No edit summary |

|||

| (47 intermediate revisions by the same user not shown) | |||

| Line 8: | Line 8: | ||

|- | |- | ||

| 460-XXX || WITHHOLDING TAX PAYABLE || Under Current Liabilities | | 460-XXX || WITHHOLDING TAX PAYABLE || Under Current Liabilities | ||

|} | |} | ||

'''NOTE:''' | '''NOTE:''' | ||

GL Account not compulsory to follow. | GL Account code not compulsory to follow. | ||

<br /> | |||

===Maintain Withholding Tax=== | |||

''Menu : Tools | Maintain Withholding Tax...'' | |||

<br /> | <br /> | ||

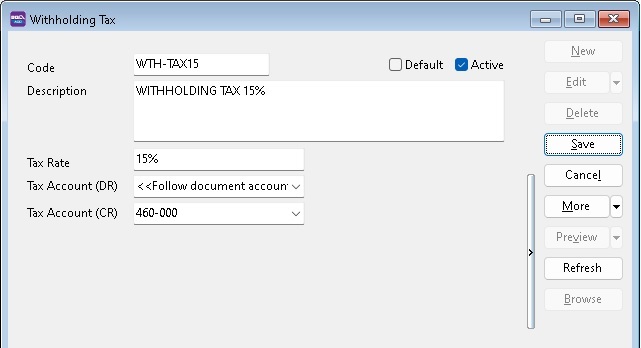

= | :1. Click '''New'''. | ||

:2. Input the following data: | |||

''[ | ::{| class="wikitable" | ||

|- | |||

! Field Name !! Explanation || Remark | |||

|- | |||

| Code || Set a code || WTH-TAX15 | |||

|- | |||

| Description || Describe the meaning/usage of this code || Withholding Tax 15% | |||

|- | |||

| Tax Rate || Withholding Tax Rate || 15% | |||

|- | |||

| Tax Account (DR) || Expenses account || '''<<Follow document accounts>>''' if leave blank | |||

|- | |||

| Tax Account (CR) || Set to '''Withholding Tax Payable''' account || At GL\Maintain Account, create the Withholding Tax Payable account under Current Liabilities | |||

|} | |||

::[[File: WTH-Tax_03b.jpg| 400PX]] | |||

'''NOTE:''' | |||

Tax Account (DR) leave blank | |||

<br /> | |||

:3. Click on '''Save'''. | |||

<br /> | <br /> | ||

: | ==Withholding Tax Purchase Entry== | ||

Available in: <br /> | |||

''Menu : [Purchase | Purchase Invoice...]'' or [Supplier | Supplier Invoice...]<br /> | |||

: | ''Menu : [Purchase | Cash Purchase...]'' or [Supplier | Supplier Invoice...]<br /> | ||

''Menu : [Purchase | Purchase Debit Note...]'' or [Supplier | Supplier Debit Note...]<br /> | |||

:[[ | ''Menu : [Purchase | Purchase Returned ...]'' or [Supplier | Supplier Credit Note...]<br /> | ||

