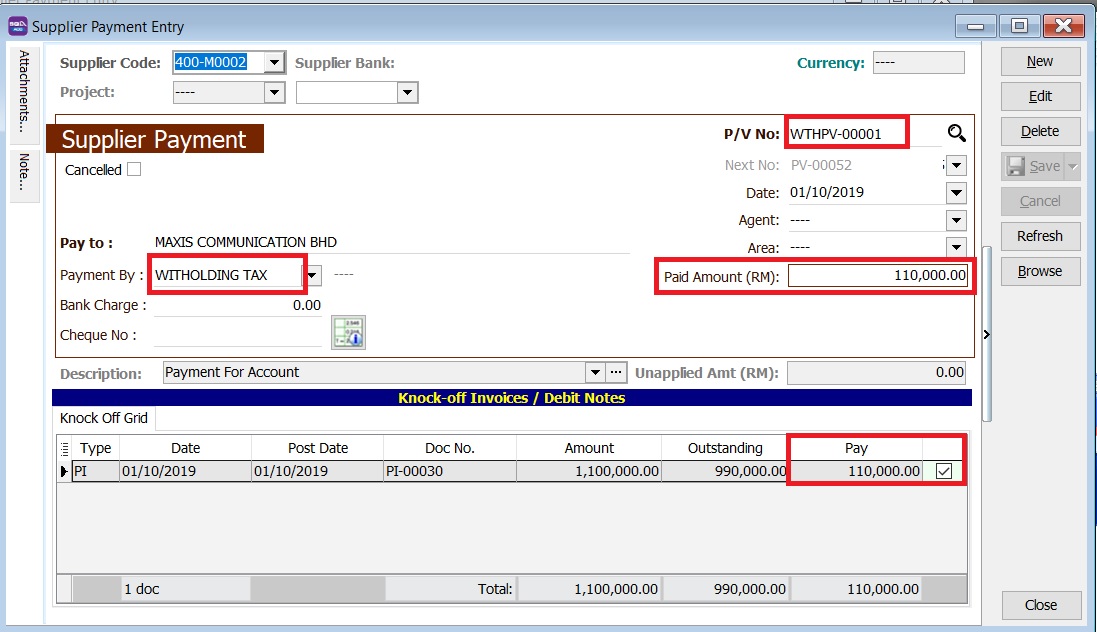

===Withholding Tax (AP)=== | ===Withholding Tax (AP)=== | ||

''[Supplier | Supplier Payment...]'' | |||

<br /> | |||

:1. Create new '''Supplier Payment'''. | |||

:2. Select the '''Supplier Code'''. | |||

:3. Select the Payment by: '''WITHHOLDING TAX'''. | |||

:4. Enter the Paid Amount: '''110,000.00 (Withholding tax amount 10% of supplier invoice value)'''. | |||

:5. Knock-off the supplier invoice. | |||

<br /> | |||

:[[File: WTH-Tax_05.jpg| 500PX]] | |||

<br /> | |||

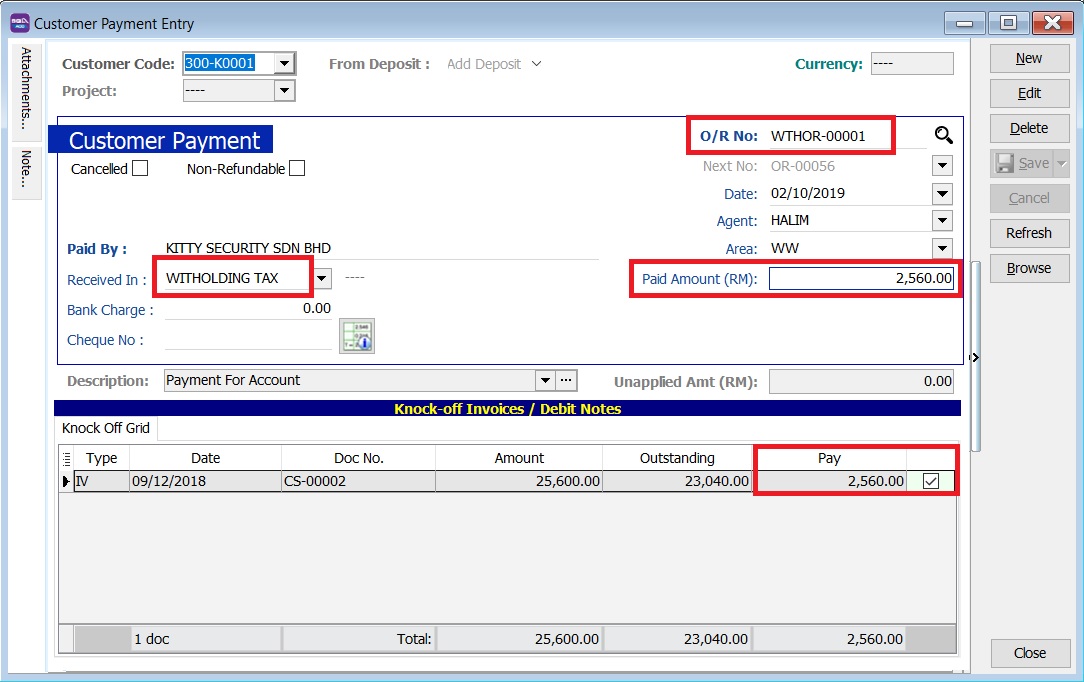

===Withholding Tax (AR)=== | |||

''[Customer | Customer Payment...]'' | |||

<br /> | |||

:1. Create new '''Customer Payment'''. | |||

:2. Select the '''Customer Code'''. | |||

:3. Select the Received In: '''WITHHOLDING TAX'''. | |||

:4. Enter the Paid Amount: '''2,560.00 (Withholding tax amount 10% of customer invoice value)'''. | |||