<br /> | <br /> | ||

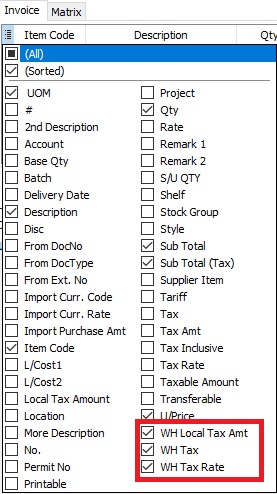

:1. In '''Purchase Invoice''', insert the following columns: | |||

::* WH Local Tax Amt | |||

::* WH Tax | |||

::* WH Tax Rate | |||

::[[File: WTH-Tax_10a.jpg| 300PX]]<br /> | |||

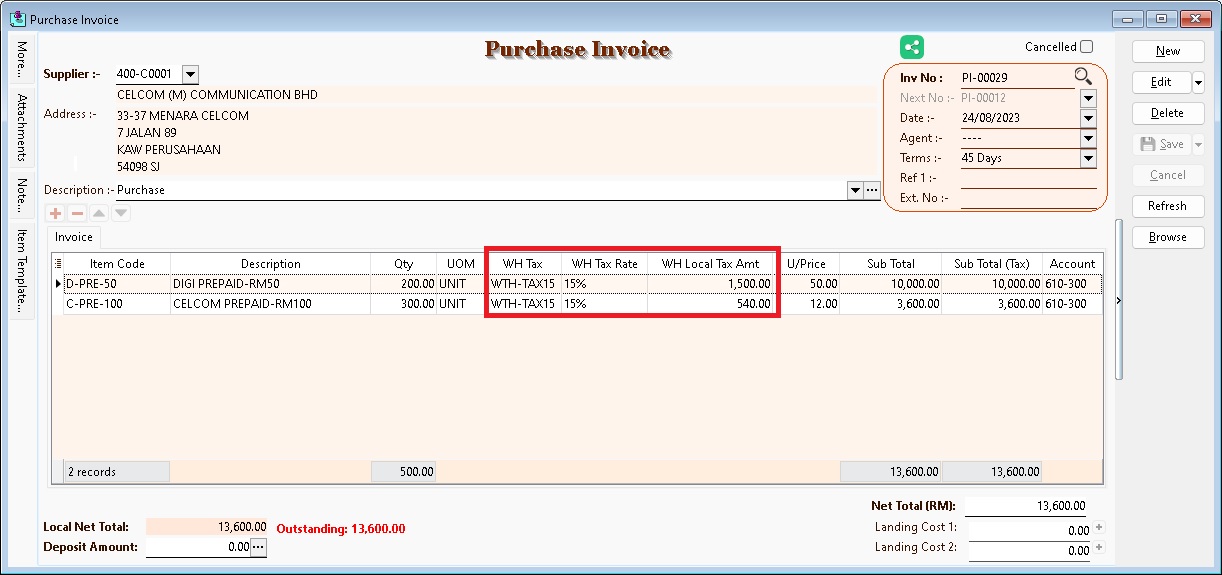

:2. Select the Withholding Tax Code in '''WH Tax''' column. | |||

::{| class="wikitable" | |||

|+ For example, | |||

|- | |||

! !! Amount | |||

|- | |||

| Original Supplier Invoice|| 15,640 | |||

|- | |||

| Withholding Tax || (2,040) | |||

|- | |||

| '''Supplier Account Payable''' || '''13,600''' | |||

|} | |||

::[[File: WTH-Tax_11b.jpg| 200PX]]<br /> | |||

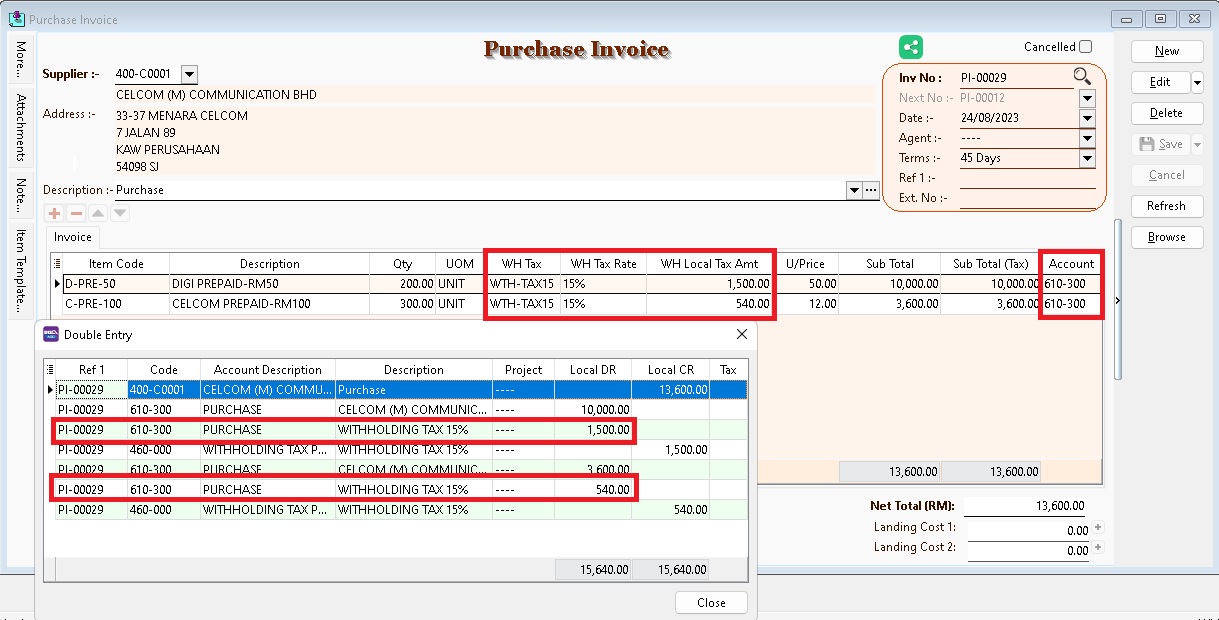

:3. System will auto post the withholding tax double entry. Press '''CTRL + O''' to check the double entry. | |||

::{| class="wikitable" | |||

|- | |||

! GL Description !! Local DR || Local CR | |||

|- | |||

| Expenses Account (follow the document detail GL Account) || XXX || | |||

|- | |||

| Withholding Tax Payable || || XXX | |||

|} | |||

::[[File: WTH-Tax_11c.jpg| 200PX]] | |||

<br /> | |||

'''NOTE:''' | |||

Withholding tax amount will not add into the purchase invoice as Outstanding Amount. | |||

:4. Supplier payment knock-off purchase invoice with RM13,600 (outstanding = 0). | |||

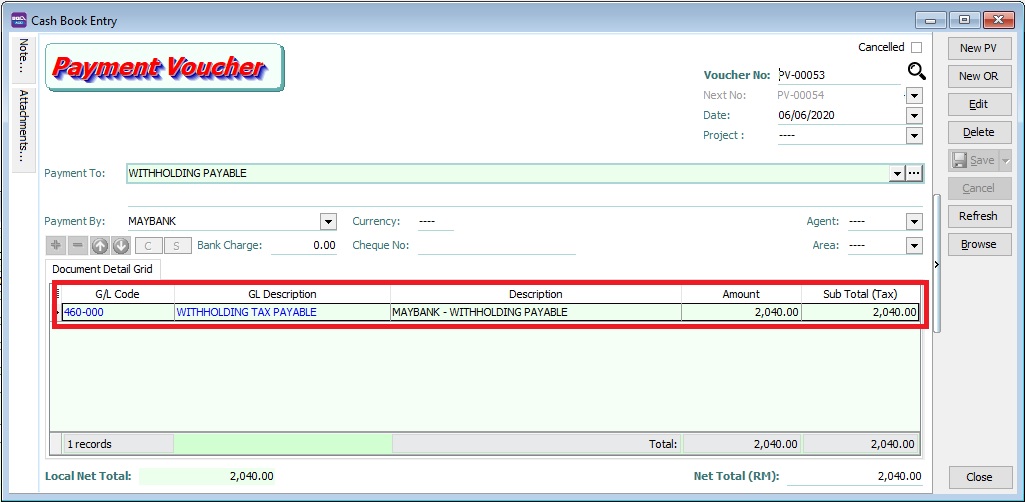

==Payment of Withholding Tax== | ==Payment of Withholding Tax== | ||

| Line 36: | Line 93: | ||

:1. Create new PV. | :1. Create new PV. | ||

:2. Enter Payee name. | :2. Enter Payee name. | ||

:3. Select | :3. Select bank account to pay. | ||

:4. | :4. In detail grid, select the GL Account '''(Withholding Tax Payable)'''. | ||

:5. Enter the withholding tax amount to paid. | :5. Enter the withholding tax amount to be paid. Save it. | ||

:[[File: WTH- | :[[File: WTH-Tax 10d.jpg| 500PX]] | ||

<br /> | <br /> | ||

:6. You can check the ledger report for Withholding Tax balance. | :6. You can check the ledger report for '''Withholding Tax Payable outstanding balance'''. | ||

<br /> | <br /> | ||

==See also== | ==See also== | ||

* [[Cash Book Entry]] | * [[Cash Book Entry]] | ||

* [[Print Ledger Report]] | * [[Print Ledger Report]] | ||

* [[Account Inquiry]] | * [[Account Inquiry]] | ||

* [[Maintain Withholding Tax]] | |||

Latest revision as of 09:10, 25 September 2023

Initial Setup

Withholding Tax Account

Menu : GL | Maintain Account...

GL Account Description Remark 460-XXX WITHHOLDING TAX PAYABLE Under Current Liabilities

NOTE: GL Account code not compulsory to follow.

Maintain Withholding Tax

Menu : Tools | Maintain Withholding Tax...

- 1. Click New.

- 2. Input the following data:

Field Name Explanation Remark Code Set a code WTH-TAX15 Description Describe the meaning/usage of this code Withholding Tax 15% Tax Rate Withholding Tax Rate 15% Tax Account (DR) Expenses account <<Follow document accounts>> if leave blank Tax Account (CR) Set to Withholding Tax Payable account At GL\Maintain Account, create the Withholding Tax Payable account under Current Liabilities

NOTE: Tax Account (DR) leave blank

- 3. Click on Save.

Withholding Tax Purchase Entry

Available in:

Menu : [Purchase | Purchase Invoice...] or [Supplier | Supplier Invoice...]

Menu : [Purchase | Cash Purchase...] or [Supplier | Supplier Invoice...]

Menu : [Purchase | Purchase Debit Note...] or [Supplier | Supplier Debit Note...]

Menu : [Purchase | Purchase Returned ...] or [Supplier | Supplier Credit Note...]

- 2. Select the Withholding Tax Code in WH Tax column.

For example, Amount Original Supplier Invoice 15,640 Withholding Tax (2,040) Supplier Account Payable 13,600

- 3. System will auto post the withholding tax double entry. Press CTRL + O to check the double entry.

GL Description Local DR Local CR Expenses Account (follow the document detail GL Account) XXX Withholding Tax Payable XXX

NOTE: Withholding tax amount will not add into the purchase invoice as Outstanding Amount.

- 4. Supplier payment knock-off purchase invoice with RM13,600 (outstanding = 0).

Payment of Withholding Tax

[ GL | Cash Book Entry..]

- 1. Create new PV.

- 2. Enter Payee name.

- 3. Select bank account to pay.

- 4. In detail grid, select the GL Account (Withholding Tax Payable).

- 5. Enter the withholding tax amount to be paid. Save it.

- 6. You can check the ledger report for Withholding Tax Payable outstanding balance.