:5. Knock-off the customer invoice. | |||

<br /> | |||

:[[File: WTH-Tax_06.jpg| 500PX]] | |||

<br /> | |||

==See also== | ==See also== | ||

* [[Print SST Listing]] | * [[Print SST Listing]] | ||

* [[SST-Account for Pending Service Tax over 12 months]] | * [[SST-Account for Pending Service Tax over 12 months]] | ||

Revision as of 10:28, 1 October 2019

Initial Setup

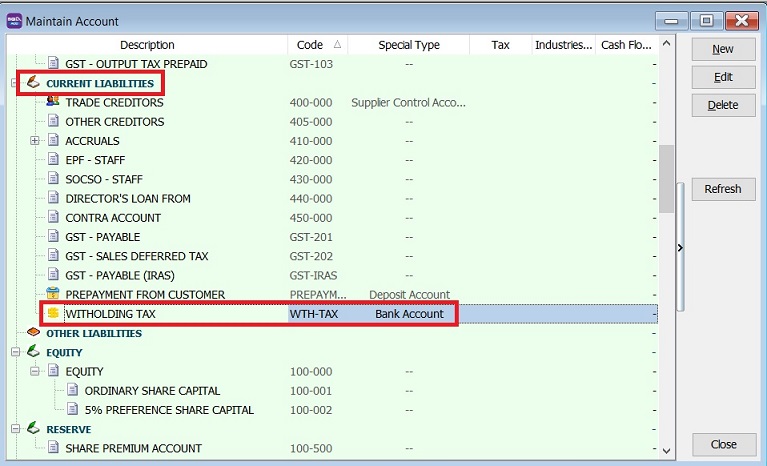

Create Withholding Tax Account

[GL | Maintain Account...]

- Create the following GL Account under Current Liability.

GL Account Description Special Type WTH-Tax Withholding Tax Bank Account

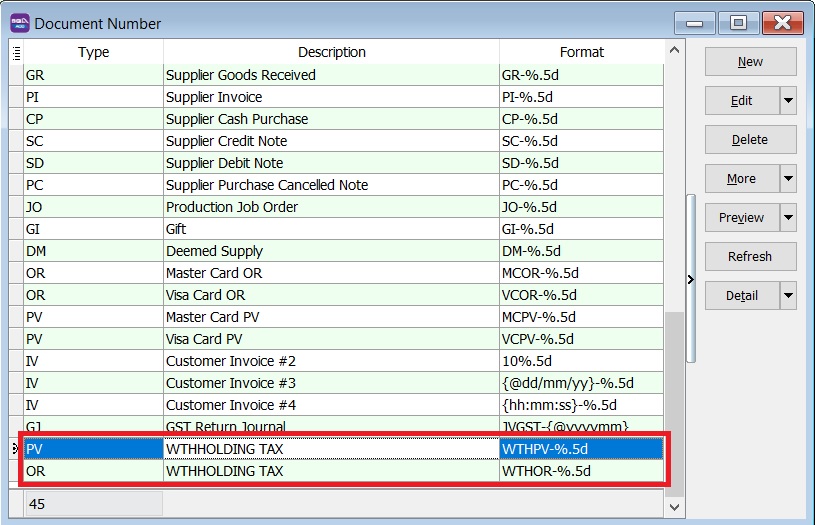

Withholding Document Number Set

[Tools | Maintain Document Number...]

Descripion Document Type Format WITHHOLDING TAX Payment Voucher WTHPV-%.5d WITHHOLDING TAX Official Receipt WTHOR-%.5d

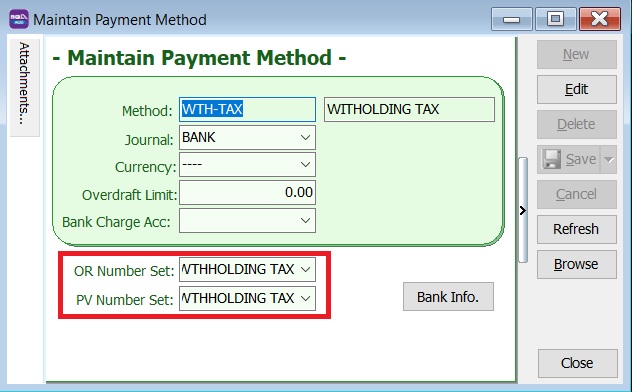

- 2. Next, Go to Tools | Maintain Payment Method...

- 3. Edit the WITHHOLDING TAX.

- 4. Set OR and PV number Set to WITHHOLDING TAX. Click Save.

Withholding Tax

Withholding Tax (AP)

[Supplier | Supplier Payment...]

- 1. Create new Supplier Payment.

- 2. Select the Supplier Code.

- 3. Select the Payment by: WITHHOLDING TAX.

- 4. Enter the Paid Amount: 110,000.00 (Withholding tax amount 10% of supplier invoice value).

- 5. Knock-off the supplier invoice.

Withholding Tax (AR)

[Customer | Customer Payment...]

- 1. Create new Customer Payment.

- 2. Select the Customer Code.

- 3. Select the Received In: WITHHOLDING TAX.

- 4. Enter the Paid Amount: 2,560.00 (Withholding tax amount 10% of customer invoice value).

- 5. Knock-off the customer invoice.